|

|

The climate experts didn’t warn us we’d need more electricity for winter in Australia.

If only carbon dioxide make winter nights warmer, Australians wouldn’t have been using up stockpiles of coal and gas in the last six weeks, and setting winter-time demand records. These geniuses got everything wrong.

Coldest start to winter in decades for eastern Australia with power grid under strain

The Guardian

Early June temperatures in Melbourne didn’t go above 15 degrees for first time in 70 years as cold weather pattern starts to break

Eastern Australia’s giant cold snap is finally breaking down but not before temperatures reached lows not seen for seven decades or longer and pushed the country’s main electricity grid to the brink.

The extended chill was caused by an unusual weather pattern that locked in cool pools of air over southern and eastern states, triggering the deepest snow dumps in the alps since 1968, according to Ben Domensino, a senior meteorologist at Weatherzone.

Australia so cold it’s already setting winter electricity demand records

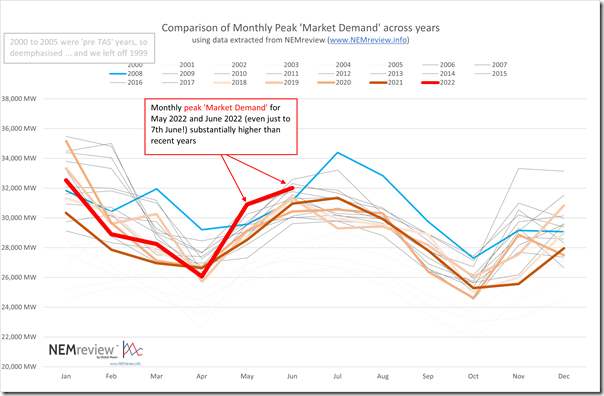

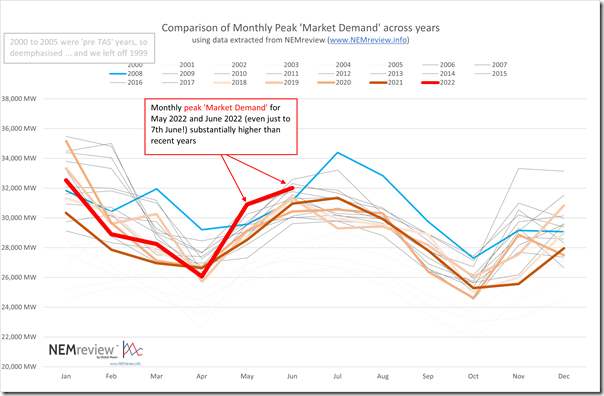

It’s not about record cold snaps, it’s more of a long run of below average days. In a sign of how not-warm it is in Australia the sheer number of megawatts being used on the East Coast was the highest ever recorded for May, and WattClarity noted that the first week of June was already in the top four years. Demand on June 7th this year was 32,000 Megawatts — the highest winter day since 2008. It’s not as high as our highest summer records which are just under 36,000 MW. Nonetheless, it wasn’t supposed to happen much was it?

As a temperature proxy the NEM leans heavily on Melbourne and Sydney conditions.

May and June peak ‘Market Demand’ very high on a historical scale | WattClarity Anyone who wants to file a complaint that a cold month or two doesn’t mean anything can send it in with all their complaints to the ABC for every news story about a hot weekend being “climate change”. We want receipts.

9.7 out of 10 based on 89 ratings

So it’s a new record. In the 20 years since the National Energy Market formed it has never operated on such a vapor thin margin. Only a few days ago Paul McArdle at WattClarity thought a mere 15% instantaneous reserve plant margin was a headline event, but tonight the grid survived (so far) on a tiny 3% Instantaneous Reserve Plant Margin NEM-wide. Things were so tight the NSW Minister for Energy sought emergency powers to force coal companies to provide fuel to coal generators for the next 30 days on his say so. Presumably next on his list would be emergency powers from God to make the wind blow.

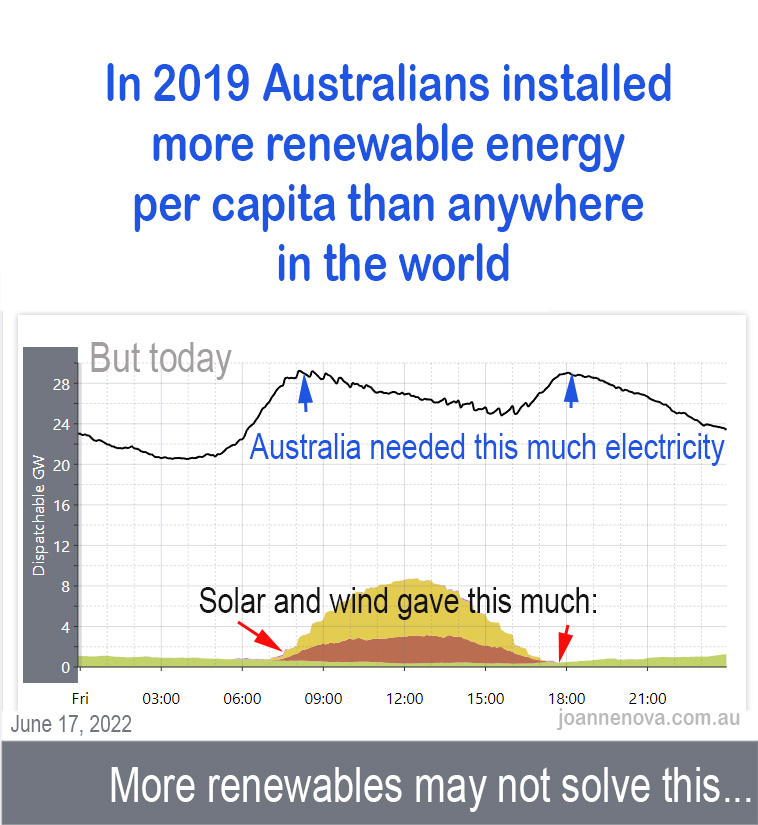

Two years ago Australian taxpayers spend $13 billion a year in climate action (Moran). As researchers at ANU noted, Australia was leading the way — installing more megawatts per person than any other nation on Earth. (Blakers) Despite being the fastest growing and sparsest population, on the most remote nation which was practically a quarry and farm built on coal and uranium deposits, Australian political leaders rushed to compete for green booby prizes in Beautiful Weather Contests.

And the toll from the bonfire in prices is just starting with Iron Foundry’s and Brickmakers already going to the wall. Businesses that have survived wars and market collapses couldn’t survive green fantasies.

Rising gas prices blamed as Advance Bricks says its oven will go cold after 82 years in Stawell

In the Victorian town of Stawell, about 230kms north-west of Melbourne, local manufacturer Advance Bricks is shutting after more than 82 years in business.

Managing director John Collins says the company, which employs 23 people, could no longer afford the power bill after the collapse of commercial gas supplier Weston Energy in late May forced it onto a plan with “retailer of last resort” Energy Australia.

“The assertion by (Victorian) Premier Andrews and (federal) Minister Bowen that heavy industries can transition to renewable energy is complete and utter fantasy,” he said.

For every green job we create we destroy two to five real ones:

A South Australian manufacturing business reliant on wholesale electricity has labelled the national electricity market a “failure,” after standing down 170 employees due to unaffordable operating costs.

InterCast and Forge managing director Brett Lawrence said he was forced to shut down operations at his iron foundry in Adelaide’s northern suburbs on Wednesday, following the Australian Energy Market Operator’s (AEMO) decision to suspend the spot market.

Mr Lawrence said soaring wholesale electricity prices had been a “nightmare” for the iron foundry, which accounts for about 1 per cent of South Australia’s total electricity consumption per day when fully operational.

Some coal mines have struggled with both covid and also rain from the La Nina slowing down production. Look at the detail published in The Australian. Every coal unit matters. For some reason no one is mentioning the one they shut deliberately at Liddell in March this year. If only they hadn’t….

