|

|

Jo Nova

It seems people only wanted renewable energy if they got cheap loans

Just as the quarterly reporting season revealed crippling losses for wind power and EV’s, so it is with Solar energy.

The general US S&P shares index gained 15% this year but The Invesco Solar ETF (Fund) which invests in solar energy stocks around the world — fell by a dire 40%. Even the US “Inflation Reduction Act” couldn’t save the solar sector. As finances tighten with rising interest rates, apparently solar panel orders are among the first to be cancelled.

Some of the worst performers in the whole US share market are solar shares, with SolarEdge and Enphase losing 70% each this year. A few weeks ago, the CEO of SolarEdge said revenues this quarter were about half of what was expected. He blamed “unexpected cancellations” from European distributors. But US demand was down too. Indeed, the bad news started in California, the largest market in the US, when the government slashed home solar “net metering” payments in April by about 75%. Suddenly, it was going to take 10 years to pay off the panels. Solar panels were a luxury item.

If only solar panels were cheaper, in tough economic times, everyone would want them.

by ZeroHedge, Oil Price

The renewable energy industry is in full collapse mode this week. First, Orsted A/S, the world’s largest offshore wind farm developer, abandoned two major US projects due to supply chain and interest rate impacts, and now solar stocks are being clubbed like a baby seal in US premarket trading on Thursday after solar equipment-makers SolarEdge and Sunrun reported dismal guidance amid waning demand.

That’s a nasty surprise:

Let’s start with solar equipment maker SolarEdge Technologies. The company said current quarter revenues are expected between $300 million to $350 million, far below analysts’ estimates of $718.9 million, as per Bloomberg Consensus data.

This has been a sharp turnaround in the solar industry. The rocket-like growth of 2020 has collapsed. And as long as interest rates are high, nobody is talking about a fast recovery:

What happened to solar stocks? Investors ‘pick up the pieces’ after a brutal earnings season

Claudia Assis reports at Marketwatch,

Just about every major U.S. solar company had big quarterly misses…

Shares of Enphase Energy Inc. ENPH, which sells microinverters widely used in solar-power systems and can stand in as a barometer for solar, among other wares, are down more than 70% in the year. As recently as 2020, the stock drew triple-digit yearly gains; it rose 45% last year.

SolarEdge Technologies Inc. SEDG warned late last month that starting in the second half of the third quarter it experienced “substantial unexpected cancellations and pushouts of existing backlog” from our European distributors, a dip it said wasn’t related to the Israel-Hamas war.

Some residential solar companies in the US are down 55-70% too. These are terrible numbers.

Beth Kindig, Forbes

Solar is arguably one of the market’s most sold-off industries at the moment,…

SolarEdge and Enphase are among the S&P 500’s worst performers this year, falling more than 70% each; a significant weakening in US demand starting in Q2 worsened with weakening European demand in Q3, causing revenues to nosedive. Residential solar companies SunPower, Sunrun, and Maxeon have all declined more than 55% to 70%, as well.

The decline was sudden in Quarter 3. What was a 25% growth in quarter two, became a 34% fall:

Enphase echoed SolarEdge’s commentary about weakening EU demand, as European revenues fell (34%) sequentially in Q3, after recording +25% QoQ growth in Q2. That’s a pretty swift QoQ decline in European revenues, which Enphase attributed to “high inventory at our distribution partners along with a softening in demand in our key markets – the Netherlands, France, and Germany.”

The near-term outlook for solar has definitely taken a hit from high rates impacting demand – a forecast from Wood Mackenzie/SEIA is pointing to a YoY decline in US residential solar installations in 2024, weighed down by a sharp contraction in California. Overall, the group expects installations to drop (4%) in 2024, dragged down by a (38%) contraction in California primarily due to the shift to NEM 3.0.

________________________________________________

10 out of 10 based on 94 ratings

9.7 out of 10 based on 9 ratings

8.5 out of 10 based on 12 ratings

By Jo Nova

Imagine you built hundreds of wind turbines off your coast and then found out they reflect the signals used by your air defense radar?

It turns out that large rotating blades reflect radar pulses rather like planes do, and with future offshore wind turbines as tall as the Eiffel Tower and 1,000 feet wide, things are only getting worse.

