|

|

||||

|

Image by Manuel Angel Egea Only 18 months ago the Australian government gave $14 million dollars to Andrew “Twiggy” Forrest to figure out if his team could build a 500MW electrolyser to make hydrogen gas on an island near Brisbane. It was going to be a glorious Australian green-techno future, the largest hydrogen plant in the world, but it’s missed three deadlines in the last three months to greenlight the project. Instead the Australian company is going overseas. As Nick Cater points out this part of the made-in-Australia renewable superpower is going to be made-in-Arizona because they still have cheap electricity — a miraculous 7.5c a kilowatt hour! Australia’s manufacturing decline is a story of broken promises and failed industry welfare programsBowen described the project’s success as “critical” to Australia’s ambition to be a green energy superpower. It turns out abundant sun was not such a competitive advantage in the manufacture of green hydrogen. Low taxes, fiscally responsible government and cheap and reliable carbon-free energy are far more appealing drawcards for investors. The future is already being built in Buckeye, Arizona, where Fortescue is investing $US500m ($765m) in a green hydrogen plant it says will be up and running by 2026. In 2023, manufacturing in Arizona grew faster than in any other state. It includes energy and water-intensive industries such as silicon chip manufacturing, with Arizona coming from nowhere to fourth place among US states. ..It isn’t hard to work out why. Arizona’s top state income tax rate is 2.98 per cent. … For energy-hungry industries such as hydrogen and the IT sector, however, the biggest attraction is the industrial electricity price: 7.47 cents a kWh in Arizona compared to 18 cents in California. Our electricity prices are twice as high as any hydrogen industry could bearWe are so far out of the running. Last month the boss of Fortescue Energy said he was hoping our prices would fall (by half!), and cites Norway as an example of “cheap renewable energy” as if we could emulate that. It’s a bit rich given that the only renewable energy Norway uses is hydropower (96%). Norway has 31GW of hydropower while we have 4GW and can’t even tack on a 2GW pumped hydro dessert. To put it bluntly, Norway has a thousand fjords and a half million lakes and Australia has no fjords and about fifty salt lakes. Fortescue says hydrogen hopes rest on a halving of power pricesBy Peter Kerr, Australian Financial Review, March 11 2024 Mr Hutchinson [Fortescue Energy boss] told The Australian Financial Review Business Summit that high power prices were the main impediment at Gibson Island. “We’ve been working very, very hard on it,” he said. “But it’s tough based on the current power prices when we’re looking at competing globally. It’s a tough decision. The company expects to approve a green hydrogen project in Norway this year which would be powered by carbon-free hydroelectricity. “If you look around the world where you can get cheap renewable power, competitive renewable power is below $US30 a megawatt hour,” he said.

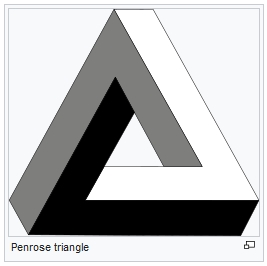

Once upon a time, Australia had electricity so cheap no one would have bought hydrogen. Now electricity is so expensive, hydrogen might be competitive, except no one can afford to make it. Like the Penrose impossible triangle, just keep going left and it never makes sense. REFERENCE AER quarterly wholesale electricity prices 1999- 2023 By Jo Nova Remember when Ford was just losing $38,000 on every EV? Those were the good daysThe biggest star in the automotive world at the moment is a black hole, and it’s swallowing whole industrial giants. It’s hard to imagine a faster way to sabotage whole nations than to disguise your spies as academics and environmentalists. Then get them to convince the government to command a whole new market into existence in a highly technological field with the wave of a legislated wand. These numbers are astronomical: Ford just reported a massive loss on every electric vehicle it soldBy Chris Isodore, CNN: Ford’s electric vehicle unit reported that losses soared in the first quarter to $1.3 billion, or $132,000 for each of the 10,000 vehicles it sold in the first three months of the year, helping to drag down earnings for the company overall. Ford, like most automakers, has announced plans to shift from traditional gas-powered vehicles to EVs in coming years. But it is the only traditional automaker to break out results of its retail EV sales.

