|

|

0 out of 10 based on 0 rating

… By Jo Nova

In the ecosystem of civilization, the OECD is just another batch of multinational barnacles slowing the ship down. These invertebrate filter feeders use taxpayer money to bore the taxpayers kids into submission to The Blob. They presumably hope the kids will grow up to vote for the Big Government Blob, thus boosting the river of money that flows past the barnacles.

In the end, improbably, a foreign committee is pretending it can save children in some of the wealthiest nations in the world from “misinformation”. As if the first world needs some remedial assistance teaching chemistry to their teenagers. The gargantuan arrogance of this is only surpassed by the intergalactic chutzpah. The OECD are, after all, just a bunch of economists, wiggling their finger at nations full of doctors and engineers, and telling them how to teach their kids science.

The gibberish, it grows: What is “action” in response to “climate anxiety”?

The Guardian (of course).

OECD’s Pisa program will measure the ability of students to take action in response to climate anxiety and ‘take their position and role in the global world’

In 2025, for the first time in nearly a decade, science will be the major focus of the OECD’s program for international student assessment (Pisa) – which runs every three years (give or take Covid interruptions), its focus rotating between reading, maths and science. … This year it will measure the knowledge and ability of 15-year-old students from 92 countries and economies to act on climate change, under a new heading: Agency in the Anthropocene.

The point of measuring children’s abilities is to collect statistics for the next batch of press releases the OECD want to browbeat the West with.

They say they want to teach children to “distinguish scientific evidence from misinformation” except that they don’t appear to know what scientific evidence is, or what science is either. If they did, they’d talk about the dangers of consensus and computer models, and the importance of observations.

Let’s have a small revolution in logic and reasoning instead:

Andreas Schleicher, the OECD’s director of education, describes the refreshed science framework as a “small revolution” addressing students’ capacity to distinguish scientific evidence from misinformation in the context of the “biggest challenge of our times – our environment”.

Look out, a foreign committee influenced by multinational corporate powers wants to provide a “non-political space” for your children.

Amelia Pearson, at the Monash climate change communication research hub, says there have been more “climate change dot points” added to the curriculum, but mainly in subjects such as science and geography.

“Climate change impacts every area of society and our lives,” she says. “So it’s really important that people who might not engage, particularly with [science, technology, engineering, maths], still have the opportunity to learn about these different challenges.”

Education isn’t about persuading children to think a certain way, she says, but providing a non-political space to understand the issues and make up their own minds.

Aren’t our schools supposed to be “non-political spaces”?

I say we survey the OECD instead to see if they know what science is — then cut off their funding when they fail.

The biggest threat to the world today is big-government. We need to teach children that cold weather is terrible, but big government is worse than an ice age.

Thanks to Tony Thomas, and Eric Worrall…

10 out of 10 based on 73 ratings

9.1 out of 10 based on 10 ratings

8.1 out of 10 based on 27 ratings

What’s on your Santa wish list? Best wishes to everyone wherever you are.

Thanks to all the good souls who make this blog possible.

Merry Christmas!

9.8 out of 10 based on 108 ratings

8 out of 10 based on 22 ratings

7.7 out of 10 based on 34 ratings

7.7 out of 10 based on 23 ratings

For a few days new posts will appear below this one. Thank you to everyone!

If you can help me cover the bills, I can keep exposing the false religion, the crooks, the stupid. If you can help me cover the bills, I can keep exposing the false religion, the crooks, the stupid.

We are running on the wire this year! I should have asked months ago…

By Jo Nova

It’s a dangerous moment in history across the West, but as those in the gulags of 1953 would surely have said, we still have so much to work with. Our Democracies might be unraveling, but the Oligarch are coming undone. Investors are fleeing from wind, solar and exploding EVs. Voters are tossing out bad governments. And more than half the population knows that climate science is a religion. We are the majority, but they don’t want you to know.

