The most dangerous Big-Government Qango of all may well be the Central Banks (not the NIH). Money drives all the incentives across national economies, but one small unelected group decides the price of money, and all corruption flows downstream from there. Ponder how they set the temperature that drives the global currents of goods, resources and opportunity. They feed Big Government, Big Pharma and Big Tech.

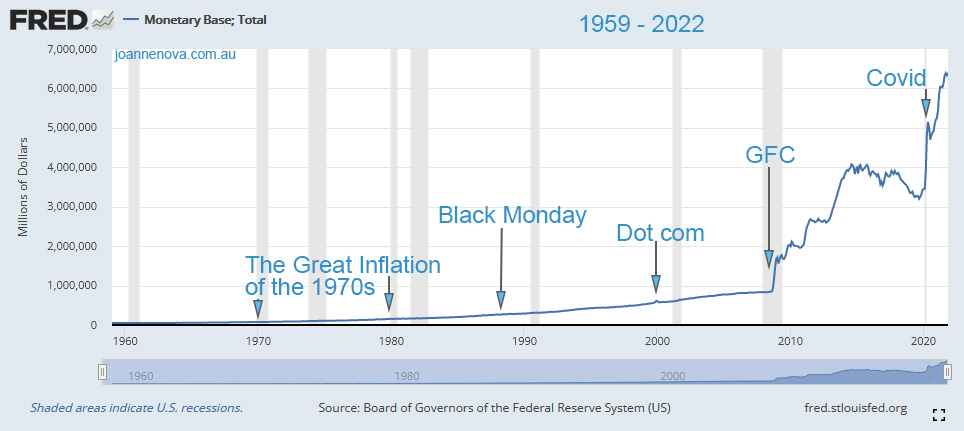

Saddle Up: There is no hiding inflation. Despite the global economy grinding to a halt in a pandemic, house prices set surging records and paradoxically the Dow hit all times highs.

It is just supply and demand. As more dollars are printed, a bigger supply of money competes for the same number of goods. And boy, have they been printing money.

It’s a temporary spike they say:

This is the money base of USD, a rough measure of “how many dollars there are”.

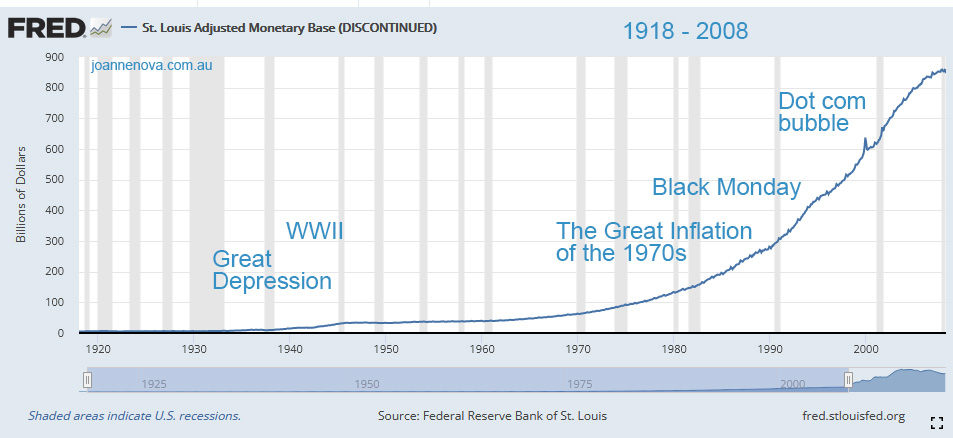

US St Louis Federal Reserve, Money Base graph 1918-2008 | Source

For perspective, below is the history of the growth in US Dollars since 1918 up until the GFC. The US left the Gold Standard in stages between 1913 and 1971, and the growth in money supply since then is obvious. But as fast as this appeared to grow in ninety years, it was nothing compared to what would come in the 14 years since.

US St Louis Federal Reserve, Money Base graph 1918-2008. Source

All the market-rattling crashes of history shrank when compared to the GFC and the Pandemic, which change the whole scale of the graph. The Occupy Crowd, and the Tea Party both recognized something was very wrong with the bail-out of 2009. But the Occupy Crowd have no understanding of what drives the inequality they hate and oppose.

The corruption of the dollar feeds all the other corruption

The people that benefit are the ones that borrow the money and spend it first. The people who lose are those holding their money in cash. Did your wage grow sixfold from 2008 to 2021?

Printing money-for-nothing is always the politically easy way to win votes. Voters like to vote themselves the treasury, so what Treasurer wants to promise austerity?

But inflation eats away at the strength of the economy. The incentives during inflation favor high risk speculation and punish the hourly wage earner and the savers. Inflation makes possible and rewards the mergers and hostile takeovers, thus conglomerating power and reducing competition. It feeds the predators like Amazon, Facebook and Google. Like acid, it destroys the benefits of competition as the big fish swallow up the little fish. It feeds inequality, and of course, it feeds Big-Government.

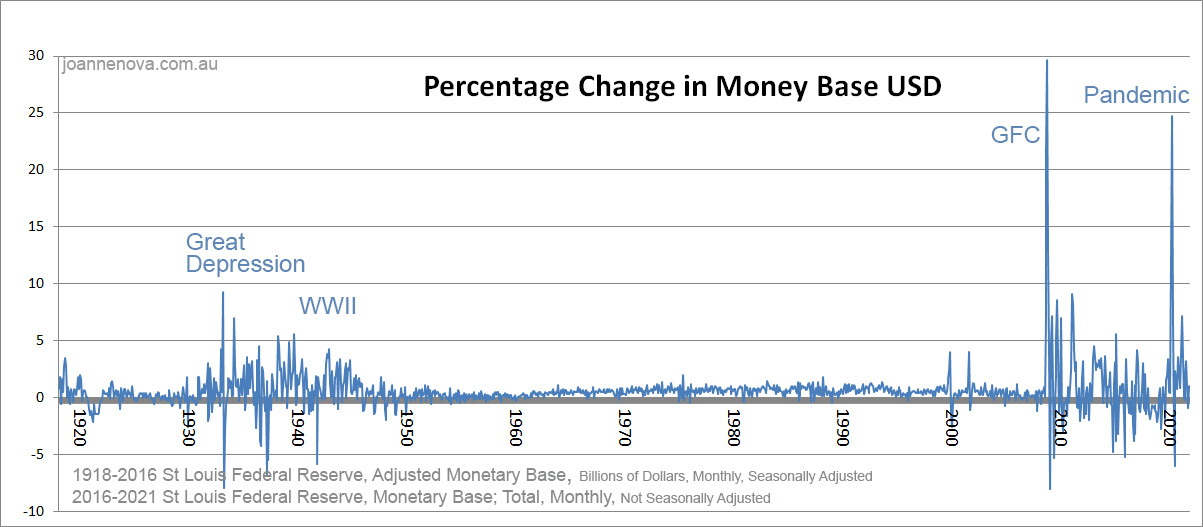

Worse than World War II

The graphs above are not log graphs, so they don’t show the proportionate shift. But the percentage change in money base shows the “seismic” surges in money supply. The GFC and the Pandemic have clearly shaken the value of the American Dollar more than The Great Depression and World War II.

Percentage Monthly Money base change, USD, St Louis Federal Reserve.*

Is it the end of an empire? We hope not. But We The People need to plan accordingly. The Chinese Communist Party is. China is buying gold.

The Treasury officials are doing their best to hide inflation. Just as with climate change, the bureaucrats keep adjusting their inflation indicators so they can keep getting away with the game of silent theft. Big Government lives off silent inflation. Gold or any other real and timeless asset is an anti-cheating device. If currencies were pegged to something real, it’s much harder for governments to grow.

REFERENCE and DATA

St Louis Federal Reserve: AMBSL and BOGMBASE

*To show both the Great Depression and recent era, the last graph crudely, brutally, connects the Adjusted Money base (seasonally adjusted) to 2016 to a different series (not seasonally adjusted) in the last 5 years. But the bodgey nature of this meld still captures the overall effect of the percentage changes quite accurately. Checking the FRED graph edits, at the links above, with “percent change” show that it’s a fair representation. If the Fed Reserve didn’t “discontinue” long data series just when things get interesting, this sort of dodgy splicing wouldn’t be needed.