The EV unit at Ford sold 10,000 cars in the first quarter this year, which is 20% fewer cars than they did a year ago. It’s that bad. In fact it’s worse. Those cars were also discounted. So the revenue mostly went beyond the event horizon — and fell an astonishing 84%. Ford is expecting losses in the order of $5 billion for the full year. Their aims now are so low, they just hope one day to sell the cars for enough to cover the cost of making them, perhaps. They can’t hope to cover the millions spent on R&D in the foreseeable future. Indeed, even covering the costs in a market with a price war is said to be “very difficult”. Meanwhile, two days earlier the IEA chief said the EV revolution was rolling on just fine:CNN readers must be confused. The electric car revolution is on track, says IEA[CNN] Global electric vehicle sales are set to rise by more than a fifth to reach 17 million this year, powered by drivers in China, according to the International Energy Agency. In a report Tuesday, the IEA projected that “surging demand” for EVs over the next decade was set “to remake the global auto industry and significantly reduce oil consumption for road transport.” So the global EV market is being powered by “drivers in China”, like these drivers perhaps who left their brand new EV’s rotting in fields in China. That would be imaginary drivers? The propaganda never ends. As Stephen Wilmot said in The Wall Street Journal last year, if Ford just canned the EV unit, its adjusted operating profit would be 50% higher. Surely that beckons… Hat tip to Marc Morano @ClimateDepot

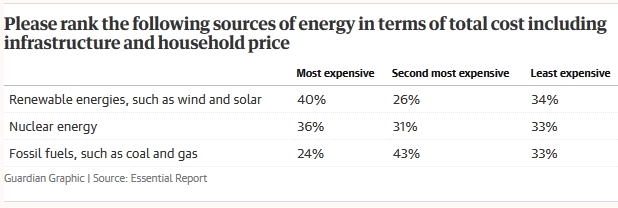

The sore losers of the renewable-fantasy hope you don’t expect them to apologizeWe are at the beginning of the big-flip. The activist pundits are suddenly realizing that renewables aren’t cheap and worse, that the public know it. Without blinking, they’re switching from telling us how cheap renewables are to saying of course, it’s going to be difficult, like everyone knows this and they haven’t been completely wrong for twenty years and wasted trillions of dollars. They hope of course to erase the past, skip the apology, and slide the public straight into acceptance — that the transition will cost more, of course. Take Peter Lewis, of Essential Polling. He writes snidely in The Guardian: Here’s the truth: energy transition is hard. Not everyone gets a ponyThe climate crisis has long been defined by its lies: From the original sin of science denial, to Tony Abbott’s confected carbon tax panic, to the latest yellowcake straw man. But the most damaging porky of all might be that the transition to renewable energy will be easy. Did you see what he did there? He blamed and named conservatives and then pretends they were the ones selling the lie that the transition would be easy? It’s writing like this that makes The Guardian the tabloid trash can of history. The most damaging porky may well be that wind and solar would be cheap, but it was a progressive fantasy and Mr Lewis himself was practically on the sales team. Pity he doesn’t have the honesty to admit it. Here’s the same Peter Lewis in 2017 — smug, wrong, and condescending to the end Clean energy is plummeting in cost, and the smart technology solutions that will make it work are proving themselves. The coal club can huff and puff but it’s too late to blow the renewable house down. The new reformed Peter Lewis now says the transition is “hugely disruptive”: Both gloss over the hard truth that fundamentally changing the way Australia produces, shares and uses energy is hugely disruptive, particularly in the regions where new infrastructure is earmarked for land and sea. Given Peter Lewis’s childishly patronizing attitude, and dishonesty, we have to wonder how biased are those “Essential Polls”? The reason he’s flipped is that the latest polls show most people don’t believe renewables are cheap anymore: And, as this week’s Guardian Essential Report shows, one of the fundamental building blocks driving this narrative is unstable: people don’t believe renewables are cheaper. When asked to rank energy sources in order of cost, renewables are rated the most expensive. Fossil fuels are seen as a cheaper solution, while nuclear is preferred by those who don’t support the transition anyway. Back in 2015 fully 47% of the voters, or almost half, thought renewables were the cheapest source of electricity, but that’s fallen to 34%. In 2015 only 20% of people thought fossil fuels were cheaper. Now 33% do. And 40% say renewables are the most expensive of all. Things are shifting fast — last October 28% of Australians thought fossil fuels were the most expensive, but six months later, that has fallen to 24%. So get ready to hear them say “we always knew it would be expensive”. It’s coming. They’re going to want to stuff “renewables are cheap” down the memory hole. Never let them forget. We need those grovelling apologies, and with letters of resignation. h.t to Ben Beatty @EnergyWrapAU