Keep reading →

9.3 out of 10 based on 71 ratings

8.8 out of 10 based on 9 ratings

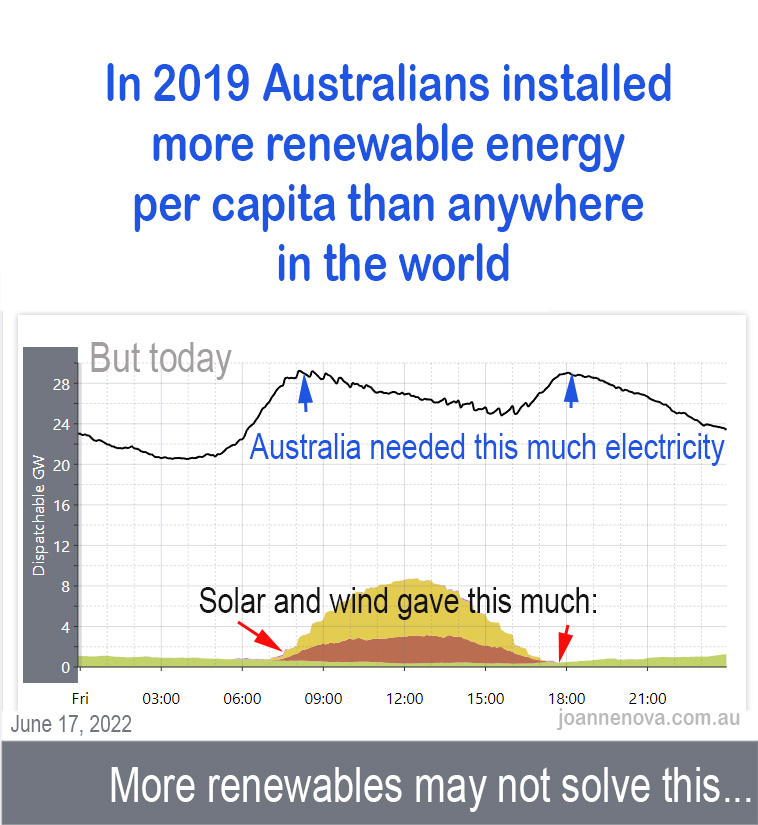

Renewable Crash Test Dummy: Friday edition

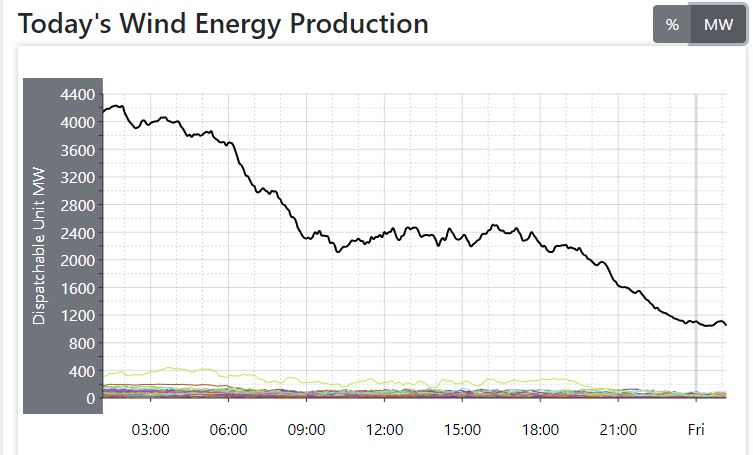

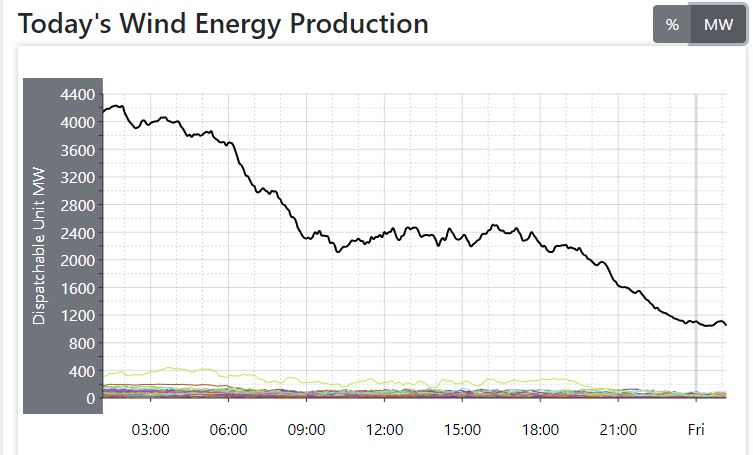

For energy-nerds following the Australian experiment, today is a big day. On the up-side, three coal turbines have rebooted adding another 1200MW to the grid. On the down-side, the wind has slowed and 3000MW has disappeared. On the hope-side, another 4 coal turbines may possibly get back in gear by Sunday, and you never know, the wind might pick up. Though it doesn’t look good.

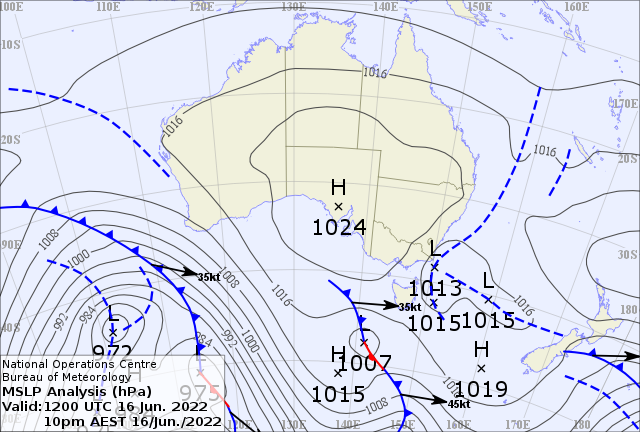

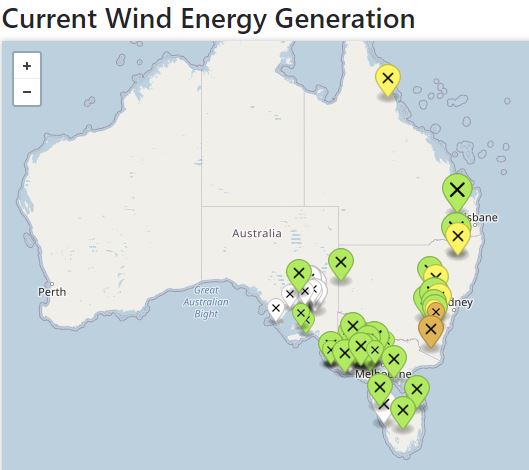

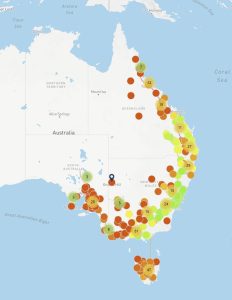

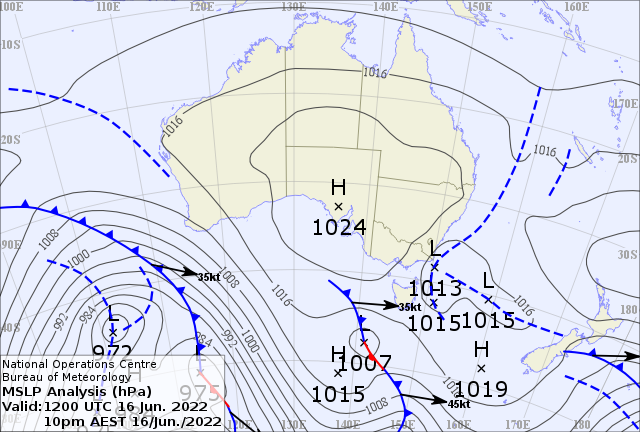

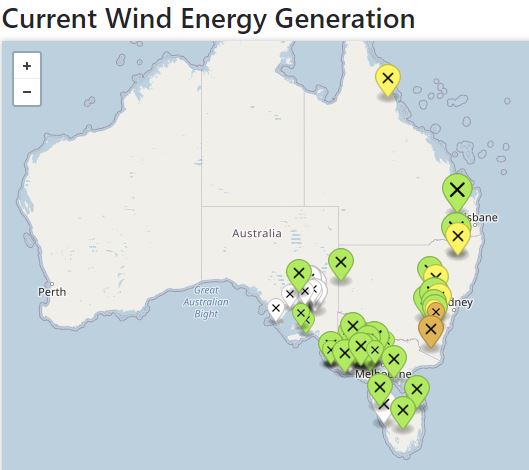

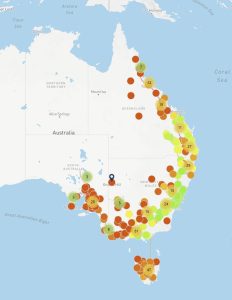

Wind generation. June 16, 2022, Australian NEM. | Anero.id It doesn’t matter how many wind farms we build when one High Pressure cell arrives to sit on them all

And here is the cell that stops a million dishwashers.

One high cell to stop them all | BOM This is where all 76 Australia NEM grid wind farms are which could, in theory be generating as much as 9.8GW but are turning out 10% of that now.

Map of Wind generation Australia Ninety percent of Australians are being asked to be careful with their electricity today while we wait for the wind to start blowing again or the weather to warm up. And millions of dollars is being burned in electricity bills (assuming people have electricity) because we shut down too many brown coal plants and didn’t maintain any of the coal fleet as if our quality of life depended on it.

The AEMO has issued LOR3 (highest risk lack of reserve) announcements for SA, Victoria, and New South Wales for today. These are updated often and it is hard to keep up. LOR3’s are a kind of “Blackout watch”. Potential shortfalls of megawatts 18 hours in advance of the 6pm evening crunch time did look ominous: In Victoria the maximum forecast load that may be interrupted was 1400MW from 5pm to 1am. In South Australia it’s 273MW from 5pm to 9pm. In New South Wales the maximum “interruptible” load is a whopping 3007MW between 5pm to 2.30am. That’s potentially one third of the total demand in New South Wales. All of these may be resolved just in time, but somebody is sweating tonight sorting this out.

These notices linked above were 98212 (Vic), 98211 (SA), 98200 (NSW) – but which have been updated. Just for the tenor of what could theoretically go wrong, note the size and multiple problem times for one NSW update (copied below). I suspect the updated LOR3 notices 98223, 98225 and 98226 are still active. But curiously the Administered price period in NSW has ended. So the spot market is back in NSW?

Keep reading →

9.6 out of 10 based on 77 ratings

Someone needs to tell the Australian Energy Minister the bad news about batteries

Climate Change and Energy Minister Chris Bowen says we just need more renewables and more storage:

Bowen says we can store water, we should be able to store power

“You can say the wind doesn’t always blow and the sun doesn’t always shine. Well, the rain doesn’t always fall either but we managed to store the water,” Bowen said.

Is this Chris Bowen’s Zuma-numbers moment with electricity?

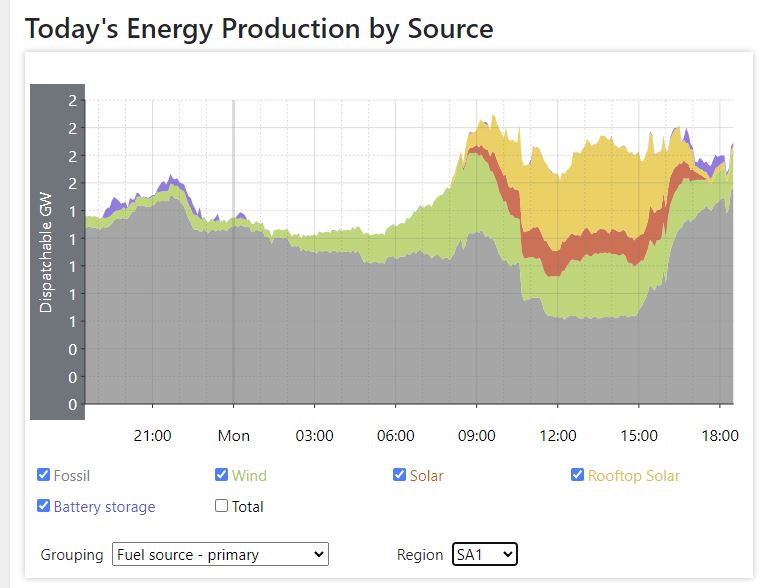

He doesn’t seem to realize that electrons won’t politely sit in a shoe box waiting for the day they run your toaster. When South Australia got the worlds biggest battery in 2017 everyone got excited but few realized it would only power the state for two whole minutes before it ran out. South Australia is just 6% of the total National Energy Market, but if we were trying to make it truly 100% renewable with a reasonable battery backup Paul Miskelly and Tom Quirk calculated we’d need 7.5 million tonnes of lead acid batteries and a spare $60 to $90 billion dollars.

In a recent “record winning moment” in solar and battery powered excitement one of the smallest and sunniest towns in Australia made headlines when it managed to run off 100% solar and battery power for a whole 80 minutes. Onslow is a metropolis of 847 people. As I said at the time, we’re only 520,000 minutes short of a year.

Last year one new Tesla Megabattery in Victoria caught fire soon after it started operating. Since it took 76 hours to stop the fire we can honestly say it burned for three times longer than it provided electricity.

That’s how ready we are to power a nation of 26 million people on solar and wind and big batteries

Storage can be more than batteries, but we’re already spending $10 billion plus on Snowy Hydro 2.0 — the giant renewables-storage scheme that will waste 20-30% of the renewable energy fed into it so we can make a non-despatchable generator into a partly-despatchable one.

Hydrogen is hardly the answer. As David Archibald says it’s is such a reactive gas that there is no source of it in nature. The only naturally occurring hydrogen is the flammable part of farts. Otherwise, the cheapest way of making hydrogen is a water shift reaction with natural gas. But about 60% of the energy contained by the natural gas is wasted in the process — if you just wanted a source of energy, obviously, you’d use the natural gas.