In every crisis, governments Reward the Reckless and Punish the Prudent.

420

Inflation has been rampant since the GFC. The print run is now being noticed by the media as it affects their business model. State Government advertising.

Despite “printing” A$1TRILLION in the last two years it is apparent that some of our states are bankrupt. Unable to pay down loans for projects that were ALWAYS unsustainable. Unable to meet their bloated payrolls.

Just when we all thought our future may look brighter with the end of Covid restrictions we face a war with our largest customer. A war we will lose. Paper never trumps scissors. Time has almost run out.

The printer is the destroyer of democracy. Election by popularity. The people unable to grasp the idea of the value of money is directly linked to interest rates.

420

Inflation is the leading tool of the Marxist movement, i.e. those who seeek to destroy capital (savings) and abolish private management of industry.

The first major economic announcement of the first Rudd government was the bare faced lie that “Howard has let the inflation genie out of the bottle”. Howard had done quite the opposite.

So, the message had to be that the new government intended to engage in inflationary policy and blame the inflation on Howard. That was the plan, to go on a spree.

Then came the GFC, and the consequent discarding of rules of prudence. This allowed them to double their spree. But the anticipated inflation hasn’t happened yet.

My understanding of economics is basicly simple. A dollar is worth what you can buy with it. If you print more dollars you must create more goods to buy with them, or the unit price must go up.

It seems to me that while we and the world were printing more dollars, China’s phenomenal economic growth soaked them up by creating ever more goods at comparatively low prices.

How long can this last? I think it might be about to hit the wall.

We have been told here that factories are shutting in Europe for want of affordable energy. How many factories? We have been watching that happen here for ten years now.

How many factories have shut in China? Was that coal that was stuck on ships there because disruption by COVID had prevented the coal from being transported to its destination?

I expect to see the worst inflation of the last half century or more this year. 2022. It was in the Rudd1 government’s plan in 2007, it just took an extra ten years to get here.

20

The covid scam is weakening business across the world. A resultant financial crash is very possible.

The aftermath will probably look like “The great reset”- A Debt Jubilee- but with a Faustian twist- those debtors who are forgiven will likely be obliged to “Rent” forfeiting their assets to become servants of the politicians or multi-billion dollar corporations.

So what starts with “QR codes” and “Vaccine passports” could progress quickly to Digital wallet that conveniently metes out fines, taxes and, why pay incentives when you can simply set a negative interest rate on savings to promote consumption or even have a time limited currency that vanishes if not used by a certain date (like the store gift cards).

[ Edit for clarity and content. LVA]

200

And if there is a financial crash, they will blame Covid, China, or Donald Trump, but the real cause of the cycles of booms and busts surely lies with those who hold the strings on the price of money.

320

The crash of 1987 was deliberately engineered, and Australia contributed its share to the result.

Every prudent businessman knew that what they were doing must lead to a bust, and still they did it, with Hawke leading up front. Remember his public vilification of Nobby Clark for refusing to take his NAB on their road to ruin?

The Marxists thought they had taken us back to the scorched earth of 1930, from where they could build their grand new plan. But their hubris brought them unstuck and they were outsmarted.

Their hubris brought them unstuck again with the May 2019 election. I don’t know who is going to bring them unstuck this year.

20

Keating claimed the brownie points for NOT changing banking rules to allow dangerous trading. The two had little in common.

00

I have been looking for safe investment vehicles that are resistant to inflation and other government interference that are accessible to people who are not the Leftist Elite Billionaires.

I am at a loss to think of any. Shares are out. Real estate is out, just look at Vicdanistan’s new laws concerning tenant’s “rights” such as even being able to alter your property without permission. Banks are out. The only viable investment or wealth preservation vehicle I can think of is gold, and that has huge problems with secure storage that you have control over, and using it in appropriate quantities for everyday transactions unless it was in the form of a variety of coins. Crypto currencies are also out as they rely on computers and no access to computers, electricity or the Internet, or you forget yiur password, and your investment just disappears.

390

Agree totally David. Even Gold and Silver pricing can be manipulated to an extent by those in control, but they are the best bet I think, but you have to physically hold and secure it as you point out.

240

I look at gold and silver as insurance for if the ‘faeces hits the fan’, i.e. economic meltdown. I see them more as currency for preppers than investments. They’re often referred to as ‘a store of value’.

For that reason, while I follow the spot price, I don’t care much where it’s at, because PMs value in such a scenario would have little connection with the market price which, as you say, is manipulated.

It’s also worth pointing out that ‘paper gold’ would have no utility if things got real bad.

David is also right about having divisible units, not big bars. Having both gold AND silver serves this purpose. If times ever come where you would use PMs for everyday transactions, such as buying food or ammunition, a $5000 gold bar would be hard to trade with.

190

There is retail and wholesale Au/Ag. Years ago I used to buy our round 50c coin. It is 33% Ag, everyone knows it and if electronic banking goes down it can be bartered. Metal content today is $10.60.

Even a nondescript sovereign has nearly $1k market so is too large for shopping.

I have heard that in troubled times in Europe you should always have enough Au sewn in your coat to bribe a border guard.

81

David – gold miners are also worth a look. Nothing is perfect and a lot of your protection depends on the extent to which the sh.t hits the fan.

80

Indeed. I would have thought gold miner shares are better leverage than physical metal.

50

Only if they have their costs under control and only if you are looking for return ON your investment, return OF your investment, not so much.

A middle ground is the royalty companies. They are bankers so costs aren’t of concern but they get their interest paid in Au/Ag, not fiat. If you are wondering how they work check out Wheaton.

30

Exactly, the old addage of “a gold mine is a hole in the ground with a liar at the top” is completely outdated and obsolete, that doesn’t happen anymore… Right?

10

Non-perishable foodstuffs, food preservation systems, Water purification equipment and chemicals, basic, non-perishable pharmaceuticals, a REALLY good first-aid kit AND the ability to use it, ammo and small arms, (if you are among the dwindling band who understand these things), high-spec, portable two-way radio equipment and some more knowledge, portable solar recharging systems, REALLY good cutlery, both indoor and outdoor types. As per he usual: Water, food, shelter, protective clothing, tools, especially fire starting and maintaining. Practice!

All sound a bit “feral”?

If the wheels are coming off, you don’t want to be trying to get sorted as the last wheel-nut lets go..

The two most valuable things you need if the SHTF are the ability to think clearly under high stress and the will to carry out your intentions.

Try to not get sent to a “refuge” for the non-compliant.

Just in passing; “Soylent Green” was set in 2022.

210

Impossible Burgers are People? (I wouldn’t know, don’t pay for food prepared by teenagers).

40

When the tenant has more rights than the owner the owner sells ane in some cases a renter buys because it is cheaper than paying rent. Unfortunately some will not be in a position to buy and unless the state steps up to provide social housing there will be more people on the street. Dan obviously has a plan but it would be difficult to find it. In the US similar laws concerning tenants were introduced during Covid with the result landlords sold at whatever price they could get to rid themselves of the burden of a rental. One large corporation now owns 17000 rentals and with that sort of clout watch the tenant laws collapse. BTW there are other large landlords all of whom donate to politicians to find favourable laws.

Happy New Year to all you serfs out there. On the bright side Pfizer is giving you a free McCafe coffee every tenth covid shot.

110

It seems the really BIG development companies which used to operate through SALES of apartments/housing developments etc are RETAINING the developments that they build…..and ……..RENTING them out……….

The future, people!

40

Everyone I’ve known who was using negatively geared residential property as a path to wealth has given up, sold it off and vowed never to try that route again. You wouldn’t believe how eagerly ‘professional, highly educated people’ will smash up the entire house and not pay rent for months, then disappear overnight.

20

I don’t have a good answer either.

I have thought that having a little bit of debt to purchase a property would be a good idea, as the debt would be inflated away.

That said, I have not found a property (looked in NSW and SA) as prices got away from me and with the border closures, did not wanted a ‘stranded asset’. Meanwhile, my cash is being eroded away.

I have been buying some Russian fossil fuel stocks. Indeed, most fossil fuel stocks should do well, and some jurisdictions are more favourable than others.

Naturally with Russia there is the political risk which you need to weigh up and I won’t allocate more than 5 %.

60

Art is out, easy to buy, hard to sell.

