The rise of the tech giant billionaires, the crime, corruption, wokery, war, inflation, climate witchcraft, and the Big-Pharma reckless experiment — is all made possible by the same thing, and it’s been coming for fifty years.

Everyone under 40 has lived their entire lives in the fairy-land-of-plenty borrowed from the future. But all bubbles come to an end.

The rot started with a corrupted currency, and now infects every corner of the world — weakening markets and minds and concentrating power obscenely. When our medium of exchange is undisciplined, everything else is too. There is injustice built right in to Fake IOU’s made from thin air — especially when some can borrow big and early and at low cost, while others have to wait to earn them slowly an hour at a time. In the inflation race, speed is everything. They devalue the incentives that drive people to make things better, faster, and stronger. It punishes the prudent hardworking savers, and feeds speculative greed.

The rot started with a corrupted currency, and now infects every corner of the world — weakening markets and minds and concentrating power obscenely. When our medium of exchange is undisciplined, everything else is too. There is injustice built right in to Fake IOU’s made from thin air — especially when some can borrow big and early and at low cost, while others have to wait to earn them slowly an hour at a time. In the inflation race, speed is everything. They devalue the incentives that drive people to make things better, faster, and stronger. It punishes the prudent hardworking savers, and feeds speculative greed.

This is what BlackRock’s influence came from, and Gates, Zuckerberg, Dorsey, and the WEF. All of them rode the wave of easy money and easy loans. Through predatory purchases on credit, they were able to buy out competitors or grind them down. What’s left are mega-glomerates of media, pharmaceuticals, and a sea of dark influence so vast that BlackRock commands more money than the GDP of every country bar China and the US, and Bill and Melinda Gates are the second largest “nation” funding the World Health Organization. The New Oligarchs speak with forked tongues, then crush the people who complain.

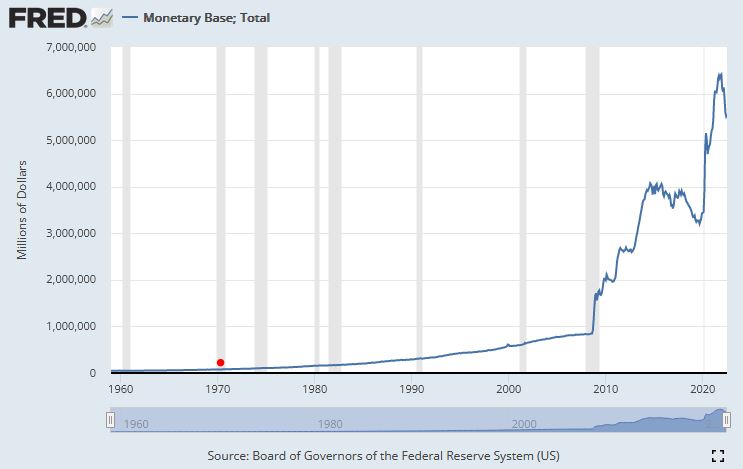

This is a graph of the US “money base” — the supply of US dollars created by the US Federal Reserve since 1960. Those base dollars are then amplified by the commercial banking system, by a factor of ten or twenty. We could label the left axis “The Global Crazy Index” and it would look just the same. Funny money feeds crazy behaviour.

The supply of money just keeps growing. We’ve been leading up to this corruption crisis since 1971 | St Louis Fed

The galactic bubbles in wokery, inflation, crime, and corruption need money to levitate above reality, so it’s no surprise that the more free money there is, the more crazy the world gets. Governments only get absurdly obese when they get access to new cream-puff-dollars created out of thin air. If western governments were stuck with just taxing the voters they wouldn’t get away with bloated welfare and bloated bureaucrats. The current everything-bubble started in 1982, after the previous inflation was wrung out of the US economy. But the signs of trouble were there in the seventies.

To fight this dark bubble, I could use your help. Thank you.

________________________________________________

1971 was the tipping point where all the trends bent

Graphs thanks to WTF Happened In 1971?

Many of these graphs don’t include the last year, so things may be even worse than they look in the rear view mirror…

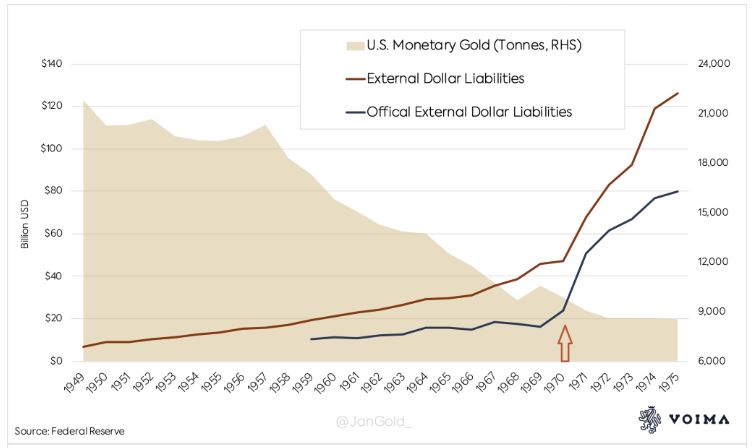

This fall of Rome type stuff.

The USA was intrinsically wealthier until the end of the 1950s. Then its gold was quietly frittered away for $36 an ounce. By the late 1960s, France and others realized the fixed price of gold was absurdly low and called the bluff, asking for delivery of the gold instead of the dollar. At that point the game was up, and it all came to a crunching end in 1971. The US just didn’t have enough gold left, and President Nixon suspended the fixed price deal, and the world was then on a purely paper currency. Starting in 1971, the US dollar — and every other official currency — was no longer backed by anything. Without the constraint of needing to buy more gold bars, the printers at the US Federal Reserve were free to unleash as many dollars as they could get away with. Free money — printed in paper and then with binary code in bank accounts began to blink into existence, and so did inflation.

Dollars are just another commodity, where supply and demand matter

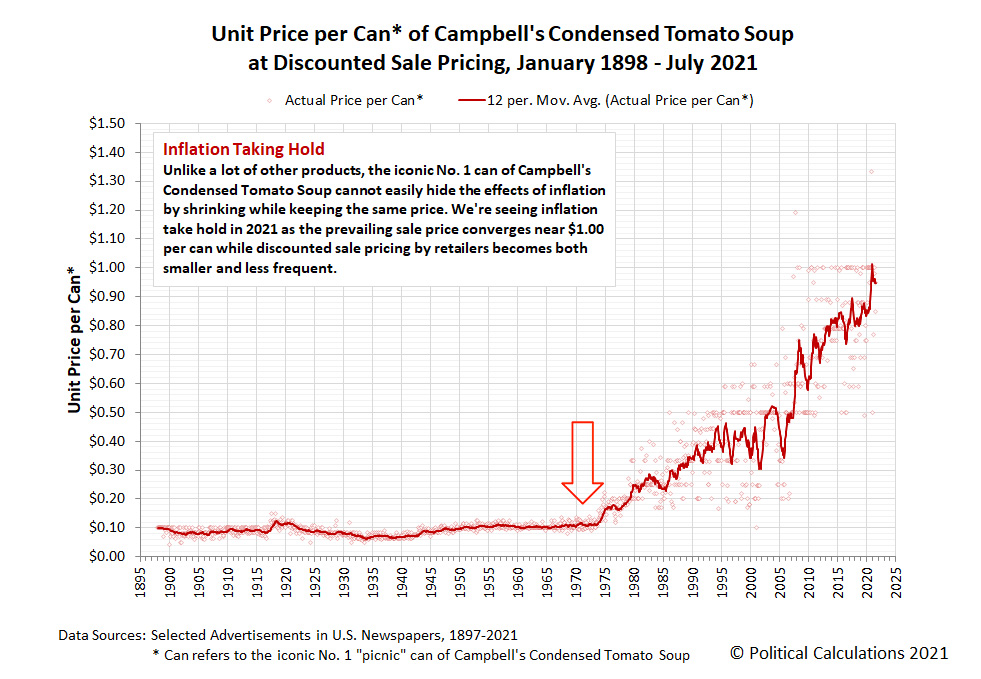

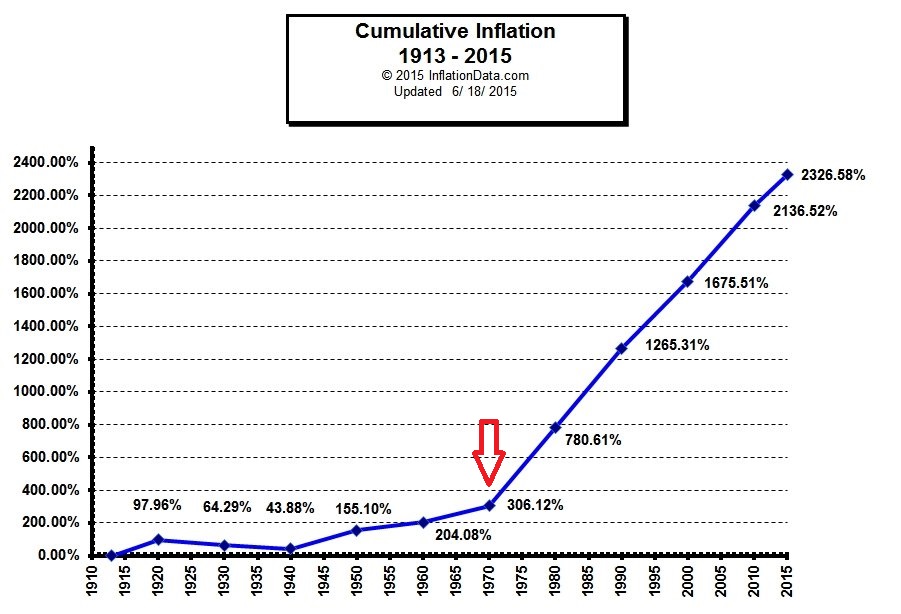

Growth of money supply = inflation:

To put things in proportion — this is The American Century. This is also a graph made in Feb 2020.

