|

|

… By Jo Nova

It’s hard to keep up with the great EV unravelling

The best news for the EV industry this month is that Ford is only losing $50,000 a car now on its electric vehicles. That’s so much better than the $132,000 it was losing last quarter. But the true economic carnage is deep and widespread. The one sure bet in the world of electric vehicles was Tesla where sales rose two percent in the last quarter but their profits plummeted 45%. The fire-sale shifted cars but it burned the bottom line. Similarly Mercedes Benz profits were down 21%, mostly thanks to EVs. And Ford’s were down 35% (not surprisingly).

We knew things were bad when the new invention has a small market share but already half of the owners wanted to go back to the old style.

There is trouble even in China where shares in Evergrande New Energy Vehicle are down almost 40% so far this year. Apparently some creditors are coming after Evergrande seeking bankruptcy proceedings for two of its EV arms.

Nearly every major manufacturer is delaying new models or rewriting their targets. Ford is delaying several models, and is redesigning a plant in Canada that was going to make EVs to one that will build pick-up trucks with fossil fuel engines. Bentley and Aston Martin have pushed back the launch of their first EVs. Jaguar have said they will drop two of their planned EV models and keep making their gasoline SUV for longer. Volkswagen diverted $60 billion back into developing ICE cars. Suddenly, they’ve all discovered that Hybrid cars are quite interesting.

Porsche kept their target and dumped it at the same time. They are still (theoretically) aiming to get 80% of its vehicle sales to be electric by 2030. But they added the clause “if the customers support us”. Anything less than 80% will be the customers fault. Porsche off the hook, eh…

Someone is going to write a book about how the top industrial heavyweights of the West virtually all fell for the fantasy that we could toss out a century of engineering and ding, invent new type of car on command. Discovery in aisle nine!

The EV bubble deflates in real time

By Matthew Lynn, The Telegraph

Over the last few days, it has become clear that the EV industry is on the brink of collapse. Hundreds of billions of euros, dollars and pounds have been pumped into this industry by political leaders and the subsidy junkies that surround them – and it is surely time they were held to account for the vast quantities of taxpayer cash that has been wasted.

And it’s not just car makers. It’s bad news for the supply line:

It is even worse for component manufacturers. Shares in Germany’s Varta are down by 70pc over the last month amid reports that the company may have to be rescued from bankruptcy after making heavy losses on batteries for hybrid sports cars. This week, the Belgium chemicals group Umicore announced a €1.6bn (£1.4bn) hit, as manufacturers warned of waning EV demand, and it postponed plans for a battery recycling plant.

As Matthew Lynn says: consumers are increasingly nervous over what may become obsolete technology. That’s got to be the marketing kiss-of-death.

Western governments threw billions of dollars to inflate this bubble

Politicians tried to play God in the car market: In France Macron tossed €700m at a plan to dominate battery production in partnership with Germany. The Germans burned €1bn too. But the EU bragged that it spent €80bn on things to do with EVs, and the US had launched cargo-ships of cash with the Inflation Reduction Act.

In the end, in the biggest transition of them all, from horse to car, Ford didn’t need a government subsidy to invent a Model T. And customers didn’t need to be forced to buy it either.

10 out of 10 based on 134 ratings

7.5 out of 10 based on 14 ratings

9.3 out of 10 based on 19 ratings

By Jo Nova

Like a sabre:

“I am the ultimate diversity hire, I’m both a woman and a person of color, so if you criticize anything I say, you’re both a sexist and a racist”

AI will destroy jobs… (hopefully one in particular).

But both sides can use this tool — to construct a narrative, as well as to destroy it.

Reality may become very hard to find with unmarked Deepfake voices “on the loose” — especially if there is no shared public forum to hammer out the truth. That seems like a brilliant but dangerous game. The thing about great satire, as opposed to deepfake lies, is that when it’s done well, and it speaks the truth (in a fake voice), the target wouldn’t want to draw attention to it by denying they said it.

But perhaps we need an AI watermark…

h/t Stephen Neil

9.9 out of 10 based on 100 ratings

9.4 out of 10 based on 12 ratings

8.3 out of 10 based on 17 ratings

By Jo Nova

The government has this hope that homeowners can be tricked into paying for the batteries (in the form of EVs) that the wind and solar industry need to make their useless random energy into something reliable. Now comes the news that not only are batteries hazardous fire risks and expensive themselves, but to connect to our grid in a two way arrangement we need to spend $3,000 dollars per household (or maybe $10,000) to buy the bit of equipment that makes this work. Not to mention adding another million gigawatts of generation so the cars can be charged in the first place.

