Image by ThankYouFantasyPictures from Pixabay

By Jo Nova

Kathryn Porter in The Telegraph, has compiled quite the list of failures as offshore wind projects get frozen around the world. Decisions are being delayed, contracts abandoned, auctions left without bidders and almost no new projects started. The awful truth of inflation, the maintenance cost shocks and cable failures is all too much. Then there was the problem of needing a 100 years of copper, nickel and lithium production before Christmas.

It’s all been kept quiet. Who knew there were no offshore wind investments in the EU last year, apart from a few floating projects?

After years of subsidies, wind power was meant to get cheap enough to be profitable and competitive all by itself, instead, 25 years later, it just needs bigger subsidies. When the great oil and coal price crunch came, wind power was supposed to rise through the ashes, instead we discovered that wind turbine and battery factories needed cheap coal and oil like the rest of the economy.

Right now Australia has no offshore wind turbines and is about to jump onto a burning ship:

The myth of affordable green energy is over

Kathryn Porter in The Telegraph,

Progress is stalled around the world as nobody wants to admit the real costs

Turbine manufacturers have been losing money hand over fist in recent years. Collectively over the past five years the top four turbine producers outside China have lost almost US$ 7 billion – and over US$ 5 billion in 2022 alone.

But the losses have also been driven by pricing structures designed to win market share, and aggressive windfarm developers who have refused to pay up, often while pocketing billions in subsidies. The market has started to look, if not like a Ponzi scheme, then like a house of cards built on the shakiest of foundations.

Offshore wind projects have been drying up around the world. During the whole of 2022 there were no offshore wind investments in the EU other than a handful of small floating schemes. Several projects had been expected to reach financial close last year, but final investment decisions were delayed due to inflation, market interventions, and uncertainty about future revenues. Overall, the EU saw only 9 gigawatts worth of new turbine orders in 2022, a 47 percent drop on 2021.

Over in the United States, despite the massive support offered by the Inflation Reduction Act, windfarm projects are also struggling. Orsted, the global leader in offshore wind, has indicated it may write off more than US$2 billion in costs tied to three US-based projects – Ocean Wind 2 off New Jersey, Revolution Wind off Connecticut and Rhode Island, and Sunrise Wind off New York – that have not yet begun construction, saying it may withdraw from all three if it can’t find a way to make them economically viable.

Meanwhile, projects off New York are asking for an average 48 percent increase in guaranteed prices that could add US$ 880 billion per year to electricity prices in the state.

Investors are starting to run

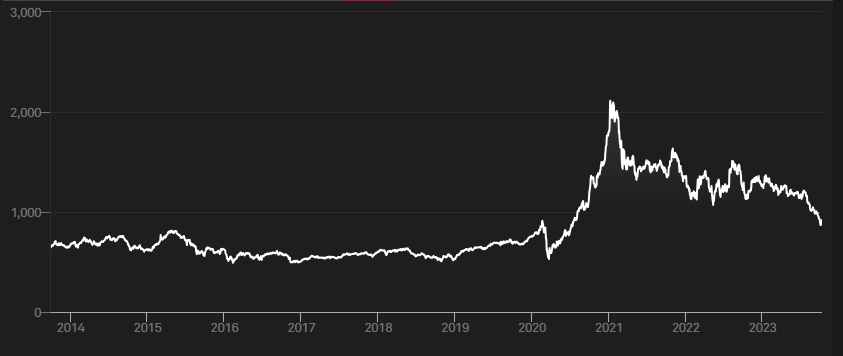

The S&P Global Clean Energy Index is down by 30% this year and most of that is in the last three months:

The S&P Global Clean Energy Index, comprised of major solar and wind power companies and other renewables-related businesses, has lost 30 per cent in 2023, with nearly all of the decline since July.

By contrast, the oil and gas-heavy S&P 500 Energy Index is up slightly this year.

In the last three years the real S&P energy sector is up 287% (white line below), but the clean energy sector (the green line) is down 32%.