There was still inflation on the Gold Standard, but nothing like what followed:

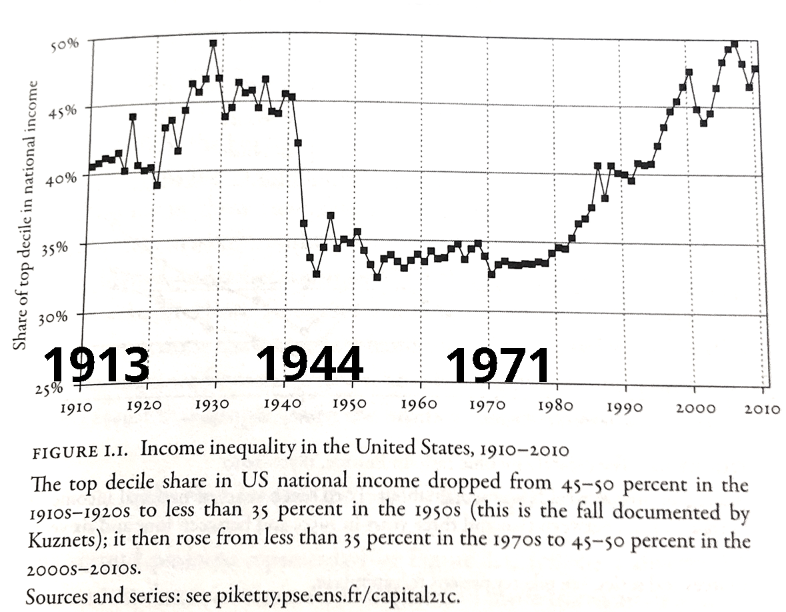

Income inequality goes hand in hand with inflation

The left rail indignantly against income inequality but apparently don’t have any idea what causes it. Inflation is the invisible thief that steals from the poor and gives to the rich. The elite Chosen Ones get fast access to new “free money” while the workers have to earn it at yesterday’s hourly wage rate. The social pain that arises from extreme income inequality is a direct consequence of Reserve Bank policies.

If only the Occupy crowd could figure it out.

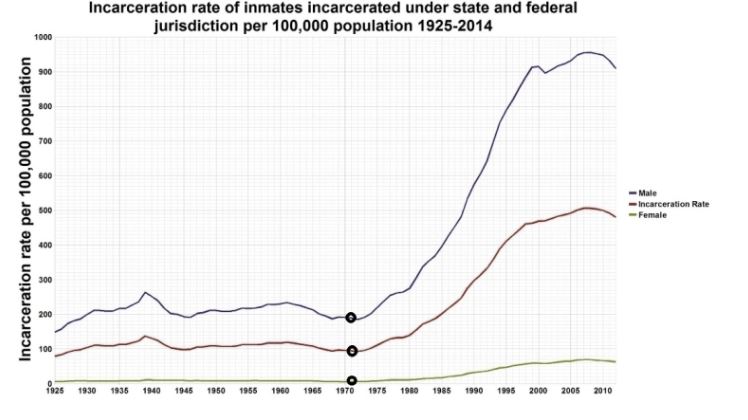

The criminals followed the money:

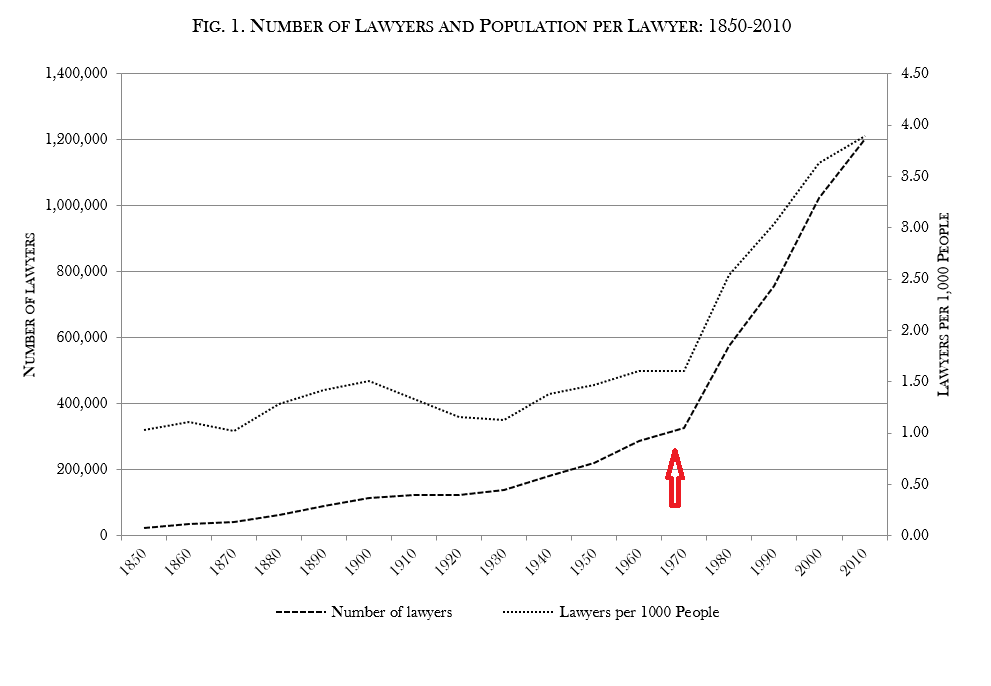

Lo and verily the lawyers did too:

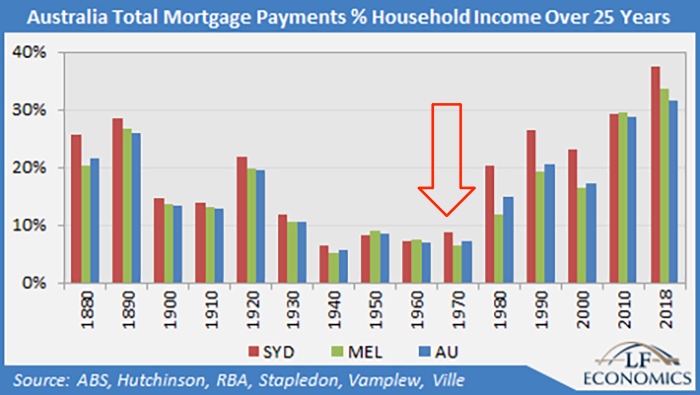

There is no free lunch and no free houses either

Printing fiat dollars didn’t print more houses, but it did make housing less affordable — as real productivity ground to a halt, and cushy luxuries and inefficiencies bled through the system. It now takes a much larger slice of household income to buy a house than it did in 1971. Houses are bigger, true, but blocks are smaller, and now it takes two incomes and years longer to pay it off.

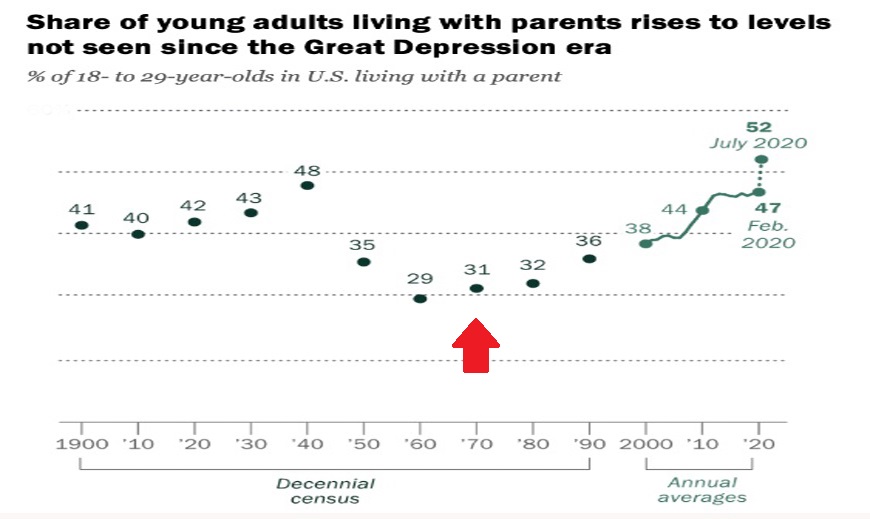

Are those kids still at home? When housing and cost of living becomes unaffordable, where else are they going to go?