RAF pilots already use the turbines to help them hide in training exercises.

The UK government has quietly spent £18m to try to figure out how to stop this and the best they have come up with is coating the blades in the type of paint used on stealth fighter jets. But the paint on F-22 jets peels off a bit too often, so they are considering something like the new ceramic paint from the F-35 program. But since that’s a top military secret, presumably it won’t be too similar. What could possibly go wrong? Since you asked, last year, after just six months on aircraft carriers, the F-35s were already looking kind of rusty.

Just drive a truckload of money to your local wind subsidy farm. Other plans include adding cameras, microphones, and radio aerials to turbines to detect hostile jets or perhaps some naughty boats and subs.

The German military have asked to be able to veto any wind development within 50 kilometers of their military radars. And given that it has 18 radars that could rule out a significant part of the German coast. The wind industry is not happy.

Imagine you bet your national economy on building thousands more of these by the end of the decade.

Thanks to Oldbrew at Tallblokes:

By Gareth Corfield, The Telegraph

Offshore wind farms blades interfere with radar signals and there are concerns that plans for a significant expansion of turbines in the North Sea by the end of the decade will cause problems for the Royal Air Force (RAF).

Dangers in the North Sea are more than theoretical: a “ghost fleet” of Russian ships were spotted mapping communication and power cables in the area earlier this year, sparking fears that the Kremlin is preparing for a campaign of sabotage.

Some planned wind arrays are 20 miles wide.

A serving RAF officer explains: “If you have three blades on one turbine, that’s three false reflections. Imagine you then put up 10 or 20 turbines.”

Former RAF Tornado instructor Tim Davies recalls using offshore turbines to hide from ‘enemy’ fighter jets during training exercises.

“We used to fly into wind farms and rapidly change direction, knowing that their radar would struggle to see us,” he says.

Just one more reason China and Russia are encouraging the West to build fields of giant industrial wind plants in the ocean.

Photos: Top wind farm (Rhyl Flats) Andy Dingley; RAF Fighter jets photo by Steve Richardson; Gwynt y Mor wind farm, Steve Daniels.

9.9 out of 10 based on 87 ratings

7.5 out of 10 based on 16 ratings

8.2 out of 10 based on 18 ratings

By Jo Nova

Shh! The Monster Banker Funds are secretly saving the World

By sheer coincidence the same day the Australian Treasurer said we’d have to pump up the subsidies on climate targets, a group of largely foreign bankers called for the Australian government to “hurry up with emissions reduction plans “.

The foreign investment bankers market themselves as “Australian and New Zealand investors” but boast they have $30 trillion in assets, which is a bit of a red flag when the GDP of both nations together is $2 trillion USD. It turns out the blandly named Investor Group on Climate Change (IGCC) is only 10% Australasian: The foreign investment bankers market themselves as “Australian and New Zealand investors” but boast they have $30 trillion in assets, which is a bit of a red flag when the GDP of both nations together is $2 trillion USD. It turns out the blandly named Investor Group on Climate Change (IGCC) is only 10% Australasian:

IGCC represents investors with total funds under management of more than $3 trillion in Australia and New Zealand and $30 trillion around the world. Investors welcome the development of internationally aligned climate risk disclosure requirements in Australia. —IGCC Submission to the Australian Treasury Feb 2023

But being 90% foreign doesn’t stop them putting in submissions to Parliament or pretending to be locals. Even The Australian thinks they are Australian:

An Australian investor group representing members with more than $30 trillion in assets says plans being developed by the Albanese government to decarbonise sectors like energy and agriculture must align to the Paris Agreement’s goal of limiting the global temperature rise to 1.5C.

The fund includes Australia’s largest retirement funds, but quietly also includes our old friends, Vanguard and BlackRock, which together make up $17 trillion of the $30 trillion dollar collective of climate concern. So it’s the two supergiants, plus 100 extras. Who controls this group? It’s not the minnows.

Bankers use your pension funds to make your electricity bill higher

The IGCC says it’s just worried about their clients best returns, as indeed they should be. But given the S&P Global Clean Energy Index is down by 36% this year, their clients best returns would have been in the real Energy Sector which hasn’t gone down at all. If they were serving their clients they would invest in oil and gas. But instead the bankers apparently want the government to rescue their bad investments. Here’s their joint plea for “certainty” which means certain subsidies:

Rose Lewis, The Australian

In a new report released by the Investor Group on Climate Change – which represents Australia’s largest superannuation and retail funds, specialist investors and advisory groups – investors outline their priorities for the government’s decarbonisation plans to ensure the country remains a competitive place to direct capital during the net-zero transition.