50

Uncontrolled Govenment spending and inflation is all part of the Marxist World Economic Forum’s “Great Reset”, some or all of the policies of which have been adopted by Australia, the US, Europe and other countries.

It’s all part of the plan for global Marxist domination and “the Great Reset”.

One of the slogans of the WEF is that by 2030 “you will own nothing and be happy”.

Rowan Dean discussed “the Great Reset” in the following 7 min 25 sec video. I urge you to watch.

https://youtu.be/NcAO4-o_4Ug

272

When you see that trading is done, not by consent, but by compulsion – when you see that in order to produce, you need to obtain permission from men who produce nothing – when you see that money is flowing to those who deal, not in goods, but in favors – when you see that men get richer by graft and by pull than by work, and your laws don’t protect you against them, but protect them against you – when you see corruption being rewarded and honesty becoming a self-sacrifice – you may know that your society is doomed.

Ayn Rand.

380

It’s been doomed for a while now based on that.

Not long to go now.

100

John Mearsheimer pointed out that in the hierarchy of what people value, security and at least a modicum of predictability are higher up than freedom AKA ‘democracy’. what I fear is that the current economic situation will lead to people accepting anything that offers some security, and that this will entail a great deal of regulation of aspects of life that up till now have been left to the individual.

300

It’s all part of the same problem; mass formation psychosis, which is a group think physiological problem. Inflation is the symptom of a far bigger and broader problem; the weakening of people’s ability to think by various means over a long time. We are being dumbed down to believe anything our “masters” want us to believe. For example, when the topic of COVID-19 vaccination comes up, those who have bought the vaccination scam hook, line and sinker go nuts. When I explain what is really happening they come up with silly counter arguments, most of which are just straw-man arguments, such as children must be vaccinated because they are being hospitalised at an alarming rate, which is of course fake news. When I press the point they just come out with even sillier responses. The common theme is they all relied on MSM news for their “evidence”. MSM is the fuel for mass formation psychosis.

In relation to the inflation “problem” the far bigger “disease” is a mass formation psychosis over “uncontrolled spending”, which is simply just a small crack in the whole earthquake that’s about to hit the financial world. The banking system is on the verge of collapse, but not for the first time. It almost collapsed during the GFC but was “saved” thanks to massive government and retail bank borrowings from the central banks. We were just days away for the complete collapse. The massive borrowings prevented it and brought back confidence in the banking system albeit it was fake. Ever since, every financial crisis has been “smothered” by more borrowings. It can’t go on forever. At some stage it will go over the cliff, and at that point inflation will be the least of our worries. The only question is will we see hyperinflation before the collapse. Only time will tell but in the end it make no difference as the system will be screwed. What follows is a new financial system with all it’s warts.

160

Talking about mass formation pyschosis, Dr Malone actually discussed it on the link posted by Analytik yesterday.

It is still on Spotify with the link he posted but has been CENSORED by YouTube.

It is also on Odysse. https://odysee.com/@altmedia96:2/dr-robert-malone-joe-rogan-experience-1093:e

Of course he has also been censored and unpersoned on Twitter.

Fancy that, the guy that invented mRNA vaccine technology, and one of its biggest critics with the mRNA covid vaccinations as currently implemented, unpersoned for discussing his own invention

This is the Leftist Utopia the Elites with the assistance of their slave army of Useful Idiots are driving us toward.

Read all about it in Orwell’s Nineteen Eighty Four.

210

I viewed that interview with Dr Malone before and found it very interesting. It was “fact checked” by various people and all they do is rubbish him with straw-man arguments. How is it that people prefer to trust them over and above Dr Malone who happens to be a well-educated and researched doctor who has published many papers and held high positions in his field of speciality? The answer is very simple. Those people are so biased they refuse to admit they are wrong and prefer to believe a lie no matter what. The problem is such people are everywhere, including in high places of authority, such our premiers and prim minister. Therein lies our fundamental problem. We are being led (actually misled) by dimwits and too many people are too lazy, gullible, clueless and/or stupid to know the difference.

150

The largest fact-checking outfit of them all is Reuters. Their unit was set up to specifically counter “vax-hesitancy”. They also do a large amount of FaceBook’s checking.

The entire project was “master-minded” by then-Reuters-CEO Jim Smith. Jim Smith now sits on the board of Pfizer and is a full-on member of the World Economic Forum with Gates, Soros, Schwab and Co. Looking good? Also…

Reference: Fact Check, Reuters: https://realclimatescience.com/2021/10/independent-fact-checkers/

Reference: Jim Smith, Reuters, Pfizer et al: https://www.pfizer.com/people/leadership/board-of-directors/james_smith

[ Edit for references and content. Unsupported claims are not helpful. – LVA]

80

I watched the entire 3 hour Dr. Malone interview.

A must see.

Please watch and share.

How many ‘journalists’ are being produced by the hallowed halls of Academia?

Put to shame by a martial arts guy.

So happens I’m a martial arts guy.

THE FORCED VACCINATION OF CHILDREN MUST BE STOPPED.

130

Governments will intervene in the free market to prevent hyperinflation.

016

There is no hyperinflation in a free market. That is caused by the government printing money. If the government doesn’t print money or otherwise devalue the currency, there is no inflation.

180

Just because some sectors of the economy have inflation is the free market operating naturally, its easily managed by government intervention. The printing of money won’t produce hyperinflation, its more complex than that.

013

I think Robert Mugabe illustrated the problem and causes of hyperinflation very adequately.

https://www.pinterest.com.au/pin/223491200249073127/

70

What happens in the Third World has nothing to do with us. Focus on the here and now, iron and coal, plus the farm gate output will see us through in good working order.

17

Read David’s post;

https://joannenova.com.au/2022/01/2022-the-year-of-inflation/#comment-2505037

There’s no free lunch.

30

If the gov. doesn’t print money, at least enough to fund GDP growth, there is no growth. Therein lies the problem of a gold standard.

Corruption is neg. growth. The scammed money tends to get hoarded not spent so added to that amount needed for growth Treasury must replace corrupt money. I don’t know but I suspect Japan is the least corrupt of the economic powerhouse nations which would explain why they thrive while having to import all basic resources and no immigration.

US and China are at the other end of the scale.

10

If the Govt doesn’t print money then we get real deflation, where goods cost less as efficiency/productivity improves, the way it SHOULD be!

You can still see this happening with manufacturing, even as Govts pour money into the system, and definitely NOT happening with Govt services!

21

KP, you nailed it! The prime example is the explosion of the personal computer market in the ’80s/’90s. As prices fell fast, the market grew huge.

Hanrahan’s “If the gov. doesn’t print money, at least enough to fund GDP growth, there is no growth.” is the great Keynesian falacy.

Economics (classical free-market) was my first love, but i switched to engineering for my second degree as it would provide more employment opportunity.

A weak joke I popped-off in economics class in the early ’70s:

Why are there no free-market economists in the Soviet Union? Because there’s no market for them.

The Prof laughed while the rest of the class looked at both of us with confused expressions. I realised then that most of them would never really understand economics.

Today, there are no real free-market economists serving in most western nations governments, and for the same reason. Governments only employ those who will justify whatever the government chooses to do.

50

Propaganda by Edward Bernays 1928

THE conscious and intelligent manipulation of the organized habits and opinions of the masses is an important element in democratic society. Those who manipulate this unseen mechanism of society constitute an invisible government which is the true ruling power of our country.

Whatever attitude one chooses to take toward this condition, it remains a fact that in almost every act of our daily lives, whether in the sphere of politics or business, in our social conduct or our ethical thinking, we are dominated by the relatively small number of per- sons—a trifling fraction of our hundred and twenty million—who understand the mental processes and social patterns of the masses. It is they who pull the wires which control the public mind, who harness old social forces and contrive new ways to bind and guide the world.

50

The last five years of strenuous and transparent manipulation show how powerful the internet is, how much a threat it is to those who see themselves as the rightful designers of our minds. The more they try, the more they reveal their perception of our potential to overcome them; the more they reveal their fear. They cannot win, just as the power structures before the printing press could not be retained. Independence and prosperity await us, with new forms of social organisation based on the free exchange of information (the almost frictionless capacity to trade, organise, research, educate) and a life-affirming prosperity. Our material wants will decline alongside our increasing ability to meet our needs. Status will no longer reside in the material. Aspects of the great reset are actually desirable. As always with politics, though, the demanded foreshortened time scale corrupts. Political people are impatient and want to force everything upon everyone too soon, creating mayhem and suffering. A natural-paced social evolution would see great changes, but over a (not much) longer time-scale, and without the authoritarian overlay. These people are stupid, control freaks, who don’t see that our ways of being are already rapidly changing as our material and informational needs are met.