So much of our life’s track depends on the luck or lack thereof, of where we are born in the boom and bust cycle:

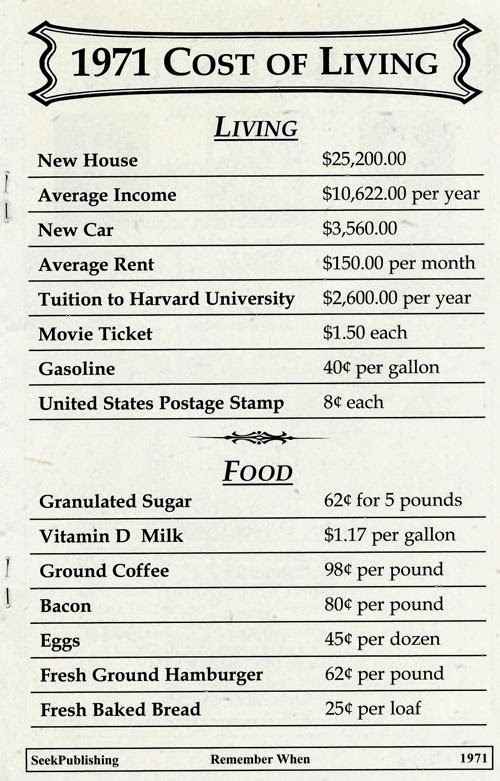

Prices back in 1971:

The power of single men like Larry Fink to control national energy policy with the bizarre aim of “changing the weather” could only happen in fantasy booms created by bubbles.

The reckless and corrupt thrive on the easy money wave. And the world’s reserve currency, the US dollar, has been undisciplined and corroding for decades. The free ride on easy borrowed money has fed the corrupt oligarchs, the hedge fund takeovers, the super multinational conglomerates, the tech giants, and the wars. It is as it always has been.

The question is not whether the bubble will collapse, but how much it will take with it in the process.

See all the graphs at WTF happened in 1971.

h/t Scott of the Pacific

Excellent article. Anyone with eyes could see this coming for 50 years. And we closed our eyes and walked off the cliff, knowing it was in front of us. It’s a long way up from the bottom, but I’m confident.

581

Hi Jo,

Yes excellent article.

I’d like to add an extra dimension you may not be aware of!

In 1973 the ILO. signed the Lima Convention.

I beg you to do an expose on this in the coming days/weeks.

Try finding info on it anywhere? It can’t be done.

It’s a bit like the taboo scene/s in Eyes Wide Shut … no-one is allowed to talk about it.

I challenged Bob Katter about this on 4bc (during a fed. election) about a decade ago.

To his credit he acknowledged he’d never heard of it & will look into it (unusual statement for a politician).

Long story short, all OECD. countries are directed to re-direct all their manufacturing industry/read jobs to what used to be called lesser-developed countries. (sorry not up on latest pc speach for this term.)

Good luck researching, please let us know what you find.

As always, warm regards,

Reformed warmist of Logan.

110

Excellent perspective, absolutely necessary to understanding the mess we find ourselves in.

The loss of value in currencies is analogous to the loss of value in society: build something on the basis of lies — a foundation of sand — and it must eventually fail. Society prospers only when truth, beauty and the rule of law (for all) are respected.

The rot didn’t just happen, it was caused by humans gaming a system for their own benefit.

I’ve been describing the times that we are in as “The Great Bedevilment”. Our institutions are corrupt because the humans who run them can profit by their corruption, for now. It’s not just wrong, it’s evil.

771

Say a person(s) starts a business and its product or service is welcomed in the market place. With help of the right type, the business is “taken Public”, that is, shares are sold to outsiders. However, the person or persons that started the business claim millions of shares for themselves. They did, in fact, create something of value.

The first shares sold – the initial public offering (IPO) – sets the price for trade in the shares, and it sets the value of the millions of shares kept by the original private owners.

The business itself has the same intrinsic value the day after the IPO as it did the day before. Nevertheless, the original private owners are fantastically wealthy. A new billionaire is created!

Why didn’t I think of that 50 years ago?

370

An IPO will make statements including how many shares will exist and how much money the company has historically made, etc.

A sensible market will divide the previous years profit by the number of shares and determine a likely return on investment, (assuming some percentage dividend from the profits and it not all being rolled back into the business). The market then determines the value of the company by how much it will pay per share.

As an example, a business that makes a profit of $1M per year with a million shares may be worth say $3 per share, (assuming that 30% of the profits are returned as dividends and people are happy with a return of 10% on their investment). Others might see a need for more return and not buy them at $3 but offer say $2. The market will determine the price.

In a sensible market, the returns justify the share price. I just wonder how the likes of Twitter are valued when the dividend returns have been zero. To me it looks like a ponzi scheme. Not much different to the US dollar in recent years, (see article).

So back to your billionaires being created…. In a sensible market they would be, IF they retained enough shares AND if the return really was that good. In reality, The reason that any company VALUED at a $B, (as above), AND with a current profit of several hundred million dollars per year would list on the stock market is not due to a need to finance their retirement, it’s probably because they DON’T have a profit that high, they just have a PLAN to make that kind of money. A plan which requires expansion and to do that they need a LOT of money. Hence the float.

But I still wonder about Twits, assuming that is what you call the owners of a virtual company with no real assets.

210

The reverse can happen. Look at Hazelton Airlines.

Australian airlines are tightly regulated. So far as I know substantial subsidies are applied to smaller regional services because governments deem it necessary that these services exist.

Regulations kept changing. The Hazeltons must have been very smart people, because as rules kept changing and other firms rose and fell around them their business just grew.

Eventually a further change in regulations put Hazeltons in the position where they had to either get twice as big or get out. They chose to grow.

They floated their company on the stock exchange, keeping 35% of the shares for themselves, apparently expecting that the other 15% for a boardroom majority could be counted on. It didn’t happen.

Such was their fame that over 50% of shares in the company were snatched up by ‘the institutions”. Those institutions are by law not permitted to engage in risks that Hazeltons were able to take with their own money to be so successful. Hazeltons, the brains of the company, were sacked from the board.

The company became just another mainstream operator, and was taken over by Ansett airlines.

Ansett, having caved in too often to union demands, went down the gurgler.

360

The US Dollar is still the best of a very bad bunch. If you want to see a failed currency then just look at the Euro. It’s toast. An experiment that could never work. The EU will break up and those countries will go back to their own currencies. The UK did the right thing to keep Sterling and has now left the very undemocratic EU. The EU Commission is not elected but has all the power. The EU Parliament is a ‘show pony’ that is elected BUT has no power. No one asked the European people on any of this. No one voted for the Euro. If the people had been asked to vote on it they would have said NO – Big Time.

The wealth of a Nation is its people. Money is not wealth but just a means of transacting stuff. In the very old days, money was sea shells and salt. So Gold Bugs, get over it. The World is never going back to the Gold Standard.

The Big culprits are the Governments who have borrowed and borrowed so much money with no intention of ever paying the money back. This has been going on way way longer before 1982. Or 1971. Try since WW2.

Don’t blame the US Fed, just have a look at the drunken sailors in the US Government who just spend, spend and spend.

There will be a Great Reset but not by the WEF. Crash and Burn is coming and a good thing to as out of it will I hope come a far far better World with Governments truly representing we the People.

I could explain the issues a lot better but on this Blog I am limited to not too many words. That’s Life I guess.

492

The starting point was August 1914. The reserve currency was the British pound. Downhill ever since. . .

180

But it was then linked to gold.

60

Covered at length by Martin Armstrong anyway.

Nonetheless correct – EU first, US States to secede, left/right civil war, socio-economic chaos imminent.

There are variables that Marty doesn’t factor in, but which I track.

I have no plans to be wiped out needlessly…

42

“money is… just a means of transacting stuff.”

Except “transacting stuff” is the grease that makes our civilization possible. It shifts goods and services efficiently and makes our economy run. Without a trusted means of exchange who will give up their products, or turn up to work? A barter economy means every transaction has to be renegotiated, which costs time and mental effort and sometimes, you know, we just don’t need extra goats, or the same hammer. It’s all so inefficient. Can you trust that the plumber who wants your lettuces now will turn up next week to fix the tap? Money solves so many things and allows a pool of a thousand strangers to all offer something different and get what they want even if no single pair of them had exactly the right combination to swap.

So obviously we need some kind of currency. Something that governments can’t “print”.