“Unless Australia’s economy decarbonises in a manner that is rapid, orderly, and fair, the long-term retirement savings of millions of its citizens will be negatively impacted. [Not to mention all the foreign investors too, says Jo].

“The more orderly the transition to net zero, the better able investors will be to protect and preserve the value of their investments in the best interest of their beneficiaries.”

Given that “profits” from unreliable energy transitions depend entirely on government subsidies and laws, these giant funds are colluding together to lobby for better returns. But if they didn’t ask their 7.5 million Australian and New Zealand customers whether they want smaller retirement funds in order to save the world — then are they really serving them, or screwing them?

$30 trillion dollars is a lot of money to use to threaten and influence a $2 trillion dollar economy. Are the foreign bankers using the threat of withdrawing investments in order to bully more subsidies out of patsy Australian taxpayers and hapless Australian electricity consumers? They could feed the “profits” back to their own retirement funds overseas, while they boost wind and solar manufacturers in China, say, to get more favours with President Xi — the possibilities are endless. One arm of a supergiant fund can rake in the money created through predatory behaviour in another arm.

Or perhaps I’m wrong, and the saintly bankers genuinely lie in bed at night worrying about a half a degree of global warming.

These are the groups concerned about koalas and corals

Members of IGCC:

Follow the money — the Greens do. Follow the money — the Greens do.

9.9 out of 10 based on 100 ratings

9.3 out of 10 based on 6 ratings

Who believes the UN anyway? By Jo Nova

A few academics want to add apocalyptic climate labels to meat to turn people off their steaks

The aim, apparently, is to shame and harass people into buying the vegeburgers they aren’t voluntarily buying, and thus make the Weather Gods less angry in 2100 AD. Fortunately, in the trial, 90% of would-be meat-eaters just ignored the label and chose the meat anyhow. This must have disappointed the new prohibitionists.

The Conversation

To gauge the impact of graphic warning labels on the number of people opting for meat, we split participants into four groups. One group saw a warning label beneath the meat option depicting a deforested area and the phrase “eating meat contributes to climate change”. Another group saw the meat option labelled with an image of a man having a heart attack and the text “eating meat contributes to poor health”. A third group saw a label below the meat option depicting caged animals in a wet market, alongside “eating meat contributes to pandemics”. The final group saw the four meal options with no labels.

When no warning label was presented, participants chose the meat options about two out of three times (64%). This figure dropped to 54% with the pandemic warning labels, 55% with the health warning labels and 57% with the climate warning labels.

Judging by the blatant comparison to cigarette smokers, the aim is not so much to connect the supposed cause and effect of climate change, but mostly to tar meat eaters with the same social opprobrium. After all, if the academics just wanted to raise awareness of the so-called “science”, they could write Beef causes Droughts, or Burgers cause Bushfires or Chicken-sticks melt the Arctic. But since that sounds so stupid, because it is, they can’t connect those dots. What they need instead are the catastrophic photos of a landscape that looks like lung cancer. It’s the feeling that matters — a feeling like leprosy.

The message is “People buying these sausages are selfish, stupid people”.

As a bonus, the labels are also free-advertising for The Cause — it would create government funded reminders all over the shop that “climate change ” needs fixing (give us your taxes, your heaters and your cars!).

These food labels are also adverts that pretend the UN is still respected and useful.

The left always go too far. Because there is no principle, just a fashion contest, more is always better – right up until it breaks.

Our mission is to reach the other ten percent who might give up their meat and help them…

Hat tip to Climate Depot

10 out of 10 based on 113 ratings

9.2 out of 10 based on 9 ratings

By Jo Nova

Hertz was aiming to make 25% of its fleet electric by 2024, but is finding 11% is too much. Given there are whole nations pushing for 100% EV by 2035 there seems to be a message here…

Let’s thank Hertz for doing that experiment for us. It turns out EV’s didn’t work well in the high mileage Uber-type system because the drivers “drove them into the ground” and repair costs were much higher than expected. So Hertz moved some EV’s to the leisure hire department, but then the revenue per day in the leisure sector fell. Presumably people didn’t want to hire them.

