|

|

By Jo Nova

Just view the BBC as the promotional wing of the Crony-Corporate Deep-State Cartel and it all makes sense

Andrew Montford lays bare the hypocrisy: The BBC won’t call Hamas “terrorists”, even though they kill babies and are legally classified as terrorists. Apparently it’s not accurate and impartial enough for them, and they say it’s a “barrier to understanding”. But the same BBC calls scientists and engineers climate deniers as if it’s the golden path to knowledge.

The BBC are expert namecallers, they know the power of labels and brands, and that’s exactly why they do it. Calling people “deniers”

is a barrier to understanding. It stops the public from listening to the scientists the BBC don’t like. The BBC have essentially admitted it in their own words. They won’t use emotive terms like “terrorists” on Hamas because they want the public to hear every excuse those-who-murder-babies say, but they will use emotive, meaningless terms like Denier when it suits them.

The BBC don’t want the public to understand skeptical scientists. That is the point.

Their hypocrisy is deliberate

The science debate can’t even start until the namecalling ends:

… Andrew Montford: The BBC is currently taking a lot of flak for its refusal to refer to Hamas as “terrorists”. Its editorial guidelines, say that that journalists need to mindful of the need for “due accuracy and impartiality”, but say that the t-word is “a barrier to understanding”.

I believe that “due” impartiality was a phrase dreamt up by the BBC as a way to deny the oxygen of publicity to just pesky voices. The term’s introduction led initially to people like myself being introduced on air as “deniers” (and one can assume that the BBC feels that the word “denier” creates “understanding” in a way that the word “terrorist” doesn’t, not even in the context of a proscribed organisation).

Ultimately though, it led to an outright ban on appearances on air by anyone questioning climate science or climate policy. Nobody from the Global Warming Policy Foundation or Net Zero Watch has appeared on the BBC for something like six years now, despite Net Zero having been a key public issue – and increasingly so – all that time. So while “due” impartiality apparently involves making sure apologists for baby killers get their views aired, for global warming sceptics and Net Zero sceptics, it means being silenced.

You have to wonder why the corporation’s senior staff feel the wholesale slaughter of innocents deserves a public defence, but critiques of the biggest public spending programme in history do not.

“Due” impartiality seems then to look very much like outright bias, a way for the BBC to enforce a hard-left agenda, promoting and defending things its staff are in favour of, and denigrating and attacking things they oppose. It’s an ugly, ugly picture, and they can’t hide it any longer.

Read it all at NetZeroWatch

9.8 out of 10 based on 113 ratings

8.4 out of 10 based on 20 ratings

By Jo Nova

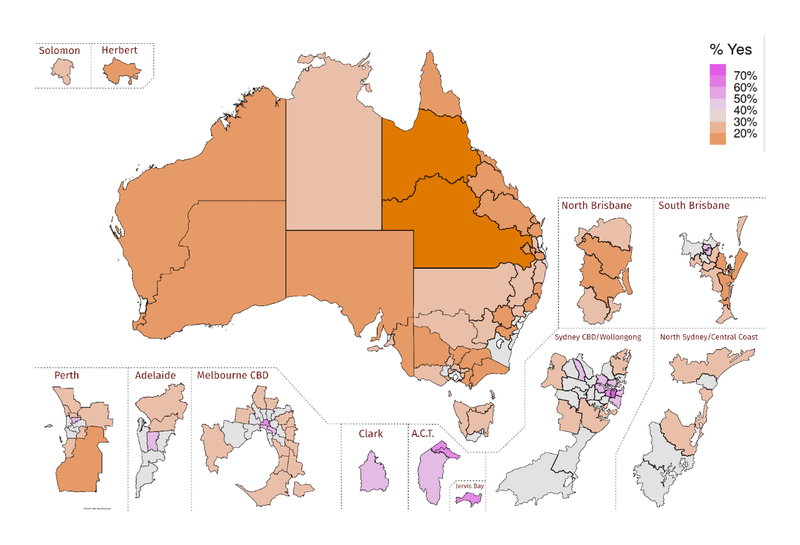

Despite spending millions to tell Australians that Good People Vote Yes, Australians overwhelmingly voted No to treating people differently according to their skin color, their heritage, or something their ancestors did.

They voted no to giving a new group of bureaucrats power to slow down, interfere or hold to ransom any laws passed through the Australian Parliament. And in a sense they voted No to shallow relentless, vague advertising too.