Gold is not the only answer, but it is still a currency and has always been so. The government would like you to think it is just a commodity, like coal or nickel that gets consumed. But on the LBMA some 700 tons of gold transfers hands every single day. We only dig up 2,500 tons a year in the entire world. That rapid turnover of more than a quarter of total annual global output every day is not a commodity trade.

Gold has been used as a store of wealth for 5,000 years. Whether or not it is a legal standard doesn’t change that.

PS: Government debt is only a sub-part of national debt.

191

“So Gold Bugs, get over it. The World is never going back to the Gold Standard.”

haha! I’ll remind you of that one day… “The world” may not, but the top most successful countries are likely to, once the current clowns have crashed their countries and ‘the West’ is a bunch of Spains.

Russia will decide the fate of the $US as a world reserve currency, and its not looking good. Riots and burnings will force Govts to do better than fiat floods of helicopter money, so fresh that the ink runs.

Lets see who is the first to offer gold & silver coins as daily currency, or the first to demand gold for oil, or gas, or computer chips..

Great article Jo- Along with the mass political avoidance of those problems is also the under-funded pension schemes and the declining birth rates in the West. Its all been visible for decades.

93

I believe you’ve nailed it, Jo. This easy money has indeed empowered organizations like Black Rock and the WEF and insanely wealthy individuals like Bill Gates. Without it, we would have no wokery, no climate change hysteria, no Big Pharma wreaking havoc with our lives.

522

Here Is The Solution For Those Who Are Really Interested –

https://www.armstrongeconomics.com/armstrongeconomics101/economics/the-solution-6/?utm_source=Newsletter&utm_medium=Email&utm_campaign=RSS

62

I’ve been aware of this for 50 years and expected a crash much sooner.

The basic problem is that governments of all types whether left or right found that they could buy votes with taxpayer money supported by borrowing and money printing so there was a deep incentive to print or borrow more than was collected in taxes thereby debauching the currency.

The voters are to blame and generally it was the leftist voters most to blame because they see a big state as beneficial in itself and so anything the state promised they were up for regardless of cost.

Some centrist and right leaning politicians tried to stem the tide but in the end they were all swamped because it was impossible to get voter consent to any significant pull back from the excessive financial irresponsibility of the previous leftist administration.

There is no way that total global debt can ever be repaid and politicians worldwide have tried to paper that over by keeping interest rates artificially low. If they had not done that the most indebted nations would have been unable to service their debts and defaulted long ago.

As it is, the global manipulation of interest rates has stoked yet more irresponsible borrowing and money printing over recent years has helped delay the inevitable even longer.

The combination of the insane attempt to pursue net zero, thereby reducing reliable energy production, and now the Russian destabilisation of food supplies has brought the whole farrago to an end with the long delayed inevitable global financial collapse now imminent.

Cheap labour from China and Asia helped to delay the crash for a decade or so because the production of cheap goods helped to offset the otherwise inflationary gap between supply and demand. That has now ended so inflation can roar ahead which must be followed by rising interest rates which will force many indebted nations into a cascade of defaults.

When that happens the value of investments in stocks, bonds, property and pension funds will collapse. Even cash deposits will suffer the depredations of continuing inflation though rising interest rates may partially offset that.

There is far more to fear from that than any manufactured fear of an imagined climate crisis.

There is going to be a very painful period of adjustment with widespread destruction of capital until the money supply is back in balance with the balance of supply and demand for goods and services.

This is not a failure of capitalism though that is what we will be told.

It is a result of capitalism being corrupted by socialism.

One can have capitalism moderated by sensible laws to prevent abuses but the western world has gone way further than that and effectively stripped out the advantages of capitalism altogether.

We are all going to pay for it.

522

There is always the Germany 1923 option. . .

110

Or Zimbabwe.

70

Sri Lanka has already defaulted.

50

You should check Henry George’s teachings.

All George’s books are still in print

(including his seminal work “Progress and Poverty” published in 1879), which is more than can be said for most other economic theorists, including Keynes.

See https://www.henrygeorgefoundation.org/

Enjoy getting it right (for once) …

80

Henry George had a great mind and its hard to fault him. Utopian socialism is worth fighting for.

36

NO socialism is worth fighting for.

There is ALWAYS some scumbag who will gee-up the slavering thugs to achieve “perfect” socialism. Example: Pol Pot.

Per Irma Bombeck”

“Well may the grass bee greener over the septic tank; but it is ALWAYS greener over the mass graves”.

30

Related to this, Paul Joseph Watson talks about the energy crisis and financial crisis in his latest video.

He also states that the O’Biden administration has printed more paper money in tue last two years as in the last 200 years in the US.

Video is 11.5 mins.

https://youtu.be/0IGMNDBFx7w

The Elite Left are trying to enslave us all.

We want our freedom back.

232

The US does not have much in the way of paper dollars. And, there are more paper US dollars circulating throughout the rest of the World rather than in the USA itself.

The other US dollars have been created electronically. And there are a lot, lot more of them than paper dollars.

110

A fundamental problem is that the Sheeple don’t understand inflation.

In the absence of a gold standard it mostly comes from government printing money, or today, the digital equivalent of doing that.

It benefits no one except 1) the Elites who can borrow large amount of money when the currency is worth more and repay it when it is worth less and 2) people with fixed interest loans.

People who save and invest such as retirees and people in fixed incomes suffer.

The government printing money is like diluting milk. You don’t get any more real substance than you started with but you have to use more to get the same amount of real product.

Inflation is a dishonest economic ideology of the Left and comes from Keynes.

It enables governments to spend more (popular among the weak-minded) without taxing more (unpopular) but it doesn’t come for free because it is a form of taxation as it devalues what you earn and own. (But remember, the policy of the WEF is that “you will own nothing and be happy”.)

Further reading: http://www.quebecoislibre.org/001028-11.htm

Milton Friedman video, 13.5 mins. https://youtu.be/GJ4TTNeSUdQ

261

Is JN blogsters “sheeple” = HC’s “deplorables” ?

56

No. The Sheeple would be the weak-minded and ignorant fools that continually vote for “free stuff” at the expense of their fellow taxpayers and who vote for the likes of Albanese or Dictator Dan in Vicdanistan.

401

Politicians are great leaders.

For decades, they’ve been leading the Sheeple in ever expanding circles and each day getting closer to the cliff edge.

The nation we built in the quarter century after WWII is gone.

251

‘The nation we built in the quarter century after WWII is gone.’

Well and truly… we were too successful and once we didn’t have to struggle to achieve, it all went morally bankrupt.

A large survey done many many decades ago found that the average voter preferred inflation as it meant a regular wage increase each year and they felt they were getting ahead… Prior to the 1800s there were long periods of zero inflation, so generations saw a loaf of bread costing about the same.

Andrew Dickson White wrote an essay on inflation at the start of the 20th century and ended up giving lectures to Senators about what happened in France in the late 1780s when the National Assembly was convinced to write ‘promissory notes’ instead of paying in gold..

It is a short essay of greed and corruption, played out over and over again since then by every generation of politicians. The results are obvious around us-

“Even worse than this was the breaking down of the morals of the country at large, resulting from the sudden building up of ostentatious wealth in a few large cities, and from the gambling, speculative spirit spreading from these to the small towns and rural districts. From this was developed an even more disgraceful result,—the decay of a true sense of national good faith. The patriotism which the fear of the absolute monarchy, the machinations of the court party, the menaces of the army and the threats of all monarchical Europe had been unable to shake was gradually disintegrated by this same speculative, stock-jobbing habit fostered by the superabundant currency. At the outset, in the discussions preliminary to the first issue of paper money, Mirabeau and others who had favored it had insisted that patriotism as well as an enlightened self-interest, would lead the people to keep up the value of paper money. The very opposite of this was now revealed, for there appeared, as another outgrowth of this disease, what has always been seen under similar circumstances. It is a result of previous, and a cause of future evils. This outgrowth was a vast debtor class in the nation, directly interested in the depreciation of the currency in which they were to pay their debts. ”

https://www.gutenberg.org/files/6949/6949-h/6949-h.htm

Sorry Jo, chop it down if its too long-

20

I strongly suggest “the Bitcoin Standard” by Saifedean Ammous. Whatever your opinion on BTC- and it’ll change as you read the book- he sets out the framework for all Jo’s talking about

14

Bitcoin is potentially the solution but the real one, not the one you name IMHO.

BSV (Bitcoin Satoshi Vision) has reinstated the original protocol and it actually works as digital cash. BTC does not. Look at https://coin.dance/. Some of the important data is comparing hash power with transaction volume – it is clear that BSV is far more efficient and able to transact quickly and at very low cost. Price per coin is not an indicator of real value. BSV is heavily shorted on the “exchanges” by hidden forces with very deep pockets. There is plenty of evidence that the forces Jo mentions above do not want BSV to succeed.

Real Bitcoin can do much more than just simple peer to peer txs. That means from me to you with no intermediary. Look up SPV for an explanation of how this works in BSV.