It’s not that this is Bad News week for EVs — it’s quarterly reporting week, so companies have to tell investors things they’d rather not.

Great nations don’t force citizens to buy heavier cars with shorter ranges and bigger repair bills in order to stop bad weather one hundred years from now.

Hertz is slowing down the roll out of EVs onto its fleets as the CEO cites higher than expected repair costs and price cuts.

The rental car company reported lower than expected margins in the third quarter of this year, citing EV repairs as one of the challenges.

“Collision and damage repairs on an EV can often run about twice that associated with a comparable combustion engine vehicle,” said Mr Scherr.

It all started out so well:

Andrew J Hawkins, The Verge

Rental car company Hertz once envisioned itself as the ultimate EV broker, doling out battery-powered vehicles to business travelers, ridehail drivers, and tech newbies in an ambitious plan to grease the wheels for the EV revolution. The company inked agreements with Tesla and Polestar to buy nearly 200,000 EVs. Tesla’s valuation topped $1 trillion on the news.

Part of the problem is linked to Hertz’s plans to rent EVs to ridehail drivers. Of the 100,000 Tesla acquired by Hertz, half were to be allocated to Uber drivers as part of a deal with the ridehail company. And drivers said they loved the Teslas! But Uber drivers also tend to drive their vehicles into the ground. This higher rate of utilization can lead to a lot of damage — certainly more than Hertz was anticipating.

Lora Kolodny, CNBC

Musk frequently says that electric cars require less maintenance than counterparts with internal combustion engines (including plug-in hybrid electrics). …

But electric vehicle owners can face unique maintenance needs, as well. Nikhil Naikal, CEO of Kinetic, a startup that is not affiliated with Hertz or Tesla but provides repairs for electric and autonomous vehicles, told CNBC on Thursday:

“The reality of electric vehicles is that they can be 1,000 pounds heavier or more than gas vehicles, and they move faster, with higher torque. Since they’re extremely zippy and heavier, it’s just physics — the ability to overcome inertia so quickly is going to effect their suspension systems, the brakes and steering columns. It’s counter-intuitive, but even with fewer moving parts they are susceptible to requiring more maintenance. They especially require tire-swapping, because the tires wear out more quickly from that high torque and weight.

h/t Brenda, Stanley and Yarpos.

Photo: NZ archives Christchurch

10 out of 10 based on 98 ratings

9.4 out of 10 based on 7 ratings

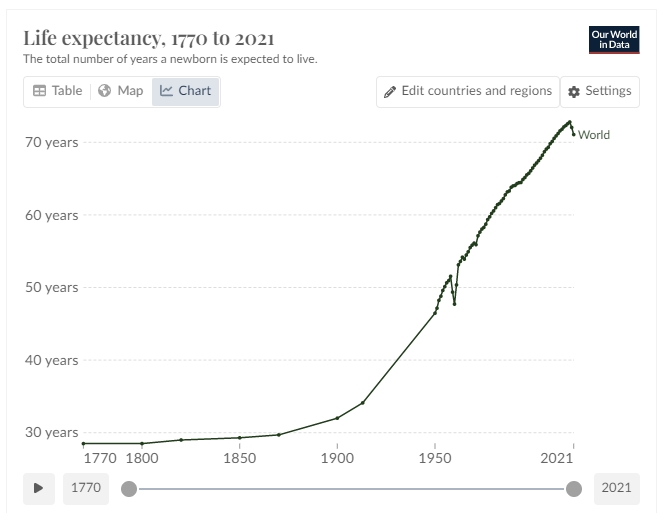

By Jo Nova

Lets meld climate and health into one giant government quasi religion. What could possibly go wrong?

The medical industry leapt into politics and medical witchcraft on Saturday, calling to fuse human and planetary health into the one all-purpose emergency.

This is despite humans living longer now than they’ve ever lived, eating more food than they ever have, and being less likely to die in storms, floods and cyclones.