Energy Sector Index growth (white) compared to the Global Clean Energy Sector (green) in the last three years.

“The energy sector has been the best-performing market segment so far this month, with oil prices surging 30% over the past three months.” — Globe and Mail

Yahoo Finance graphs the extraordinary growth of the S&P 500 Energy Index since 1994.

Thanks to NetZeroWatch

It can’t happen fast enough in my opinion.

Look out for your super funds, how much will people lose due to the investments by those superannuation fund managers investing in green ruinable schemes just for a boost in esg ticks

530

super fund just sent a email saying they are going Paris complaint

ASB took steps to help manage this risk by moving our global equities asset class*, or international shares, to track a ‘Paris Aligned Index’, specifically the MSCI World ex Australia Climate Paris Aligned Index.

30

Once upon a time i would have thought that was a huge sum…..

…..then i read that donations alone to the BLM movement topped $83billion !

..So i conclude that there is plenty of corporate (let alone tax payer), cash floating about to prop up any and all dud enterprises that are required to reach the agreed goal. !

20

That sounds an awful lot for BLM to lose. The boss took a few million to buy her houses and no doubt there were others with their woke fingers in the pie ripping off the good and gullible but 83 billion is a very big number.

00

They didnt lose it……it has just been redirected to other similar anti establishment causes.

10

In the early 1900s, before commercial power lines were strung along our rural road, my grandparents erected a 60 foot windmill which generated electricity for lights in the house and barn– This was a great improvement over kerosene lamps which needed to be cleaned and serviced daily. Also, with its well and an overhead tank, the windmill provided running water for the house and the livestock.

This was excellent wind-power technology, and is still available. But tech based on wind and batteries simply cannot equal the energy stored in petroleum. We expect too much. The “failure” lies therein.

600

And Gas and Uranium. Hydrogen too but that is a difficult one to handle right now.

200

Please share any tips for good stocks to buy. The laws of physics will win out in the end. Invest accordingly.

190

The best stocks are those that you can put all the “Ruinables” loonies (‘Pollies’, alleged Climate Scientists, Subsidy seekers/Grifters, etc.) into and then throw stuff at them until they come to their senses.

280

From the CBC

Canada could lead the world in oil production growth in 2024

70

Last week, someone posted an article from 2013 that reported shale oil reserves, greater than all the middle east and Russia reserves, had been identified in central Australia .

233 Bn barrelsi recall was the estimate.

Strange that no one wants to develop those reserves ?

50

Yes, it’s in the Cooper Basin in northern SA. Leaving this resource unutilised borders on treason.

100

The laws of physics may apply to the wind and solar industries, but the stock market is driven by the laws of the stock market:

1. Buy straw hats in winter.

IOW, the best time to invest in alternatives was when money was pouring into renewables.

There may still be money to be made, but the equations aren’t so clear-cut now.

100

The stock market has always been a ‘bubble’ – in more than one sense – with only an indirect relation to any real world. Like an old-time casino, it’s all cigar smoke and mirrored walls, full of people who hope to make a profit at the expense of others’ loss.

A counterintuitive rule of thumb for this zero-sum game: Buy when everyone is selling, sell when everyone is buying.

90

‘Buy in gloom, sell in boom.’

Gary S, proud English, Scottish and Scandinavian man from Corieltauvi country. (former Anglo – Saxon kingdom of Lindsey, afterwards, Danelaw).

100

An anti ESG theme has worked well this year. Uranium has gone gangbusters and probably has more upside, thermal coal has been great and gas a winner and the best part of all this is that the Greens/Socialists hate them all.

What is not to like?

90

I bought some of these and so far I have done OK but it’s risky and volatile. Recently they had a few good years with no guarantee that will continue.

https://www.google.com/finance/quote/WHC:ASX

Not a stock tip … worth what you paid for it, but at least something to keep an eye on, as it zooms up and down. Exciting news stories too as the activist minority shareholders are doing their tricks … nothing is safe!

10

Slow learners these unreliables backers. But..this lunacy cannot fail fast enough in my opinion.