Remember in the end, we are not buying EV’s because they go further, cost less, or are more convenient, we’re buying them because we want to stop storms in 100 years.

How many nice weather days will I get in 2100AD for that $3,000 inverter?

By Natasha Schmidt, The Australian

Interim Director of Monash Energy Institute, Roger Dargaville, said powering EVs in just one million households could cost as much as $10bn in power inverters.

Professor Dargaville said such inverters, unlike home batteries such as Tesla’s Powerwall, would allow EV drivers to recontribute power into the grid.

“That piece of infrastructure costs about $10,000 at the moment, and if you have a million vehicles sometime in the future trying to do this that’s $10bn,” he said.

Prof Dargaville hopes that mass production might reduce the cost to $3,000 each if we are lucky. (Mass money printing and inflation will probably prevent that.)

Historians will look back on this era and describe it as a case study in corruption and mass delusion. The great capitalist free market of Adam Smith exists only in limited pockets that masquerade as “free choice”.

10 out of 10 based on 93 ratings

8.4 out of 10 based on 29 ratings

By Jo Nova

If Australia gets any more free cheap energy we’ll go broke

The Australian Energy Regulator has the data on electricity pricing and possibly a budget $20 million a year but hasn’t yet updated with the last quarter, so I thought I’d help them out. Because surely this is a graph that all Australians need to see?

This is every state in the National Energy Market, and even though some have more renewables than others, the long term trends are the same. Unreliable generators in one state can vandalize the whole market:

(Click to expand). Back in the dinosaur days when Australia had virtually no wind and solar power, the price for wholesale electricity was $30 a megawatt hour year after year. Then Kevin Rudd was elected in 2007, and we started to add the intermittent, unreliable generators which have free fuel, but need thousands of kilometers of wires, batteries, subsidies, schemes, farmland, FCAS markets, and an entire duplicated back up grid that sits around not-earning money for hours, days or five years at a time.

And we wondered why electricity got more expensive:

And again with labels.

The market never did recover from the closure of the Hazelwood coal plant. Costs rose by 85% and it took a pandemic to bring them down again, but only temporarily.