Spontaneous No Signs were seen in nearly every state of Australia in 110km zones:

Seen in Western Australia | Photo from Stephen Neil. The main benefit of the $365 million dollars the referendum cost is that now a lot of Australians feel more confident talking about race, while a lot of others found out that that calling people “racist” doesn’t persuade them. That may not have been what those in charge were aiming for. But hopefully we can have more productive conversations now instead of endless platitudes and meaningless pandering. The culture of victimhood is not helping anyone.

Significantly, the Referendum failed in every single state of Australia. Nationally it was 39.7% – Yes to 60.2% – No. The only Territory to vote Yes, was the Australian Capital Territory (ACT) the levitating bubble-land which voted 60% “Yes” in a country where every other constituency voted the opposite. Remarkably, the Northern Territory, which has by far the highest proportion of actual aboriginal people (30%) voted just as strongly against the Voice as all the other states did (62% voted No).

The Voice truly was a tool of the Bankers, the Bureaucrat-class and Big Business, and Australians saw through it.

Across the Tasman, New Zealanders voted to throw out the Labor Government. It’s a good day!

9.9 out of 10 based on 150 ratings

8 out of 10 based on 14 ratings

Like a Brexit moment for the nation.

UPDATE: Australia overwhelmingly votes for No Segregation. 60:40

UPDATE: New Zealand votes to throw out the Labor Government. It’s a good day!

The Labor Government wants to make some changes to the Constitution but they won’t tell us what they are what’s in the legislation that flows from the vaguely worded changes*. Presumably they know we won’t like it, and presumably, most Australians seem to have figured that out.

How, under the sun, did a nation of adults get to a point where we are being asked to effectively sign legal documents that no one has read?

Polling from FocalData suggests that the people who live in the high density inner city locations, furthest from disadvantaged Aboriginal communities, are the ones voting Yes. It’s like a fashion accessory. And for Big Business and washed up celebrities too.

FocalData also said: “… our estimates point to a significant loss, and the potential for a realignment in Australian politics that looks quite a lot like the US and UK realignment.”

h/t Neville

*Amended: It’s a blank cheque. The wording of the constitutional change is listed here, giving Parliament and the High Court infinitely wide scope to interpret how the new constitutional “body” works, how the members are selected, who gets to vote on “the Voice” and who is excluded. The body effectively would be able to “make representations” on everything. What law could possibly be made that did not affect or relate to “Aboriginal and Torres Strait Islander peoples”? What percentage of indigenous heritage is enough? 10%, 1%, 0.1% or none at all?

Thanks to Strop.

9.9 out of 10 based on 93 ratings

By Jo Nova

Just more junk science to spook those who want to be spooked

Did you sneeze today? It must be “Climate change”. Go forth and buy some solar panels…

Like a continuous propaganda machine, the government pays academics money to find a crisis, so they do, and then the media rephrase the story like a Pavlovian prompt. It’s a form of mass hypnosis. Everything is climate change and only the government can save you:

by Laura Chung, The Sydney Morning Herald

Did your hay fever start earlier this spring? The coughing, the sneezing, those terrible itching eyes? You are not alone, and it might get worse in coming years as climate change extends the season, experts say.

About 15 per cent of Australians have hay fever, with those between 25 and 44 years old most likely to suffer during spring. Hay fever is an allergic response when substances including pollen from grasses and trees, dust mites or mould come into contact with the nose and eyes.

The only time a climate scientist remembers that CO2 helps plants grow is when it’s bad:

Plants rely on carbon dioxide to fuel photosynthesis, so they may grow larger and produce more pollen with increased gases in the atmosphere.

Summers are going to keep getting longer — (especially because temperatures in 1910 keep getting colder every time we revise the dataset):

Data from the Australian Institute published in 2020 found that summer was, on average, one month longer than it was 100 years ago, while winter was more than three weeks shorter. For example, in Port Macquarie in New South Wales, summers have increased by 48 days.

And if summers stop growing, we’ll just change the instruments, build another runway and add another radar.

Remember girls and boys — your hay fever is not because of the highly allergenic shrubs your neighbors planted, or the westerly wind that blows over the hay plains. It’s got nothing to do with your wayward gut flora, antibiotics, diet, mineral deficiencies or any other possible thing.