240

Not ‘Unreliable Backers’, but ‘Subsidy Harvesters’. I’m sure they are aware that the system is unfit for purpose, but will continue as long as other people’s money flow in.

430

They’re all now looking for a bigger fool to sell to.

I was talking to a few well connected Wall St traders a few weeks’ ago. They each said Wall St is cooling on renewables. The smart money is trying to get out, without getting a significant haircut.

It will start to accelerate slowly from here.

Find a short.

00

These people were never “investors”, they were/are Skimmers who bled our savings for profit.

They did not acknowledge physical reality, all they wanted was the easy takings.

Remember those 14,000 derelict, abandoned wind turbines in the U.S., why was no lesson taken from that disgusting episode?

Kalm Keith

October 11, 2023 at 6:09 am · Reply

The three truths have been pushed aside by the adoption of the New Religion that has penetrated The West.

The Engineering Truth.

The Financial Truth.

The Environmental Truth.

These “Truths” have been discussed and the wrongs exposed ad nauseam but cannot surface into public perception from the Schwamp of the modern government-public service? insestuism.

The only solution to our current religious dilemma is to Drain The Schwamp, and do it quickly.

There’s not much time left.

440

But, but, but….

WE all knew this yonks ago.

210

It’s critical that Aussies don’t follow the EU donkeys and we must abandon the corruption and fraud of offshore wind ASAP.

The cost of their RUINABLES are easily demonstrated if you follow the Net Zero Australia guesstimates of TRILLIONS of $ before and after 2030 and the 15 to 20 year ongoing replacements until 2060.

I think the Bowen and Albo idiots are too stupid to understand this, but we need to stop their TOXIC W & S RUINABLES before we flush more TRILLIONS $ down the drain.

The cost to the offshore and onshore environments will be disastrous, including the whales, birds, koalas, bats etc.

350

Would be interesting to know how many solar and wind farms have been built over the last six months, and whether Australia is on track to meet the govt’s Net Zero promises.

50

No, Neville, don’t try to stop their “Toxic W & S Ruinables”. No.

Don’t waste your time.

The thing is to “Bring it on”.

Encourage them. Keep it going.

Bowen is a fool. But, a piece of putty in our hands. Encourage him to not stop.

He’s the best thing the Conservatives have going for them.

When it crashes – which it will – we will start to see sanity return. Rationality. Engineering. And, the likes of Bowen and the rest of his Marxist idiots being seen for what they are. Fools. Labor Party, Marxists. Fools.

20

Odd, isn’t it that now most of the good sites for European offshore wind farms have been utilised, there are now a dearth of new projects.

Odd, isn’t it that the subsidies paid for coal, oil and gas are never mentioned when talking about subsidies for sun and wind.

Odd, isn’t it that market capitalism manages to find ways to siphon said subsidies into the pockets of their new feudal lords.

054

No matter what subsidies are on offer, the environmental mantra that energy has been to cheap for too long is dodgy.

The market determines the price, based on supply and demand.

251

Asutralia

https://www.energyfactsaustralia.org.au/key-issues/energy-costs/

The world

https://ourworldindata.org/grapher/levelized-cost-of-energy

18

How many more times – you CANNOT correctly compare energy costs using LCOE. I shouldn’t have to explain this but I will. LCOE costing only looks at the costs during an energy source’s own lifetime. It makes no attempt to compare costs when some energy sources have much longer lifetimes, such as coal, gas and nuclear.

If you use FCOE costings, these accurately compare costs using the longest energy source’s lifetime. During this time, short-term energy sources have to be replaced at least once, or more usually twice as a minimum. This naturally greatly increases their overall costs.

120

Correct.

But, why would you expect the fools to understand this?

Case in point?

Peter Fitzroy. The most intelligent fool in the Kingdom.

00

The link you give says nothing about these mysterious oil and gas subsidies, nor does it bother explaining the very large number of assumptions made when calculating costs of generation. What capacity factors are presumed? Lifespan? Maintenance costs? Battery fires aren’t cheap … and Bouldercombe is the second major fire already in Australia and it’s only been a few years since they even started installing the things. Were fires included in the assumptions?