For more info try https://bitcoinassociation.net/

BEWARE – there are other sites pretending to be sources of info on BSV but are not what they seem.

Most importantly BSV can scale to be a world wide currency, and it is fully programable. None of the others can do this. In addition it is an immutable record of time stamped events. Read – data that can’t be changed over time!

51

The value of currency in circulation greatly exceeds the value of known gold (so I have read but can’t find a source right now).

I suppose this just reflects the fact that without a gold standard, there is no direct connection between the two.

A return to the gold standard or collapse of the US dollar or other major currencies would dramatically increase the cost of gold.

91

I have read that the Toz of gold owned on paper exceeds all the known gold. It too is likely a bubble or a Ponzi type scheme.

90

Paper-gold is indeed a bubble and a ponzi scheme — like all paper currencies. The Comex spot price on gold futures (paper gold) is pumped full of loaned “instant” money.

There is a big difference between owning paper certificates for gold and taking possession of actual metal.

121

Ladies, gentlemen, and others, one of the biggest problems in dealing with a fiat currency, is how to value things. Price in paper currencies may be familiar, but they make one think in terms of a yardstick that is changing and shrinking. Price and value do not always coincide. If the price of everything goes up, it’s not the value that is going up, but the fact that the unit of exchange (currency) is going down in value compared to everything else.

When this is occurring, losses can be prevented by exchanging “currency” for thing of value that have some durability. It does not have to be metals, although they are the most commonly thought of, but even semi durables such as flour and sugar (carefully stored). One gains by buying at price X, and using them over time (buying no more than you will use), preventing you from having to buy more along the way at ever increasing “prices”.

But remember this – the same governments that pump out all this money may choose to pull some back in, which can bankrupt people who use too much debt leverage to buy “things”. The “House” is crookeder than a dog’s hind leg. . .

151

Here is a Zimbabwe one hundred trillion dollar bill (link below).

One day soon Australia will have a bill like that with Albanese’s face in it.

And so will the US with O’Biden’s face.

https://s3-eu-west-2.amazonaws.com/newzimlive/wp-content/uploads/2022/02/02034754/trillion.jpg

141

Here is a selection of roughly real time world debt clocks. Note that for federal states like Australia or the US only federal debt is listed, not state debts.

https://usdebtclock.day/world.php

It is frightening how fast debts are rising.

The Australian Debt Clock https://australiandebtclock.com.au/ appears to be down at the moment.

71

For the Elites, the only thing that matters is the relative debt, relative to U.S. Dollars; so Albo can easily afford to send another AUD$400 million to Ukraine for his mate Vlod to spend.

For the U.S. itself, no worries mate, every bit of inflation helps to minimise the problem of paying back foreign debt. If I remember correctly, this is what stirred China up a few years ago.

The political problem of this type of inflation in Australia is easily fixed by blaming the old “boomers” who had it so easy and so bringing all the Gen Somethings into the voting corals. Victimhood is so so useful, just listen to their ABCCCC.

102

ABCCP??

30

P?

10

P for Party as in Australian Broadcasting Chinese Communist Party

31

“The Australian Debt Clock https://australiandebtclock.com.au/ appears to be down at the moment.”

The hands most likely flew off the clock from rotating so fast.

131

Time to Boycott the boycotters!

Blackrock and associated investment behemoths are hell-bent on forcing the holders of your retirement funds into carbon neutrality/ESG compliant companies! Quite contrary to their fiduciary duty and quite likely against your wishes. What looks like blackmail Company Boards are being coerced into investments that may not necessarily provide you with the best return perforce of being voted off the respective Board by the power of Blackrock shares that are in effect your shares. Remember these are your retirement savings that you rightly deserve to earn the very best return to ensure you have a comfortable post-employment existence. Act with all haste! Re-read JN recent item and broadcast the message as wide as possible! https://joannenova.com.au/2022/08/19-us-states-fight-back-against-blackrock-the-political-climate-police-disguised-as-a-monster-investment-fund/

160

” There’s a reason everything seems to be going off the rails simultaneously”

Yes.

Governments are Completely, Absolutely and Utterly

Beyond Our Control.

In short, we here in Australia are no longer partners in a Democracy: we are pawns, slaves, subjects living, barely, on the perimeter of the massive swamp.

270

Exactly – We are being ruled, not governed and have no say in the big picture items that greatly effect our lives. The uniparty is in lock step on those.

110

Cause and Effect guys. We have a respectable voting system. What causes and allows “the uniparty”. Why can Australians mostly only vote for the same policies on both sides regardless? Follow the money.

Who owns the traditional media and social media both of which censor all smaller political parties (bar The Greens). Who has the largest financial / lobbying / political influence? Who can tell national leaders to adopt “climate action” or suffer a 1.5% interest rate hike? (See Josh Frydenberg and Scott Morrison November 2021). That’s why they said Australia adopted “Net Zero”.

Who benefits from the introduction of a trillion dollar carbon trading market?

110

Great post

70

Thanks.

40

It is a strong post, the lower classes going into battle against the elites.

The Yuan may become the Reserve Currency.

40

I see a lot of hockey stick shaped graphs there.

71

I know, it’s like I’m watching an Allan Kohler segment.

20

A couple of things I heard on their abCCCCCC this am, fringe benefits tax helps inflate the cost of EVs, and the amount of money yanked out of super accounts by mostly young people during the wuflu debacle exceeds one billion dollars, setting them up for a skinny retirement.

40

Way back before super was frozen, every time I changed jobs, I took the super with me and it helped buy my first home.

Freezing super is a bit like waiting for your inheritance – not much use if your parents are long-lived and you can’t use it rationally.

70

Ronin gets the gold star today for listening to the ABC. He listens so the rest of us are saved from that misery.

50

It’s sometimes a thankless task. 🙂

20

70

Does anyone remember what the USD value to our pound was just before our change to decimal currency.

I seem to remember 5/- to a dollar.

40

I seem to remember Australia was on a par with the USD.

ie 10 shillings per USD, and then dollar for dollar.

Things changed when some bright politician “floated” our dollar.

And it’s been floating ever since.

30

There were twenty shillings to the pound in the UK. I assume the same here in Oz?

20

Yes Steve.

20 shillings to the pound in Australia as well.

In fact our early coins and notes were British.

30

I remember that I left the UK in 1966 with £300 in my pocket (and little else, except a pregnant wife) and got $600 Australian in return. Not sure how that related to the US$ at that time.

40

Back in the 1930’s depression the Australian Govt. devalued the Aus.$ from parity to 15 shillings to the UK Pound.

I don’t know if it helped repay the debt run up by various States but most of our exports then were to the UK, so a boost to exporters (and possibly) the Federal Govt. Stiill we had a severe depression.

My mother, when very young, was sent to rescue an auntie from the slums of City Road (in Sydney) and send her to the country.

30

I was told that in France, when they changed to Euro notes and coins at the start of 2002, you could buy a normal mass produced beer for about 6.5 francs, or 1 Euro.

Now the same beer is barely south of 6.5 Euros – in some parts of Paris, anyway.

30

So 650% inflation over 20 years.

20

The increase is 5.5Euro.

So the % increase is 5.5 / 1 times 100

= 550%

21

For a long time now, I have been saying that in any emergency the government’s reaction is always to punish the prudent and reward the reckless. I’m delighted to see Jo Nova put it all together so neatly. Thanks, Jo, for your tireless work for sanity.

220

Thank you Jo for a great article.

Two graphs in the link to See all the graphs at WTF happened in 1971

stood out to me.

The first was the huge rise in production with little rise in pay.

The other was the last graph which shows the huge rise in medical administration

compared to the people practicing.

We are WAY over-governed.

No wonder everything is getting expensive.

There is another good one which is the HUGE rise in top executive salaries.

170

1971? generally speaking the wave of Boomers passed into adulthood

20

US Gold standard disappeared.

60

Nothing to do with boomers.

Nixon abolished the final vestiges of the gold standard and others followed.

The USD was previously based on a fixed price of gold of USD$35 per ounce.

After that most currencies became free floating and there was no disincentive for governments to print money and cause inflation as a hidden form of taxation.

110

Many “boomers” started work after the intermediate certificate at the age of 14 or 15. Most of the rest were hard at work by the age of 17 or 18 and a very few went to university.

This suggests that the first big boomer push into the workforce would have been between 1965 and 1970; and definitely no “gap years”.

10

Report reveals the staggering scale of Australia’s net-zero path

Australia’s north would be transformed by five or six “Tasmania-sized” solar arrays and huge hydrogen hubs, and draw several million additional people as an army of workers arrives to build and service a vast net-zero economy.

Those are among the key findings of a landmark forward-looking, multi-year modelling project led by experts at the universities of Melbourne, Queensland and Princeton in the US, which for the first time details the staggering scale of the nation’s decarbonisation pathway.

Delivering on that vision of a near-zero carbon economy that exports energy to the world will also require wind and solar energy capacity equivalent to 40 times that of today’s national electricity market.