As a fuel, hydrogen has some big shortcomings. It’s has low energy density, so a big, high-pressure tank of the stuff doesn’t take you far. It has an explosive range in air of 18% to 60%. It causes embrittlement of steel. There is a plot at the moment to add hydrogen to the natural gas distribution system — which then might start leaking like a sieve. It has a colourless flame, so leaks that have caught fire can’t be seen. In the days before infrared cameras, workers at a rocket fuel factory in Texas used to detect hydrogen leaks by walking with a straw broom in front of them. When the broom caught fire they had found the leak.

— DAvid Archibald

There’s more information on why Hydrogen is not the answer either here, thanks To Rafe Champion.

Like a third world nation we’re rationing electricity in winter:

Watch the fiery moment Energy Minister loses it at a journalist for suggesting more coal was the answer to the energy crisis

Last night hospitals were ordered to reduce electricity use and millions of people urged not to use basic appliances.

The potential for mass blackouts has increased with about 1800MW of coal-fired power not operating in Queensland and 1200MW of capacity offline in the states of NSW, Victoria, South Australia and Tasmania.

The Tomago aluminium smelter in NSW, the country’s biggest electricity user, was also forced to cut production to reduce the chance of a blackout.

h/t Old Ozzie

9.9 out of 10 based on 67 ratings

…

8.2 out of 10 based on 9 ratings

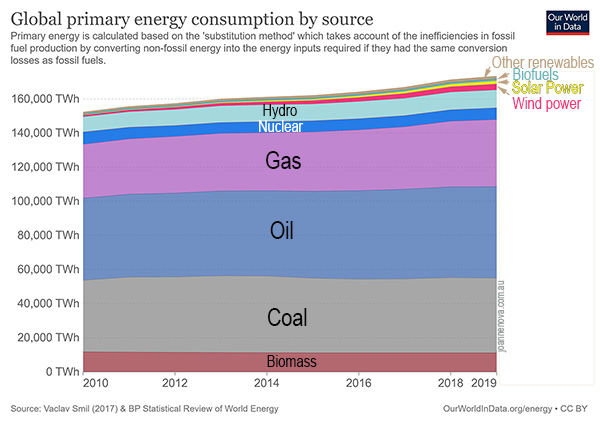

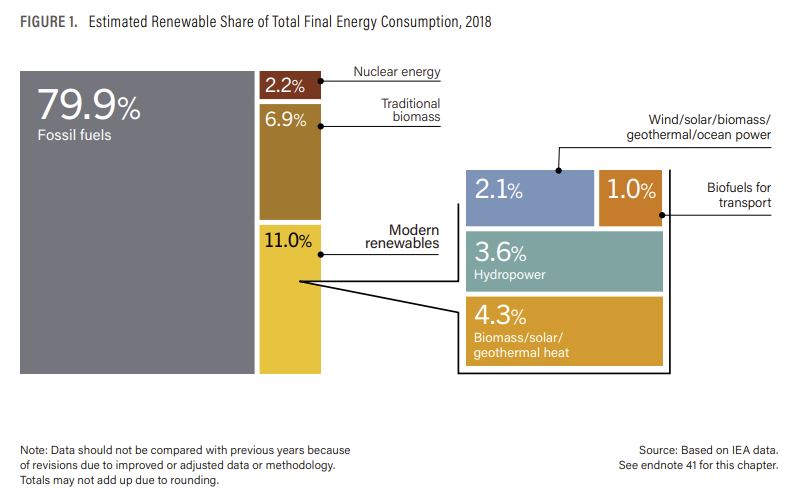

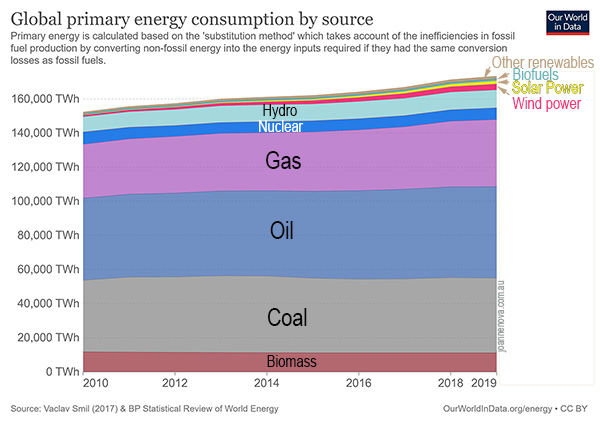

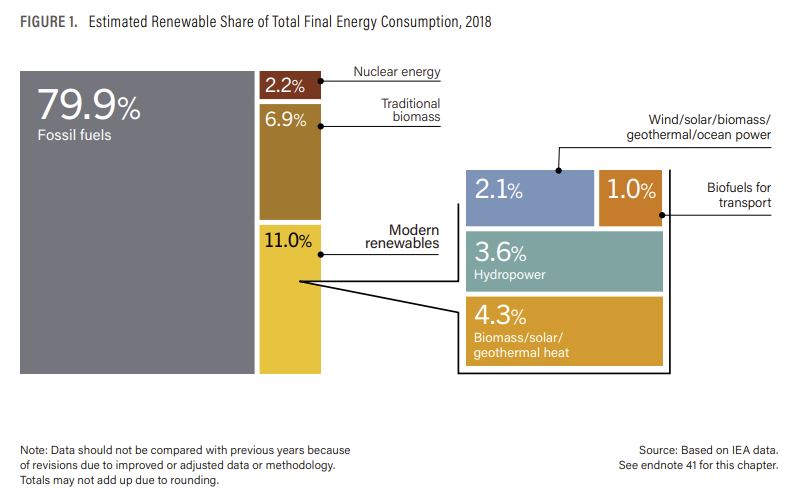

Reality must be depressing for Green-believers. Here they are, after all this revolutionizing, they’ve installed more than a million megawatts of glorious solar and wind totems and it has barely made a dent. The world still stubbornly runs on fossil fuels.

The BBC laments:

Matt McGrath, BBC

A new study says that the world is using more fossil fuels than ever as the transition to green energy stalls.

The Renewables 2022 Global Status Report says the share of wind and solar in the global energy mix has risen minimally in the last decade.

“The share of renewable energy has moved in the last decade from 10.6% to 11.7%, but fossil fuels, all coal and gas have moved from 80.1% to 79.6%. So, it’s stagnating,” said Rana Adib, the executive director of REN21. “And since the energy demand is rising, this actually means that we are consuming more fossil fuels than ever.” As the world rebounded from Covid-19 in 2021, there was a significant rise in overall energy use, most of which was met by fossil fuels.

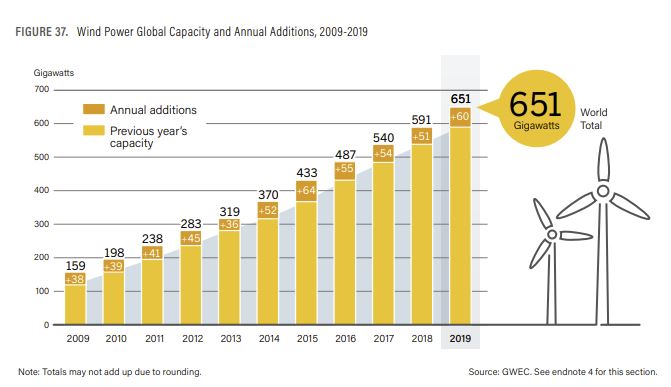

Here is the whole last ten years of the renewables revolution

Despite having 61 figures in their 367 page report, they didn’t seem to have a graph of how global fuel sources have changed. To help them, I created one:

OWID | Click to enlarge What would you do, if you had thousands of marketing dollars to spend and wanted some eye candy that made renewables look like they weren’t a complete failure. You might use something like this:

Global Energy sources | REN21

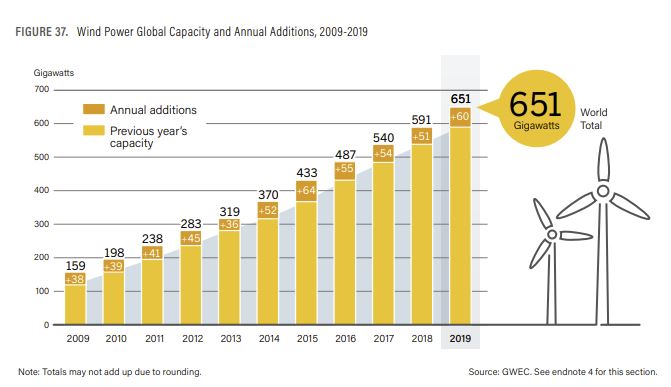

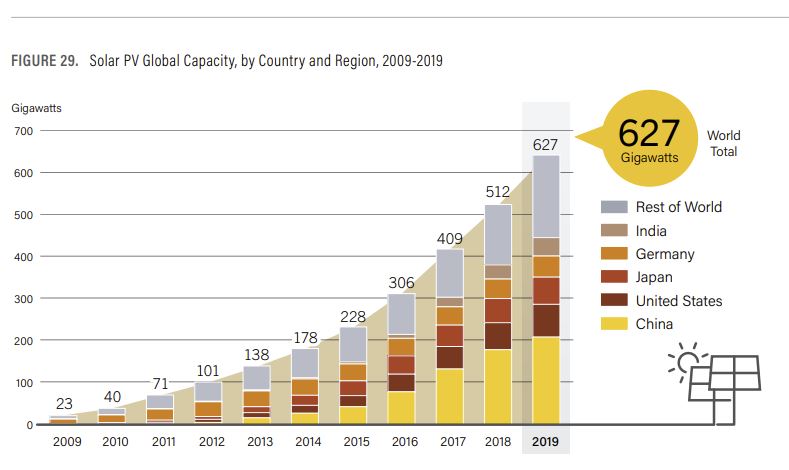

And here’s 1.2 million megawatts of wind and solar power installed in the last decade. If only it was useful?

Wind power growth | REN21

Keep reading →

9.8 out of 10 based on 69 ratings

The Renewable Crash Test Dummies: Test in progress

A LaTrobe Valley Coal Plant Day #3: Huge Yallourn coal plant in Victoria loses 2 of 4 turbines. The AEMO suspends the whole market. Blackout warnings continue. Australians are being asked to conserve electricity. It’s just another day in the forced transition we don’t have to have.

How much lower can we go? Half of the generators from the ultra cheap brown coal Yallourn plant went phht yesterday. This was “unplanned”. It normally makes 20% of Victoria’s electricity. It’s owned by EnergyAustralia (China Light and Power) which is keen to close it early in 2028 and has a special secret deal with the Victorian government to do so. Perhaps China Light and Power is scrimping on those maintenance costs?

Warnings about potential blackouts exist for all five states on the National grid during the next 48 hours. The Minister for Energy, and the head of the AEMO, and several state Ministers have asked Australians to turn off all the non-essential electrical items. The NSW Minister asked people not to use their dishwasher tonight. Go first world modern nation! Meanwhile Matt Canavan wonders why people can’t use their dishwashers but the glorious Vivid Light Festival is going ahead. Priorities Matt!