20

The way to crush the bourgeoisie is to grind them between the millstones of taxation and inflation.

– Vladimir Lenin

220

Wall Street always wins, no matter.

This is the “science” behind Man Made Climate change and death by incineration due to human origin CO2.

The term “Inflation” or rampant inflation sounds so harsh.

Let’s rename it;

QUANTITATIVE EASING.

So restful and non threatening.

90

COPIED FROM ELSEWHERE, WRITTEN DURING THE OBAMA REGIME

An economics professor at a local college made a statement that he had never failed a single student before, but had recently failed an entire class. That class had insisted that Obama’s socialism worked and that no one would be poor and no one would be rich, a great equalizer.

The professor then said, “OK, we will have an experiment in this class on Obama’s plan”.. All grades will be averaged and everyone will receive the same grade so no one will fail and no one will receive an A…. (substituting grades for dollars – something closer to home and more readily understood by all).

After the first test, the grades were averaged and everyone got a B. The students who studied hard were upset and the students who studied little were happy. As the second test rolled around, the students who studied little had studied even less and the ones who studied hard decided they wanted a free ride too so they studied little.

The second test average was a D! No one was happy.

When the 3rd test rolled around, the average was an F.

As the tests proceeded, the scores never increased as bickering, blame and name-calling all resulted in hard feelings and no one would study for the benefit of anyone else.

To their great surprise, ALL FAILED and the professor told them that socialism would also ultimately fail because when the reward is great, the effort to succeed is great, but when government takes all the reward away, no one will try or want to succeed. Could not be any simpler than that.

(Please pass this on) These are possibly the 5 best sentences you’ll ever read and all applicable to this experiment:

1. You cannot legislate the poor into prosperity by legislating the wealthy out of prosperity.

2. What one person receives without working for, another person must work for without receiving.

3. The government cannot give to anybody anything that the government does not first take from somebody else.

4. You cannot multiply wealth by dividing it!

5. When half of the people get the idea that they do not have to work because the other half is going to take care of them, and when the other half gets the idea that it does no good to work because somebody else is going to get what they work for, that is the beginning of the end of any nation.

600

An excellent illustration of reality.

180

Something the leftards just don’t understand.

152

As soon as more than 50% of a democratic society is dependent on the government for income, ie public servants and welfare recipients, there is no turning back. I believe we may have already reached this point in Australia.

360

We have already crossed that line in Australia. During Joe Hockey’s reign as Treasurer ( not his fault, just coincidental) there was a point when more than 50% of households in Australia were receiving some form of government assistance. That’s probably at least 10 years ago , so it’s now even worse.

80

DM – great example. I experienced a situation where our “professor” marked himself a failure before realising the implications and immediately corrected his “mistake”.

Did a 1 year marketing course at Sydney university in the early 90s. Even back then the faculty were so up themselves. As he returned the end of year group project papers to each team he announced that some would find they had 2 marks with one crossed out and to ignore the one crossed out (obviously!?!). A later quick check around the groups that had received 2 marks found that all crossed out ones were lower than the one that stood. A quick count up showed that about 40% of the groups had received a crossed out (lower) mark and some also had a crossed out derogatory statement along the lines that their project paper made it hard to believe the authors had just done a marketing course. The over riding conclusion that most of us came to was that our “professor” had initially (and to character) cut loose with his arrogance when marking the papers until he realised that they were all of the same standard and that perhaps rather than show up the students the results were reflecting the “quality” of the tutor.

140

An excellent example. Probably explains why remote aboriginal communities living off the dole and other handouts make no progress.

120

” WRITTEN DURING THE OBAMA REGIME”

Interesting looking at the graphs, that the explosion was mostly after 2008. Except for 2 short years of turn around until covid, that period has been filled by Obama’s first, second, and now third terms….

90

This is straight out of the rich man’s bible.

Tell me how does one reconcile the billionaire with his mansions, cars, yaght’s etc (and who pays little or no taxes) with the thousands of struggling workers who work in his employ for a menial wage.The story of the economics professor is a gross simplification of the reality of rich vs poor.You cannot blame socialism for everything or maybe you can. But one thing I know is that for one man to be rich, there has to be many more poor. Just look at the ‘success’ of capitalism in United States of America.

08

Vladimir Illich Ulyanov is an interesting person to study, but NOT as a role model.

There is NO immutable law that supports your claim. How many more times do we have to see TRUE socialism imposed, because the last lot were not ding it right.

Walking the Killing Fields of Cambodia in 1990 gave me a perspective that has been a useful gauge in such matters.

Knowing that the same country is now effectively back under the “guidance” of the people who sponsored the Khmer Rouge is more than a little saddening.

30

https://fred.stlouisfed.org/graph/fredgraph.png?g=HFwb

The Producer Price Inflation has crossed over 20% on the basis of percent change from a year ago.

100

That means that there is a 20% inflation upstream of the existing distribution network.

In other words, all the inexpensive stuff in warehouses and contracted deliveries is gone.

Now comes the new economy that includes the effects of political decisions for the past 11 months.

In 2022, expect to pay 20% more than you are paying now, for everything.

120

We are heading into a very, very serious economic crisis. Modern monetary theory is at the root of the problems, with ‘experts’ proposing that borrowing printed money is absolutely fine. The only word for this is idiocy.

210

MMT is nothing more than Keynesian economics with a new name and a bigger printing press.

https://mises.org/library/upside-down-world-mmt

10

I’m no maths guru or economist or clever investor and I’m very afraid that I agree with Jo and most of the comments above.

China and Russia frighten me because they don’t intend to waste endless (printed) trillions $ on the so called climate emergency and will be in a sound position after the crap really hits the fan.

And after May this year we’ll have the Labor + Greens idiots in charge and that will speed up our Aussie descent at a much faster rate.

160

Any talk of economics brings to mind Bruce Petty’s cartoon machine with its innumerable economic levers.

40

‘The banking system is on the verge of collapse …’

Highly unlikely, there are ways for government to intervene and bring about a soft landing. Australia has inflation in the property market, the simple way out of this is for Morrison to build houses for those unable to get into the market. He is unwilling so Albo will run on a platform along those lines and very fast trains, allowing people to go bush, should provide the answer to stop house prices rising.

114

You forget that someone has to pay for all the “free stuff”.

Reasons for Australia’s outrageous property prices include:

1) Lack of land for house building released due to unreasonable environmental restrictions.

2) Labour market restrictions ensuring everyone gets paid the same no matter where they live and the local cost of living. This means employers have no incentive to set up in areas outside the main cities where labour costs could be theoretically be lower because other costs such as housing would be theoretically lower.

3) Lack of road infrastructure making it difficult to commute from a more remote area with cheaper land and housing to an area with more employment.

4) A general war against the motor vehicle by the Leftists that control everything so extensive parking restrictions and new apartment blocks built witg no parking provision for many apartments. Thus, limited commuting options for residents.

5) Leftist UN policies of “compact cities”, the Left don’t want people living on traditional single family homes on quarter are blocks. Pile everyone in on top of each other. They’re easier to control that way.

6) High “stamp duty” property taxes on purchase of new property creating a continuous loop of buyers and sellers trying to recover these obscene taxes by ever escalating property prices.

There are some of the reasons Australia no longer has the highest home ownership rate in the world.

211

Your tirade against the leftists is out of date.

Covid has changed everything and Australia is in the box seat to bring about a brave new world. Its possible to soften inflation in the property market by government building houses in the bush for millennials and if they don’t take advantage then new immigrants will.

124

Where did they get money to buy material? From Santa Clause!

“If the Treasury were to fill old bottles with bank-notes, bury them at suitable depths in disused coal-mines which are then filled up to the surface with town rubbish, and leave it to private enterprise on well-tried principles of laissez-faire to dig the notes up again (the right to do so being obtained, of course, by tendering for leases of the note-bearing territory), there need be no more unemployment and, with the help of repercussions, the real income of the community, and its capital wealth, would probably become a good deal greater than it actually is.”