102

The worst aspect of alarmism, whether its climate or covid (or whatever) is this idea that it must be solved by highly visible, instant solutions. Mostly requiring government support etc. Whereas the less visible, minor improvements are overlooked which almost always cost less anyway. With Labor in power, expect more of these big, flashy pie in the sky solutions. I have always admired the Japanese philosophy of constant improvement- to me, it just makes more sense. Trouble is, it doesn’t get you voted into government.

110

Just imagine what will remain of the Congo and other countries once China has finished pillaging metals and walks away, leaving an environmental, and humanitarian disaster behind.

For the green zealots it seems this is all fine and dandy as long as Australia is “net zero”.

Looking at what seems to be a complete lack of criticism of the Albanese regime by the media, I now assume “net zero” really refers to the sum of Australian IQ points.

60

There was a cycle in politics and economics. Labor/Democrats represented the workers and that included blue collar workers and all public servants and the Conservatives/Republicans represented the employers and bankers and military.

And when Labor gained power they spent with wild abandon, like Whitlam and now Biden. When the conservatives regained control, they balanced the budget and saved, as Trump built up the strategic reserve for petroleum. And the piggy bank was ready for Biden and friends.

But automation has changed the workers. Docks are automated, farming is automated, clerical work is automated and the vast numbers of people who voted Labor has dropped. And the former conservatives have gone more Green than Labor. Most importantly, the last allegedly Conservative government in Australia did not even bother balancing the budget. Just like the Democrats in the US today.

The game is just printing money. Deficit? Imaginary. And the result? Runaway inflation which they counter by printing more money and selling the strategic reserve. And the blue collar workers are changing sides, what is left of them. Even Australia’s farmers are voting for their own demise with carbon taxes and Global Warming.

Now Biden has spent $500Billion on an “Anti Inflation” Bill. That’s money he doesn’t have and is typical of the thinking. They can print their way out of this hole. It’s completely nuts.

Democrats/Labor they rely on the Conservatives taking charge once again, forcing restraint and budgeting and cutting back on the madness and getting the house in order and losing voters in the process. So the cycle continues.

But Morrison and Frydenburg were very different. Wild spending. And Albanese has nothing left in the tank. However the next Republican government will build the border, open the coal mines, open the oil pipelines and stop the handouts.

The printing of money has to stop.

190

And as part of his inflation fighting, Joe Biden has just announced.

“a federal bailout of student loans at a cost of $10,000 per borrower, amounting to at least $300 billion in the first year — vindicating warnings that President Barack Obama and Democrats ignored in 2009 and 2010.”

Buying millions of votes before the Mid Terms. Even cheaper than war with China, which is Pelosi’s idea.

Ho Hum. All that student debt? Just forget it. Won’t cost us a cent. But we may have to print another $300Billion to fill the hole in the budget so that public servants get paid.

120

Biden Pours Student Debt Gasoline on Inflation Fire

’cancels out any deficit reduction from the phony Inflation Reduction Act’

It’s hard to imagine a worse time for the U.S. government to decide to launch a massive student loan forgiveness program than right now.

The plan announced by President Joe Biden on Wednesday is actually bigger than the $300 billion program many had been expected. It not only forgives up to $10,000 of student loans for anyone earning under $125,000. It also forgives another $10,000 for recipients of Pell Grants, a student aid program for low-income families. The current time-out on student loans, which was due to expire at the end of the month, gets extended to the end of the year.

The White House also indicated that it would be putting forth a regulation that would slash the share of discretionary income that borrowers in income-driven repayment plans must pay each month on undergraduate loans from 10 percent to 5 percent. This amount had already been reduced from 15 percent just eight years ago. The rule would also forgive loan balances in these income-driven plans after 10 years of payments, down from 20 under the current rules. Back before the Obama-era overhaul of student loans, it took 25 years to earn debt forgiveness.

Of course, it is not really “debt forgiveness.” It is a debt transfer. The loan payments that will no longer be made by debtors will effectively be picked up by taxpayers.

One question is how the Federal Reserve will react. Very likely, it will need to offset the inflationary pressure created by Biden’s scheme with higher interest rates. This very likely means that unemployment will wind up even higher than it otherwise would have and the looming recession will cut deeper and last longer. Part of the cost of relieving ex-college students of their debt will be throwing people out of work and damaging businesses across America.

60

Majority of White House Staffers Eligible for Biden’s Student-Loan ‘Forgiveness’

A White House report that detailed the pay of more than 470 staffers last month showed that roughly half of current White House employees make $90,000 or less per year, with the other half making more than $100,000. More than 300 staffers on the list earn less than the $125,000 threshold.

It is not clear how many White House staffers have student-loan balances. One-in-five White House aides required to file a 2021 financial disclosure reported having student loans, according to disclosures reviewed by Bloomberg News. However, only senior or well-paid staffers have to file the disclosures, the report notes.

At least 30 senior White House staffers have student-loan balances, according to the report

40

Democrat Voter view of Inflation

41

Biden Cancels Student Loan Debt for Federal Borrowers, Extends Pause for Loan Payments Through End of Year

The student debt crisis is real. Millions of Americans were sold a fake and worthless “degree.” Now they’re strapped with insurmountable debt.

But American tax payers shouldn’t be forced to bail them out.

The universities who defrauded them should be. Seize the endowments!

That’s exactly right! Harvard, University of Texas/Texas A&M, Yale, Stanford, Princeton… Each of them is a hedge fund with a schools attached to it. Seize the endowments!

They are abusing their non-profit status!

60

The Half-Trillion-Dollar Student-Loan Executive Coup

Biden’s student-loan write-off is an abuse of power that favors college grads at the expense of plumbers and FedEx drivers.

By The WSJ Editorial Board

Well, he did it. Waving his baronial wand, President Biden on Wednesday canceled student debt for some 40 million borrowers on no authority but his own. This is easily the worst domestic decision of his Presidency and makes chumps of Congress and every American who repaid loans or didn’t go to college.

80

Wonder if there will a canceling of electric bill debt?

Nah.

Jouvenalian Theory of Political Order

https://sydneytrads.com/2020/02/20/pierce-mcnamara/

10

Albanese has inherited labors debt from Rudd, Gillard, Rudd, with interest.

70

They have always relied on a (fiscally) conservative government refill the piggy bank. No such luck this time. Frydenberg and Morrison have already sold the farm. Which makes it very hard to reward your friends or be magnanimous. And Turnbull was a disaster. Cash everywhere. Where is that $444Million he gave without request to his wife’s friends to ‘save’ the Great Barrier Reef? Vanished without a trace? Does no one care?

100

Seven and a quarter tonnes of gold, buried in a treasure chest somewhere on the edge of an island in the great big barrier reef.

Pirates are still around but it’s hard to recognise them now when they discard the eye patch and put on a suit.

How much was the great train robbery in Britain and how long was he in gaol?

20

“The printing of money has to stop.”

It won’t stop, it can’t stop, who do we owe the money to, do they owe us money, or is it borrowed from our future, leaving a debt bomb for our kids and grandkids.

60

I confess…..1971 was my last year of university….. and being single!

10

Tens, hundreds, thousands, millions, billions, trillions. What comes after trillions?

30

I know you know the answer

quadrillion

/kwɒˈdrɪljən/

cardinal number: quadrillion; noun: quadrillion; plural noun: quadrillions

a thousand raised to the power of five (10^15).

60

A reset to zero! 😆

80

Number | number of zeroes | number of groups of zeroes

Million 6 2 (1,000,000)

Billion 9 3 (1,000,000,000)

Trillion 12 4 (1,000,000,000,000)

Quadrillion 15 5

Quintillion 18 6

Sextillion 21 7

Septillion 24 8

Octillion 27 9

Nonillion 30 10

Decillion 33 11

Undecillion 36 12

Duodecillion 39 13

Tredecillion 42 14

Quatttuor-decillion 45 15

Quindecillion 48 16

Sexdecillion 51 17

Septen-decillion 54 18

Octodecillion 57 19

Novemdecillion 60 20

Vigintillion 63 21

Centillion 303 101

30

Mandarin.

20

Quadrillions, gazillions.?

20

I think I like “gazillions” better – it portrays better the craziness of the whole thing.

50

George W. Bush was sitting in the Oval Office when…

…his secretary walks in with a phone in his hand.

He says, “Three Brazilian soldiers were killed today in Iraq.”

Upon hearing this The President says, “Oh my God!” and he buries his head in his hands.

The entire Cabinet was stunned. Usually George Bush showed no reaction whatsoever to these types of reports.

Just then, Bush looked up and said, “How many is a Brazilian??”

70

I thought comedy was violence these days? Or is it racist? Sexist? Just plain offensive?

Whatever, you should stop offending people because .. wait … oh, you’re mocking a conservative!

Sorry, my bad. Carry on.