It’s been 16 years here on this blog, somehow, outside the system, living off goodwill and donations, debating the U.N. and trillion dollar cartels. Real freedom is writing with no corporate sponsor, and no major advertiser. There’s no billionaire publisher to toss me off, no editor to boss me around, and no committee to answer to. The government can’t take away a grant it never gave me, and the cowards of Cancel Culture can’t scare away advertisers. It’s been 16 years here on this blog, somehow, outside the system, living off goodwill and donations, debating the U.N. and trillion dollar cartels. Real freedom is writing with no corporate sponsor, and no major advertiser. There’s no billionaire publisher to toss me off, no editor to boss me around, and no committee to answer to. The government can’t take away a grant it never gave me, and the cowards of Cancel Culture can’t scare away advertisers.

I am not dependent on any institution, but I am of course, dependent on you, the reader, which is exactly how it should be. To serve the people direct, instead of serving Disney, Pfizer or the Minister of Misinformation. When no one holds the strings, everyone does.

I don’t ask for a subscription here, just any help you can spare.

That’s why Western governments across the world are trying so hard to set up rules to censor blogs and forums like this. The Australian government wanted to fine people like me $6 million dollars if I published “misinformation” and they define truth as “everything the leftist government-paid-expert says“. What they really want is to stop critics of the government and force everyone to use ID.

Thank you to everyone who cancelled subscriptions to the propaganda sheets, and sent that money to the new independent media instead.

Never surrender

Please hit the tip jar, buy me a coffee, a steak, a month on the server ($140) and money to pay the bills. Australians may prefer to use direct deposit (details below) where you can also set up a monthly donation which helps me plan ahead. Thanks for your contribution, no matter how big or small. I know times are tough for some people.

Due to ridiculous legal froufrou, Paypal donors will need to “buy” a number of “units of emergency chocolate” — (1 unit=$1) so write a number of dollars into the Quantity Field! (Apologies it’s not more user friendly). This works in AUD, CAD, EUR, GBP, NZD or USD.

OR send help directly via National Australia Bank for UnQwerty Pty Ltd BSB: 086420 Account number: 563148308 or via International transfer or even via snail-mail.

I’m setting up a GiveSendGo and a KoFi so there will be alternatives. I’ll update as soon as I can…

Merry Christmas and best wishes to everyone here.

Thank you to Troy, Lloyd, Margaret, DavidM, PGC, Spiros, JohnK, CarolineK, FrankF, LawrieA, AndrewH. Thanks to TrevorP, and of course, as always to Bryant.

Thanks also to E &LFS, to PAF, Owen, TK, DJH, Andre, Neil, DSM, Adam, Rodg, GM, VK, …