So far, there have been reports of blackouts in Sydney on Monday night and in Queanbeyan near Canberra today.

This afternoon the AEMO gave up on trying to run the wholesale generation market under normal rules and suspended it completely. It is likely to stay suspended for a week. The Soviet fixed pricing system of $300/MWh was too low and generators were avoiding bidding in because they don’t like running at a loss. Reserves were already wafer thin, so this just made it all impossible.

7 News: The suspension will mean the AEMO is in charge of directing supplies from energy generators to the power grid, until further notice, safeguarding households against the threat of blackouts. In a market notice issued on Wednesday afternoon, the AEMO declared the spot market in NSW, Queensland, South Australia, Tasmania and Victoria was suspended from trading after it was “impossible to operate the spot market in accordance with the rules”.

The move by the regulator marks the first time the entire national electricity market has been suspended since it was formed in 1998.

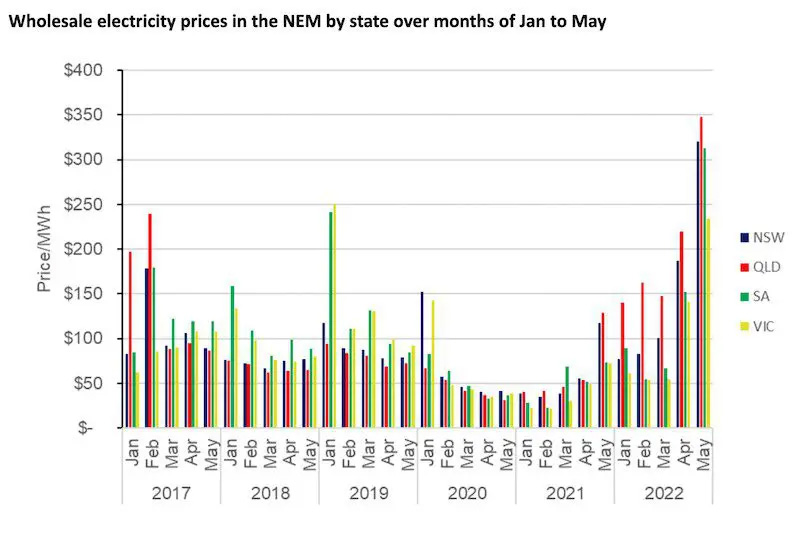

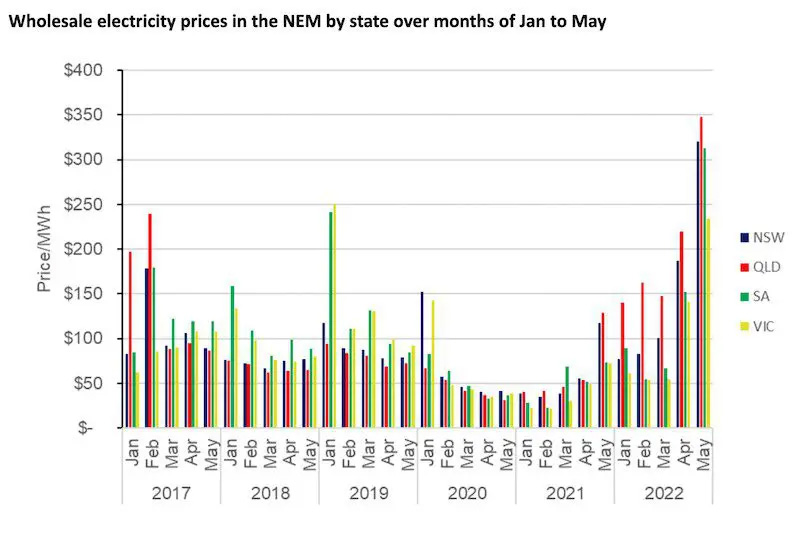

The AEMO chief said that suspending the market will mean generators will have to be transparent about their available generation and the prices will be figured out later based on the prices of the last month (which were exceedingly expensive). Lets not forget that the average price for June so far in NSW and Queensland was about $500/MWh. Utterly blistering. Two years ago the average price for June was $50 in NSW and $33 in Qld.

The Premier of super renewable South Australia was scathing about how embarrassing this was — but blames all the generators, which presumably are mostly not in his state, for being greedy because they don’t want to generate electricity for a loss. What are they thinking?

Through sheer luck South Australia is at this mostly powered nearly entirely by windpower. What luck!

The Australian energy operator says South Australia faces potential rolling power cuts on Friday as there is no reserve left in the national electricity grid, with Premier Peter Malinauskas saying policymakers should be “deeply ashamed” of the crisis.

AEMO this afternoon issued further LOR3 warnings in SA for Wednesday 9pm to 9.30pm and Thursday 8am to 8.30am and 9am to 10am.

A forecasted shortfall warning is also in place from Thursday 3pm all the way through to 4am Friday.

Premier Peter Malinauskas said he received advice this morning that “there’s a degree of confidence there’s enough supply in the system” for South Australia to avoid an imminent blackout.

These people have no shame. He complains they are running the grid on “market ideology” when obviously it’s that other ideology that has got us in all this trouble:

But the Labor Premier took numerous swipes at the condition of the national electricity market due to “repeated policy failures that seem to be obsessed with market ideology rather than outcomes for users”.

Keep reading →

9.8 out of 10 based on 58 ratings

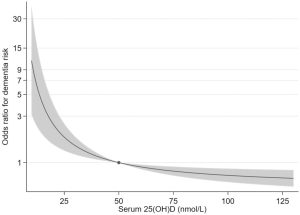

Just imagine that 17% of dementia cases could be prevented with a new drug that cost five cents, had a huge safety margin, and virtually no risk?

The study from the University of South Australia looked at data from 294,000 people in their 60s in the UK, and followed them for a median of 11 years or so. Researchers even controlled for time spent outdoors, types of physical activity, and the amount of oily fish they ate to try to cover for other benefits from these activities.

Seems to me, that if Ministers of Health were interested in actual health, they might be offering free Vitamin D tests, free supplement bottles, lessons in school and public awareness programs. They might even offer testing clinics in shopping centre car parks or free bottles at the RSL and Bowls clubs. Crazy idea right? In the world you thought you were living in, the treasurer might be chasing them down to forecast savings on public health spending ten years from now by keeping 1 in 6 out of nursing homes. Instead our Departments of Health are apparently keen to approve patented drugs with few clinical benefits that cost $28,000 per patient (and that’s after the price was halved due to the outcry). How many taxpayers will die to save one Big Pharma shareholder?

Where are the journalists — probably not asking the Minister of Health any hard questions. This is not the first study to show Vitamin D reduces dementia. Like this one, and this one, and this one. By some estimates more than a billion people worldwide don’t have enough Vitamin D.

The Australian

The minimum healthy level of vitamin D is 50 nmol/L, but an estimated 31 per cent of adults in Australia have inadequate vitamin D, increasing to more than 50 per cent in women during winter and spring in the southern states.

The UniSA study found that those with vitamin D of only 25 nmol/L had a 54 per cent higher risk of developing dementia than those whose levels were 50 nmol/L.

The researchers found 17 per cent of dementia cases could be prevented by increasing vitamin D levels from 25 to 50 nmol/L.

From the paper — there are three ways vitamin D could protect brains — it helps neurons grow, reduces blood clots, and is an anti-inflammatory:

A protective effect of higher 25(OH)D on brain health is biologically plausible and could be explained by at least 3 potential mechanisms. First, the presence of vitamin D receptors in the hypothalamus has suggested a neurosteroid function for active vitamin D, promoting the growth and maturation of neurons (48, 49). Second, there may be vascular mechanisms as active vitamin D has been associated with reduced thrombosis and regulation of the renin–angiotensin system (5). Third, replete concentrations of active vitamin D may act as a neuroprotectant through the suppression of excess inflammatory neurovascular damage caused by proinflammatory cytokines and attenuation of amyloid proteins, commonly observed in Alzheimer disease (3, 4).

Flashback to June 2021 — FDA rushes through approval of Alzheimers drug which costs $56,000.

It reduces beta-amyloid but doesn’t yet show any benefit for memory:

The drug, which is called Aducanumab but will be marketed as Aduhelm, has been shown to reduce levels of beta-amyloid, the sticky plaque that is the hallmark of Alzheimer’s disease, in the brain. HelloCare says the studies have not been able to show the drug slows declines in memory and thinking, and in fact, “two large recent studies have had opposite findings.” In November, a panel of the US Food and Drug Administration (FDA) advisers recommended the agency not approve the drug.

The FDA approved the drug through its ‘accelerated approval pathway’, a fast-track approval process designed to hasten access to drugs that could provide a “meaningful therapeutic advantage” over existing treatments for patients with serious or life-threatening diseases, and where a clinical benefit is “expected” – even if there is still uncertainty about the benefit.

Keep reading →

9.9 out of 10 based on 55 ratings

All the rules are breaking.

The price market broke on Sunday night and now the interconnectors rules are broken too. The whole Eastern five state “National” grid is flying seat of the pants — the reserves are so incredibly thin that there are LOR3 forecasts — meaning Lack Of Reserve Level 3 rolled out for all five states. It doesn’t mean blackouts will happen, but it means all the protective layers of this onion are gone. The system is running bare. The price market broke on Sunday night and now the interconnectors rules are broken too. The whole Eastern five state “National” grid is flying seat of the pants — the reserves are so incredibly thin that there are LOR3 forecasts — meaning Lack Of Reserve Level 3 rolled out for all five states. It doesn’t mean blackouts will happen, but it means all the protective layers of this onion are gone. The system is running bare.

UPDATE: There were some blackouts in Sydney’s northern suburbs last night. “Millions of homes” were apparently told to conserve their power in Brisbane and Sydney. Welcome to RenewableWorld!

ht/ WattsUp, Eric Worrall, and RicDre

The price market broke on Sunday night when for the first time the AEMO imposed somewhat anachronistic price setting clauses it had never used. By fixing the wholesale price in Queensland, market bidding suddenly phase-changed into a twilight world where prices were set too low (at an obscenely high $300/MWh, but not high enough now), and generators didn’t want to bid. So offers to supply “Yo-Yo’d” and the AEMO had to run emergency orders of a different kind to force generators to run. In days to come, some bureaucrats will work out later what they should all really be paid post hoc after their compensation claims are filed. The Administered Pricing in Queensland quickly spread to NSW and Victoria and South Australia.

It’s not 100% clear how thin actual generation reserve is, or how much the crisis is due to generators not wanting to bid at these prices. Even the lawyers are busy. The Australian Energy Regulator (AER) has sent out letters to all the generators today reminding them they have an obligation to provide electricity generation and play nice, and they must not omit intentionally or recklessly anything that might contribute to current (ahem) circumstances.