(sarc)

31

“Tsunami Of Shutoffs”: 1 In 6 US Homes Are Behind On Power Bills

50

Rent Problems Escalate For Small Business Owners – 40% Can’t Pay

50

More Billions To Ukraine As America Falls Apart

Watching Biden bragging about sending billions of dollars to corrupt leaders overseas with American cities looking like bombed-out Iraq or Libya is US foreign policy in a nutshell.

The Washington elites tell the rest of America that they must “promote democracy” in some far-off land. Anyone who objects is considered in league with the appointed enemy of the day. Once it was Saddam, then Assad and Gaddafi. Now it’s Putin. The game is the same, only the names are changed.

What is seldom asked, is what is in this deal for those Americans who suffer to pay for our interventionist foreign policy. Do they really think a working American in Ohio or Pennsylvania is better off or safer because we are supposedly protecting Ukraine’s borders? I think most Americans would wonder why they aren’t bothering to protect our own borders.

90

The rest of us watch as the dollar buys less and less.

As Washington salivates over fighting Russia in Ukraine, the rest of America feels like we’re becoming Zimbabwe.

How long until it takes a trillion dollars for a loaf of bread? Will there be a run on wheelbarrows?

40

EFTPOS systems can (and do) add zeroes to the left of the decimal point effortlessly.

🙂

00

Horrific Biden Consequence, 20 Million American Households Behind on Electricity Bills, Pending Shutoff

August 24, 2022 – Sundance

Long-term CTH readers might remember in 2014 when President Obama claimed U.S. families had been paying too little for electricity for too long. As soon as Joe Biden took office, he began implementing the Green New Deal energy policy that, (a) directly forces higher costs for energy; and (b) is now creating massive problems.

In July I noted my own electricity bill had jumped 28% in a single month. That bill was followed by another almost identical increase this month. A review of the Consumer Price Index (CPI) for July [Data Here] shows that nationally the same thing is happening. The year-over-year electricity price has increased 15.2%. However, worse still, the July increase alone was 1.9%, which figures to an annualized rate of 22.8%.

Steve Cortes calls this the backside of the Biden created inflation hurricane. The backside of a hurricane is the worst because it hits from the opposite direction upon already weakened infrastructure.

50

And as if on cue, oil jumps back to $100 a barrel. Can’t have cheap energy, can we. The initial oil price “shock”, blamed on nasty OPEC and greedy Ay-rabs, was actually planned in a secret Bilderberg meeting in Stockholm in 1973 by various billionaire oil oligarchs like the Rockefellers and insiders such as Kissinger.

Got to keep oil “scarce”. Can’t have too much of it. No profit in that. Alaskan and North Sea oil was unviable at lower prices, so the price had to be jacked up. The Saudis got very rich and recycled all their cash flow into New York banks.

The biggest of which, Chase Manhattan, was run by David Rockefeller.

Now it’s called JP Morgan. They dropped the Chase.

New boss, same as the old boss.

50

Biden’s Student Loan ‘Forgiveness’ Is An Unjust, Cynical Abuse Of Power

BY: DAVID HARSANYI – AUGUST 24, 2022

not to mention a moral hazard, counterproductive, and fundamentally immoral.

“No Money shall be drawn from the Treasury, but in Consequence of Appropriations made by Law.” That’s what it says right there in the Constitution. And yet, without any legislation, Joe Biden now promises to “cancel” up to $10,000 in student loans per borrower ($20,000 for Pell Grant borrowers), limited to those with annual incomes of less than $125,000.

Let’s start by pointing out that President Joe Biden isn’t “canceling” or “forgiving” any student loans. Those are preposterous euphemisms favored by Democrats and the media. The debt in question already exists, it has been lent and spent, and those who borrowed the money of their own volition have already received services. This debt isn’t cancelable.

The president hasn’t “forgiven” loans, he’s unilaterally broken existing contracts and transferred the responsibility of payment to taxpayers—many of whom have either repaid their own student loans or never borrowed any money to begin with. Now, if you’re opposed to repaying some stranger’s loan, that’s too bad. A new batch of IRS agents will be there to ensure that you do.

It should also be stressed that capping loan “forgiveness” to those making under $125,000 means absolutely nothing because most borrowers are at the beginning of their careers and have yet to enjoy the durable benefits of a college degree. The average worker with a bachelor’s degree ends up making, on average, $1 million more in their careers (those with graduate degrees $2-3 million more) than a worker with a high school diploma. And yet, the Biden administration is going to compel truck drivers and clerks without college degrees to pay the loans of white-collar workers on their way to six-figure salaries.

70

MORE ON STUDENT DEBT, AND OUR DECREPIT PRESIDENT

Scott wrote about the Biden administration’s massive cancellation of student debt here and here. On its face, the administrative action appears to be illegal. In January 2021, a memorandum by the Principal Deputy General Counsel of the Department of Education concluded that the “HEROES Act” did not confer authority for such a mass loan forgiveness. That memorandum was repudiated and revoked yesterday by the Department of Education’s General Counsel. Nancy Pelosi is on record, saying that the Biden administration cannot lawfully forgive student debt. Today she changed her mind.

The theory underlying the administration’s mass cancellation is that it is “directed at addressing the financial harms of the COVID-19 pandemic.” How the obligation to repay debt on the part of millions of borrowers, or any incremental difficulty in repaying debt on the part of some of those millions, can be chalked up en masse as a “financial harm of the COVID-19 pandemic,” is beyond me.

20

Committee For a Responsible Federal Budget

Debt Cancellation Plan Is Costly, Inflationary, and Cynical

Today President Biden announced his plan to cancel $10,000 per borrower of student debt by executive action for households who make less than $250,000 in income (and individuals who made less than $125,000) plus up to $20,000 for Pell Grant recipients while extending the current repayment pause until December 31st. The plan also creates a new Income-Driven Repayment plan that cuts in half the required payments for undergraduate student loans and significantly reduces payments for all borrowers by making changes to the formula that determines the amount owed per month. The new repayment plan will also forgive smaller debt levels after ten years of payments.

The changes proposed today will likely cost an astronomical $400-$600 billion. Prior to the announcement, the last two Administrations and Congresses had already spent roughly $300 billion to pause repayments for 29 months and enact a variety of other changes to the student loan system. Including today’s announcement, policymakers will have spent between $700-900 billion on student debt cancellation and relief since the start of the pandemic.

The following is a statement from Maya MacGuineas, president of the Committee for a Responsible Federal Budget:

10

Biden cancelled the debts to hopefully encourage those people to vote for the Democrats in the November Mid Terms.

Next, he will grant citizenship to all those illegal migrants that have crossed the joke of a border with Mexico. Hoping that they will vote Democrat in the Mid Terms.

All is fair in Love and War………………lol

20

Is there a compelling reason why these ‘students’ can’t repay their own debt.

40

YES. They are broke and woke.

And most probably unemployed with useless degrees in things like Social Sciences, Tea Leaf Astrology, How to do Basket Weaving, How to cook an egg, How to……….The list is endless.

70

“And yet, the Biden administration is going to compel truck drivers and clerks without college degrees to pay the loans of white-collar workers on their way to six-figure salaries.”

Yeah, that sounds fair…. civil war.. here we come.

110

It won’t be a Civil War. It will be the smart clever wealthier States joining up against the woke broke States. The Disunited States of America is just around the corner.

40

You sure are offering a lot to this blog Johnny.

00

LOL. OldOzzie and David Maddison do more. You still need to go to Specsavers……………….

30

A disunited states system might be the way forward, hopefully it will be a gradual process to avoid collateral damage.

The US Civil War was probably unavoidable, two different forms of capitalism on a collision course.

10

F. William Engdahl basically lays out the facts in his 2012 book ” Myths, Lies and Oil Wars “.

The entire environmental movement, Club of Rome, WWF, and the like were set up by Rockefeller oil interests to create the illusion of energy scarcity and keep the price of oil high and controlled by the oil oligopoly. Who controls oil controls the world. Petrodollars also underpin the entire western banking system.

Earlier research by German and Russian scientists indicating abiotic origins of oil and huge untapped reserves of it was carefully buried.

Here we are. The climate lobby grows shriller by the day.

If coal power generators are shut down, only natural gas and diesel will provide adequate baseload to backup useless renewables. Big Oil cashes in more.

As for science-fictionlike ” free energy “, that would render trillions in oil and LNG infrastructure obsolete, so of course no one is allowed to research it.

A fine pickle we are in.

21

Interesting speculation. Would take a long dissertation to back up those claims.

20

Trump Is Right. Mitch McConnell And Elaine Chao Spent Decades Getting ‘Rich On China’

For years, the McConnell and Chao families have cultivated a relationship that enriches the couple and grants status to the Chaos’ shipping company.

For decades, Senate Minority Leader Mitch McConnell and his wife Elaine Chao have maintained a glaring conflict of interest, conducting extensive government business despite the Chao family’s deep ties to China through a maritime shipping company. Now, former President Donald Trump is calling attention to the top Republican’s problematic China ties, while most of Washington remains silent.