This is despite a truckload of papers on 74 million people showing 6 to 20 times as many people die in cold times rather than warm ones. Rather than being dangerous, global warming saves 160,000 lives a year. All over the world, people die in winter more than summer, year after year. Even in hot cities like Brisbane, cold weeks are the killers, not the hot ones. Room temperature is linked to mortality, and there’s no heatwave on Earth that can’t be solved with more air conditioning. Give the poor and downtrodden more fossil fuels, not less!

The illusion of millions of doctors:

Calls went out on the weekend supposedly from “the doctors of the world” and 200 health journals, but in reality this is just self-selecting upstart committees or conglomerate publishing houses presuming to speak for 3 million doctors, nurses and ambulance drivers without asking any of them.

The world’s leading GP and health bodies, representing more than three million health professionals worldwide, will deliver an open letter on Saturday calling for urgent action against climate change to protect the health of communities.

“We the family doctors, doctors and health professionals of the world call on world leaders to take urgent action to safeguard the health of global populations from the climate crisis,” the open letter reads.

Our science associations are looking more like sacred medieval guilds than select groups created to serve their members.

In the world we thought we lived in, doctors and nurses who disagree would be writing to their association, howling in protest at the pagan politicized science of it all, but many will stay silent, thinking they are alone, or afraid of being called names like “climate denier”. Thus and verily, not through reasoned debate but kindergarten bullying do the great pretenders of science get away with rank nonsense in supposedly our most esteemed modern professions.

Journal editors, God Emperor of the world, What’s the difference?

It’s hard to believe but editors of supposedly the most hallowed science journals decided it was their job to speak out as the chosen ecologists, climate scientists, energy experts and government of the world.

But then medical journals have had low standards for years. The Lancet is the world’s highest impact medical journal and that didn’t stop it shamelessly stretching the axis of a graph for political impact.

Listen to the experts, they say, which means, them, for everything. Who needs energy experts, or nuclear engineers when you could ask your gastroenterologist?

What kind of emergency is it when everyone lives longer?

Thanks to Climate Depot

10 out of 10 based on 70 ratings

9.3 out of 10 based on 15 ratings

By Jo Nova

Last week the EV bubble popped

It’s been a crushing week for the EV industry as the bad news that has been brewing for months was laid bare in the quarterly reports. Across the industry, corporate CEO’s are all admitting that demand is unexpectedly slow, orders are down, and suddenly projects are being delayed “indefinitely”.

Volkswagen admitted orders are down a shocking 50% and they are sacking 2,000 jobs in the software division. Ford posted an operating loss of $1.3 billion for the quarter — meaning they are losing $36,000 for every EV they sell. They face a ghastly full year loss of $4.5b, so not surprisingly, they are delaying battery plants, and plans to expand production. All up they are now holding off on $12 billion in investments.

The head of Mercedes-Benz described the market as “a pretty brutal space”. Harald Wilhelm hinted that some manufacturers won’t survive: “I can hardly imagine the current status quo is fully sustainable for everybody,” he said.

Panasonic has slowed EV battery production was reduced by 60% in Japan compared to the same quarter last year. While its US plants were OK, profit forecasts of the whole energy division were down 15% and depended on US subsidies.

News of cars kidnapping drivers, and airport car infernos have added to range anxiety and crushing interest rates to squeeze the EV bubble til it popped.

The bloodbath has been bad:

Epoch Times

Toyota’s chairman and former CEO, Akio Toyoda, told reporters at an auto show in Japan this week that waning demand for electric vehicles (EV) is a sign that people are waking up to the reality that EVs aren’t the silver bullet against the supposed ills of carbon emissions they’re often made out to be.

“People are finally seeing reality” about EV technology…

Mr. Toyoda, a long-time skeptic of a full-steam-ahead adoption of EVs, stepped down from his role as CEO of Toyota this year amid criticism that he wasn’t serious enough about pushing the company into a quick adoption of battery-powered cars.

Peak EV has been reached too soon…

The Ford Chief Financial Officer, John Lawler, tried to put it in the best light he could

“The narrative has taken over that EVs aren’t growing; they’re growing,” Lawler said. “It’s just growing at a slower pace than the industry and, quite frankly, we expected.” — Automotive News

Even if EV sales are still growing, it’s far too soon for them to be tailing off. At this early point of the transition — when the EV share of the market is small, and if EV’s are going to take over the world in the next ten years, they should be going gangbusters. The really important narrative, that must surely chill the bones of any EV investor, was that the Chairman of Toyota said: ” People Are ‘Finally’ Waking Up to Reality of Electric Vehicles”. If EV sales growth is already shrinking it suggests the final size of the EV market, barring a miracle discovery, is not very big.