Sneeze and think about all those evil people causing your terrible itching eyes because they’re driving a Ford Ranger XLT and loving it.

UPDATE: All around the world the past keeps getting adjusted, not just in Australia. John McLean audited the UK Hadley global dataset and found they were cooling the past one hundred years later. Then there’s the US adjustments of GISS where the 1970’s kept warming for decades.

9.8 out of 10 based on 69 ratings

9.3 out of 10 based on 6 ratings

By Jo Nova

Kathryn Porter in The Telegraph, has compiled quite the list of failures as offshore wind projects get frozen around the world. Decisions are being delayed, contracts abandoned, auctions left without bidders and almost no new projects started. The awful truth of inflation, the maintenance cost shocks and cable failures is all too much. Then there was the problem of needing a 100 years of copper, nickel and lithium production before Christmas.

It’s all been kept quiet. Who knew there were no offshore wind investments in the EU last year, apart from a few floating projects?

After years of subsidies, wind power was meant to get cheap enough to be profitable and competitive all by itself, instead, 25 years later, it just needs bigger subsidies. When the great oil and coal price crunch came, wind power was supposed to rise through the ashes, instead we discovered that wind turbine and battery factories needed cheap coal and oil like the rest of the economy.

Right now Australia has no offshore wind turbines and is about to jump onto a burning ship:

Kathryn Porter in The Telegraph,

Progress is stalled around the world as nobody wants to admit the real costs

Turbine manufacturers have been losing money hand over fist in recent years. Collectively over the past five years the top four turbine producers outside China have lost almost US$ 7 billion – and over US$ 5 billion in 2022 alone.

But the losses have also been driven by pricing structures designed to win market share, and aggressive windfarm developers who have refused to pay up, often while pocketing billions in subsidies. The market has started to look, if not like a Ponzi scheme, then like a house of cards built on the shakiest of foundations.

Offshore wind projects have been drying up around the world. During the whole of 2022 there were no offshore wind investments in the EU other than a handful of small floating schemes. Several projects had been expected to reach financial close last year, but final investment decisions were delayed due to inflation, market interventions, and uncertainty about future revenues. Overall, the EU saw only 9 gigawatts worth of new turbine orders in 2022, a 47 percent drop on 2021.

Over in the United States, despite the massive support offered by the Inflation Reduction Act, windfarm projects are also struggling. Orsted, the global leader in offshore wind, has indicated it may write off more than US$2 billion in costs tied to three US-based projects – Ocean Wind 2 off New Jersey, Revolution Wind off Connecticut and Rhode Island, and Sunrise Wind off New York – that have not yet begun construction, saying it may withdraw from all three if it can’t find a way to make them economically viable.

Meanwhile, projects off New York are asking for an average 48 percent increase in guaranteed prices that could add US$ 880 billion per year to electricity prices in the state.

Investors are starting to run

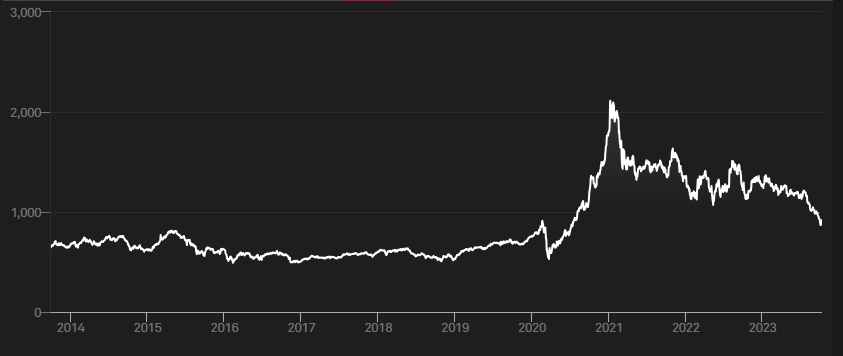

The S&P Global Clean Energy Index is down by 30% this year and most of that is in the last three months:

The S&P Global Clean Energy Index, comprised of major solar and wind power companies and other renewables-related businesses, has lost 30 per cent in 2023, with nearly all of the decline since July.

By contrast, the oil and gas-heavy S&P 500 Energy Index is up slightly this year.

In the last three years the real S&P energy sector is up 287% (white line below), but the clean energy sector (the green line) is down 32%.