Besides that, the article you link to has data only up to 2014 in the charts … whatever assumptions they made are completely wrong now … heck, just interest rates alone have swung enough to invalidate everything.

You seem to do these blunders over and over … I’m starting to think it’s deliberate. Do you enjoy getting stuff wrong all the time? Most people would start to feel a touch uncomfortable by now.

30

From your own source link (Climate Council):

“On average, a residential electricity bill comprises:

wholesale electricity costs make up 34%

retail costs and profit margins make up 16%

network costs make up between 43%

environmental costs make up between 6%.”

These guys can’t even finish the line saying “network costs make up between 43%” and …??? They don’t have a clue.

For “Australia’s leading climate change communications organisation”, they can’t even complete a simple sentence.

And so with new utility solar and wind projects requiring substantially increased “network costs”, who knows how high this % could go.

This network line item of the bill is already *at least* 43% for actual KWh of real energy of only 34%.

Don’t think you have a handle on what drives the true costs.

10

Peter,

Odd, that you always fail to mention that renewables were supposed to be cheaper.

Odd, that you always fail to mention that if we had a free market, with no subsidies, that renewables would wither and die.

Odd, that you fail to realise that the wind blows everywhere, and if wind power was so good (as we are told), that we should be able to harness it everywhere.

Odd, that you fail to mention that the alternative to ‘market capitlism’ would be, and is in some countries, a LOT worse.

500

Mr. Pace: It would have been clever if his last line could have begun, “Even if……” But he’s not the sharpest commenter.

00

Then you may also find that there is little enthusiasm for off-shore wind turbines in the USA despite the Government wanting them with subsidies.

130

Odd, that the so called subsidies for at least oil, are actually rebates for taxes paid when the products are purchased and refunded because the tax does not apply.

For example, purchases of oil based products such as diesel and petrol, include a road tax. Many of the purchases are used by businesses such as mining and farming on private property where no road tax is payable and the road tax is refunded.

380

The Fuel Tax rebate is in fact a reimbursement and not a true subsidy as it applies to roads already built and not subject to road tax. on farm and mining production contribute a lot to Australia’s bottom line, unlike renewables which are akin to a succubus and contort the market with mandated feed ins. Fossil fuel production is reliable and a benefit to the nation.

270

Not odd at all Peter…Coal, gas and oil all work 24/7.

260

Please list these subsidies.

I was speaking with Malcolm Roberts, he stated,

Each wind turbine is paid $600,000 to $900,000 per year, depending on the generation capacity, for just standing there, not generating. Then you have 50% of costs for construction met by the tax payers, 100% of the cost for poles and wires, (this requires rewiring the entire Australian grid) the Renewable Energy Certificates, preferential feed in and on and on.

Wind and solar need coal, as they get paid the coal bid, without it their failures and your electrical bill would be massive, their zero bids are based entirely on this parasitic method.

Pumped hydro and batteries do not generate one watt, they are also net consumers.

Look at any wind generators financials, the profits are the subsidies, without which they would fold.

Market capitalism Verses subsidy harvesting. Capitalism is equality in the market, survival of the fittest, wind and solar are on life support.

100’s of thousands of acres of Kola habitat are being strip mined in the GBR catchment for temporary feel good moments and virtue signaling.

300

My guess is that Peter is relying on the totally wrong March 2022 Australia Institute report, “Fossil Fuel Subsidies in Australia” for his “information”.

This report makes incredible assumptions, such as energy rebates to pensioners are fossil fuel subsidies. And iron ore port improvements are somehow FF subsidies. It then goes on to add assumptions about future impacts due to using FFs, using models, and somehow adds these to the FF subsidies.