The system is reaching a crisis point and April is turning out to be the month of confessionsHis speech was the sound of an industry being tortured. The transition is going backwards. Big projects are stalled. Costs are rising and reliable old assets are being closed too quickly. It’s like we are disassembling the plane as we fly it… A couple of weeks ago in Australia the chief of Alinta Energy admitted in a big speech that the industry needs to be honest with the public about the costs of the transition. This marks a big shift from the “cheaper and cleaner” misinformation which the renewables industry was practically built on. Jeff Dimery had a stark warning — his company bought a large old coal plant in Victoria for a billion dollars in 2018, and it powers one fifth of Victoria. But to replace that today with renewables would cost $10 billion. But he also laid bare the crushing effect subsidized rooftop solar PV panels are having on the transition. No news outlets seemed to appreciate the implications of this. Fully one in three Australian homes now has solar panels, but they are all dumping power on the grid at the same time pushing wholesale prices into negative territory that burns the other generators. The midday solar glut, as he calls it, means no one wanted to invest in large scale renewables. But as night follows day, surely that which ruins the market for large scale renewables would also ruin it for large scale fossil fuel plants too? The subsidized solar panels are vandalizing the whole market. Skeptics who have been predicting this all along, note that the same people who cheered every time a coal plant was struck down are now wading through an impenetrable swamp of their own creation. The same subsidies that hurt coal and gas power, now wipe out the large (subsized) wind and solar plants too. It’s takes some chutzpah to complain about solar subsidies ruining the market for other generators which are also subsidized. Someone let a plague of solar-locusts on our grid. They eat the profits out of all the reliable providers, which close down. We are actively sabotaging the entire grid — killing off the parts that made it work. Australians to pay more for their energy as transition accelerates, Alinta Energy saysBy Colin Packham, The Australian Australians face higher bills as the country struggles to build adequate replacements for coal with soaring costs for new sources of green power and transmission, Alinta Energy chief executive Jeff Dimery has warned. The stark comments, described by the energy boss as “truths and straight talking” comes amid growing concern about the toll of Australia’s energy transition. Mr Dimery said Australian energy stakeholders must be honest with the public about the toll of the transition. Mr Dimery complains he can’t build anything profitable at $58 a megawatt hour. “When I sat down to write this speech, the future Victorian energy price for the 2026 calendar year was $58 a megawatt hour,” said Mr Dimery. “At $58, I can’t build anything to meaningfully prepare for coal to come out of the system. I can’t build more solar, because we already have a glut of solar in the middle of the day, which is sending spot prices deeply negative. If I was just looking at the forward price, I would also be very wary about building new wind, because the margins would be slim to non-existent, and any curtailment – which is a growing problem – could be disastrous.” If only the energy commentators of Australia could read the same AEMO reports that unpaid bloggers do? Then they’d know that this time last year old brown coal plants were still selling electricity for $15 a megawatt-hour. But Mr Dimery probably knows this, since he owns one of those coal plants, and he didn’t mention it either. (Perhaps he believes in the transition, or perhaps the Hong Kong owners of Alinta might not appreciate that?). He’s being more honest than the other energy chiefs, but Australians need the whole truth. Just what are we giving up by blowing up the old coal plants?

The renewables transition was like a gold rush, but quickly projects started to fail… as Big Government plans do:11 minutes: I also want to explain what’s caused the drop in investment for large scale renewables. … In the last 5 years the top three gentailers [combined generator-retailers] in this country have collectively written off in excess of $10 billion of shareholder funds. There’s a race to Net Zero but it’s supposed to be for emissions not for profit. In the early era of renewables Australia had the perfect investment climate for wind solar and pumped Hydro. It could have been seen as the gold rush for renewable generation and certainly we saw no shortage of companies trying to get a piece of the action, but very quickly projects started to fail, loss factors increased and investment cases started to crumble. With a lack of planning and proper infrastructure we quickly found the grid overwhelmed… Costs are rising rapidly: 15 minutes: Let me tell you why higher cost and uncertainty about recovering those costs that’s why in 2017 Alinta energy developed and built the first big battery in Australia for around $1.5 million per megawatt. Right now we’re building another one that will cost roughly $1.7 million per megawatt . In 2020 it cost around $850,000 to insure a gas fired power plant. Today it’s around $1.75 million — that’s up 40%. I shocked people when I spoke at a conference two years ago and said that it would cost $8 billion to hypothetically replace our Brown Coal fired power station which was acquired for $1.1 billion. Replacing it with pumped hydro and offshore wind today would now cost in excess of $10 billion. That’s up two billion in a mere two years. Developers rightly are afraid to lock in high costs in case they can’t be recovered. The Alinta chief admits his biggest problem is the glut of solar panels at middayEverything he says about the problems with massive solar input at lunchtime is true for all the original baseload generators on the grid too. In full honesty he would admit coal plants were not retired because solar and wind were cheap, they were driven out of the market by the subsidy on an essentially irrelevant unreliable form of extra generation that always turned up when we didn’t need it: 18 mins: Without the deployment of new private capital, state and Commonwealth balance sheets simply cannot carry the financial burden we have a glut of daytime rooftop solar energy at the same time that 95%of all large scale renewables are getting curtailed — basically switched Off in some hours of high rooftop solar. The percentage of all energy produced by large scale renewables that was curtailed increased from 10% in the last quarter of 2022 to 13% in the last quarter of 2023. Now you might think 3%, who cares? Well boards care, investors care, and developers care. No one wants to lose 13% of their output and no one dares think just how much more could be lost that could be the difference between profitable and unprofitable. In short, ladies and gentlemen, continued subsidies at one end of the market are driving higher uptake into a glut and undermining the economics of new and existing large scale renewables.