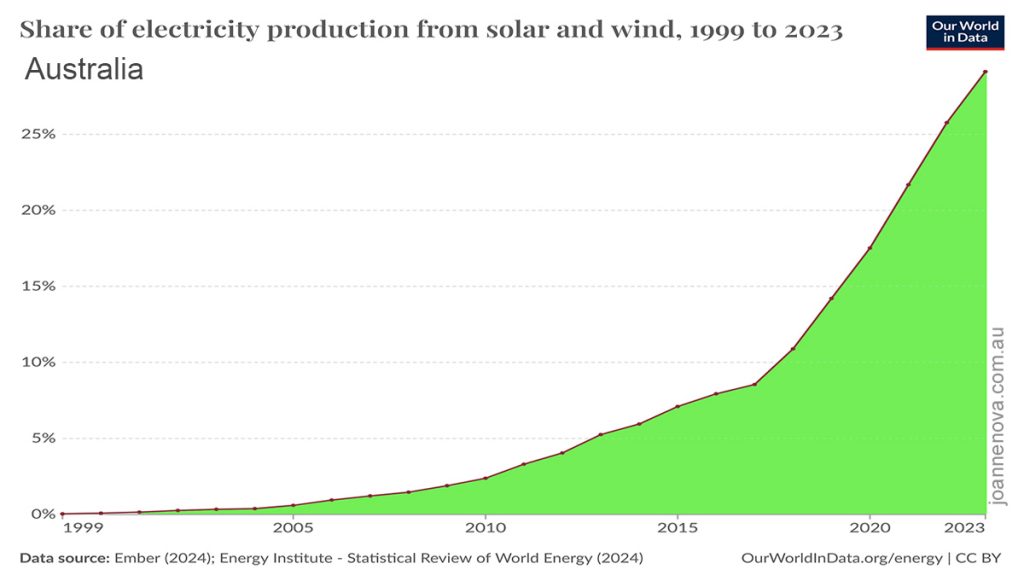

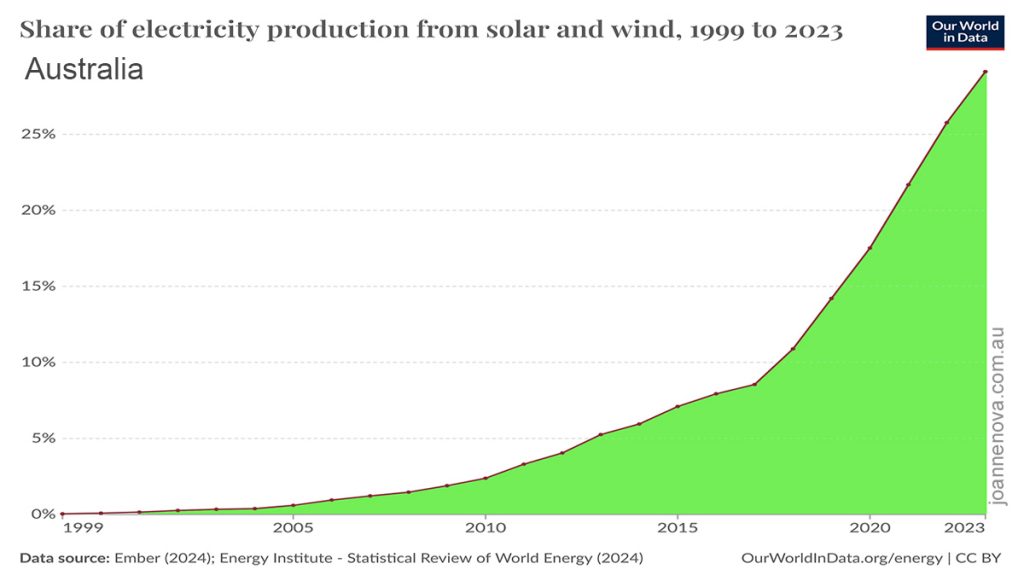

So Australia is close to 30% total wind and solar generation, and aiming with gossamer fairy wings for 82% in five years time.

Luckily, it appears there’s no chance we’ll get there. The solar daytime glut, negative prices and community hatred of high voltage lines is spoiling the market for developers. And not a day too soon….

REFERENCES

Keep reading →

9.8 out of 10 based on 101 ratings

8.5 out of 10 based on 15 ratings

By Jo Nova

It’s another outbreak of the Hottest-ever-Day Fever , where buses catch fire, and the worlds top journalists forget to ask anyone anything useful about the last 500 million years.

The Copernicus data might be fine and dandy but it only goes back as far as 1979. The warm weather we are having now is just a welcome break in a cooling trend that started 7,000 years ago. It not only isn’t a record that means anything, it’s almost certainly a net benefit to warm blooded mammals.

The collective amnesia about the Holocene and most of the history of human civilization is complete. Apparently the world is in uncharted territory, except for thousands of rocks, stones, spears, shells, bits of wood, pollen, diatoms, fossilized plant leaves, and all the ice cores we’ve ever dug up. 4,000 stone-age spears and whatnot that melted out of the Norwegian glaciers in the last few years, must have frozen into them sometime in the last 5,000 years. And all the bones of dogs, rabbits, geese and frogs found inside the Arctic circle suggest our world is too brutally cold now. Likewise the giant oyster shell found on a building site in Taiwan reminds us of a time the oceans were 1 to 2 meters higher than today, and the cavemen survived just fine.

CNN By Angela Fritz

Sunday was the hottest day in recorded history, according to preliminary data from a climate tracking agency monitoring temperatures since the mid-1900s.

It’s the second consecutive year average global temperatures have crashed through shocking climate records and will not be the last, as planet-warming fossil fuel pollution drives temperatures to shocking new highs.

July 21 clocked in at 17.09 degrees Celsius, or 62.76 Fahrenheit, and was the hottest day on Earth since at least 1940, according to the preliminary data from the European Union’s Copernicus Climate Change Service.

It’s 100,000 years of journalistic negligence:

Despite being based on data from the mid-20th century, the temperature records represent the warmest period the planet has seen in at least 100,000 years, scientists have found from many millennia of climate data extracted from ice cores and coral reefs.