180

Yes, certainly a case of ” I reject your reality and substitute my own”. For years Australian agriculture has been accused of receiving subsidies whereas in reality they are non-existent compared to both Europe and the US. Sometimes even our allies ( US ) accuse Australian wheat exporters of receiving subsidies when they are competing for overseas markets. When you examine their absurd claims it’s due to Australian wheat farmers claiming diesel rebates for off road use, which is completely justified of course. (Not may tractors/ wheat harvesters/ sprayers clock up major road kilometres). It’s always in the detail.

120

Odd, isn’t it, that even with all the good sites taken they still cannot reliably generate average baseload power at more than a fraction of the installed nameplate rating. And every single installation of unreliables relies totally on full baseload conventional plant to back it up.

No, not odd at all. Predictable from the outset. The idea it would be cheaper has always been false. Wind may be free, but the hardware to collect it is not, and even passing knowledge of the economics of reliable standard electricity generation reveals that fuel costs are and have always been a tiny fraction of operating costs. Nor is it cheaper to maintain two systems just to make up for the permanent unreliability of one of them.

230

Regardless of whether all the “good sites” have already been taken up or not, to achieve Net Zero, the govt would still have to push ahead adding more and more solar and wind farms. And another 10-20 Snowy 2s, or acres of batteries, as backup storage. Regardless of whether any suitable sites are available or not. So that’s not a valid argument if the govt still wants to achieve Net Zero.

90

Peter, the recent U.S. govt report found that since 2016, 80% of govt energy subsidies went to renewables, while fossil fuels received only 13%.

I’m guessing that a similar ratio would exist for Australia’s energy subsidies.

70

The free market speaks – ‘We get a tax credit if we build a lot of wind farms. That’s the only reason to build them. They don’t make sense without the tax credit.’ – Warren Buffet. Someone who knows how the scam really works.

140

Ken Stewart shows our East coast energy generation in early July 2023.

How can our loony pollies believe that we should change to more TOXIC W & S and all the blackouts that we would suffer because of their ignorance and stupidity?

https://kenskingdom.wordpress.com/2023/07/17/all-our-electricity-generation-is-weather-dependent/#comments

200

Things are getting interesting . What took them so long ? Invest in businesses that make things that people use , like food and energy . Beware of anything that’s too good to be true….Investors in renewables are about to discover the cheese in the mousetrap isn’t free .

230

All those involved in promoting the LIE that renewables are cheap and reliable need to be prosecuted.

It’s been known to be a lie since the National Socialists started promoting wind power. They even promoted the manufacture of hydrogen from wind power.

Nothing has changed.

Sadly the modern socialists just repackaged the ideas of the National Socialists.

See:

http://en.friends-against-wind.org/realities/how-renewables-and-the-global-warming-industry-are-literally-hitler

https://www.americanthinker.com/articles/2017/07/the_nazi_origins_of_renewable_energy_and_global_warming.html

And National Socialist Hermann Flohn in 1941 published in German an article “The Activity of Man as a Climate Factor” warning about anthropogenic CO2.

Also see Rupert Darwall, Green Tyranny: Exposing the Totalitarian Roots of the Climate Industrial Complex (2019).

These National Socialist ideas have to be destroyed just like they were first time around, 1939-45.

220

Salvation by faith in Gaia has turned into one of the worlds biggest wrong turns on the road to paradise. Mother Nature has become Mother Hubbard.

140

No business should ever rely on either a legal monopoly being granted by government or taxpayers being forced to subsidise a fundamentally defective product.

Sooner or later a rational government will be elected or the country will go bankrupt, whichever comes first.

170

It has always been based on government backing it up using other people’s money.

Government making up the losses.

Government artificially increasing the costs of alternatives.

Government mandating and banning.

It was precieved as low risk because of the promise of a bail out, as well as the ongoing subsidy.

As long as their people were calling the shots….

But now everybody is going broke.

Even those who are not in high tax brackets are paying through inflation.

Now the money well is running dry.

It has been dumped into a money pit.