John Maynard Keynes

80

‘Where did they get money to buy material?’

There is a shortage of wood for building, because of the black summer bushfires, but apart from that we are laughing. Decentralisation is the key to greater prosperity, they will encourage superannuation funds to bankroll the investment.

015

That’s not a very wise observation.

“Decentralisation is the key to greater prosperity, they will encourage superannuation funds to bankroll the investment.”

Do you intend to say that “taking, borrowing, stealing, or misdirecting” the retirement funds to “bankroll the investment” is a rational view of people’s lives and the economy?

Why don’t you “invest” your own money and leave everyone else to choose for themselves?

110

Half of Australian super funds is spent on overseas investment in assets and they have every right to do so. All I’m suggesting is that monies could be redirected towards local infrastructure building based on good business principles.

Australia’s population is expected to double over the next three decades and super funds might see opportunities.

111

El Gordo, if these housing projects were worthwhile people would invest in them and there would be no need for them to be forced.

Giving people free housing without a traditional requirement to work or save will be an economic disaster.

Perhaps people like you should open up your homes for one or more people who wish to live for free?

152

Not free housing, affordable housing.

00

el gordo- advocates exactly what the China has done. The gov got crony corps to build homes. It was so successful it did not stop, they built large cities – which are empty. No residents, no rent, no income. The development corps are going bust. The national economy is threatened.

11

The ghost cities are a clear example of capitalism, naive entrepreneurs with big ideas.

10

If they keep up the quantitative easing (QE) there will be hyper inflation.

If they stop the QE, interest rates will rise and the share market will crash and the government will not be able to pay the interest on their debt.

No matter which, it is going to be very messy.

140

Watch the shell game being played for Trillions. On Monday. Only the “little people” will get hurt.

“On Monday morning, those window-dressing RRPs will unwind, and the overall balance will drop back to near where it had been over the past few days. Way too much liquidity due to QE

The real issue is the monstrous amount of QE since March 2020. These RRPs show that the Fed could reduce its balance sheet by $1.9 trillion; it would just mop up the excess cash now absorbed by the RRPs. Long-term interest rates would rise, and they should rise, given that there is nearly 7% CPI inflation currently, the most in 40 years, while back then interest rates were far above the rate of inflation. But in terms of liquidity, reducing its balance sheet by $1.9 trillion would just remove the excess liquidity that has now been absorbed by RRPs.”

https://wolfstreet.com/2021/12/31/fed-drains-1-9-trillion-in-liquidity-from-market-via-overnight-reverse-repos/

20

Take off QE and the markets will slowly adjust to face the new reality, no crash and burn.

00

Even Arctic sea ice extent is inflated.

On the last day of 2021 it was above every year back to and including 2004 !

60

That should read 2nd last day.. Value for 31st Dec isn’t in yet.

41

Link? Not showing up here: https://nsidc.org/data/seaice_index/

20

Thanks again to David Maddison for linking us to that very accurate video from Rowan Dean about the Great Reset and the Klaus Schwab + Prince Charles + UN sec general idiot’s endless yapping about our lefty TOTALITARIAN future.

That Schwab donkey even looks and sounds like some sort of Dr Evil out of a very bad James Bond movie.

101

Property, precious metals, real estate, digital currency. All with their own worries and now all doubtful prospects for security in this life. God’s word in the gospel of Matthew 6:19-21, has always applied, regardless of circumstances.

“Lay Up Treasures in Heaven.

Do not lay up for yourselves treasures on earth, where moth and rust destroy and where thieves break in and steal, but lay up for yourselves treasures in heaven, where neither moth nor rust destroys and where thieves do not break in and steal. For where your treasure is, there your heart will be also”.

41

“If they stop the QE, interest rates will rise and the share market will crash and the government will not be able to pay the interest on their debt.”

The wealth of the mega rich is often based on the value of shares they own in the businesses they control. The value of the shares is usually based on buying and selling of shares on the share markets. If the share markets crash so does the wealth of the mega rich.

Superannuation funds, including industry super funds, invest much of their members funds in businesses listed on stock exchanges. If the share markets crash, so do the super fund investments in shares listed on stock exchanges.

60

Strangely if we called BS in the US on the Climate fraud and went full-bore on fossil fuels again, we could probably outgrow our inflation by enough to mitigate the crisis; exports of fuels, and having a low fuel cost economy would provide real goods, services,

and tax dollars at a high rate.

190

Doesn’t sound strange at all. It is sensible – and therefore, highly unlikely.

100

The issue with the monetary system is that we have to have confidence in it . Would you exchange something for money if you knew that the money could not be exchanged for what you need ? That is its basic function . Some sort of barter system will probably emerge if hyperinflation starts and that will become the ultimate market economy . Those living on fixed incomes and government handouts will be hardest hit as hyperinflation will destroy their ability to purchase what they need . Venezuela is the poster boy for this process . Interesting times…

70

For hyperinflation to get a foothold the whole economy would need to be inflationary, where people cannot afford food. This cannot happen in Australia.

010

El Gordo,

All Australian governments are spending money they don’t have (Deficits). This is being done on a massive scale – thus the link to Venezuela . If you were to borrow (or print) money beyond your ability to service the debt or pay it back what do you think will happen to you ?

70

Australia is hugely different to Venezuela, we won’t have any problem in paying off debt.

210

Evidently, your understanding of economics and supply chains is limited.

Printing money that has no value does not increase wealth because new monies are backed by nothing but promises, and nothing weighs less than a promise.

All AU imports must be paid for with Value, not Promises. Absent Value, one may expect Inflation in direct proportion to fiscal irresponsibility.

“we won’t have any problem in paying off debt”. That’s true, so long as you are paying that debt by selling resource futures or increased inflation/taxation upon the citizenry. Nigeria did that.

Get back to us in a year and see how well your theories play out. I’ll make book in neutral hands that they won’t.

51

A decade ago the Canadian Pension Fund bought Sydney’s desalination plant, money for jam.

Comparing us to Nigeria is folly and let me assure you my grasp of economic history is sound. Back in 2016 the government tried to convince pension funds that Inland Rail was a good investment, but they gave the finger to that idea.

So let us try again, I propose a VFT for passengers from Brisbane to Melbourne, paralleling Inland Rail, would be a good investment for Super Funds.

https://www.youtube.com/watch?v=1fS19D-vEHM

16

Australia used to run like that- businesses would have their own currency as tokens, so Woolworths would accept and give their tokens as change, and maybe deal in Coles as well. It would soon shake itself down for daily living and the best currency would become the most valued.

The State would hate it and try every dirty trick they could to force people to use their devalued arse-wipe. It shows all around the world when a black-market arises, with an ‘official’ exchange rate and the much better rate some spiv gives you in the back streets.

40

Paul Driessen has a humorous look at the so called Climate Emergency and a lot of good data evidence to think about.

https://wattsupwiththat.com/2022/01/01/channeling-dan-and-jane-to-confront-biden-policies/

30

Jo, I think your wrong about your inflation concerns. I too spent my whole life thinking inflation is bad. Every economics textbook I read talked about the destabilizing affects of inflation. The inability for businesses to plan ahead properly, the extra costs to middle-income people and so on.

Turns out it’s ALL WRONG! Inflation is a good thing! Didn’t you know? (I didn’t)

I found this stellar article from one of the most accurate and objective media outlets in the world! MSNBC. Don’t believe me, just check out their bang-on reporting on Trump and the 2016 Russian Collusion and compare it with the Mueller Report. Word for word said the same thing.

Anyways, where was I? Yes, the good news of inflation from MSNBC

How Covid became the unlikely hero of our inflation crisis

This masterpiece was written by none other than James Surowiecki

Who is James Surowiecki you ask? Haven’t got a clue! BUT I KNOW that he has a wealth of economics schooling. I just haven’t found it yet. And since he’s writing for MSNBC well, that’s the clincher.

I have my wheel barrow ready, do you? Or I guess all you you hi-techy people will need a 1 terabyte hard drive to keep track of all those zeros.

123

Mark, for goodness sake use the “ sic” button next time. People will think you’re serious!!