Someone should send Angela Fritz (and most of the world’s journalists) the graphs of the ice cores which she has clearly never seen:

7,000 years of cooling in Greenland. This graph shows the ice-core data up until 1855. The last 150 years (1705 to 1855) are highlighted in red to show the warming as the Earth began coming out of the LIA. Send them the Vostok Ice Cores too. Send them Brazilian sea levels, and tell them the the Sahara was lush green and wet, and the water near Indonesia was 2 degrees hotter. And 6,000 boreholes drilled around the world agree, along with 700 Pacific Islands that aren’t shrinking. The real science deniers are the ones ignoring half a billion years of evidence.

It’s been hotter for thousands of years during human civilization and it wasn’t caused by our cars.

https://secretsoftheice.com/ REFERENCES

Copernicus media release –they it’s a the hottest day “in recent history” which the media turned into the hottest day in a hundred thousand years. h/t Gee Aye

Keep reading →

9.8 out of 10 based on 102 ratings

8.8 out of 10 based on 16 ratings

By Jo Nova

Europe’s solar manufacturers are in a crisis

Forty year old German solar panel producers are closing factories they only opened three years ago.

The world now has the capacity to make 1,600 GW of solar panels annually, but demand has unexpectedly flat-lined — staying at barely 500GW. In a world awash with solar panels that no one needs, prices have fallen dramatically, but that hasn’t solved the glut which is so bad, people are using solar panels for fencing in Europe.

The CCP has bet big that the exponential growth curve in solar customers was going to keep being exponential. Instead, demand flattened off suddenly. Currently, 80% of the world’s solar panels are pouring out of China.

With impeccable timing, just weeks ago the Australian Government threw a billion dollars at a program to help Australia become a solar panel superfactory just at the moment when China is practically giving them away.

Rachel Millard and Amanda Chu, Financial Times

“There is overcapacity in every segment, starting with polysilicon and finishing with the module,” said Yana Hryshko, head of global solar supply chain research at the consultancy Wood Mackenzie.

According to BloombergNEF, panel prices have plunged more than 60 percent since July 2022. The scale of the damage inflicted has sparked calls for Brussels to protect European companies from what the industry says are state-subsidized Chinese products.

Europe’s solar panel manufacturing capacity has collapsed by about half to 3 gigawatts since November as companies have failed, mothballed facilities, or shifted production abroad, the European Solar Manufacturing Council estimates.

The Salad Days of Solar Power are behind us

The sudden death of the solar boom is due to rising interest rates which take the fun out of getting a loan, but it’s also due to rising electricity costs, which increase the prices of everything, including solar panels themselves and the batteries they need to back them up.

But there’s an argument to be made that the grid itself has reached the limit. The Duck Curve has been quacking on grids in California and Australia for years. Ponder that in towns like Alice Springs the microgrid is in danger of falling over when a cloud rolls in, and only 1 in 4 homes there have solar panels. Indeed, in the sunny centre of Australia, the limit for solar power appears to be just 13% — meaning it’s hard to stabilize the grid when more than 13% of the annual supply is made from solar power.

When storms knocked over a high voltage line in South Australia the first thing the government did was to ask people to switch off their solar panels so they wouldn’t crash the grid.

Even on the big grids, there’s already such a glut of solar panels on homes, that the midday surge of “green” electrons is causing voltage surges which can damage other equipment. Solar “feed in” tariffs to homeowners are shrinking to nothing, or even going negative themselves. In Adelaide and Perth the government now insists people installing solar panels get smart meters so the grid managers can remotely switch off their panels. Worse, in Sydney solar home owners now have to pay to dump unwanted solar power on the grid at lunchtime.

Then there’s the mayhem of negative prices on national markets which is driving baseload providers off the grid and out of business. Large industrial generators are restructuring their businesses to accommodate the crazy pricing.

Last word: China already controls 80% of the market, would it really want to dump so many solar panels it drove the last 20% out of business, or was this just one huge Big-Government mistake?

Photo: Tadeáš Bednarz

9.9 out of 10 based on 112 ratings

7.9 out of 10 based on 15 ratings

7.9 out of 10 based on 34 ratings

7.8 out of 10 based on 22 ratings

If you are in Perth this weekend, I’ll be speaking about vandals and witchcraft in the National Energy Market for the Council for the National Interest (CNI) If you are in Perth this weekend, I’ll be speaking about vandals and witchcraft in the National Energy Market for the Council for the National Interest (CNI)

Sunday 21st July 2024, 2.30pm to 4.30pm (Socialising from 1.30pm to 6.00pm) at the APIWA Clubroom, Rear No.10 Mallard Way Cannington 6107.