Energy Sector Index growth (white) compared to the Global Clean Energy Sector (green) in the last three years.

“The energy sector has been the best-performing market segment so far this month, with oil prices surging 30% over the past three months.” — Globe and Mail

Yahoo Finance graphs the extraordinary growth of the S&P 500 Energy Index since 1994.

Thanks to NetZeroWatch

10 out of 10 based on 96 ratings

9 out of 10 based on 9 ratings

8.3 out of 10 based on 8 ratings

By Jo Nova

All flights are currently suspended at Luton Airport, London after a major fire broke out last night at 9pm. No one at the BBC, apparently, can explain why it spread so fast (the mystery!). But everyone is grateful this was not an underground carpark below, say, a 20 story apartment building with babies sleeping upstairs, especially since part of the top floor of the carpark has collapsed.

The fire has, unfortunately demolished some dreams of carbon reduction.

UPDATE: Apparently the word is that it was a diesel car that started the fire. The question is then, if there were no EV’s on that floor, would it have spread just as fast, would the floor have collapsed, and would cars have exploded like popcorn in the microwave? Awaiting the BBC gurus…

Hear the sound of cars exploding:

By Greg McKenzie and Emily McGarvey, BBC News

All flights at London Luton Airport have been suspended and people have been asked not to travel there because of a large fire in a terminal car park.

The Terminal Car Park 2 suffered a “significant structural collapse”, Bedfordshire Fire Service says. Up to 1,200 vehicles may have been in the car park and subsequently damaged, the fire service said. Four firefighters and a member of airport staff were taken to hospital for smoke inhalation.

Russell Taylor, 41, an account director from Kinross, saw the flames after flying in to London Luton from Edinburgh. He told the PA news agency: “There were a couple of fire engines with a car ablaze on the upper floor of the car park at just after 9pm. “A few minutes later most of the upper floor was alight, car alarms were going off with loud explosions from cars going up in flames.”

h/t GaryS

9.8 out of 10 based on 76 ratings

By Jo Nova

We can’t even run a cement factory all day anymore

Get your candles for summer! Unlike the last three years the Australian national grid won’t be rescued by another cooler La Nina this year. Fears of rolling blackouts are fraying nerves at The Australian Financial Review Energy & Climate Summit. The transition is described as stuttering, gridlocked, faltering, and the government as “desperate”.

Things are so bad, former CEO’s of major generators are warning that “the lights are going to go out” and accusing one Energy Minister of speaking “complete and utter horseshit” because they don’t think we need reliable peaking gas plants to replace coal power. Said Energy Minister has responded by refusing to even take his calls. That’s really going to work. Meanwhile Japan is getting nervous just watching us, afraid we have screwed things up so badly we can’t be relied on to keep sending them gas.

Not only is summer nerve-wracking, but things are already so bad, one of our largest cement producers is shutting down nearly every day because it can’t afford to pay for the peak electricity spikes even in springtime. Here in Renewable World it’s cheaper to let 5,500 workers sit around for 30 minutes than pay for electricity. The company was paying 54% more for electricity than the year before.

Riding the Express Train to the Renewable Faraway Tree

The numbers are staggering. Australia is racing headlong to the glorious 82 per cent renewables target by 2030. The catch is that the national grid at the moment uses coal for 62% of its electricity. The opposition energy spokesman is calling it “lunacy”, which it is. To reach the land of sunshine and breezes, our grid manager, the AEMO, is theoretically going to close two-thirds of the country’s existing coal power generation in the next ten years.

To put this in perspective, since the last hot summer we’ve shut down Liddell Coal plant, and still haven’t fixed the coal turbine that blew up in Queensland two years ago. New renewable investment has ground to a halt when it clearly should be going gangbusters. No one wants to build new wind and solar plants until someone builds the 10,000 kilometers of high voltage lines to reach distant cheap windy real estate, and no one wants to live or farm next to those transmission towers, so the protests are fierce.

Decarbonising Australia’s fossil-fuelled electricity grid is proving slower and more costly than previously advertised, with reliability risks increasing as the exits of coal-fired power plants run ahead of cleaner and reliable replacement generation.

Nerves are frayed “We’re not having an honest conversation”:

Angela MacDonald-Smith, Australian Financial Review

Former Snowy Hydro CEO Paul Broad said, “the lights are going to go out” in a return to normal conditions after three mild summers and said politicians were not listening to the warnings about the risks around supply, while the industry was not speaking up enough.