50

C’mon, man… the ” sic” was dripping from the 2nd paragraph, and by the 3rd it was a proverbial flood. Green-thumb for Mr Kaiser!

Is the ‘heat’ getting to you Ross, as it sure has cooked the tiny minds of NZ’s media (radio & website) skeleton staff today: folk are freaking out that parts of the country have reached 30°C (yeah, bring it on!) while Metservice issued a “heat warning” for Queenstown’s expected 26° (they reached 28° at 4pm). Puh-leeeze! Drive 5 km away from the lake and it’ll easily be in the low 30s as it is every summer.

Then again, most ‘media’ staff have to be double-whacked these days, with a 3rd ‘borcestershire’ shot on the way… they know not what they do 🙂 /sarc

60

Mark, of course, and the little people shouldn’t complain about the rising price of food, because of all the cash they hid away during Covid….

60

Temperature for Auckland tomorrow is predicted to be 28° which is about normal for this time of the year.

Now hang onto your hats: I’m going to make a prediction:

The next financial crash is due in October 2026.

That’s based on my observations of the financial cycle. I called the 2008 one exactly.

That will make the second half of this decade a right pig’s ear: 2026 the banking system falls apart and according to https://grandsolarminimum.com/ (I think — can’t remember where I found it) 2028 will be the start of a famine.

May you live in Interesting Times.

40

I remember where I read about 2028: Davud Dubynes’ Adapt 2030.

Wow. Mark Kaiser does sarcasm and tongue-in-cheek together really well. (Pity about his misspelling of you’re ) He appreciates web sites of high superiority and calibre.. Go Mark!

40

NASA’s James Webb telescope launch. (It’s long!)

I didn’t post this earlier because I lost it. But patience (and persistence) pays off

I found this very interesting … hope whoever reads this post and goes on to watch the youtube video does too.

20

My prediction is for October 2023.

It always seems to be in October.

I just don’t think they will last until 2028.

The US money printing is following the German example after the First World War. The Germans started printing during the war but really cranked up the presses from 1920.

It took until 1923 before the hyper inflation started.

1920 and 1922 were seen as boom times. There is always a lag between the printing and the inflation. It takes time for people to understand the value of their currency is falling.

The US govt have so much debt their only options are to inflate the debt away or to default. They won’t default so they have to choose the inflation option.

The consequences of the German inflation was the rise of National Socialism led by a very unpleasant left wing Austrian.

20

I stand by 2026 for the financial crash.

If it happens sooner than that, then thems the breaks but I don’t think it will.

Ok: You’ve offered 2023. Let’s watch it together.

David Dubyne has proposed 2028 for the food shortage and resuis when the GSM will bite hard.

10

Economic crisis are perfect for implementing political change. Covid has softened the public up for much greater socialism via climate change policy, sacrifice for the greater good, we are all in the together. That’s why they’ve been so keen to close up and print money.

91

QE is practiced around the world and once Covid is behind us then economies will pick up. Zero interest rates everywhere will give way to a gradual rise in interest rates, nothing to fear.

110

“once covid is behind us” – I don’t think I need to point out the flaw in this phrase.

It is a meaningless assertion to say that QE being practiced around the world – so? That’s what we are worried about. And your

ending saying’nothing to fear’ makes me wonder if you are employed by the government (and that isn’t meant as a a compliment Mr Gordo)

90

Janet if QE wasn’t practiced over the past few years we would be in an economic Depression, a very deep hole requiring a Keynesian approach.

17

I agree there’d be a huge depression. But arent we kicking the can down the road ?

50

That’s like calling off a sore tooth ache by drinking more alcohol rather than going to the dentist to fix the issue. The longer they postpone the inevitable the worse the crash and burn will be. Not to worry, you can relish in the cool aid, own nothing and be happy.

70

Good point PeterS

It isn’t a choice between a depression and not a depression.

It’s not even a choice between a small depression now and a large depression later.

That option is long gone.

It is now a choice between a massively large depression now and a much bigger one soon.

El Gordo doesn’t understand that it is Keynsian economic theory that got us into this mess.

40

Not sure. The powers that be certainly dont want covid to be behind us, sure. But I think perhaps people will just move on themselves. We can see that in the Aus public now, people are just over it and dont care about the issue anymore. Young people are just going out to actually catch the virus and be done with it, thats the general attitude (possibly rightly so).

Im keeping avery close eye on Brazil to try an see the future. Theyve let covid rip through them like few others, and its currently at very low levels and will be very interesting to see if it re-emerges as I imagine natural immunity must be very high and large numbers ended up taking the vaccine as well. Such conditions could see an end to it ? Dont know, thats why Im watching Brazil.

40

I hope you’re right. But I still think that’s their plan, cause an economic crisis and implement to cause a politcal shift, be they right or wrong, its their hope.

40

I am at a loss to understand why anyone thinks inflation is a good thing.

It is nothing more than the systematic devaluing of money due to the government either printing money or otherwise expanding the money supply.

The government spends the money but no wealth is created.

It is a direct tax on working people and most others because it means you now need more money to buy the same basket of goods.

It does not benefit those with cash savings and fixed incomes but may benefit those Elites with large debts who find it easier to repay them with the deflate currency.

Inflation is no different to diluting a substance. If you require the same amount of active ingredient, you need more of the diluted substance but no new active ingredient is created.

Surely that’s not that hard to understand?

190

” but may benefit those Elites with large debts who find it easier to repay them with the deflate currency.”

That is it in a nutshell! Govt found that workers wanted regular pay rises to feel wealthy and didn’t care as much about price increases, so they bought in continuous inflation and just made lot of noise about targets and ‘how much’.

It suited their modern money ideas as inflation pushes money circulation faster and punishes anyone saving rather than spending. This is always unsustainable, but no politician thinks beyond the next election, and then inflation is a problem for someone else.

It always ends in disaster, as explained in this link I put up yesterday- How inflation destroyed France 300years ago. Nothing is new here!

https://www.gutenberg.org/files/6949/6949-h/6949-h.htm

70

Exactly. An observation by Keynes was that people will accept a reduction in the real wage (purchasing power) but will not accept a reduction in the money wage. The blissfully ignorant.

60

The GFC was caused by US greed.

13

Without government interventions, “investments” based on pure greed are quickly exposed and customers and then capital flees. The schemes implode, angry

investorsspeculators take the schemers to court and everyone learns the lesson that real investments need to be productive.Government interventions to “save the economy” are what allow unadulterated greed to be rewarded rather than punished

30

The Evergrande implosion is Chinese greed.

04

Same as for my reply about the GFC only the Chinese economy, above the mom and pop store/restaurant level, is all about government interventions. This means that greed and corruption and hence inefficiency are inherent.

00

Friedman’s inflationary expectations observation put paid to Keynes’ nominal wage hypothesis decades ago. it does have quite a time lag, and is subject to quite a lot of hysteresis and rate uncertainty, but it is how expectations are set.

60

Low inflation rates provide a buffer against the risk of deflation, which is why the RBA aims for inflation in the 2% – 3% range.

Deflation tends towards a large-scale deferment of discretionary spending and investment, because people delay purchases in the expectation of prices dropping. It becomes a positive feedback loop.

That was a large part of the unspoken rationale for the Covid cash splash.

40

That idea is crap of course, unless you’re thinking of buying a yacht for fun… You will still need to buy the food, the clothes, the microwave oven, the main part of the economy that goes around.

Deflation might put off the purchase of luxury items, but seeing most people just live continuously in debt at the moment, a little sacrifice of time might do them some good!

Deflation was the norm for hundreds of years, all the time before we had fiat currencies or when emperors were debasing he coinage. It is a sign of efficiency and productivity, goods SHOULD get cheaper, not more expensive.

20

Large discretionary purchases such as a house, new car, stereo, computer, lounge suite, home renovation, holiday on the Sunshine Coast, probably less so with small items such as going out for tea or to the pub, taking the kids to Maccas or KFC …

For businesses, buying new tools or equipment, repainting the shop, levels of inventory on hand, …

It’s the “stocktake sale” syndrome writ large.

Low rates of inflation (especially below the risk-free rate of return) tend towards neutral time preferences and even out the velocity of money. High inflation biases discretionary spending towards the present, deflation biases it towards the future. It’s the inverse of interest rates.