Readers here are welcome tomorrow. There is no charge but please RSVP to apimail AT apiwa.com.au

9.9 out of 10 based on 54 ratings

By Jo Nova

Brown coal is the best kept secret in Australia

Imagine, in this cost-of-living crisis, if the nation discovered a 430 billion ton deposit that could produce electricity at a tenth the cost of gas and hydroelectricity? What a bonanza — the people could live like kings with heated pools, large homes, indoor spas and businesses would flock to the state to set up production lines. The state would become a trade giant and a mecca for tech.

Then imagine they let themselves be spooked into not using it for fear it would cause bad storms in a hundred years? Like the country is run by teenage girls…

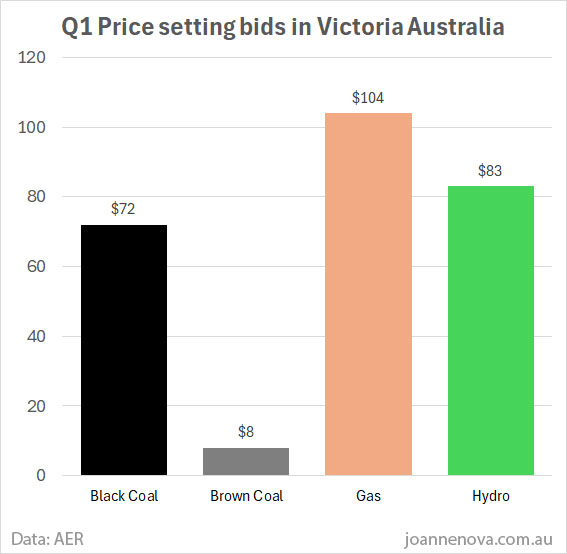

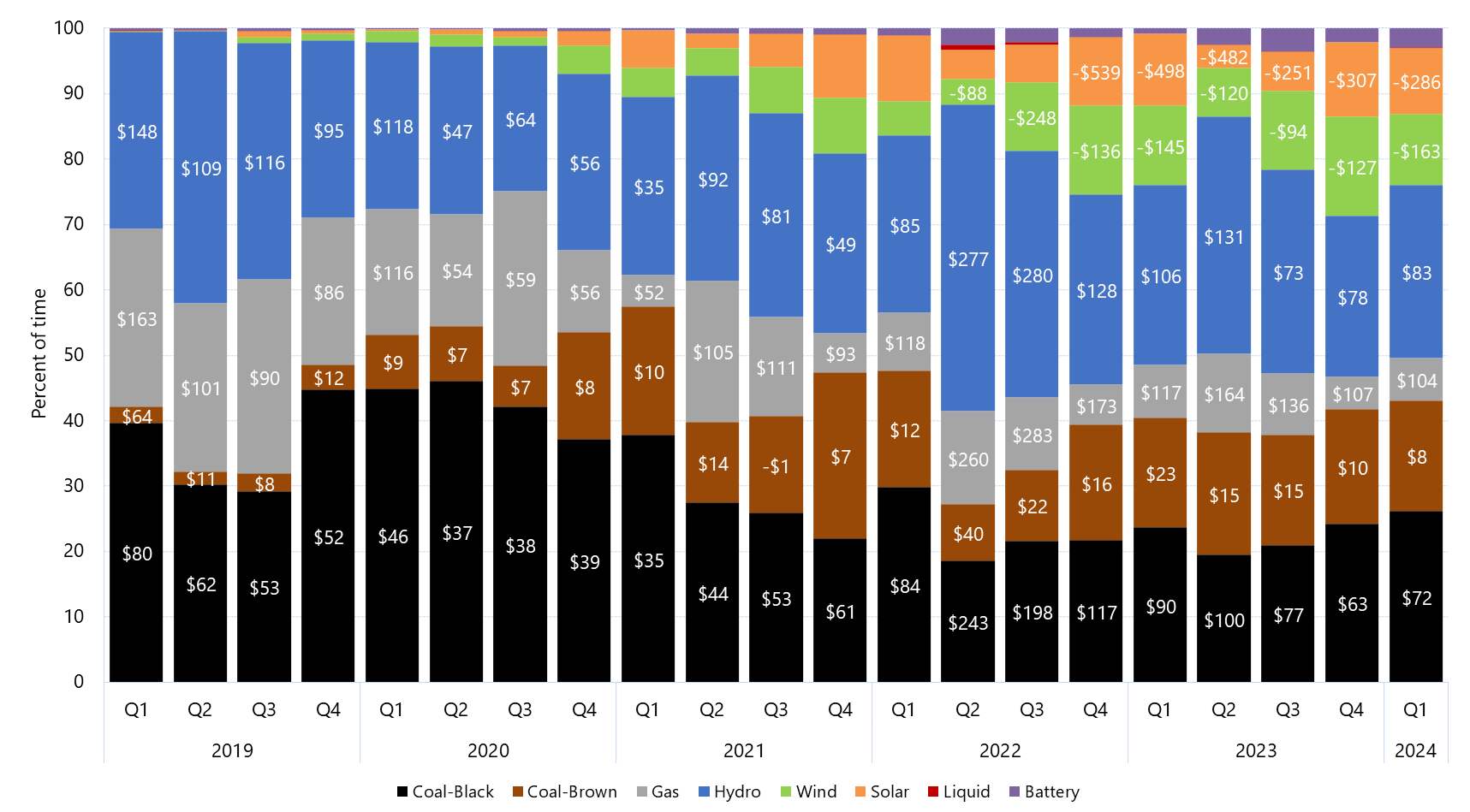

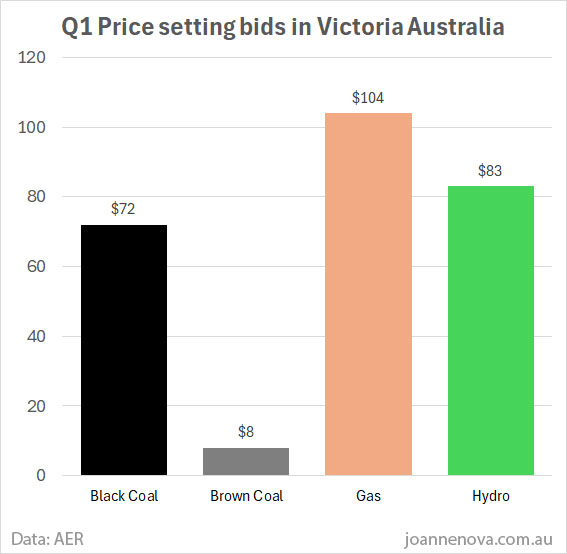

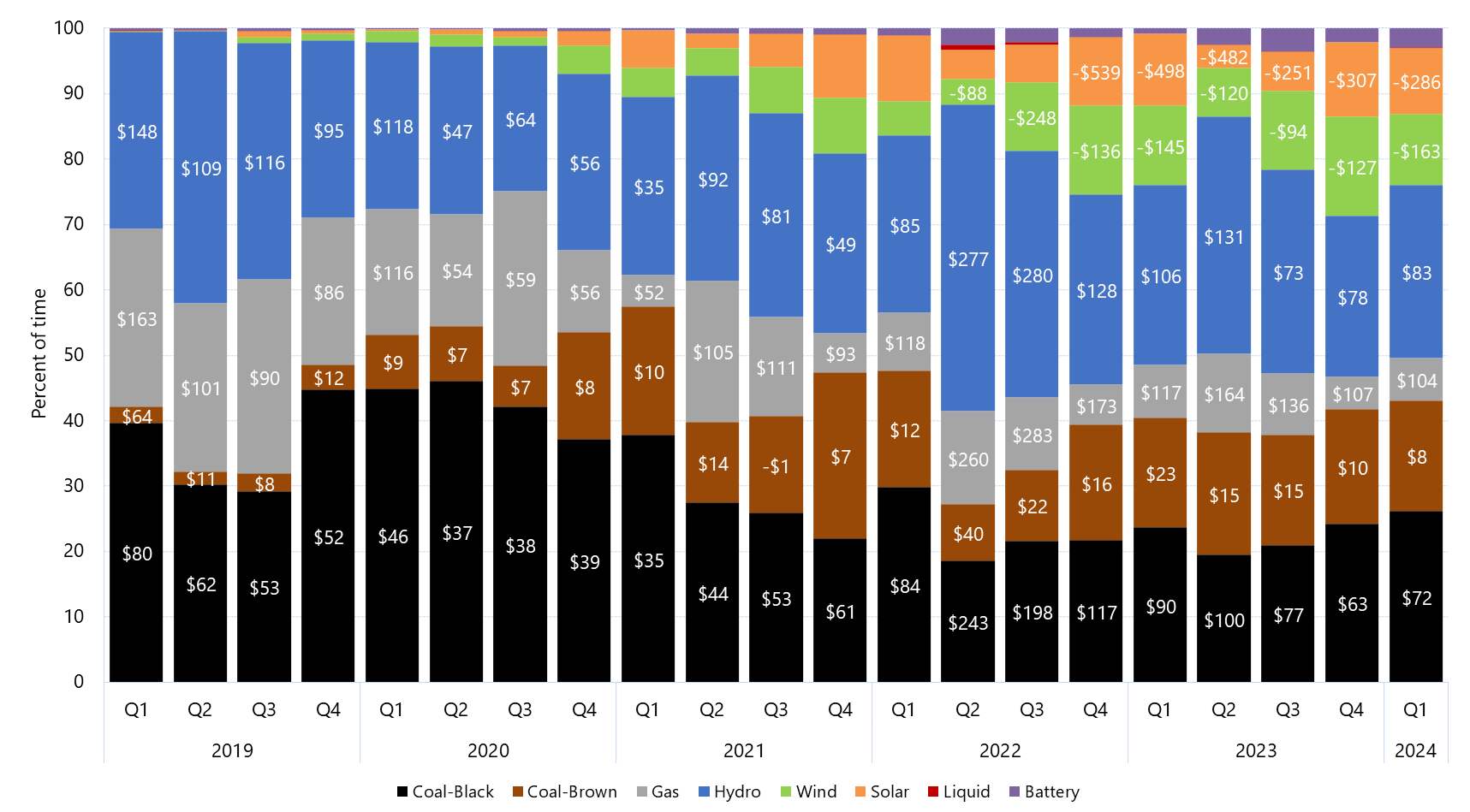

Source: AER

Despite the costs of everything rising in 2024, the brown coal plants in Victoria are still offering to supply wholesale electricity at $8 per megawatt hour (which is 0.8c per kilowatt hour). That’s the average winning bid from brown coal plants across Quarter 1, 2024.