Last night, the AEMO got through the night (in Queensland)*. But to avoid blackouts the AEMO broke its own rules on interconnector flow to allow some energy through to Queensland. The interconnectors are normally limited by automatic equations which are designed to stop a situation like the total Black-State-SA that occurred in 2016. As I understand it, states need enough reserve power so that the largest single generator can go kaput and trip out without also causing a cascading system collapse. Last night things were so on-the-brink that Queensland didn’t have that reserve. Someone in central control had to override the protection formulas to allow megawatts from NSW to sneak through to Queensland, even though it meant that last layer of protection against a system black was stripped away. Bare knuckle stuff in the control room. It’s fine as long as everything works.

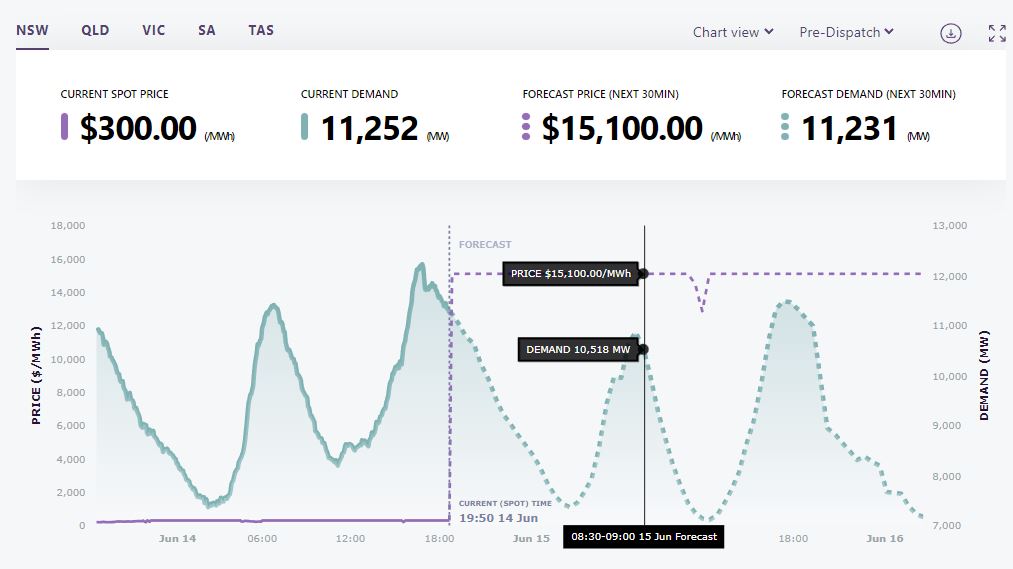

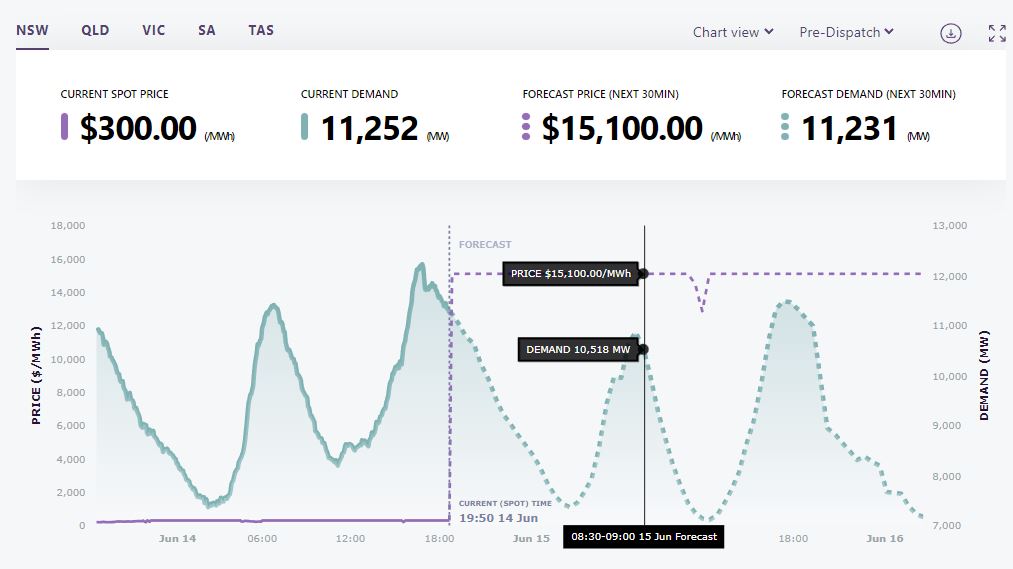

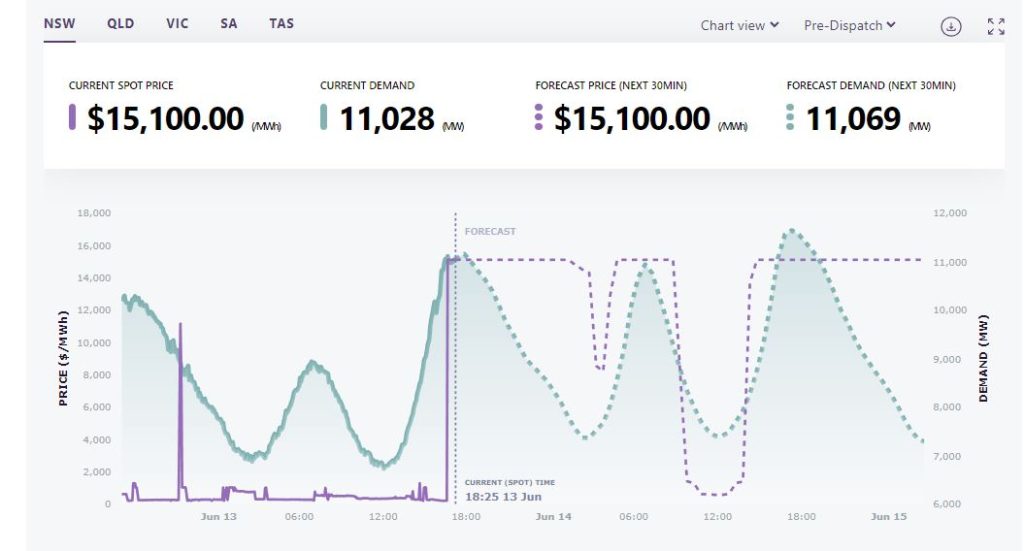

Graphs that show the market is broken

Here the forecast price for the whole of NSW is a blistering $15,100/MWh for nearly every single minute of the next 24 hours, but the actual price is coming in at the mandated $300.00. The Queensland graph looks almost exactly the same. There has not been a day like this…

All those solar panels at midday (with their subsidies) are reducing the price forecast to $12,855, whatever that means.

The flatlining graphs show that this is not a “market”. Prices are forecast at $14,000 but coming in at $300.

Teetering on the brink all night, and tomorrow, and in all five states

AEMO Market Notices are like a ticker tape parade. Queensland has warnings issued today running from 4.30pm right through to midnight. NSW is in trouble from 5pm to midnight. Loads that may be interrupted are in the order of 1500MW in both states, though both appear to have made it through the day’s peak load. Currently NSW sits at LOR2 (Lack fo Reserve Level 2) and there are forecasts of LOR2 for no less than 7 time periods tonight. Even Victoria is running thin enough that there is a warning of a 218MW forecast of load to be “interrupted”.

WattClarity is struggling to keep up with AEMO Market Notices. The pace is so blistering that dedicated market watchers missed LOR3 forecasts for Tasmania and South Australia — normally something that would be the most exciting news that year, but now, just another blip.

Similar warnings apply for tomorrow night in all three largest states in Australia.

Where is all that global warming?

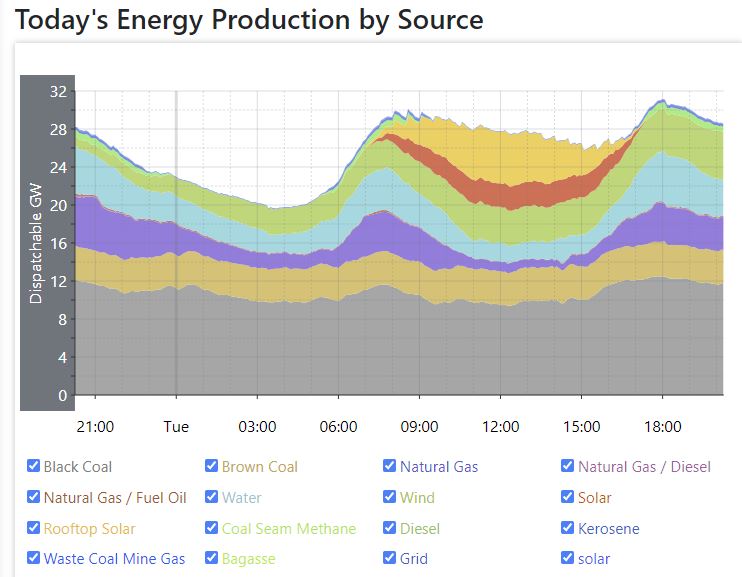

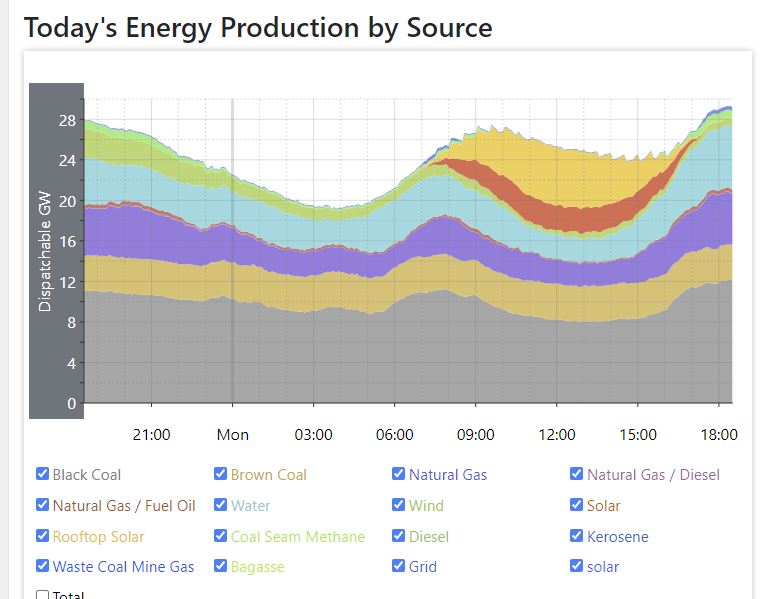

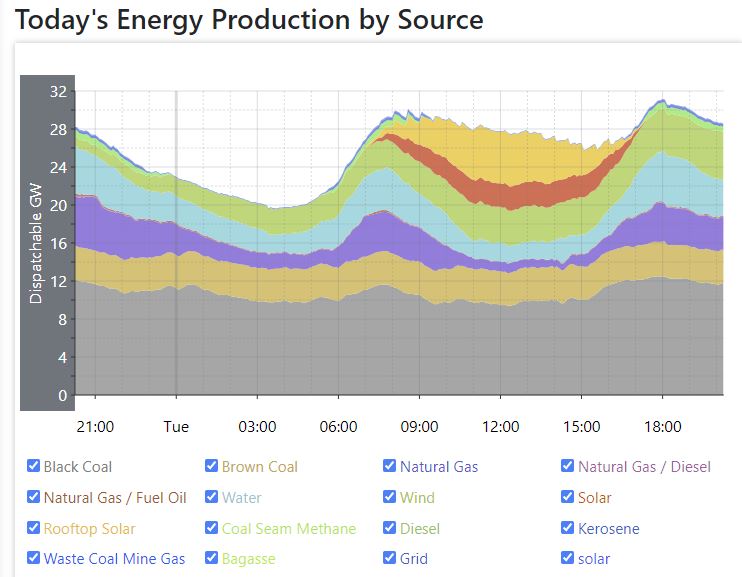

Today’s peak demand for the grid was 31,200MW — a high reading for winter in Australia. It must be cold on the East Coast today, but luckily there was some 4GW of wind power (green band) which arrived today in time to keep things afloat for the evening peak. There was only 1GW of wind or less overnight last night. So cold windy nights are OK. It’s the cold windless nights that break the system.