Many of these companies have bet big on EV technology, but they are not turning a profit.

Elecktrek

Meanwhile, Volkswagen CFO and COO Arno Antlitz explained on a media call that EV orders in Europe are down to 150,000. That’s 50% lower than last year’s total of 300,000.

These are crippling losses:

Dan Mihalascu, InsideEVs

Despite the higher volume, EV losses continued to rise in the third quarter, with the company posting an operating loss of $1.3 billion, up from $1.1 billion in the previous quarter and more than double its loss from Q3 2022.

This means that Ford lost around $36,000 for every electric vehicle it sold in the quarter, surpassing its estimated $32,350 loss per EV in the second quarter. For the entire year, the carmaker expects a full-year loss of $4.5 billion for its EV unit. Why is that, though?

Ford admits that people don’t want to pay more for an EV than petrol and diesel cars:

Pras Subramanian

Ford said in its earnings report that US EV buyers were “unwilling to pay premiums for [EVs] over gas or hybrid vehicles, sharply compressing EV prices and profitability.”

Even Tesla (TSLA) CEO Elon Musk, perhaps the biggest EV evangelist in the industry, poured cold water on the EV market and general economic landscape. Musk noted on Tesla’s conference call last Wednesday that the company was delaying construction of its upcoming Gigafactory in Mexico due to concerns about global economic conditions stemming from rising interest rates that make financing cars more expensive for consumers, thus crimping demand.

Business Insider

Ford has halted billions of dollars in investment in EV manufacturing, warning that customers will not pay a premium for these vehicles. The auto giant announced in its third-quarter earnings call on Thursday that it would postpone $12 billion in planned spending on electric vehicle production and pause some major projects, including the construction of a new battery factory in Kentucky.

There’s a “hornet’s nest of anxiety ” about slowing EV demand

…the decision to scrap plans for more affordable EVs is sure to deepen worries about the future of the EV market in the US and abroad. Tesla’s price cuts, shrinking profit margins, and softening demand has kicked up a hornet’s nest of anxiety about the massive shift to electric vehicles that’s currently underway.

And that anxiety is being reflected in a number of the big player’s moves, including GM’s recent announcements about longer wait times for its upcoming slate of electric trucks and Ford’s move to temporarily cut one of three shifts at the factory that builds the electric F-150 Lightning. –– The Verge

Bad portents: EV’s are taking twice as long to sell

Australian Financial Review

EVs are … lingering longer on dealership lots. Dealers are taking 88 days to sell their entire supply of electrified cars and trucks, compared with 39 days in October 2022, according to Cox. Petrol-powered vehicles, by contrast, are selling in 60 days.

Only one-third of US consumers say the next car or truck they buy is likely to be electric, according to a survey from Yahoo Finance/Ipsos.

Even though sales hit a new record high, the slow-down is upon us:

A record 313,000 electric vehicles were sold in the US in the third quarter, according to data group Cox Automotive. Electric cars climbed to 7.9 per cent of total industry sales in the third quarter, up from 6.1 per cent a year ago, Cox Automotive found.

Even so, the pace of growth is slowing. Year-on-year sales growth for the third quarters of 2021 and 2022 was about 75 per cent; this year the increase was a comparatively cooler 50 per cent, according to Kelley Blue Book, a research company owned by Cox Automotive.

GM’s Trucks and vans slow down too:

General Motors’ biggest bets on the future — electric vehicles, autonomy and subscription software — are all running into trouble, and now the likelihood of sharply elevated labor costs is raising the stakes even higher.

Electric cars: GM last week abandoned its target to produce 400,000 electric vehicles (EVs) through the first half of 2024, citing slowing demand, continued manufacturing bottlenecks and profitability concerns.

-

-

- The company had already announced it would delay production of its next-generation electric pickup trucks until 2025 to figure out how to make them more profitably. And it recently paused production of its BrightDrop electric commercial vans until next spring.