In the chart below of the last five years of quarterly prices, we can see that every single quarter brown coal power is the cheapest source of electricity there is bar none. (Wind and solar power, with their crazy negative prices, don’t count because they’re subsidized up-the-kazoo. Their real cost is paid through other hidden means. It’s either that, or the negative prices tell us wind and solar power are so awful you have pay people to take those toxic electrons away…).

In the last quarter brown coal set the winning bid price about 15% of the time. These were the times when there was enough brown coal power in Victoria that the grid managers didn’t have to buy any black coal, gas or hydro power at all.

The more coal power Victoria has, the more often the wholesale price will be insanely low…

Because of the way the auction works, the highest successful bidder sets the price for everyone. In theory, generators are supposed to bid the lowest price they’d accept and then the AEMO takes the cheapest offers first until it meets the full demand.

And it’s the same all across the Eastern Coast of Australia — in New South Wales was getting bids from brown coal generators at $12 per megawatt hour. In South Australia, $11. In Queensland $13, and in Tasmania $7.

9.8 out of 10 based on 90 ratings

8.8 out of 10 based on 15 ratings

By Jo Nova

The irony! The only generator that can make affordable hydrogen is brown coal

The Great Green Hydrogen dream was killed by the dual impossibility paradox, it has no customers prepared to pay the Gucci level rates, and it can’t be made cheaper without using brown coal to which would mean it isn’t “green”.

The irony is practically radioactive — analysts admit Green Hydrogen is only economic if a company can get electricity at $30 to $40 per megawatt hour, which Australia had for decades, but blew away by adding “renewables”. Like every other nation on Earth, the more unreliable wind and solar we added, the more expensive our electricity got. These days the only generator that still make electricity at that price now is old brown coal.