“That’s our problem,” he said. “We’re not having the honest conversations and us in the industry we’re not speaking up.”

Mr Broad, who abruptly exited Snowy Hydro last year after a run-in with Mr Bowen, accused Victorian Energy Minister Lily D’Ambrosio of speaking “complete and utter horseshit” in her refusal to recognise the need for peaking gas power plants in Victoria as coal power exits the system.

He listed Ms D’Ambrosio among energy sector figures who would no longer take his calls as he tried to get the message through, including former Australian Energy Market Operator Audrey Zibelman.

We can’t even run a cement factory all day anymore:

Chanticleer, The Australian Financial Review

Mr Bansal [the chief executive of Boral] told the Summit that Boral’s electricity price rose by 54 per cent in the 12 months to the second half of last year, and have not retreated, counter to expectations.

He said Boral had about 5500 “blue collar” workers who were being told to stand aside and do nothing for 30 minutes at a time when power prices made it too expensive to operate.

“At a certain price during the day, when the price goes up [to] a certain level, our manufacturing stops because we’ve worked out economically it’s actually better to have thousands of people waiting idle for the prices to come down then actually do the work,” he said.

“That’s a real issue we are facing every single day on 300 manufacturing sites across the country. So we are extremely nervous what that means.”

The chief at Boral pointed out that he’s not willing to sign up to 20 year electricity contracts because everything is so uncertain.

They still don’t understand the difference between reliable and unreliable power

It’s OK, the believers protest, Australia has added 20 gigawatts of solar.

“Australia has three-and-a-half-million solar systems installed and that represents around 20 gigawatts of potential output,” Westerman says.

“That’s more than seven Eraring power stations at full output and capable of meeting almost half the energy demand in the day when the sun is shining at its brightest.”

As if solar panels can be measured on the same page as a coal plant. For half an hour a day, on a good day, only in summer, and as long as the clouds don’t roll over, the peak output might be like seven coal plants. These people are crazy.

Australians should protest and shout,

Leaving those in control in no doubt,

Of the wrong that they did,

In wrecking the grid,

When the lights all start to go out.

–Ruairi

10 out of 10 based on 115 ratings

9.8 out of 10 based on 9 ratings

8.6 out of 10 based on 14 ratings

By Jo Nova

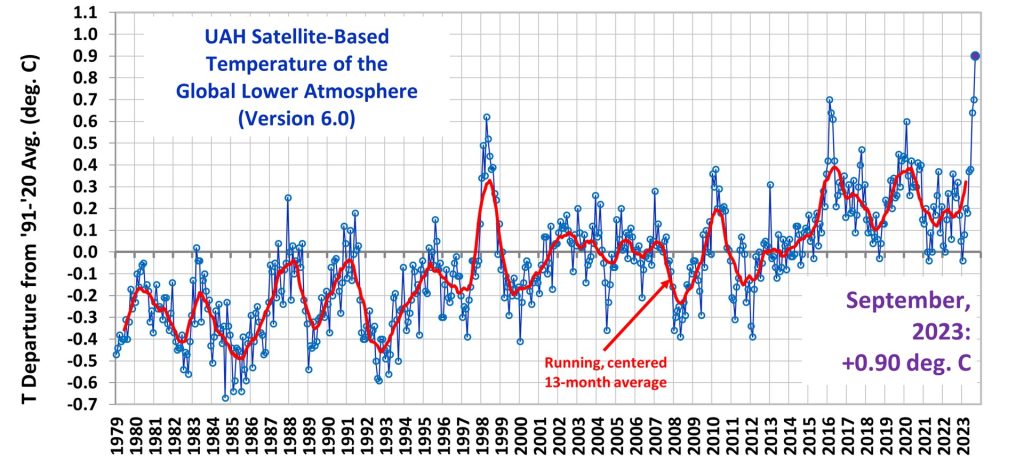

The “hottest ever” headline is misleading

While the UAH satellite measurements are the hottest by far of the 44 year satellite record, nothing about the “hottest ever” media frenzy makes sense — not for health, history, the long term, or human biology. It’s only the “hottest ever” if we ignore most of the last ten thousand years. It’s just another attempt to scare people out of their money.