But let’s be real eh? We were happy to destroy the profitability of the old coal plants and the gas plants that taxpayers built, which is what all the subsidized intermittent players did. We’re only complaining now, Mr Dimery, because we care about “renewable” profits.

The solution to the solar panel glut is battery storage (What did I say? One reason for the EV mandate is so they can make you buy the backup battery to store the useless intermittent watts in?) Dimery doesn’t want to offend 3 million solar panel owners, but he is quietly saying “they must pay”: I know how much households love their solar and how important solar is to the transition, but as with any of the intermittent technologies on its own it has pluses and minuses. … the daytime production from rooftop solar needs to be stored and shifted to when it’s required. We’ll need household batteries but they’ll fill up quickly. We’ll need big batteries, and they’ll also fill up quickly too. EV’s will take time to build up to critical mass and for vehicle-to-home and vehicle-to-grid models to alleviate some of the imbalances of homeowners dominating solar and battery installations. We’re exploring other options too like inviting retail customers to be co-investors in wind farms and giving them a portion of the output offset against their bill as well as providing better insights about their appliances via itemized bills that show what’s being spent on heating and cooling and refrigeration. It’s a solar death spiralHe points out that solar PV owners themselves don’t care about the negative wholesale prices at lunchtime (but in a real market they would). Rooftop solar is contributing to low energy prices at various times in daylight hours but it isn’t affected by price signals in the same way large scale generators are. It’s a problem we need to solve. So we subsidize lunchtime solar we don’t need, which makes electricity more expensive for those without solar. Eventually everyone feels they have to buy solar panels, but at the same time the solar glut is driving out the generators we need the other 75% of the day. This is a spiral that only goes down. The end is coming. The subsidy game can’t go on forever. We need to put real prices on solar panels now, and if that stops all new solar being installed (except in remote locations) so be it. Then we then need to rejig the billing system so those who installed the panels aren’t being subsidized by those who couldn’t afford them. It will take years to unravel this mess. The land of truth is arriving at the magic renewable tree. Keep reading → Lest We Forget. By Jo Nova The term “Net Zero” has become a dirty wordIt’s a win. The climate wars will rage on, but the Net Zero spell isn’t working any more, so they will have to find a newer one without such a smell. The sacred propaganda term that was going to save all life on Earth until five minutes ago is more than just a worn out advertising slogan, the skeptics campaign against it has made it a toxic term. Like ESG, it’s become a liability. The people know “Net Zero” is not just a fluffy footprint on a forest, but an attack on their wallet and their lifestyle. It’s a great credit to GWPF and NetZeroWatch in the UK for turning this phrase back against the infinitely well funded financial-house-and-government-alliance. Net zero has become unhelpful slogan, says outgoing head of UK climate watchdogThe Guardian (of the ruling class) The concept of “net zero” has become a political slogan used to start a “dangerous” culture war over the climate, and may be better dropped, the outgoing head of the UK’s climate watchdog has warned. “Net zero has definitely become a slogan that I feel occasionally is now unhelpful, because it’s so associated with the campaigns against it,” he said. “That wasn’t something I expected.” Politicians on all sides are now wary of associating themselves with the term, he said, which was inhibiting progress. The scare stories worked. Look at the backpedaling on meat and flying: Tackling the climate crisis has been presented as a massive change, but Stark was at pains to point out that it would not be. “The world that we’ll have in 2050 is extremely similar to the one we have now. We will still be flying, we’ll still be eating meat, we will still be warming our homes, just heating them differently,” he said. “The lifestyle change that goes with this is not enormous at all.” Now they are trying to tell us it will be easy to change the weather? This is part of the big backdown we’ve seen in so many theatres. First ESG became a dirty word, now “Net Zero” is too. Money is fleeing from “sustainable investments”. EV’s are on the nose. It’s the end of an era that started (as best as I can tell) around 2015 and the Paris agreement and has been hammered for the last five years. But make no mistake, the freeloading barnacles of bureaucracy and banking will transmogrify, and they will hide their intent a little more carefully. In Australia, after the Carbon Tax became a dirty term (when Tony Abbott won in a landslide) the tax returned under many guises, but it was never