30

Writen before the switch side and become Darth Vader

Gold and Economic Freedom

by Alan Greenspan

Published in Ayn Rand’s “Objectivist” newsletter in 1966, and reprinted in her book, Capitalism: The Unknown Ideal, in 1967.

An almost hysterical antagonism toward the gold standard is one issue which unites statists of all persuasions. They seem to sense — perhaps more clearly and subtly than many consistent defenders of laissez-faire — that gold and economic freedom are inseparable, that the gold standard is an instrument of laissez-faire and that each implies and requires the other.

Stripped of its academic jargon, the welfare state is nothing more than a mechanism by which governments confiscate the wealth of the productive members of a society to support a wide variety of welfare schemes. A substantial part of the confiscation is effected by taxation. But the welfare statists were quick to recognize that if they wished to retain political power, the amount of taxation had to be limited and they had to resort to programs of massive deficit spending, i.e., they had to borrow money, by issuing government bonds, to finance welfare expenditures on a large scale.

Under a gold standard, the amount of credit that an economy can support is determined by the economy’s tangible assets, since every credit instrument is ultimately a claim on some tangible asset. But government bonds are not backed by tangible wealth, only by the government’s promise to pay out of future tax revenues, and cannot easily be absorbed by the financial markets. A large volume of new government bonds can be sold to the public only at progressively higher interest rates. Thus, government deficit spending under a gold standard is severely limited. The abandonment of the gold standard made it possible for the welfare statists to use the banking system as a means to an unlimited expansion of credit.

130

“A government, which robs Peter to pay Paul, can always count on the support of Paul”.

Attributed to, of all people, George Bernard Sahw.

50

Shaw!

10

Max we got bitcoin now and so none of what Greenspan said applies.

Hopefully real obvious SARC !!!

10

I’m no financial wiz, but this article opened my eyes wide! It’s not real long, and it has several other crucial points.

https://thephilosophicalsalon.com/a-self-fulfilling-prophecy-systemic-collapse-and-pandemic-simulation/

“In 2019, world economy was plagued by the same sickness that had caused the 2008 credit crunch. It was suffocating under an unsustainable mountain of debt. Many public companies could not generate enough profit to cover interest payments on their own debts and were staying afloat only by taking on new loans. ‘Zombie companies’ (with year-on-year low profitability, falling turnover, squeezed margins, limited cashflow, and highly leveraged balance sheet) were rising everywhere. The repo market meltdown of September 2019 must be placed within this fragile economic context.

When the air is saturated with flammable materials, any spark can cause the explosion. And in the magical world of finance, tout se tient: one flap of a butterfly’s wings in a certain sector can send the whole house of cards tumbling down. In financial markets powered by cheap loans, any increase in interest rates is potentially cataclysmic for banks, hedge funds, pension funds and the entire government bond market, because the cost of borrowing increases and liquidity dries up. This is what happened with the ‘repocalypse’ of September 2019: interest rates spiked to 10.5% in a matter of hours, panic broke out affecting futures, options, currencies, and other markets where traders bet by borrowing from repos. The only way to defuse the contagion was by throwing as much liquidity as necessary into the system – like helicopters dropping thousands of gallons of water on a wildfire. Between September 2019 and March 2020, the Fed injected more than $9 trillion into the banking system, equivalent to more than 40% of US GDP.

The mainstream narrative should therefore be reversed: the stock market did not collapse (in March 2020) because lockdowns had to be imposed; rather, lockdowns had to be imposed because financial markets were collapsing. With lockdowns came the suspension of business transactions, which drained the demand for credit and stopped the contagion. In other words, restructuring the financial architecture through extraordinary monetary policy was contingent on the economy’s engine being turned off. Had the enormous mass of liquidity pumped into the financial sector reached transactions on the ground, a monetary tsunami with catastrophic consequences would have been unleashed.”

90

Damm that’s good, F&C! Follow the money to right here-

“If we ‘follow the money’, we will see that the economic blockade deviously attributed to Virus has achieved far from negligible results, not only in terms of social engineering, but also of financial predation. I will quickly highlight four of them.

1) As anticipated, it has allowed the Fed to reorganise the financial sector by printing a continuous stream of billions of dollars out of thin air;

2) It has accelerated the extinction of small and medium-sized companies, allowing major groups to monopolise trade flows;

3) It has further depressed labour wages and facilitated significant capital savings through ‘smart working’ (which is particularly smart for those who implement it);

4) It has enabled the growth of e-commerce, the explosion of Big Tech, and the proliferation of the pharma-dollar – which also includes the much disparaged plastic industry, now producing millions of new facemasks and gloves every week, many of which end up in the oceans (to the delight of the ‘green new dealers’). In 2020 alone, the wealth of the planet’s 2,200 or so billionaires grew by $1.9 trillion, an increase without historical precedent. All this thanks to a pathogen so lethal that, according to official data, only 99.8% of the infected survive (see here and here), most of them without experiencing any symptoms.”

160

another snippet

“The bottom line is that the paradigm shift underway is the necessary condition for the (dystopian) survival of capitalism, which is no longer able to reproduce itself through mass wage-labour and the attendant consumerist utopia. The pandemic agenda was dictated, ultimately, by systemic implosion: the profitability downturn of a mode of production which rampant automation is making obsolete. For this immanent reason, capitalism is increasingly dependent on public debt, low wages, centralisation of wealth and power, a permanent state of emergency, and financial acrobatics.

If we ‘follow the money’, we will see that the economic blockade deviously attributed to Virus has achieved far from negligible results, not only in terms of social engineering, but also of financial predation.”

30

Inflation is only starting. Go and talk to some farmers and ask about the increase in the cost of farm inputs eg. fertilizer. Going through the roof. These are the costs of next year’s harvest and so next year’s cost food.

120

Aren’t fresh food prices decided by Woolworths and Coles, rather than farmers?

>sarc off<

130

Farmers dont get to pass on costs. We just have to take what we are given in the markets. The same big companies that sell us fertilizer also buy the products we sell. They wont be taking a cut in profit, so it is the farmers that will get screwed, well, the family farmers anyway. They want to get rid of individual farmers and replace us with huge corporations that own the farms (and everything else for that matter). It seems to be the same mega-huge corporations taking over the planet, and the more they take over, the more they can take over. This is the totalitarian nightmare.

180

Too right Jane.

My father used to say farmers are the only people who buy retail, sell wholesale, and pay the freight both ways.

160

And Farmers are so independently minded the last thing they would ever do is get networked and organized for their own good. I remember wanting to bang heads together when I was trying to help The Thompsons (feedlot farmers IN WA who broke no law and yet were driven out of business). So many other farmers were silent, fearing they would be targeted next. So the Dept of Enviro-lawyer-activists just picks them off one family at a time, tweaking their license conditions, it’s not one law for all, but one rule for whomever the bureaucrats want…

180

Correct Jo. We were discussing the farmers costs on a NZ blog the other a day and a guy made the comment that a farmer near where he lived entered into a contract about a year ago to buy $1 million dollars of fertilizer for later in the year, at a price set in the contract. All the neighbours thought he was absolutely crazy. That same order at todays prices would be $300,000 more. What could have they all saved if they asked the guy why he was doing it and perhaps all got together a negotiated a much bigger combined order (even if individually they spread their risk at the time and only committed half of their needs to the contract).

90

If farmers DO try to organise they are dubbed agri-socialists. Graziers got no sympathy when their Wool Marketing Board collapsed for this reason.

Cliven Bundy in the US was singled out with little broad support.

90

If what you say were true, then why is the price of food quite volatile?

https://fred.stlouisfed.org/series/PFOODINDEXM

Clearly some farmers are getting paid extra, because it’s at all time highs right now. If you happen to have locked in contracts, then I guess you didn’t negotiate all that well … but anyone trading in any market will find there are situations they could have handled better once that 20/20 hindsight kicks in.

I would expect that in 2022 we find out whether those “organic” farmers who claim not to need so many artificial fertilizers are going to come to the forefront, or not.

00

Does anyone have any thoughts on the rumours that “they” will get rid of Australian land titles. I know from a surveyor friend that the Land Titles office has been privatised and sent offshore to a company based in the Canary Islands or somewhere a few months ago. There are not supposed to be using paper title any more, only digital. Great – that means that land titles are now subject to a Cyber Pandemic. Can we protect ourselves?