For years Australian average wholesale electricity prices were $30/MWh

Sure, for five minute bids, and with generous subsidies stolen from taxpayers, wind and solar can pretend to be cheaper, but it turns out that the hydrogen factories, like every other factory, aren’t efficient if they stop and start every time a cloud rolls over, or the wind ebbs. All the infrastructure and staff, and the insurance and loans are still sitting around clocking up the bills, while nothing gets done. And all the inflows and outflows need to be adjusted, and the temperatures held steady. It would have been obvious to any precocious ten year old that hydrogen plants needed reliable electricity, which means they needed galactic size batteries to fill in the gaps, and therefore an interstellar budget.

The truth is, no one really wants “Green” hydrogen, or green steel, except as a fashion accessory to brag about at Davos. But people might buy it if it was cheap, which it isn’t. The only way to make it cheaper is with brown coal, which means it’s isn’t green hydrogen, and so we find the nation has accidentally stepped into a Escher Puzzle where all staircases lead upwards and left and end right where they started except the bank balance goes phht with every cycle.

Let’s not underestimate the scale of this debacle

Andrew “Twiggy” Forrest burned off $2 billion dollars (AU) on setting up his Green Dream Hydrogen energy plan which has just collapsed with the loss of 700 jobs. But bigger than that, the Australia Labor Government made it the centerpiece of its $2 billion Hydrogen Headstart program.

For more than two years, Fortescue has been full throttle trying to turn Forrest’s promise of converting green hydrogen into a commercial reality within years.

Instead, as the economics around surging electricity costs needed to produce green hydrogen sunk in, deadlines were pushed back and back. The mission changed, then there was a revolving door of executives.

Twiggy blames fossil fuels and the Russians:

“I am not giving up on hydrogen at all,” Forrest tells The Australian.

“The green electricity price just kept keeps heading north, and It’s been dragged up by the fossil fuel price. We’re not pivoting away. We’re going upstream to get the green electrons at the right price”.

On the 7:30 Report he kept dodging the question of what this meant for Labors big Renewable Nation plan, which means it obvious isn’t good.

At one point he mentioned “the war”. As if somehow a war which limited gas supplies and drove up the price of coal “dragged up the price” of renewables. The truth was that the Ukrainian-Russian War and the death of the Nordstream Gas pipeline should have been the best thing that could happen to renewables. It was their golden market opportunity to fill the gap, but it only exposed how useless they are. When push came to shove, everyone wanted coal and gas, including the companies that make wind turbines and solar panels. The reason wind and solar went up in price was because wind power can’t make wind turbines, and solar power can’t make solar panels, and no one can afford to make batteries.

Those killer costings on Hydrogen:

Matthew Rennie, a former EY partner who is now an independent adviser, said his firm’s analysis indicated that prices for power and electrolysers – which use renewable power to split water into hydrogen and oxygen – would need to be much cheaper to produce green hydrogen in Australia even at under $3 a kilogram.

He said power prices would need to be less than $40 a megawatt-hour and electrolyser costs would need to more than halve to produce hydrogen at that level – still 50 per cent more expensive than the government’s $2 target for the gas to be competitive.

Or worse, $30 a megawatt hour:

By Joe Kelly, Nick Evans and Rhiannoin Down, The Australian

Dr Finkel, said green hydrogen could replace coal as a chemical-reducing agent in the production of iron, but acknowledged its viability was “highly dependent” on the costs of renewable electricity.

He said the goal should be to start producing green hydrogen at about $2 a kilogram, “which would require the electricity that is used to make the hydrogen to be less than about $30 per megawatt hour – which is very cheap.”

The current average price on the wholesale national electricity market in the top two renewable states this month is $199 per megawatt hour (SA) and $214 in Tasmania. Even in Qld and NSW the prices are still $100 a megawatt hour more than they used to be.

Twiggy Forrest and Anthony Albanese believed their own fantasy propaganda. Twiggy was still talking tonight of “infinite” energy in Australia from the sun and the wind, showing how little he cares about numbers that matter.

Image by Pete Linforth from Pixabay

Graph: AER data

9.9 out of 10 based on 109 ratings

|

JoNova A science presenter, writer, speaker & former TV host; author of The Skeptic's Handbook (over 200,000 copies distributed & available in 15 languages).

Jo appreciates your support to help her keep doing what she does. This blog is funded by donations. Thanks!

Follow Jo's Tweets

Follow Jo's Tweets To report "lost" comments or defamatory and offensive remarks, email the moderators at: support.jonova AT proton.me

Statistics

The nerds have the numbers on precious metals investments on the ASX

|