called a Carbon Tax again. Among many names, it became The SafeGuard Mechanism, where an emissions trading scheme was legislated unbenownst to nearly everyone. Now they want to impose a fossil fuel tax. They are barely hiding it. After years of failure at UN junkets to set up international emission trading schemes, which also got themselves a bad name, the EU has set up a Carbon Border Adjustment Mechanism. These carbon tariffs will take money from foreign countries to make their own emissions trading scheme workable. And just like all the other taxes, the media sycophants tell us we will “prosper” with an international carbon price. (Just as soon as we figure out how to smelt steel with solar panels.) Long live Elon Musk In the Bermuda Triangle of electricity bills, the more cheap generators you add, the higher your electricity bills grow The experts at the CSIRO tell us that renewables are the cheapest sources of electricity, with all their Capex calculations and their levelised maths, and yet the electricity bills set the house on fire. (It’s Russia’s fault!) Could it be that the experts accidentally forgot to analyze the system cost and that all the hourly megawatt dollars per machine don’t mean a thing? In the race to the most expensive electricity in the world, this week the UK is the winner. Germany is handicapped by being bundled into the EU27, lumbered with all the French nukes and is therefore not in the running. Australia is missing in action, but possibly only because the price rises were too fast and too much for the Eurostat, the US DoE, and IEA to keep up with, so they gave up. And people wonder why China is the world’s manufacturing base. In the next graph is the “rest of the world”. After 2021 Australian electricity prices are unmarked for some reason, but officially they rose 20% two years in a row. So that cost of €210 per MWh in 2021 could easily have become €300 by 2023, putting Australians second highest in the world after the UK.* The bottom line is that from 2008 the price of electricity in China fell from €100 down to €80 per megawatt hour. While in Australia it rose from €125 to €300 and in the UK prices rose from €150 to €360. Effectively, the price of electricity fell 20% in China at the same time as it rose 240% in Australia and the UK. If President Xi had wanted to run a campaign to sabotage our grids, he couldn’t have done it better. By uncanny coincidence the percentage of wind and solar power penetration on each national grid pretty much predicts the order of the price graphs the EU collated. Among this pool, the nation with the highest penetration of wind and solar power is the UK which gets 29% of its electricity from wind and solar power. Australia is second at 26%, and the EU collective third at 22%. Turkey and Brazil get 16% of their power from the unreliable generators, the USA got 15%, China 14%, Japan 11%, India 9% and Russia 1%. Japan’s electricity is more expensive than its modest unreliable-generator-percentage would suggest, but then they have virtually no oil, gas or coal to call their own, and no interconnectors to rescue them either. Is 20% renewables the tipping point?The three winners of the Highest Price Electricity race are all states with renewable penetration above 20%. The whole grid can absorb the penetration of unreliable energy up to a point, but there comes a time when adding more random energy generators is a burden too far. The system costs start to breed like Ebola, as the good generators get euthanized, storage costs get out of hand, frequency stability becomes an issue, and everyone wants their own personal interconnector. Then word spreads that the bird killing, bat destroying and whale shredding equipment is noisy, ugly and a fire risk, and before you know it, farmers need 100 times the money to make the high voltage towers bearable. It all just adds to the cost. And finally everyone realizes that the environment you were supposed to be protecting is being clubbed by a windmill, and Florence the borer is stuck in tunnel. Smaller grids or countries without interconnectors will hit that tipping point faster. Watch this space, world. There is no nation over the border to rescue the Australian grid. * Estimating the unlisted Australian price leap: the ACCC here found domestic retail bills jumped from $1400 annually to $2000 in NSW, and $1200 to $1600 in Victoria. (p66). In Australia the retail electricity rates now roughly average 33c per kilowatt hour, with a range of 26-45c/KWh (AUD). But that useage cost doesn’t include all the charges. As Craig Kelly points out the €250/MWh European rate is effectively 25 euro-¢/kWh. But the official “Default offer” in South Australia is $0.68 kWh (or 41 euro-¢/KWh). In NSW it is $0.53 – $0.56 kWH (32-34 euro-¢) and in Queensland it is $0.50 kWH (30 euro-¢). So Australia really is more expensive than the crazy-land EU. And while traditionally few customers paid the “default offer”, in 2023 as many as 40% of customers on flat rate plans were paying that rate, according to the ACCC (p47). h/t to Schroder, thank you, and @CraigKellyPHON.