Total peak demand was 31.2MW which is high for winter. Breaking the interconnector safety rules

For a couple of hours from around 6 – 8am this morning Queensland was importing more energy from NSW than was considered safe:

Paul McArdle, Wattclarity

1) NEMDE can’t find a feasible solution to dispatching the NEM for 07:10 this morning without ‘violating’ some constraint equations.

2) This has the effect of allowing more transfers into QLD from NSW than what would be ordinarily considered safe to do so.

3) However it comes with a risk … particularly, in this case, had Kogan tripped during this period we would have been a heightened risk of Voltage Collapse in the grid.

4) Should this have happened, it may well not have been as ‘controlled’ as what might happen if this forecast LOR3 for this evening does not get resolved … rather, what might have happened might be more catastrophic, and longer to recover from (more like the SA System Black).

5) The AEMO’s done this because the market presented them with very few other options…

The graphic included in the post includes a data table with words like “Out=Lismore SVC, avoid Voltage Collapse on loss of Kogan Creek”“. Presumably this translates as we’re over-riding the normal requirements and if Kogan coal trips, the interconnector will load-shed Queensland, and the whole system goes down. (Hey but a “System Black” in Queensland is only billions of dollars and potentially a life and death situation for a few people.)

Various government agencies are currently reminding all the players that they have to play whether they like it or not. It’s a totally Soviet system now, with only the illusion of being a free market.

As an aside, for the true energy-nerds, it appears Australia doesn’t have much in the way of “pre-programmed” blackout capability to deal with this type of crisis. Those are called rather cutely, “Negawatts”. Wattclarity analyzes the Wholesale Demand Response during these extraordinary times, and finds that it essentially amounts to almost nothing. Apart from the two giant aluminum smelters in NSW and Vic that use about 10% of each state’s generation, there were only 12 units registered to provide “wholesale demand response” which is a big total of 59MW in a system that is currently drawing around 30,000MW.

Evidently, it’s harder to get people to voluntarily give up their electricity even when there are payments on offer.

9.3 out of 10 based on 48 ratings

7.6 out of 10 based on 12 ratings

The Queensland grid is in crisis — the forecast price for nearly the entire next 24 hours is $15,000 per megawatt hour.

I have never seen a graph like this one. It’s a “white knuckle ride” as Paul McArdle describes it. The IRPM (or Instantaneous Reserve Plant Margin) is just 8%. “This shows total Available Generation of 31,679MW ready to supply aggregate ‘Market Demand’ of of 29,201MW at this point … so a surplus of only 2,478MW NEM-wide.” But only last week there was a record day where the grid demand was 32,000MW — the highest winter demand day for years.

Reserves are incredibly thin, not just in Queensland, but also in NSW.

Market Notices from the AEMO are flowing like confetti. There is an Actual Lack of Reserve Level 2 (LOR2) in Queensland as of 6pm to 8pm. There is an LOR2 running for NSW as well, and an LOR1 for Victoria. If things shift up to LOR3 that means blackouts are likely, and LOR3s are forecast — in QLD tonight and in NSW tomorrow night. The margins are thinner than they look. Because extra generation on one part of the grid may be 3000km and an interconnector or two away from where it is needed. The interconnectors have complicated automated rules about flow to try to avoid black-state situations and to minimize prices. It’s not always obvious why they limit flows.

*** UPDATE: The LOR3 forecasts have been cancelled, but the Cumulative Price Threshholds (CPT) have been blitzed, and NSW now joins QLD. This is all new territory for the national market. Perversely, once the CPT is breached, and the “soviet” fixed price conditions are set, many generators withhold auction bids to supply, and then the AEMO has to order them to do so. It’s just a rolling crisis with one bandaid to fix the last cut piled onto the new wound… Paul McArdle tried to keep up with the Yo-Yo-ing of available generation in QLD once the CPT threshold was set on Sunday evening there. It appears the fixed price is $300/MWh, which is curiously, lower than the actual average daily price the market has arrived at every single day in June in both NSW and QLD. To give people some idea of the bloodbath on the Australian grid the average “monthly” price so far in June is $460 (NSW), $677 (QLD), $333 (SA), $284 (Tas) and $306 (Victoria). Thus the wholesale price of electricity for entire states for nearly two weeks is 46c in NSW and 68c in Queensland. And generators will be able to apply for compensation for losses, so there are more dollars to flow long after the crisis is over.

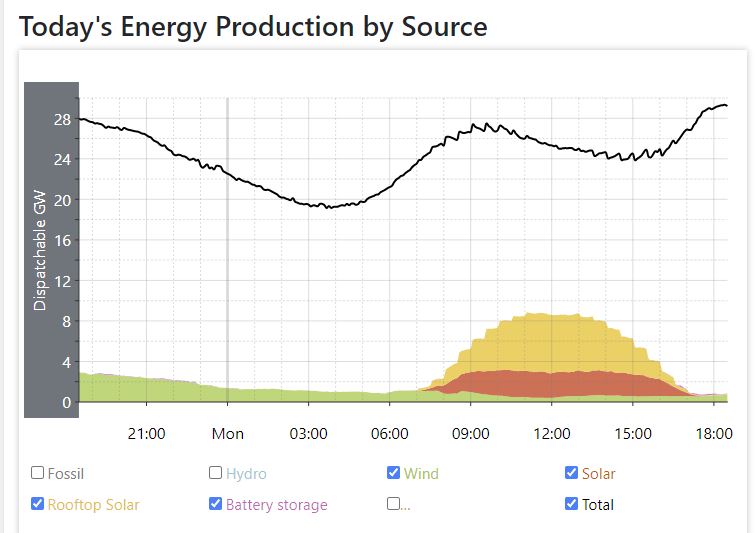

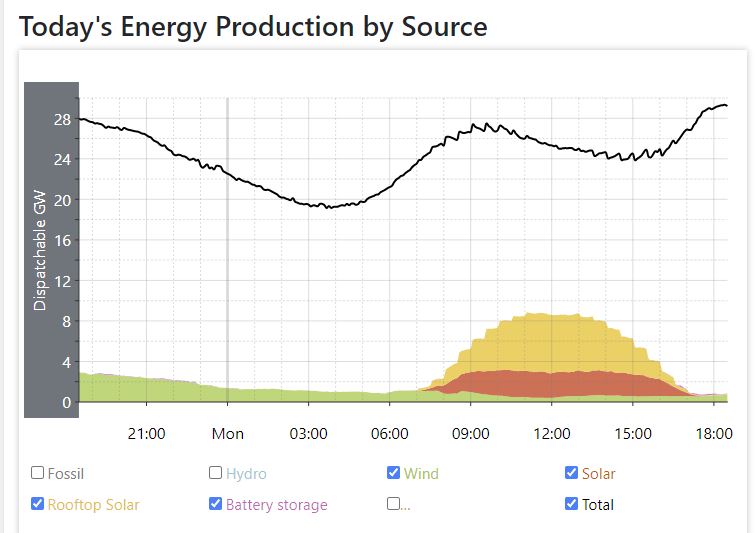

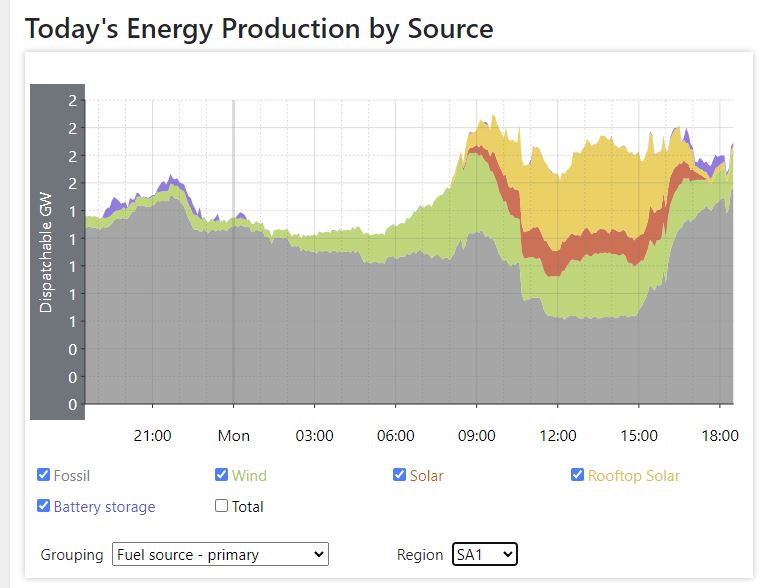

There is almost no unreliable intermittent renewable energy available to use during this peak time

This graph shows how much the entire renewable revolution is helping at this moment in Australia. The graph also shows “Battery storage” so people can see how much it is contributing. To notice the microscopic sliver of red battery power flicker on and off, go to Anero.id and tick-untick the battery box.

Everyone will blame “the failure of coal” but anyone can see that more solar panels and wind turbines wouldn’t solve anything tonight.

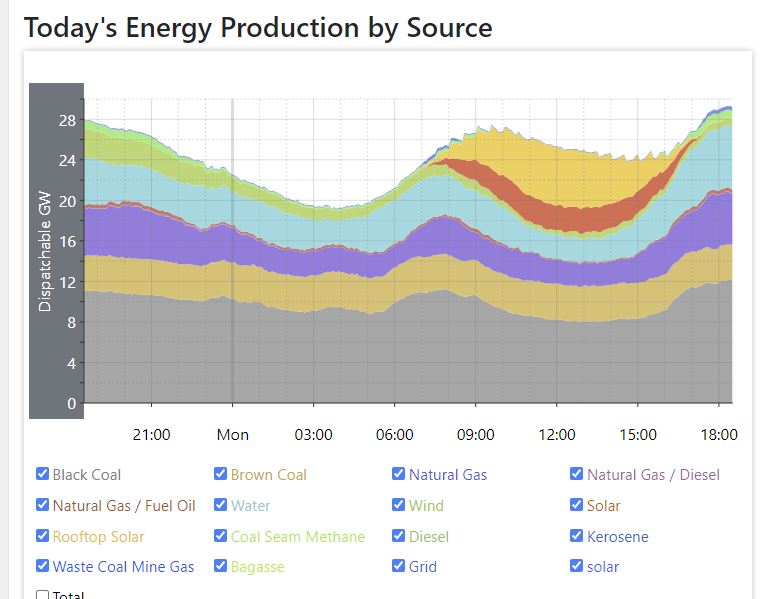

There is almost no solar, wind power or battery power available. | Anero.id Coal power is obviously the mainstay of the grid

Those sources from the bottom are black coal, brown coal and natural gas. The light blue is hydro power. Everything else is trivia.