The latest UAH satellite measurements may be affected by the water vapor launched into the atmosphere by the Hunga Tonga volcano. There don’t appear to be any clear details about that, but even if we accept this as is, it’s still nothing to spend a trillion dollars on:

In the big scheme of human history, the world has been a lot hotter and a lot colder. Homo sapiens are 37 degree animals who retire to warm climates, not cold ones. Most people on Earth live in the warm tropics, not the cold poles. Two hundred million years of evolution mean mammals are made to deal with temperature change. We live in places that range from minus 50C minimums to plus 40C maximums (-58F to 107F). That’s a ninety degree temperature range (or 160F), and yet we’re supposed to panic if the world heats by half a degree more?

The hottest inhabited place on Earth is probably Kebili, Tunisia, where 60,000 people live and the average July maximum is 41.7°C (107F). And Marble Bar, Western Australia, has had an average of 41°C in January for the last 100 years (106F). Fossil Fuels make it possble. Give the poor air conditioning!

The coldest inhabited place is Oymyakon, Siberia, Russia, where 500 people live even though the average temperature for January is -50°C (-58F). These are the average temperatures, not the hottest and coldest days.

Almost every day of the year we deal with five to twenty degrees of warming, and that’s just dawn to afternoon tea.

Humans hate the heat right?

Cold is the big threat to crops and lives, not heat

Human mortality rises 6 – 20 times higher in winter, even in hot cities like Brisbane, Australia. The biggest climate threat humans face is the next ice age. Twenty thousand years ago there were walls of ice a kilometer high over New York — that’s 2,000 feet of frozen water that has to melt before you can plant one plum tree.

The “Hottest Ever September” was just the hottest in the 40 year satellite record. The world was likely hotter in Roman Times, hotter in Minoan Times, and hotter during the Holocene peak 7,000 years ago. Sea levels were 1 – 2 meters higher then, when humans lived in mudhuts and teepees. Yet somehow humans thrived.

Seven thousand years ago the world was hotter than even our “hottest ever September” and yet the Great Barrier Reef survived, the Amazon forests grew and even polar bears and penguins were not wiped out. Only 6,000 years ago the world was warmer and the Sahara was lush green and wet.

In the West, wise academics could be speaking up to give us some perspective, yet they’re silent. What do taxpayers pay them for if not this? Our public funded media could be giving us the whole truth and nothing but the truth. Our ABC, BBC, CBC and NPR have specialist “science units” for reporting science, not just the one-sided propaganda that screws money from taxpayers, and feeds childhood anxiety.

These institutions have no problem reminding us how CO2 hasn’t been this high for 4 million years, but they forget day after day that temperatures have been and for thousands of years.

UPDATE: This graph shows the ice-core data up until 1855. The last 150 years (1705 to 1855) are highlighted in red to show the warming as the Earth began coming out of the LIA. Western Australia is one of the oldest and most stable parts of Earth, making it an ideal place to study sea levels. We’re worried about seas rising by 3mm a year (and only after the satellites were “adjusted”) but the oceans rose 125 meters, stayed high for thousands of years and have been falling for most of human civilization.

Save the world from witchdoctors. Teach children geology and the history of the Earth.

___

PS: Any miners reading this with photos of Marble Bar they don’t mind me using? Please send them in. There are surprisingly few photos available on any copyright-free libraries. Somewhere out there someone must have a photo of shimmery heat rising off bitumen!

REFERENCE:

Lewis, S.E., et al., Post-glacial sea-level changes around the Australian margin: a review, Quaternary Science

Reviews (2012), http://dx.doi.org/10.1016/j.quascirev.2012.09.006 [abstract] (paywalled).

9.9 out of 10 based on 81 ratings

8.2 out of 10 based on 12 ratings

8 out of 10 based on 21 ratings

by Jo Nova

When will the Green climate activists realize they are the minions of the Banksters, and communist governments?

In 2021 BlackRock used its shareholder influence to force Exxon to drop some gas fields under the guise of “climate activism”. BlackRock were the second largest shareholder with 6.6% of Exxon at the time. They bragged about getting three new activist board members elected to help Exxon in the “energy transition”. But they also happened to be major investors in PetroChina too with 7% of the Chinese oil and gas company and BlackRock didn’t seem to care too much about their ESG policy. Conveniently, PetroChina was “poised” to buy many of the fields that the giant US oil company was getting its arm twisted to sell.