150

One Nations lattest cartoon. Vote No

https://www.youtube.com/watch?v=6EUVpyL8jVc

90

Seems like a very accurate article in ” The Telegraph”. Hard to debunk a lot of the claims, particularly the S&P stats. It’s a shame our media are not publishing these facts and more. The allied advertising industry is still mostly very praiseworthy of solar and wind power generation. So many ads for all types of products are tagged with comments like” buy our product and save the world because we”re so much greener than our competitors”. Power supply companies are really bad but it also extends to car manufacturers , mobile phone providers, supermarkets and all sorts of other service providers. Also, don’t expect the ABC to change their tune any time soon. First time in years I watched Landline. They were doing a story on the farmers protests vs the new proposed powerlines. Firstly, I suppose good on the ABC for doing a story but the whole narrative of the piece was incorrect. Their overall theme was that these powerlines MUST be built because, you know, climate change. That, weren’t all these farmers rather cute, doing protests like their big city cousins. There was never a thought about the stupidity of building all these useless solar and wind installations in the first place. At one stage they even interviewed a farmer in Tassie who was opposed to the powerlines. But the ABC claimed (he never stated it on video) that he had moved to Tassie from Victoria due to climate change. So, expect The ABC to be supporting the Labor government/ Net zero/ Chris Bowen until the cows come home.

140

They probably asked the guy why he left Victoria … and he told them that the whole climate had changed since Dan Andrews took power and the place had become unlivable.

20

Yes indeed Jo, and nett zero is unravelling but the ABC won’t tell you that.

They just repeat the net zero ideology while their heads are buried in the sand.

Meanwhile the Australian economy keeps going south . .

140

Ya gotta just love politicians who read the scripts written for them, telling how wonderful that their Offshore wind proposal will be, confidently saying all the ‘bullet points’ written for them to say ….. you know, like they actually ‘know!’ what they’re talking about.

Okay then, offshore wind! Sounds great eh, and so easy to talk about. It’s going to be here ….. and here ….. and here ….. and here ….. umm, before you even know it.

Yeah right!

Have a look at this page of images. (and a lot of them are artists impressions) These show the special ships required to actually construct these things, umm ….. IN the Ocean, did you get that ….. in the wilds of the open seas around Australian shores, not on the immovable land based sites.

There’s a global shortage of these ships, umm, all of them located in the Northern Hemisphere, you know, around the seas of Europe. The ships are designed for constructing offshore wind towers, not for their speed across the open oceans.

So, they have to get those special ships (remember that shortage of them) to sail all the way here to Australia, from there in Europe, across open Oceans.

For a what is basically a small project when compared to the ones already in and around Europe.

Naah! Look, we’d, umm, really like to help you, but the cost would be prohibitive (you know another of those hidden costs no one mentions because renewable power is just so cheap) and, seriously, I don’t think our vessel is designed for travel for so long at such a slow speed on the World’s unpredictable oceans.

And then, sail very slowly all the way back home when construction is completed.

Offshore Wind ….. Australia ….. umm, good luck with that mate!

Tony.

300

The trouble is Tony, that our (expletive deleted) believer politicians will just offer them more money to come to Australia. The other problem will be that the quickest route to Australia (and that pile of cash) would be through the Suez canal.

So our (expletive deleted) believer politicians will decide on floating turbines which will be built in Norway and sail out using the roaring forties.

And, if anyone thinks I am being sarcastic, I point out that Snowy2 is now 6 times the initial estimate, and the (expletive deleted) believer politicians still want it to go ahead, even if it means more (of your) money.

160

Tony,

Renewables are a black hole that sucks in both the educated and the rubes . We are being gamed extensively and AI is being used to model everything . Powerful interests are modelling scenarios , measuring results and acting on the results . When you look at the accuracy of this process you get the current political and social chaos . Massive change coming , i hope it wants to be friends…

120

Azimovs Foundation series

50

Not just a shortage Tony, I believe that even the existing special ocean-going high-lift cranes needed for offshore wind farm assembly are already booked out years in advance. So surely no chance of any offshore wind farms being erected in Oz for the next few years, thank goodness.

70

The danger is, of course, if there is a dearth of approvals for off shore wind in Europe, those specialist vessels will be hungry for other countries’ subsidies, even down under.

