It’s just another signpost on the way to the Great Green Economy Downunder

We’re watching the renewable bubble pop around us. Tritium was the wonder-child Australian technology business that built fast chargers for electric vehicles. It took 20 years to create, and only two years to unravel into receivership. At its peak in 2021, it launched on the NASDAQ and was worth $2 billion, now it is insolvent.

The Driven, explains just how big it was:

The company says it has sold more than 13,000 DC fast chargers in more than 40 countries. At its peak it claimed to be the biggest maker of fast chargers in the US with a 30 per cent market share (unclear if this included the Tesla network), and a 75 per cent share in Australia, and one of the top three in Europe.

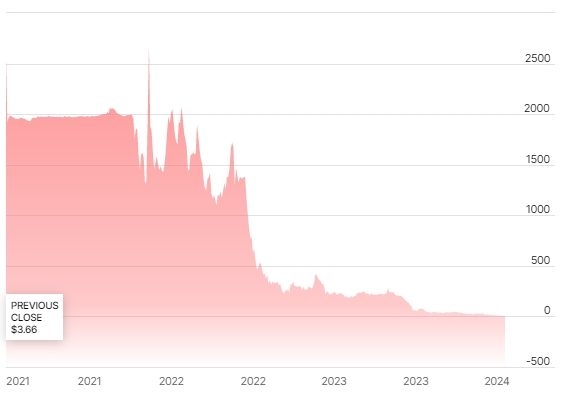

When it launched in 2021, shares were selling for $2,500 each. The current price is $1.35.

Tritium Share Price. NASDAQ

Tritium is the perfect emblem for the Technocratic Planned Economy

Only one year ago the Prime Minister of Australia was raving about them, and using Tritium as the posterchild to sell his new $15 billion “National Reconstruction Fund” to “build sovereign capability”.

During his visit, the Prime Minister said, “This is my third visit to Tritium. Every time I come back, I hear about more revenue, more jobs being created, and more countries where Australia is exporting to. This is a great success story here and I congratulate everyone at Tritium for their achievements.”

Nick Bonyhady and Tom Rabe at The Australian Financial Review point at energy prices:

A Nasdaq-listed electric vehicle fast-charger company hailed first as a Queensland success story and then as a justification for government subsidies is the second major Australian manufacturer to collapse this week.

Tritium’s demise comes just days after Australia’s largest plastics producer, Qenos, was placed into administration, and as an industry chief warns that rising east coast gas prices will continue to threaten a range of domestic manufacturing across the country.

In 2021 Australia was the world’s largest exporter of LNG but in a quest for climate purity we’ve banned so many exploration sites, and pursued so many stupid energy options we are about to start importing gas.

” Gas industry leaders have labelled “bizarre” and unbelievable the likelihood that Australia could soon start importing gas.”

Daniel Mercer, ABC

Peter Tinley [MP] said it made no sense for states to ban the practice of fracking to develop onshore gas reserves while also allowing the import of offshore supplies that were exploited using the same method.

Victoria has banned fracking through legislation since 2017.

“I find it ironic that some jurisdictions ban fracking, for example, but will eventually be importing fracked gas,” Mr Tinley told the Australian Domestic Gas Outlook conference in Sydney. “How do you correlate that?

h/t CO2 Lover, Old Ozzie, David Maddison.

Image by Reto Scheiwiller from Pixabay