REFERENCESEuropean Commission, Directorate-General for Energy, Smith, M., Jagtenberg, H., Lam, L. et al., Study on energy prices and costs – Evaluating impacts on households and industry – 2023 edition, Publications Office of the European Union, 2024, https://data.europa.eu/doi/10.2833/782494 Or https://op.europa.eu/en/publication-detail/-/publication/3b43f47c-e1c5-11ee-8b2b-01aa75ed71a1/language-en/format-PDF/source-316287713 Inquiry into the National Electricity Market: December 2023 Report, ACCC, Australia, December 2023.

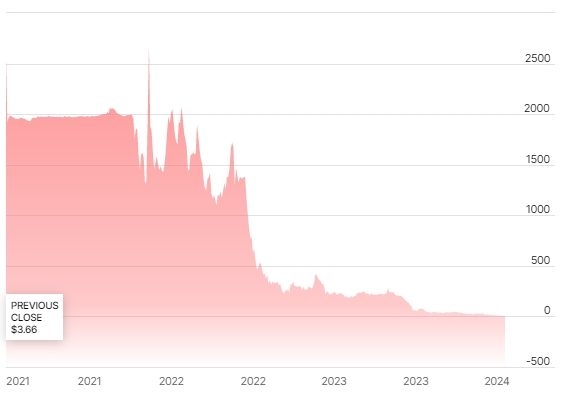

It’s just another signpost on the way to the Great Green Economy DownunderWe’re watching the renewable bubble pop around us. Tritium was the wonder-child Australian technology business that built fast chargers for electric vehicles. It took 20 years to create, and only two years to unravel into receivership. At its peak in 2021, it launched on the NASDAQ and was worth $2 billion, now it is insolvent. The Driven, explains just how big it was: The company says it has sold more than 13,000 DC fast chargers in more than 40 countries. At its peak it claimed to be the biggest maker of fast chargers in the US with a 30 per cent market share (unclear if this included the Tesla network), and a 75 per cent share in Australia, and one of the top three in Europe. When it launched in 2021, shares were selling for $2,500 each. The current price is $1.35.  Tritium Share Price. NASDAQ Tritium is the perfect emblem for the Technocratic Planned EconomyOnly one year ago the Prime Minister of Australia was raving about them, and using Tritium as the posterchild to sell his new $15 billion “National Reconstruction Fund” to “build sovereign capability”. During his visit, the Prime Minister said, “This is my third visit to Tritium. Every time I come back, I hear about more revenue, more jobs being created, and more countries where Australia is exporting to. This is a great success story here and I congratulate everyone at Tritium for their achievements.” Nick Bonyhady and Tom Rabe at The Australian Financial Review point at energy prices: A Nasdaq-listed electric vehicle fast-charger company hailed first as a Queensland success story and then as a justification for government subsidies is the second major Australian manufacturer to collapse this week. Tritium’s demise comes just days after Australia’s largest plastics producer, Qenos, was placed into administration, and as an industry chief warns that rising east coast gas prices will continue to threaten a range of domestic manufacturing across the country. In 2021 Australia was the world’s largest exporter of LNG but in a quest for climate purity we’ve banned so many exploration sites, and pursued so many stupid energy options we are about to start importing gas. ” Gas industry leaders have labelled “bizarre” and unbelievable the likelihood that Australia could soon start importing gas.” Daniel Mercer, ABC Peter Tinley [MP] said it made no sense for states to ban the practice of fracking to develop onshore gas reserves while also allowing the import of offshore supplies that were exploited using the same method. Victoria has banned fracking through legislation since 2017. “I find it ironic that some jurisdictions ban fracking, for example, but will eventually be importing fracked gas,” Mr Tinley told the Australian Domestic Gas Outlook conference in Sydney. “How do you correlate that? h/t CO2 Lover, Old Ozzie, David Maddison. Image by Reto Scheiwiller from Pixabay For readers in Perth: David Archibald, long time skeptic and author will be speaking tomorrow.

Topic: “Building Australia’s Defence”

Sunday 21st April at 2.30pm to 4.30pm

David Archibald is the author of: Twilight of Abundance, Australia’s Defence 2016 and Beyond, and American Gripen; The Solution to the F35 Nightmare.