“Why do Republicans Senators allow a broken down hack politician, Mitch McConnell, to openly disparage hard working Republican candidates for the United States Senate?” Trump asked in a Truth Social post on Sunday. “This is such an affront to honor and to leadership. He should spend more time (and money!) helping them get elected, and less time helping his crazy wife and family get rich on China!”

It didn’t take long for the corporate media to mock Trump’s assertion, framing his legitimate criticism of McConnell and Chao as unfair and unjust. Some outlets such as Vanity Fair even hinted that Trump’s comments were revenge against Chao for resigning from the Trump administration following the 2021 Capitol riot and subsequently cooperating with the illegitimate Jan. 6 Committee.

Trump’s criticism of McConnell and Chao, however, is not something to be taken lightly. For years, the McConnell and Chao families have maintained a symbiotic relationship that grants opportunities to the Chaos’ shipping company, Foremost Group, which largely operates in and on behalf of communist China.

This reciprocity is well documented, but unlike with Hunter Biden, there is less scrutiny from observers, including those on the right, for this “corruption by proxy,” as author and Government Accountability Institute President Peter Schweizer calls it.

– Blood Runs Thicker than Water

– How to ‘Get Rich on China’ 101

– Status and Power

– Consequences?

Given this track record, the likelihood that McConnell will support policies that curb his family’s fortunes is questionable at best. That’s why Trump’s criticism of the McConnells’ close personal and professional relationship with China is long overdue. At a time when Republicans are questioning McConnell’s ability to advance the new GOP’s agenda, raising these connections is nothing short of necessary.

51

As I said in January last year, the corruption and conflict of interest is so obvious, in-your-face and chilling with McConnell.

Mitch McConnell’s rich connection with China

100

from Jo:

Graph

I’d offer that the graph suggests it was the police state that followed the money.

50

Could be Bozo, though I believe the police in CA are not even picking up most criminals now.

30

This has been obvious since 9/11, when they went “all in” and abolished interest costs for the rich. Good summary that neglects that aspect. I call it the Great Theft!

10

I suspect the ‘arms to Ukraine’ is a cover for shipping to Myanmar via Bangladesh. Remember the plane that crashed taking off from ?Albania? full of goodies?

31

If you got this far and missed my comment at #10 above… can I respectfully suggest it might be worth reading?

10

When the banks go bust it will not be the depositors that are first in line to be paid off as creditors but the speculators:

https://watchingromeburn.uk/news/when-your-bank-fails-dont-walkrun/

30

The Future for Australia under Labor.Greens as shown by Canada

Canadian ‘climate ministry’ will have arms storage and detention rooms – media

The facility for Trudeau’s new climate cops includes a massive firearms storage space and interrogation rooms

A Ministry of Environment and Climate Change Canada (ECCC) facility under construction in Winnipeg includes a sizable firearms storage room, as well as multiple evidence rooms and interrogation rooms, according to CounterSignal. The outlet, which claims to have received a leaked copy of the architectural plans as drawn up by a Winnipeg firm, published a snapshot showing some of the more disturbing labels on Tuesday.

The sprawling 50,000 square-foot building also encases biological labs, media relations offices, a weather forecasting station, and – perhaps most disturbing, given the implications – facilities for housing hundreds of people, including “enforcement officers” working for the ECCC.

The “enforcement officers” are essentially climate police, endowed with equivalent authority by the 2019 Impact Assessment Act, which purports to be legislation aiming to reduce the impact of energy, farming and other large projects on indigenous communities and the environment. They may enter any property without a warrant in order to verify compliance with the IAA, taking photos, accessing computers, phones and other devices, giving orders to anyone operating machinery, or even demanding the premises be vacated and future access prohibited.

According to a job posting on Indeed.com, Canada is currently hiring these “enforcement officers” to enforce pollution regulations. They are given a secret security clearance and restricted weapons, which they carry – along with handcuffs – into whatever environmental conditions Ottawa calls for them to inspect.

ECCC agents were spotted earlier this week on private farmland in Saskatchewan, where they claimed to be taking water samples in order to measure nitrate levels. Premier Scott Moe demanded to know what the agency planned to use the samples for and why it was being done without the permission and knowledge of the farmers.

Many farmers fear the PM could follow in the footsteps of his counterpart in the Netherlands, whose planned restrictions on fertilizer usage threaten to put the majority of Dutch farmers off their land. In 2020, Trudeau announced plans to reduce fertilizer emissions by 30% over the next 10 years, which will not only reduce crop yields and make it impossible to continue growing food, but, fertilizer industry advocates say, won’t even lower carbon emissions.

20

Phew! a lot to digest in here: but someone, lease, pray tell me: How do you discuss that with your neighbours and colleagues, in the name of (re)-education when all their response is ‘head down and keep on going when you can’t change it anyway’ . It’s this mentality which feeds the greed of others.

Pity I missed the event of ’71. Hmm so Nixon wasn’t so bad after all ? or WORSE than we thought… something like ‘oor Gordie Broon’ what he did with oor gold, as Chancellor.

30

‘head down and keep on going when you can’t change it anyway’

Exactly!! That’s why no-one talks to any of Jo’s readers these days, they just don’t want to know! If they can’t change it directly, its not worth their time considering it.

..and somehow its all completely disconnected to their voting decisions. All ‘this stuff’ is buried around election times and they argue about which identical clown has more appeal or looks more honest..

30

There are now 23 countries not taking USD debt in exchange for goods.

US owes the rest of the world one year of its entire output and is growing at an accelerating pace.

US is the only country that can export its inflation. It can only happen as long as other countries continue to accept US debt and that is a reducing number.

The sanctions against Russia are having unintended consequences. My forecast that the US would lose its status as world banker in Biden’s term is looking realistic.

I was thinking the new BRIC Bank would become a power in international banking but its woke world is worse than most other banks.

60

The China Development Bank is a better source for BRICS members, the new High Speed Rail in Java got CDB support. If the first phase is successful then they will extend the line to Surabaya.

30

How many Countries have loans from China to build coal-fired generation plants?

And how many Countries have loans from China to build wind farms?

40

The inflation in Australia was created right here in Australia … our RBA printed more AUD during 2020 & 2021 than had existed prior to 2019.

https://tradingeconomics.com/australia/central-bank-balance-sheet

There’s a graph for you … it’s TRIPLE what it was back in 2019. If anything, Australia’s commodity and agriculture economy gave us some protection from inflation but that won’t last forever.

Sure the USA has some problems, but we can’t blame them for what we have done to ourselves.

50

“Debt” is the biggest illusion (trap) of all. Government debt was borrowed how? From some entity that had actual reserves from which it could loan out some portion? You must pay back, with interest, a fictitious loan? Is that not the definition of criminal fraud? It is all a trick to ensure the indebted servitude of all people (victims) who are not part of the criminal organizations that perpetuate the crime.

20

Ok, after reading everything above.

It seems paper money allows governments to spend like crazy and hopefully reduce their debts via high inflation.

So it is a ponzi scheme?

At some stage the paper money becomes virtually worthless.

Brilliant outcome.

Ok. My history, before I became a first responder..

I was a Mining Engineer working at the Metroplitan colliery, Helensburgh NSW. Australian Iron and Steel, A BHP subsidiary.

I know coal.

My point is that when that paper money becomes worthless does burning 1 kg of it have the same calorific value as 1 kg of high quality black coal…..

The short answer.. No it doesn’t. Not close.

So what is the use of this worthless paper?

Forget gold. Forget paper money.

Invest and acquire coal. It will be priceless.

You can warm your home whilst dreaming of your $1000 loaf of bread.

Despite billions of investment in renewables, A decade and a half,

At this moment 11:22pm AEST 25/8/2022, On the eastern states, 72% of our electricity supply is via coal.

The madness continues

90

🙂 🙂

20

As Dominic Frisby has suggested (in his book, Life after the State) the solution is the separation of Money and State, in much the same way that we have separated Church and State. As long as money has existed, governments have been debasing the currency for their own ends. The solution is a medium of exchange that governments can’t screw around with. Gold and other precious metals can fulfill this role nicely.

30

When physical currency was made of precious metals “coin clipping” waa highly illegal and punishable by death, but when government does essentially the same thing by printing money or the digital equivalent, few people complain.

As a tamper proof indicator that a coin was clipped or not clipped, that’s why, even today, coins have a pattern around the rim even though coins are worthless.

60

TRIVIA:

In 1982 the copper value of the US penny coin became worth more than the face value of the coin so the composition was changed to include zinc in the core.

According to the calculator at http://coinapps.com/copper/penny/calculator/ the current melt value off a pre-1982 pennylt is US$0.024 but it is illegal to melt them.

40

It is quite obvious that the O’Biden administration is trying to deliberately destroy the US economy.

Nobody could be so incompetent as to do it by accident.

40

There’s never been any doubt about that; from day one, the closure of the pipeline from Canada.

Appalling.

30