40

I believe what you said is true.

And they destroyed all those beautiful old land title certificates to be replaced by digital entries in a computer.

https://www.smh.com.au/business/companies/big-four-banks-destroy-16-million-paper-land-titles-in-push-to-digital-versions-20161028-gsdcgn.html

SEE LINK FOR REST

30

Surely they should have been kept? Stored somewhere relatively safe, not reliant on the moods of the sun, etc.

70

It was probably a clueless Xennial or Milennial that made the decision.

60

Annie,

When we finally paid off our house we got a printed copy of our title and its framed . If you can get an electronic copy perhaps you should print it and get it notarised .

50

Titles can still be printed, but only by the lands office(?)

They are stamped on the reverse invalid or some such thing since 2019 in QLD.

https://thesilentmajority.org.au/

00

I sold my house in South Australia and got an electronic copy of my Title (pdf format). It ran to 91 pages.

40

Yep – no more Land Title document. When we bought an investment property recently, we waited in vain for the title to arrive from our solicitor’s office. When it didn’t we wanted to know where it was – & was told that it was now all digital.

Anyway, we printed out a verification of ownership from solicitor. Not quite the same. And I found it very disconcerting to know that the only verification seems to be in the signed Contract for Sale documents held by our solicitor.

Very unsatisfactory.

40

That is defiantly the case in QLD, I believe all titles for private property title deeds have been transferred to three private companies, all paper titles are now invalid.

These private companies trade on the open market based on the value of their portfolio, which is your property.

There is one person fighting this in the courts, Len Harris, on his own coin and via donations. Len brought a van and turned it into a bill board and attends rallies trying to wake people up to this.

Maybe the same in other states?

https://thesilentmajority.org.au/

20

I really don’t think that is the case. We have a property portfolio (as property investment is our source of income) and those original Title documents are still recognised – as was clear in a recent sale of a property when the solicitor required the Title Deed for the transaction.

Indeed, when recently re writing our Wills, the solicitor asked whether we wanted to leave our Title Deeds with his office. We declined and said they were in a a deposit box in our bank.

20

The change to digital only titles only happened in the last few months, as in two or three, so if your transactions were more than a few months ago the change would not have happened by then.

20

Len Harris was having it heard a couple of weeks ago in Cairns, Len was happy with the outcome, it was agreed he had a case and can progress to what ever level is next, or something like that.

I have the title deeds for my block, its after 2019.

https://www.legislation.qld.gov.au/view/html/asmade/act-2019-007#pt.9-div.3

Subdivision 2

Certificates of title

214

Definition for subdivision

In this subdivision—

certificate of title means a certificate of title issued under this Act before the commencement.

215

Certificates of title cease to be instruments

(1)On the commencement, a certificate of title—

(a)ceases to be an instrument under this Act; and

(b)ceases to be evidence, conclusive or otherwise, of the indefeasible title for the lot for which it was issued.

(2)To remove any doubt, it is declared that subsection (1) does not affect—

(a)the indefeasible title for the lot for which the certificate of title was issued; or

(b)any interest in the lot for which the certificate of title was issued.

216

Registration of particular instruments lodged before commencement without certificate of title

(1)This section applies to an instrument lodged before the commencement if—

(a)the instrument could not be registered for a lot because the certificate of title for the lot had not been returned for cancellation as required under former section 154; and

(b)immediately before the commencement, the instrument had not been rejected under section 157(1).

(2)The instrument may be registered despite the noncompliance with former section 154.

(3)In this section—

former section 154 means section 154 as in force from time to time before the commencement.

00

I also seem to remember that “title” is only good for 99 years; essentially, ALL real estate belongs to the “state / crown”. Freehold is a very dodgy concept in these parts.

Any legal beagles care to weigh in?

10

Here’s my understanding, which gives you the basic outline:

* Most states operate “Torrens Title” which is similar to a perpetual lease in as much as many limitations apply to your “ownership” and what you can do with your land, and you are required to pay rates, etc. This system ALWAYS involves a central registry in some form or other.

https://en.wikipedia.org/wiki/Torrens_title

* The state “councils” are not really part of government (even though they have elections) they are merely agents acting on behalf of the state government.

* A very small amount of true freehold land does exist in Australia, but only in cases where the land title was granted by the British Empire in early colonial Australia. Any of these titles can be converted over to “Torrens Title” if the owner decides to do so … and there’s no way back! Mortgaging one of these handful of freehold properties is very dangerous because the bank has no real long term interest in your property title, and probably will do the conversion while you are not looking.

* Canberra internally operates differently in as much as their lease system is not actually perpetual … although it normally does get continually extended on a 99 year basis.

* Native title is a totally different system again, created at the Commonwealth level and then imposed on the states from above.

States are known to use strong-arm tactics to eliminate the last of the remaining freehold property in Australia, and I think in the long run they will win. They also have almost unlimited eminent domain powers, although you will need a real property lawyer (and a dang good one) if you get stuck in an eminent domain situation … don’t ask me exactly where the limit of state power is in this respect.

00

While we are on the subject of inflation and printing money , China may have its own problems . If the report in this link is true things are about to get interesting . https://youtu.be/jmgBpRAB8B4.

21

Reminds me of the scam in Portugal in the 1920’s. The printing plates were used again supposedly because the new notes wold be overprinted.

Instead they were circulated and the economy boomed briefly. Once the scam collapsed there was a depression followed by a dictatorship.

I visited Portugal and Spain in 1977 when both were (just) democracies and Portugal was struggling as it was in 2016. Spain looked better off.

20

This is how you will own nothing. How you will like it is being developed/exhibited in the “pandemic” and “climate” conditioning which so many accept without question.

50

Australia is looking solid economically. Australia is currently living well within its means with the strongest ever current account surplus:

https://tradingeconomics.com/australia/current-account

US continues to live off the rest of the world in a big way:

https://tradingeconomics.com/united-states/current-account

Trump had turned the corner but Covid and Biden ended that. US does not have a problem providing the rest of the world continues to accept USDs. I believe there is a limited time frame here because USDs will become increasingly worthless. The USA owes the rest of the world almost a year of full GDP. That is a lot of international debt. Fortunately it is all denominated in USD so USA will never have an issue paying it off. At some point countries will not want to hold US debt. China is working hard to avoid holding US debt. Can you imagine the day when US companies buying stuff from China will need to use Chinese crypto.

United Kingdom is battling to get in front again:

https://tradingeconomics.com/united-kingdom/current-account

The lack of investment in fossil fuel extraction will underpin broad inflation. Australia will benefit significantly from the upward price pressure on coal and gas due to global shortages.

On a divergent tack, I have been staggered by the growth in the metaverse. Has anyone else noticed who sponsors the Adelaide Strikers?

There are already new fortunes being made in this new world. The coming generation will see energy as a vehicle for data networks. The virtual world is quite rapidly replacing the real world. The new generation will be glued, wired or wirelessly connected to screens.

https://www.nanalyze.com/2021/12/real-time-data-analytics-metaverse/

The source of energy will only interest the new generation when it fails to come out of a socket or their network crashes.

The metaverse enables the players/developers to be engaged but meeting the desire for a low carbon footprint. These are the people who will cycle for exercise and catch a train if they ever travel anywhere; maybe own an electric car but will value their on-line persona greater. It meets the new aspirations evolving from what kids are being taught about carbon footprint.

Cryptos have the potential to displace banks and federal reserves. Communication networks are now intimate to life on earth. The security of cryptos are bound to the ubiquity of networks. The networks embody the wealth.

27

But we don’t live within our means militarily, or financially.

We need Big Help to defend the nation, so we are pulled along in the same orbit as the US and UK.

And when we elected a government to do nothing “Net Zero” the bankers apparently (or maybe it was via Boris and Biden) threatened to raise our interest rates by 1.5% and suddenly we got Net Zero promises.

And how many days of oil do we have? 55 – 80?

170

Thought it was 30 days. Whatever it is in peace time, halve it for war.

We do have emergency storage……..19 days worth…..in the USA.

90

The only country with serious military might now is China. US probably have enough of an arsenal to cause serious destruction in China providing their dilapidated systems survive the initial cyber attack from China. China has shown the USA is highly susceptible to a bio-weapon. They have fared the worst from Covid if you disregard developing countries like India and Indonesia.