APIWA Club Room, Rear 10 Mallard Way, Cannington, 6107

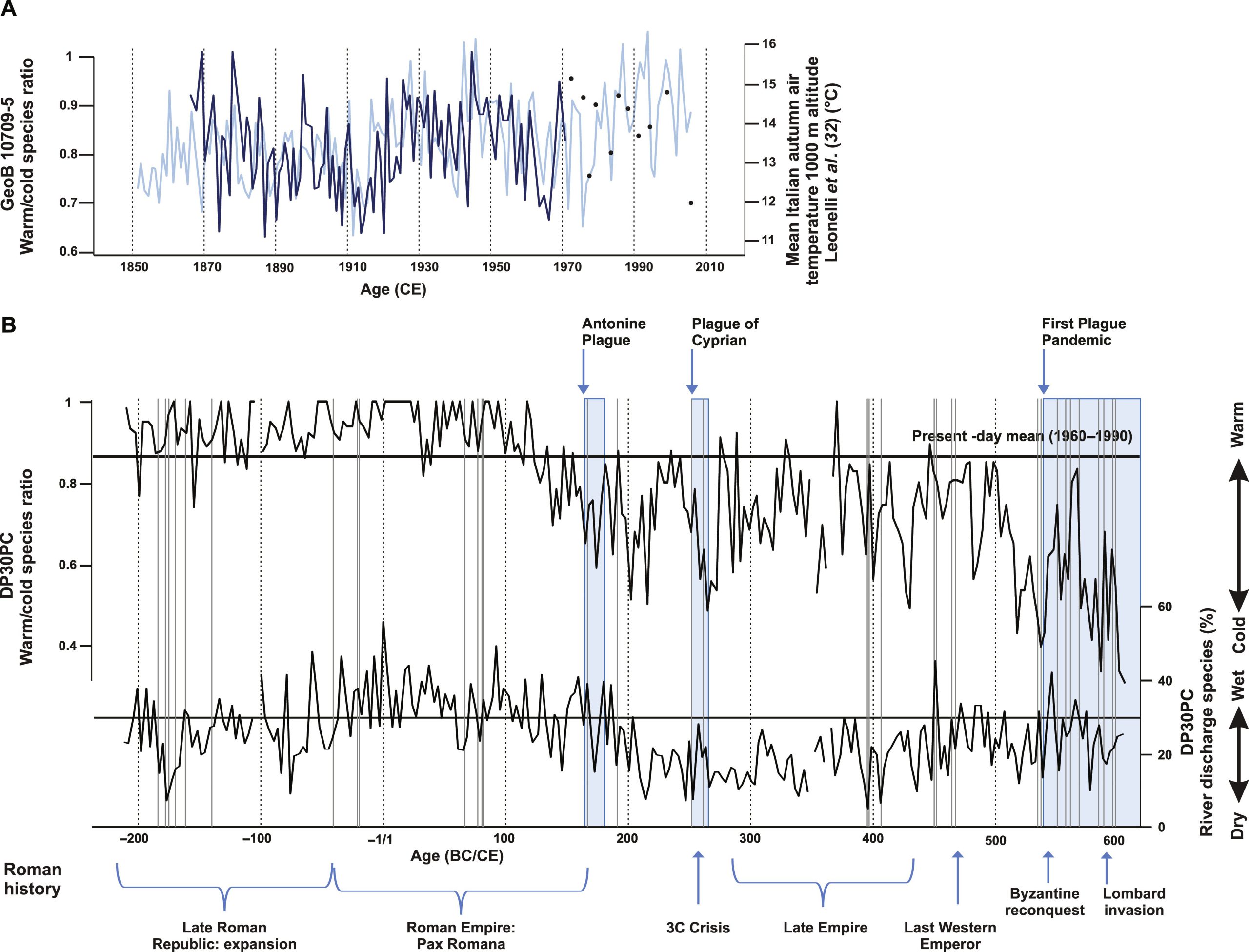

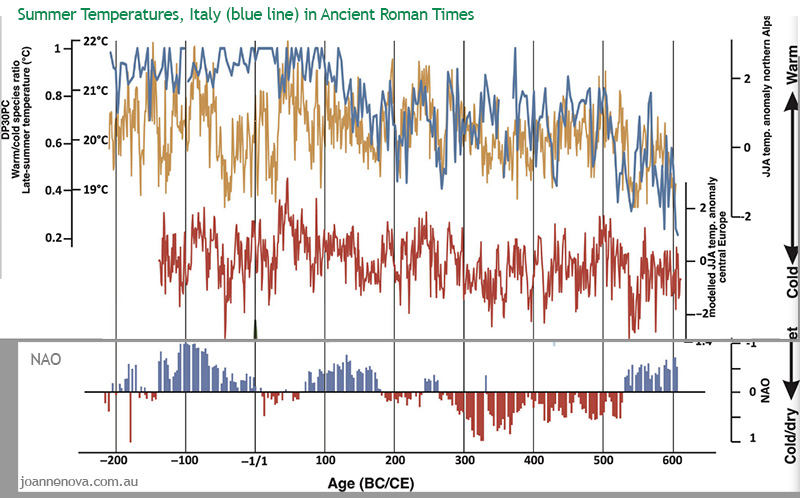

The Roman Climate Optimum livesQuietly hidden in a paper about ancient pandemics is the most detailed estimate of Roman temperatures I’ve ever seen. For 800 years temperatures gyrated over a three degree range. The Climate Alarmists of Rome could have run the whole warming-cooling-warming-scare back to back for 400 years. But make no mistake, the good times, Pax Romana — were the warmest and wettest ones. The colder times are associated with aridity, plagues and collapse. Two thousand years ago plankton bloomed and died, and the different ratios of warm and cool species left thick layers on the ocean floor just off the heel of the boot of Italy. Every ten years another centimeter thick layer of dead dinocysts collected on the sea floor, which makes for a remarkably detailed record. They report a jaw dropping “three year resolution”. The record was so rich they could pick out the seasons, and wow, by golly, they could compare it with modern air temperatures. (See graph A below) Though, for some reason they don’t make that easy, or say much about how those ancient temperatures compare to today. (Presumably, if they found things were hotter today, they’d have got a Nobel Prize.) Cold times don’t guarantee a pandemic, but warm times do seem to discourage them: Despite the expert predictions of doom in hot weather, the ancient Roman records don’t suggest mass outbreaks of malaria, flesh eating bugs, or viral pandemics. Note the words “Present Day mean (1960-1990)” on the horizontal line on Graph B… it was hotter for 200 years in a row.  Fig 2A: (Click to enlarge) (A) Comparison between late-summer/autumn dinoflagellate cyst–based W/C ratio (black line + black points) of core GeoB 10709-5 and mean autumn Italian temperatures at 1000-m altitude (blue line). (B) Late-summer/autumn dinoflagellate cyst–based W/C ratio and relative abundance of discharge species (nutrient sensitive) reconstructions (black lines) and the occurrence of epidemics and pandemics in the Roman empire (blue blocks) as well as disease outbreaks in Roman Italy (gray lines) and major historical periods/events. In the paper Graph B is strangely truncated at the hottest points as if their printer jets got clogged. Perhaps the heat broke some climate models? Just how hot was that spike in the era of Jesus? I’d like to get that data… The plaguesThe Antonine Plague, from about 165 to 180 AD was probably smallpox, no one is sure what the Plague of Cyprian was, from about 215 to 266 AD; it might have been measles, smallpox, or some relative of Ebola. At it’s worst 5,000 people a day were said to be dying in Rome. In Alexandria one historian estimates the population fell from half a million people to just 200,000. The Plague of Justinian was a form of Black Plague. It started from about 541 to 549AD, and they say rather somberly, lasted on and off until C.E. 766. Long live hygiene and antibiotics, eh? The researchers can only speculate about why the pandemics spread more often in the cold. They don’t mention the word vitamin. But the first thing I would suggest is vitamin D3 — levels of which probably fall the minute people get out of their Toga’s and pull on their jackets. The Antonine Plague of 165 A.D. — SmallpoxIf you want to feel lucky, read Edward Watts description in The Smithsonian of what life