30

Good morning, Shipping Vessel Insurers, Bruce speaking

Good morning Bruce, our Company owns a large offshore wind turbine construction ship. We currently have a proposal before us for the construction of an offshore wind plant in Bass Strait, just south of Victoria in Australia, and we were hoping you might give us a ballpark figure on what it might cost us to insure the vessel for the trip there, the work, and then the trip home.

Is this construction ship specifically designed for such a long and arduous voyage across Two oceans.

Wellllll, not particularly. It’s mostly designed for turbine installation, and not for such extended ocean sailing.

Umm, how much is this ship worth then.

Oh, ballpark, say $650 Million in US dollars.

Oooooookay.

Why, can you actually insure it, and how much would the premium cost us?

Oh, let’s see then. How about you take one dollar off the number you just quoted me!

Can I get back to you on that. I have to run it by the Australian Government Minister, Bowen, I think his name is, but really, I think he could cover that!!!

Tony.

60

Tony

I have a friend whose career was in oil drilling got him to see a fair bit of the world both on and off shore.

One of his comments is relative to ereecting and maintaining offshore wind in Oz –

“The North Sea was bloody dangerous. So is Bass Strait”.

60

“Facts and numbers don’t care about your feelings”. Trust “Mr Market” and the true Capitalists to figure this out first. They’ll congregate like flies around a piece of …. where they can suck a subsidy off government, but then run the moment they’ve pocketed it, and then rinse, repeat…and the poor taxpayers will continue to suffer…

80

It was only a matter of time. Now time to go after and finish off the delusional science that isn’t. A stack of logical fallacies known for millennia but somehow utterly opaque to the experts who aren’t is causing untold economic and social harm to all the non experts who are correct.

A perfectly fine civilization is a terrible thing to waste.

100

Energy prices come down because of a milder winter and supposedly renewables.

https://www.theguardian.com/australia-news/2023/oct/09/electricity-prices-wholesale-down-sydney-power-bills

22

Another blow hits. New York rejected the huge price increases proposed by developers.

https://gcaptain.com/new-york-state-denies-additional-funding-for-offshore-wind-and-renewable-projects/

Makes sense for NY. They will hold another procurement and these folks can bid at the new price and if nobody bids against them they will likely get it given the goofy law, if they can still get financing. Or they might get underbid. But in the short run their stock may take a hit based on bad news, especially Ørsted. And it delays everything which I like. The cascade of grief continues.

81

As a curiosity, there’s a coal fired fish & chip shop in the UK, Grimsby in Lincolnshire to be exact.

Started in 1948 and (now) the only one left.

Customers queued up out the door and down the street every day, and not a climate loon in sight.

https://www.lincolnshirelive.co.uk/news/local-news/food-monster-review-one-uks-6004020

70

Grimsby, formerly the world’s greatest fishing port. When I was a lad there in the fifties, there were over five hundred trawlers based in the port.Today, half a dozen.The haddock is supplied from Grimsby, the chippy is in Upton, by Gainsborough.

20

Interesting that this site has the projected results for tomorrow’s voice referendum.

This covers the national result and every state and every electorate.

They’re predicting a NO win and similar to the online betting market.

https://www.focaldata.com/blog/bi-focal-9-australia-and-the-voice-referendum

40

Couple that with the young in high density areas rather than just Labor voting electorates being the largest “yes” voting demographic and I get the feeling that many “yes” votes in the polls are sheeple that will vote no in the booth.

40

Considering Brexit, which the overseers of ‘elections’ (which may gave undergone definitional change like ‘vaccine’, ‘force’, and ‘woman’), barely accepted … and considering the ‘fortified’ 22020 POTUS election* …

I will be watching the Voice vote to see if ‘elections’ have not gone the way of Science and Medicine, which is to say, in the crapper.

I heard that the Oz Premier recently stated he “would accept the result of The Voice Referendum”.

How very Global Democrat of him.