Naturally the Stupid-Media wrote this up as a win for koalas and whales or something:

It’s like sabotage of national assets

While BlackRock pretend to care about the environment, they were potentially undermining a US company, their US shareholders, and own pension fund clients, all to get a better deal, perhaps, with “favours” of who-knows-what for a foreign company, which is a subsidiary of the Chinese State CNPC. We can only speculate, but the conflict of interest is ripe with possibilities. It’s easy to imagine President Xi being grateful. And as it happens, BlackRock became the first to operate a wholly owned China mutual fund in June 2021. Coincidence?

Thankfully, two US State Republican governments noticed the conflict of interest, and put pressure on BlackRock and other pension fund managers. The Wall Street Journal article below is a year old, but under the fiduciary duty headline, many people may have missed the detail about PetroChina being the winner, and about BlackRock’s “environmental attitude” being so anti-West and pro-China.

By Jed Rubenfeld and William P. Barr, Wall Street Journal, Sept 6th, 2022

Last week Attorneys General Jeff Landry and Todd Rokita of Louisiana and Indiana, respectively, went further. Each issued a letter warning his state pension board that ESG investing is likely a violation of fiduciary duty. Last week Attorneys General Jeff Landry and Todd Rokita of Louisiana and Indiana, respectively, went further. Each issued a letter warning his state pension board that ESG investing is likely a violation of fiduciary duty.

The Louisiana and Indiana opinions didn’t make headlines but have seismic implications: They suggest that state pension-fund board members, investment staff and investment advisers may be liable if they continue allocating funds to ESG-promoting asset managers such as BlackRock.

First, Mr. Landry’s guidance spotlights potentially explosive, undisclosed conflicts of interest in the Big Three’s “selective” promotion of ESG criteria against U.S. companies but not Chinese companies. According to Mr. Landry, in 2021 BlackRock exercised its proxy voting rights as Exxon’s second-largest shareholder to lead “an activist campaign that forced Exxon to cut oil production,” without disclosing that many of the “oil fields dropped by Exxon” are “poised to be acquired by PetroChina” and that BlackRock is “one of PetroChina’s largest investors.”

Mr. Landry has a point. BlackRock has an enormous stake in PetroChina, reporting holdings of between one trillion and two trillion shares, representing between 5% and 10% ownership, from 2018-22.

The US Republican states may yet save us. We know this campaign has been successful in slowing the ESG trainwreck. One giant fund, Vanguard, pulled out of the global banker cabal in December last year. The Insurance fund consortium has largely fallen apart. Larry Fink (the CEO of BlackRock) has stopped bragging about ESG, and BlackRock has closed one small China fund just last month, after such pressure.

The dark bubble is the reason everything seems to be going off the rails simultaneously.

Are your retirement funds being used?

Photo by eflon on Flickr. Adapted. CC by 2.0.

9.7 out of 10 based on 89 ratings

9.4 out of 10 based on 8 ratings

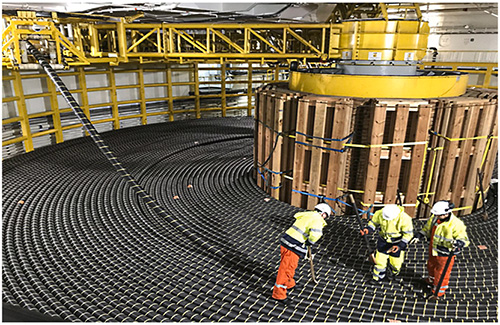

They’re not much use without a lot of cabling. | Image by Norbert Pietsch from Pixabay

By Jo Nova

Thanks to Oldbrew at Tallblokes Talkshop

Who knew high voltage cables running for kilometers in a deep electrolytic moving body of water would be expensive?

Despite offshore windfarms dealing in a kind of mechanical hell of high speed salt water spray, big waves and volatile wind conditions, surprisingly 85% of the insurance claims are because the underwater cables are failing.* If the subsea cables can’t be insured, it’s another unexpected cost threatening the economics of offshore wind.

The underwater cables needed for offshore wind are apparently so costly to repair, and the losses from lack of generation so steep, they are in danger of becoming uninsurable.

Energy News Live

The race to harness offshore wind energy has hit a significant roadblock, with the reliability of subsea cables emerging as a critical concern.

Global Underwater Hub (GUH) has raised alarm bells about the escalating issue of subsea cable failures.