At one point today the total power from our entire wind generation across five states was 409MW at 12 noon out of 8.5GW of “capacity”.

Coal is keeping the grid running. | Anero.id Updating this page…

Australian Financial Review

The national energy market operator is having to direct electricity generators in Queensland to switch on plants to avoid blackouts, after the introduction of controlled prices in the state left some generators unprofitable. Despite the orders, Queensland is at risk of potential blackouts later on Monday because of a deficit in supply, the Australian Energy Market Operator signalled, by forecasting a level-three “lack of reserve” notice.

“The wheels seem to have fallen off the energy market,” said power market watcher Paul McArdle at specialist information service Global-ROAM. He noted AEMO has forecast that 1454 megawatts of demand could be “interrupted” at 5.30pm, a load “about the size of Brisbane”.

An extended period of extreme electricity prices triggered a rarely-used cap on wholesale power prices in Queensland on Sunday evening, of $300 a megawatt-hour.

Price caps and emergency rules are in action. Generators are being called up to perform whether they like it or not. But some are short of fuel, and any group ordered to supply can ask for compensation payments. In Queensland a cumulative total of seven days in a row topped $1.36 million so the “price cap” was triggered for the first time.

The renewable wonderland of South Australia is tonight running on fossil fuels:

Specifically, South Australia is currently using natural gas, diesel, and fuel oil to keep the lights on. The price is $272/MWh, with about 2GW being used at 7.40pm local time near the end of the highest peak for the day. Prices are also forecast to be at risk of tripping the cap of $15,000 in the next hour, but they may not. Tasmania is almost all hydropower at the moment but prices are $440/ MWh.

The same interconnectors that allow electricity to flow also allow blistering high prices to flow throughout the system. Apparently, both SA and VIC are at some risk of hitting their cumulative price caps too. Fortunately for WA and the NT they are not connected to the NEM and the high renewable-induced bloodbath prices in the market can’t flow through.

SA is running on fossil fuels. That’s natural gas, diesel and fuel oil. h/t Old Ozzie, Rafe,

9.9 out of 10 based on 80 ratings

Sobering thought for the day: Uganda may get a nuclear power plant before Australia gets one nuclear submarine:

Uganda is set to build East Africa’s first nuclear power plant after acquiring land for the project, according to Bloomberg. The Minister of State for Energy Okasai Sidronius Opolot announced the plans in a statement, but did not reveal where the site will be located. Uganda is set to build East Africa’s first nuclear power plant after acquiring land for the project, according to Bloomberg. The Minister of State for Energy Okasai Sidronius Opolot announced the plans in a statement, but did not reveal where the site will be located.

President Yoweri Kaguta Museveni has said that Uganda and Africa are only interested in nuclear power for energy supplies like electricity, and not for nuclear weapons. “For us, we want that power for electricity, for agriculture and not for nuclear weapons,” he said. President Museveni was speaking at a meeting this week, with the delegation of International Atomic Energy Agency at State House Entebbe.

Would the world be a safer place if Uganda had a new high tech coal plant instead?

The West could make that happen.

He added that land had been acquired to build a 2GW facility, although he did not say where. The project would be part of Uganda’s aim of increasing generation capacity by almost 12-fold to 17GW in the medium term. In 2020, around 70% of Ugandans were still using wood fuel, in the form of firewood and charcoal, according to the Uganda Bureau of Statistics, prompting concern over deforestation.

Judging by these preparations Uganda will need quite a lot of help.

In 2017, Uganda said that it wanted to build a 2,000 megawatt nuclear power plant by 2032. According to reports, Uganda has already trained 22 people at Master’s degree level in nuclear science, with the hope they will work at the landmark plant when it is built.

That many eh?

Africa wants energy. The West can leave that space open for other powers to fill or act like the world cultural and technological leaders that they are.

9.9 out of 10 based on 66 ratings

Starving for any attention, the carbon-haters need to find a reason to get into the inflation debate. CO2 keeps rising but crops are up, forests are greener, tropical islands are growing, mangroves are expanding, and the world is in more danger of being overrun with cheap soy and corn than by rising seas. Whatever. The disaster-bus will find a way to blame fossil fuels for everything that’s bad, as if through some miracle EV’s and windmills will make pork cheaper.

It’s a cult:

Climate crisis is ‘battering our economy’ and driving inflation, new book says

Edward Helmore, The Guardian

Forget Ukraine, coronavirus, corporate greed and “supply chain issues”, when it comes to inflation the climate crisis is the real, lasting, worry, according to a new book, and one that’s only likely to get worse. Climatenomics lays out how ‘supply chain disruptions’ has become a euphemism for the effects of climate change

“I don’t think people have realized that climate change is an economic issue now because it’s always been seen as an environmental, health or social issue,” says Keefe. “The fact of the matter is climate change is battering our economy.”

Any long term trend will do, even a really short one:

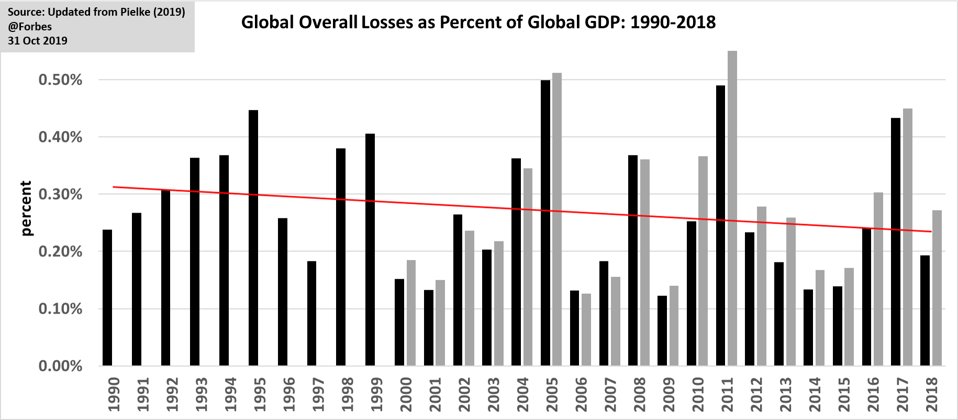

According to Keefe, citing National Oceanic and Atmospheric Administration (Noaa) figures, climate-related weather disasters cost the US economy more than $145bn in 2021 – a nearly 50% increase from last year.

Then Any big Scary Number will do. Lordy Maths! Just say “trillion” and give me your money:

Over the last five years, they have cost $750bn. Since 1980 323 weather and climate disasters have cost $1bn or more, the total cost of these events exceeds $2.195tn.

Nevermind that the long term cost of climate losses is growing smaller as a percentage of GDP.

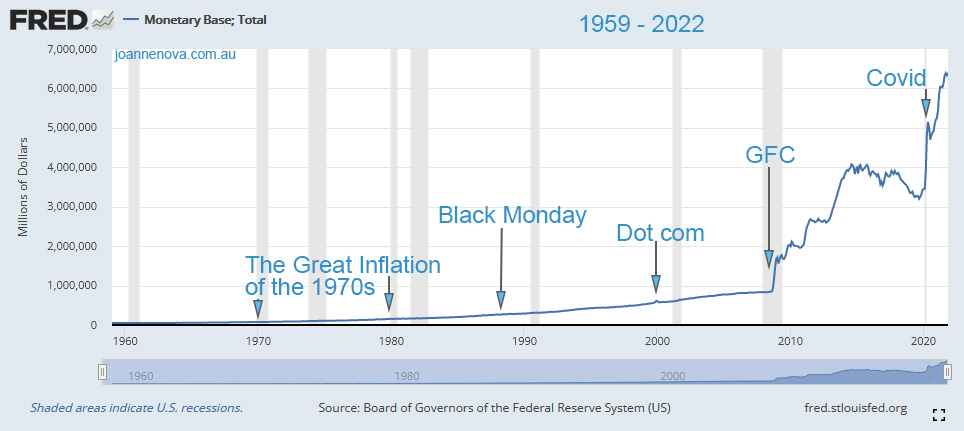

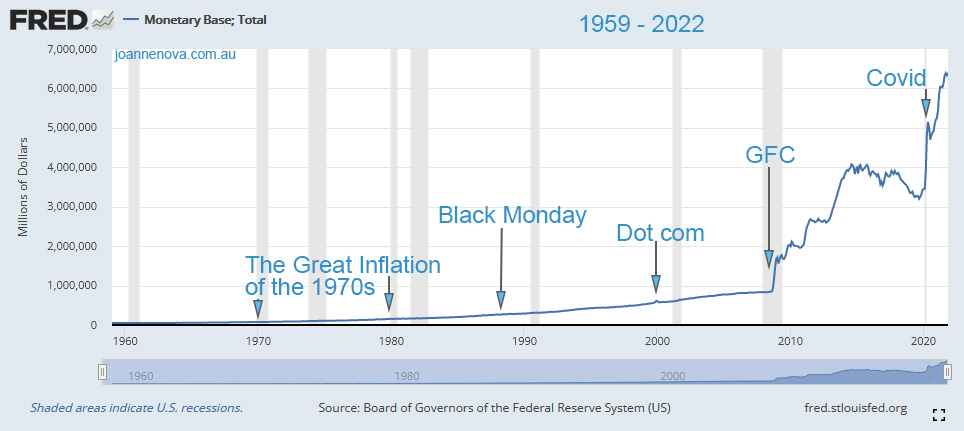

As I said five months ago when it was obvious that 2022 would be the Year of Inflation, more money, means more inflation:

More dollars fighting over the same stuff means higher prices. It’s just a supply and demand thing. This is the money base of USD, a rough measure of “how many dollars there are”. It’s obvious where this is going and it isn’t a temporary spike:

US St Louis Federal Reserve, Money Base graph 1918-2008 | Source Cause and effect.