Presciently, just before the week of quarterly doom reports came the poll showing 50% of non-Tesla EV owners are thinking of going back to petrol. Tesla loyalty was in the 70% range.

Hat tip to Kim, NoFixedAddress, Graeme#4 and GWPF

Godzilla Image by seanselbie from Pixabay

Tesla Image by Tumisu from Pixabay

9.9 out of 10 based on 107 ratings

9.1 out of 10 based on 11 ratings

7.9 out of 10 based on 24 ratings

8.3 out of 10 based on 18 ratings

Marketing fantasies from the Boom Times of Wind. Who were they kidding? | Siemens Gamesa By Jo Nova

It’s dire. After suffering a 36% fall in June due to unexpectedly bad maintenance bills, Siemens Energy has lost another 37% on Thursday as it revealed orders and revenue would be even lower than the current subdued expectations. The share that sold for 24 euro in May is now selling for 7.

Things are so bad Olaf Scholz, Chancellor of Germany has even said Siemens Energy is “very important”. Apparently talks are “intensive”, which presumably means the company is on death’s door and the German government is being asked to help save it.

And so we arrive at a point where a company selling products that depend on government subsidies is now asking to be subsidized itself. And the whole green industry depended on government pumped “science” and artificially low interest rates to exist in the first place. Like a pyramid scheme skiing on a two ponzi scams, sooner or later it has to collapse.

Tyler Durden, ZeroHedge

Siemens Energy shares in Germany crashed on Thursday after the company warned its wind turbine business is grappling with quality issues and offshore ramp-up challenges. The company said it’s evaluating various measures to strengthen its balance sheet and is discussing state guarantees with the German government. This comes as a financial crisis in offshore wind energy is brewing.

The word is Siemens Energy is asking for up to 15 billion euros in guarantees.

UPDATE: Siemens Energy is a spin off from the larger separate giant Siemens which has a market cap of 100b Euro and 300,000 employees. The smaller energy division has 90,000 employees and a market cap of only 7b Euro now, but it was 30b a few years ago. Siemens still owns 25% of the spin off energy division.

The whole wind industry is down

Even the Guardian is asking if something is is wrong in the whole wind industry, albeit only as means of paving the way to ask for bigger subsidies.

The windmill business has not recovered from the Siemen’s June shock that bigger turbines was not always better, and ominously something was wrong which would cost an obscene amount to fix. It didn’t bode well that the problem was narrowed down to either the rotor, the bearings “or the design”– which covered pretty much everything. By August Siemens Energy announced a jaw dropping annual loss of €4.5 billion.

Confidence is gone. In July the Swedish energy giant Vattenfall stopped work on the offshore wind farm plans off Norfolk. In August the Danish wind firm Ørsted lost 25% after it revealed it may have to write off ” the value of its US portfolio by nearly £2bn.” The share market was so skittish it wiped off nearly £7bn in value that week. Overall the Ørsted share price has dropped by two-thirds from its peak in early 2021.

The latest headlines on Orsted, say it all:

A week ago Deutsche Bank “slashed its 12-month share price forecast for Danish energy giant Ørsted by 36%, citing supplier delays, lower tax credits and rising rates.” — CNBC

Things haven’t exactly been good for Vestas either:

Vestas is also down 30% this year.

Despite massive subsidies, bountiful good intentions and Draconian regulations on fossil fuel competitors green energy doesn’t work and Net Zero is pure fantasy.

This is the rotor of the newest, largest offshore Siemens SG 14MW . Look how big these machines are.

It will theoretically end up propped up on a stalk 140 meters high over the ocean waves, or something like that. The blades are 115m long. Imagine fixing it.

h/t StJohnofGrafton

10 out of 10 based on 102 ratings

9.1 out of 10 based on 15 ratings

|

JoNova A science presenter, writer, speaker & former TV host; author of The Skeptic's Handbook (over 200,000 copies distributed & available in 15 languages).

Jo appreciates your support to help her keep doing what she does. This blog is funded by donations. Thanks!

Follow Jo's Tweets

Follow Jo's Tweets To report "lost" comments or defamatory and offensive remarks, email the moderators at: support.jonova AT proton.me

Statistics

The nerds have the numbers on precious metals investments on the ASX

|

Recent Comments