These setbacks not only disrupt power transmission but also incur hefty costs.

Imagine if an entire coal plant was connected to the grid through one long cable buried under the ocean and when the cable failed it took months to find and repair — during which time the plant could not earn a cent…

World Oil

GUH chief executive, Neil Gordon, said, “It’s estimated that around 85% of the total value of offshore wind insurance claims relate to subsea cables. Insurers are losing money underwriting cables with the average settlement claim in the region of £9 million. Brokers have warned that the high number of cable claims is affecting capacity and coverage and the cost of repairs typically runs into millions, with warranties rarely covering the high cost of business interruption.

“If these critical components become uninsurable, offshore wind projects around the world will be derailed, making global 2050 net zero targets completely unachievable.”

According to one developer, the cost of insuring a 1.2GW offshore wind farm over its lifetime is in the region of £350 million and insurance brokers estimate that the costs of floating offshore wind will be 30% higher than fixed bottom ones.

Global Power Marine fixes export cables and quotes one happy customer talking about needing “only” 32 days instead of 67 days to repair the cable. But all the while, part or all of the wind plant isn’t earning any income, and so much of any repair depends on getting good weather so a ship can hover and work uninterrupted while the cable is “dangling” and exposed.

Gulski et al estimate the duration of failure can be 1 to 3 or even up to 9 months:

“Last 20 years of experience shows that the power cables are the largest contributor to the failures of power supply from the offshore plants. “

For those who want the details on the challenges of engineering Gulski et al detail some of the problems with subsea cables like the need for armour that isn’t magnetic, sections that are 30-50 kilometers long to avoid “joints” underwater, and why most cables on the sea floor are called “wet structures” which allow water in (at least to the outer layers).

Wind energy might be free, but collecting it costs the Earth.

Late Update — Australia desperately needs to learn these lessons

Prompted by comments from David Maddison and Ross below:

There are no offshore wind plants in Australia but we are rushing to build them, so the tales of woe from the UK and US are especially relevant here now.

The Basslink Cable from Tasmania to mainland Australian has broken not once, but three times here in the last seven years. First in 2016 for 5 or 6 months (I believe Australia didn’t even have the right repair ship, we used the Ile De Re which was based in Jakarta). Then the cable was out again in 2018 for two months. And in 2019 for another month due to a problem on land at the Victorian end.

The Basslink repair in 2016 were delayed for weeks because of bad weather.

After three weeks of delay, the ship was finally able to leave Geelong last night and the repair team hopes calm conditions will last long enough to connect a new section of cable to the existing one. The repair team needs 16 calm days to work on the cable before it can be up and running again.

How could our BOM even predict 16 calm days on the Bass Strait…?

_______________

*Admittedly, this percentage may be high because insurance companies don’t cover most of the other kinds of failures on wind “farms”, as we see with Siemens massive stock loss as they realized the true cost of maintenance.

9.9 out of 10 based on 101 ratings

|

JoNova A science presenter, writer, speaker & former TV host; author of The Skeptic's Handbook (over 200,000 copies distributed & available in 15 languages).

Jo appreciates your support to help her keep doing what she does. This blog is funded by donations. Thanks!

Follow Jo's Tweets

Follow Jo's Tweets To report "lost" comments or defamatory and offensive remarks, email the moderators at: support.jonova AT proton.me

Statistics

The nerds have the numbers on precious metals investments on the ASX

|

Last week Attorneys General Jeff Landry and Todd Rokita of Louisiana and Indiana, respectively, went further. Each issued a letter warning his state pension board that ESG investing is likely a violation of fiduciary duty.

Last week Attorneys General Jeff Landry and Todd Rokita of Louisiana and Indiana, respectively, went further. Each issued a letter warning his state pension board that ESG investing is likely a violation of fiduciary duty.

UPDATE #2: Allegedly there were no sprinklers (which wouldn’t put out an EV battery fire anyway). Let’s try to imagine what kind of sprinkler system would contain those EV Fires — like drop-down glass-fibre spray that solidifies on contact or like jet sprayed asbestos?

UPDATE #3: As many as 1,500 cars were in the car park, it’s not clear how many survived. Fireman say all four floors pancaked in at least one part. *See the video of the supposed start of the fire. And footage where the car is visible. Seems like a very big explosion. Some are saying it was a hybrid diesel.

Let your imagination run …