REFERENCES

St Louis Federal Reserve: AMBSL and BOGMBASE

Piekle, Jnr (2018) Tracking Progress on the Economic Costs of Disasters Under the Indicators of the Sustainable Development Goals, Environmental Hazards. https://www.tandfonline.com/doi/full/10.1080/17477891.2018.1540343

A complete list of things caused by global warming: Numberwatch

Plus shorter lists:

h/t Graeme No.3

9.7 out of 10 based on 61 ratings

…

9 out of 10 based on 8 ratings

Year after year they told us it would get warmer, ski seasons would get shorter and children won’t know what snow is. Instead Thredbo in the Australian Alps has just had 125cm of snow, a full 4 feet in 7 days, which some are calling a 54 year record. Skiers in Australia are thrilled.

https://twitter.com/grand_solar/status/1534181676854788097 Daily Telegraph

In my many years living and working in Thredbo, I have never seen the Village so covered in snow ahead of the June long weekend,” Thredbo Resort general manager Stuart Diver said.

In the year 2000 the world’s top global warming experts at East Anglia University claimed “children just aren’t going to know what snow is” within a few years.

In 2003, a CSIRO report found that the total area covered by snow in Australian mountains could fall by up to 40 per cent.

“By 2020, the average annual duration of snow-cover decreases by between five and 48 days; maximum snow depths are reduced and tend to occur earlier in the year; and the total area covered in snow shrinks by 10-40 per cent,” it stated.

Think tank IPA’s senior fellow Dr Jennifer Marohasy said it had been a cold start to winter but because the Bureau of Meteorology had closed down weather stations and set limits on stations recording cold temperatures, it made comparisons difficult.

As Jennifer Marohasy says, they’ve closed long standing stations, and set limits of minus 10.4 C so if Australia were to break our long time cold records we’ll never even know it. Charlottes Pass in Australia reached minus 23 in 1994. How can we even measure that with thermometers that “stop” at minus ten?

9.9 out of 10 based on 93 ratings

EnergyAustralia is 100% owned by China Light and Power (CLP Group) and owns a suite of generators that include coal, gas, wind farms and battery storage in Australia. It was sold by the NSW government for $1.4 billion in 2011. According to Wikipedia, the mothership company, CLP, owns “a number of power stations in Asia” and most are either coal-fired or fossil fuel power stations. It also owns Hong Kong Nuclear Investment Company.

A year ago the same company that announced it was speeding up the closure of Yallourn coal power plant to 2028 instead of 2032, now warns the transition “may not be smooth” and the governments plan to pay incentives to keep them open “may not be enough”. But back in March last year, when EnergyAustralia said it wanted to close Yallorn, it also said that it wanted to show that the transition is possible “without disruption”. In fact the Managing Director raved at the time “”We are determined to show Australia, that it is possible to move from the old to the new in a way that does not leave people behind.”. Blah Blah Blah, eh?

The plan, apparently, was to close the 1,500MW cheap brown coal plant and replace it with a “large” 350 megawatt battery. The Victorian Minister of Energy said this was reasonable because another 5,000 megawatts of electricity was going to be added to the grid in coming years. Perhaps she didn’t realize that not all megawatts are equal?

Perry Williams, the journalist at The Australian did not ask if EnergyAustralia would profit from getting cheap coal competitors off the grid, thus raising the price every generator earns in the NEM auction system.

Nor did he ask whether the owners, CLP, are calling for orderly transitions out of coal in Asian markets or only in Australia.

Perry Williams, The Australian

Power giant EnergyAustralia will call on governments for a new policy to plan the orderly exit of coal-fired plants from the electricity system amid a growing energy crisis.

EnergyAustralia, which owns the big Yallourn and Mt Piper coal-fired power stations in Victoria and NSW respectively, is under short-term pressure to keep the fossil fuel in the energy mix after a string of big units suffering breakdowns amid a broader crunch in the national electricity market.

EnergyAustralia’s Yallourn station in Victoria – which started operating in 1974 – supplies 22 per cent of Victoria’s electricity and 8 per cent of the national electricity market, but has been under pressure for several years as Australia’s national power grid accelerates a transition to renewable energy.

It will close in mid-2028, more than four years earlier than its planned retirement date of 2032, after striking a confidential deal with the Victorian government. Meanwhile, the final NSW coal power plant will be shut by 2040 at the latest after EnergyAustralia’s decision to bring forward the closure date of its Mt Piper facility by at least two years in a bid to hit new green climate targets.

Did taxpapers pay EnergyAustralia to rush the closure of their own coal assets or are EnergyAustralia trying to hit “new green climate targets” because they are just nice people? Who knows. It’s commercial in confidence. The costs of the Green Transition we don’t have-to-have are always a secret.

Is it possible they will make a motza from shutting cheap coal because they can earn so much more per megawatt hour in a system screwed by a crisis?

9.8 out of 10 based on 58 ratings

10 out of 10 based on 8 ratings

And the bonfire continues

As cold fronts sweep across the south east of Australia electricity prices are setting records nobody wants to set. The wholesale prices for electricity –across a whole month — soared past $300 a megawatt hour in three states of Australia. In NSW the cumulative cost of wholesale electricity for May alone worked out at $2.4 billion dollars. It’s enough to build a power plant. Back in 2015, before Hazelwood old brown coal plant closed and Australia installed more renewable energy per capita than anywhere else on the planet, the average price in NSW was $35/MWh. Back then it cost $260 million for the whole month. (And Hazelwood wasn’t even in NSW. ) The point is not about one coal plant, but about how recently the system still worked and how fast it fell apart. Hazelwood coal plant in 2017 was 53 years old and still selling electricity at $30 per megawatt hour when it was shut down. Since then the whole grid has so much more capacity yet so much less ability. There’s no resilience left. A few speed bumps wiped out the whole road train.

Wholesale electricity prices are higher across the Australian grid than they have ever been The graph comes from Tristan Edis at WattClarity who blames the current fiasco on coal and gas producers “selling at international market prices” saying it’s not a failure of solar or wind. But as Ben Beattie points out we’ve installed 3GW of rooftop solar in 2021, so getting the same power out of it in 2022 is hardly “success”. When the weather systems rained on the coal mines, they clouded up the solar plants. We’re now a weather dependent grid but it didn’t have to be this way. And in January the price of international black coal was $200 a ton but Australian brown coal plants were still winning bids here in Australia at $22/MWh.

If only we had more brown coal plants in good condition?

The wind and solar plants ARE the vandals on the grid

The excess of random wind and solar at subsidized prices mean that cheap reliable providers get driven out of the market and we had no other alternative. It’s exactly what the Soviet-genius energy comptrollers were aiming to do. On top of that, the unloved baseload generators that haven’t been blown up aren’t being repaired and maintained properly. Plus the expert climate modelers said that winter nights would be warmer and they aren’t, and coal was a dead asset, not a $400 a ton asset. And gas wasn’t worth exploring for and we’re a nuclear free zone. It was the same circle of brains that made all the wrong predictions.

When coal and gas hit bonanza prices, Australia should be reaping in the dough. If we had enough brown coal or nuclear plants to lighten the load on the gas and the black coal it would be fine. But we have no back up for the back up anymore. We just have back up for the renewables.

A sneak peak at June prices shows that things are a bloodbath. The average price for the first nine days of June is $440 in NSW and $520 in Queensland. (See the AEMO)

9.9 out of 10 based on 88 ratings

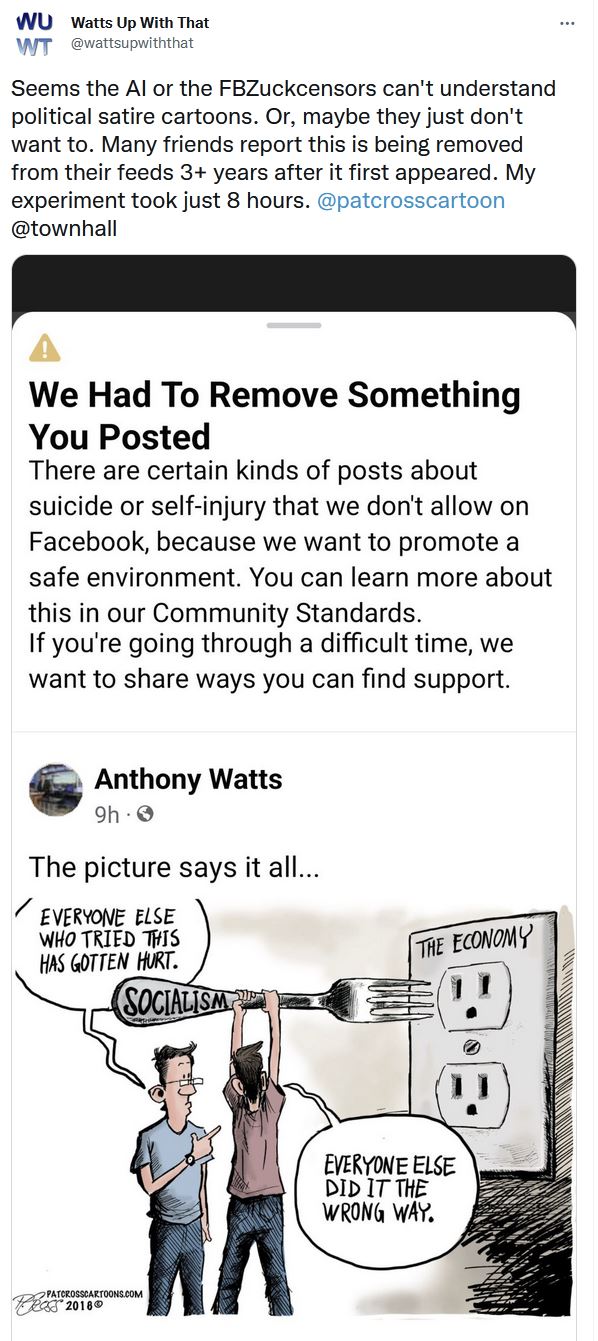

The most important jokes in the world right now are the ones Facebook doesn’t want you to see. Anthony Watts posted a 2018 cartoon which is so “hot” it got removed in just 8 hours.

This cartoon is not a joke, it’s a community safety message.

Source: The original Pat Cross cartoon.

10 out of 10 based on 78 ratings

|

JoNova A science presenter, writer, speaker & former TV host; author of The Skeptic's Handbook (over 200,000 copies distributed & available in 15 languages).

Jo appreciates your support to help her keep doing what she does. This blog is funded by donations. Thanks!

Follow Jo's Tweets

Follow Jo's Tweets To report "lost" comments or defamatory and offensive remarks, email the moderators at: support.jonova AT proton.me

Statistics

The nerds have the numbers on precious metals investments on the ASX

|

The price market broke on Sunday night and now the interconnectors rules are broken too. The whole Eastern five state “National” grid is flying seat of the pants — the reserves are so incredibly thin that there are LOR3 forecasts — meaning Lack Of Reserve Level 3 rolled out for all five states. It doesn’t mean blackouts will happen, but it means all the protective layers of this onion are gone. The system is running bare.

The price market broke on Sunday night and now the interconnectors rules are broken too. The whole Eastern five state “National” grid is flying seat of the pants — the reserves are so incredibly thin that there are LOR3 forecasts — meaning Lack Of Reserve Level 3 rolled out for all five states. It doesn’t mean blackouts will happen, but it means all the protective layers of this onion are gone. The system is running bare.

Recent Comments