was like in 165 AD: Victims were known to endure fever, chills, upset stomach and diarrhea that turned from red to black over the course of a week. They also developed horrible black pocks over their bodies, both inside and out, that scabbed over and left disfiguring scars. For the worst afflicted, it was not uncommon that they would cough up or excrete scabs that had formed inside their body. Victims suffered in this way for two or even three weeks before the illness finally abated. Perhaps 10 percent of 75 million people living in the Roman Empire never recovered. The plague waxed and waned for a generation, peaking in the year 189 when a witness recalled that 2,000 people died per day in the crowded city of Rome. Smallpox devastated much of Roman society. The plague so ravaged the empire’s professional armies that offensives were called off. And when communities began to buckle, Romans reinforced them. Emperor Marcus Aurelius responded to the deaths of so many soldiers by recruiting slaves and gladiators to the legions. He filled the abandoned farmsteads and depopulated cities by inviting migrants from outside the empire to settle within its boundaries. Apparently things were so bad that in some cities so many aristocrats died they even filled the councils with “the sons of freed slaves”. The temperatures from graph B above are marked in the figure below (just in case you don’t relate to phytoplankton ratios).  Core DP30PC and paleoclimatic records. Dark blue: Gulf of Taranto, late-summer temperature reconstruction based on dinoflagellate cyst composition (this study); orange: Northern Alps, June to August dendrochronological-based temperature reconstruction (3); red: proxy-based central European, June to August (JJA) temperature reconstruction (33) The currents flow right down the side of Italy before depositing some phytoplankton in the Gulf of Taranto where the samples were collected.. For the record, here’s how they describe the calibration: The calibration of our dinoflagellate cyst–based temperature proxy is based on the comparison of the cyst association of a reference dataset from multicore core GeoB 10709-5 (29) to mean Italian late-summer/autumn air temperatures (32). For some reason the researchers have this magnificent temperature record, and they calibrate it with modern temperatures but said nothing at all about how the Roman Optimum compared to the 21st Century. Luckily, we already know from other studies it was hotter back then. Must have been all those Roman coal plants?

h/t Judith Curry and Tom Nelson REFERENCEK. A. F.Zonneveld et al (2024). Climate change, society, and pandemic disease in Roman Italy between 200 BCE and 600 CE Physics Today 77 (4), 17–18 (2024); https://doi.org/10.1126/sciadv.adk1033 Margaritelli, G., Cacho, I., Català, A. et al. (2020) Persistent warm Mediterranean surface waters during the Roman period. Sci Rep 10, 10431. https://doi.org/10.1038/s41598-020-67281-2 Garcia-Solsona, E.; Pena, L. D.; Paredes, E. ; Perez-Asensio, J.N.; Quirós-Collazos, L. ; Lirer, F.; Cacho. I. (2020) “Rare Earth Elements and Nd isotopes as tracers of modern ocean circulation in the central Mediterranean Sea”. Progress in Oceanography, June. Doi:/10.1016/j.pocean.2020.102340 See also the write up in Physics Today. *Figure 2 headline altered to clarify the role of the blue line. 19/04/2024.

|

||||

|

Copyright © 2024 JoNova - All Rights Reserved |

||||

Recent Comments