This is a window into the minds of the New Globalist Bureaucrat.

I live in the dark shadow of Uni … did you know that ‘Global Democracy’ is now an academic field?

(They have a whole new building with a frigging underground parking lot.)

A fortress of Oxymoron populated with morons.

“Believe in Science”

“Global Democracy”

If your trash is not getting picked up in Sydney, call Brussells.

*(Here in the US, where election psychosis is in full swing, the side that wins has sworn to put the other side in jail. One side already has jails.)

50

Warmists have been told loud and long,

Their costly renewables are wrong,

When turbines can run,

Without wind or sun,

From tides that go for a song.

90

Here’s a very fair test from the UK for an EV pulling a caravan.

The first run tested the car and the next day the same car pulling a good size caravan.

Terrible result with the Van and for Aussies the forever charging nightmare would be a bad joke, because of our much longer trips.

https://www.youtube.com/watch?v=0oLeKRNsSn4

30

I saw that clip, very real how sad these things are, I’m sure we all have better things to do than fratch about finding a working available charger then spending time waiting for it to charge.

10

More on investors fleeing in here –

“Electric Grid Reliability: Texas vs. EPA”

““Just the possibility that EPA will enact such sweeping regulations will slow investment in new power generation that all U.S. power grids need. Recent grid warnings about possible outages this summer will likely continue into the winter while potential new-generation projects proceed cautiously.” ”

And in the EPA “muddling”

“Wishful Thinking

As one might expect, EPA does not entertain the idea that their proposed regulations could devastate US power grids. The reason is that the EPA models assume that replacement generation will always be built to replace shuttered coal and natural gas power generation. This was pointed out during the EPA public hearings by Michelle Bloodworth, the President and CEO of America’s Power:

EPA’s modeling concluded that it would not cause any resource inadequacy. However, EPA’s model is designed to never project resource inadequacy because the model simply adds replacement capacity to offset retiring capacity regardless of whether this new replacement capacity would actually be built in the real world and provide the same accredited capacity value and reliability attributes as the coal fleet, such as fuel security.”

More at

https://wattsupwiththat.com/2023/10/12/electric-grid-reliability-texas-vs-epa/

30

Fossiladban youtube advert

https://fossiladban.org/

Mindless crap that hurts them more than helping them.

00

I hate to be pedantic, but I don’t think investors care whether ‘green’ energy is cheap or not. All they care about is whether people will buy it and it is becoming clear time that, if the consumer had to pay the REAL cost (sans subsidies and market distorting policies), they will revolt.

30

The thing is … everyone consumes electricity … and everyone consumes other products that depend on electricity such as communications and financial services, street lighting, hospitals, food storage, pumped water, and many others … in no particular order.

Therefore, in the big picture there can be no subsidy because it only works when person can fob the costs onto another person. In the case where everyone is a consumer, the only difference is you end up paying via a different method (e.g. higher taxes). There’s no one left over to fob the costs onto.

20

And the whole mess tends to be regressive, most hurting those on lower incomes that can afford it the least.

00

“Offshore Wind is an Economic and Environmental Catastrophe”

https://amgreatness.com/2023/10/11/offshore-wind-is-an-economic-and-environmental-catastrophe/

20

Investors abandoning green energy as they realize it’ll never be cheap? I think the big investors always knew that. Personally I’d name the thread “Investors abandon green energy as they realise governments will eventually withdraw subsidies”.

20

[…] contracts abandoned, auctions left without bidders and almost no new projects started. As told by Joana Nova and also by Kathryn Porter of The Telegraph: The Myth Of Affordable Green Energy Is […]

10

Another noticing!

“Investors ditched renewable energy funds at the fastest rate on record”

https://hotair.com/tree-hugging-sister/2023/10/11/a-lesson-in-wind-industry-smoke-blowing-n584032

10

Eh Gawd!

Read it all and benefit from the halo glow of Dogger Bank!

00

Unfortunately the dumbfek investors of my pension fund will have invested substantially in this sinking ship.

00

[…] JoNova […]

00