Image, thanks to ThankYouFantasyPictures from Pixabay

*Not GoFundMe

9.7 out of 10 based on 58 ratings

By Jo Nova

This will slow down the parasites

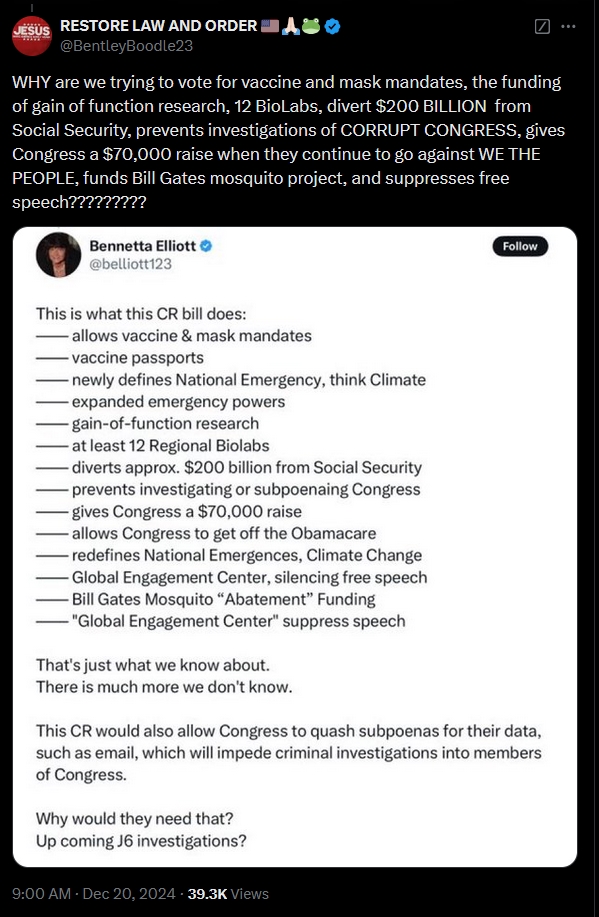

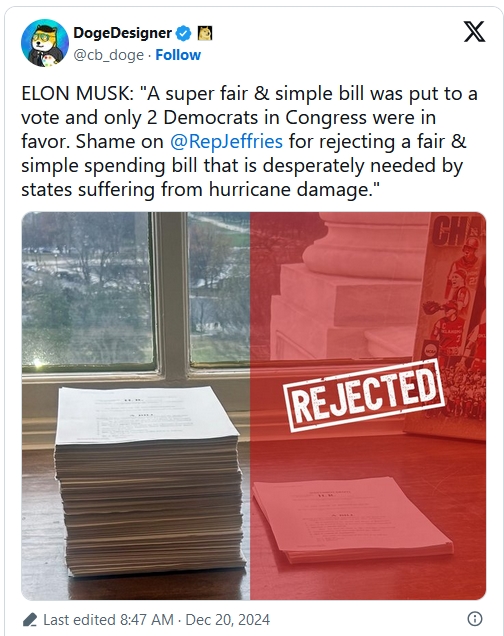

The most exciting thing I heard today was that AI was used to find all the nasty surprises secreted away in the 1,500 pages of US legislation that was being pumped through Congress in the days before Christmas. Legal aides must have spent all year stacking the deck with tricks to enrich the political class. No human could unpack the fine print overnight, but AI could. Then, free speech saved the day, the Capitol Pork was exposed when Elon Musk spread the word to his 208 million readers.

As Elon Musk says: I’m suspicious of laws that are longer than The Lord of the Rings.

No matter how corrupt you think Big-government is, it’s worse:

Posters on X exposed some of the hidden surprises which included a payrise for Congress, funding for Bill Gates mosquito games, bioweapons research, vaccine mandates and new rules to define National Emergencies like “climate change”.

How else to describe this other than rampant theft, hidden under a confected “rush” and loaded up with manipulative coercion to get it through?

As Glenn Reynolds points out: The cancer research bill was passed in March and cynically left to fester for months so that it could be used as a hostage against Republicans.

Seen on Twitter:

What is more outrageous, refusing to pass a 1,574 page monstrosity of a spending bill, or using kids with cancer as human shields by writing them into it? “We had to pass all the graft and corruption to help kids with cancer” – that was going to be their defense.

When Republicans reduced the bill to 115 pages, the Democrats who would have presumably passed all of it the day before, would not pass the short form without the grift and the graft.

The mega-long legislation affects all of us in the West. The longer the laws are the more it serves the uber rich who can afford the QCs (or KCs or gun lawyers), and the more it punishes the poor who can’t pay off any lawyer to find the loopholes that weren’t written into the rules for them anyway.

Australia voted against an emissions trading scheme in a landslide in 2013 but got one anyway two years later. The laws were snuck through in deceptive clauses just before Christmas 2015.

Now the talk all over US political circles is this radical idea of voting for one bill at a time…

It’s fantastic, and Trump isn’t even President officially for another 30 days.

UPDATE: The US House just passed the third revision which was 118 pages.

9.7 out of 10 based on 90 ratings

8.8 out of 10 based on 9 ratings

7.6 out of 10 based on 10 ratings

By Jo Nova

Quick! Set up a trillion dollar market and figure out the science later

We got it wrong for so long

Methane is supposedly 80 times more powerful as CO2 over the short term, and we are already feeding our cows seaweed and dubious additives like Bovaer® to reduce it, and we’re trying to make steaks in labs, and create burgers out of crickets. But it turns out, the experts were wrong, yet again, and trees are absorbing more methane than they emit. So just like that, there is a major new sink to remove methane from the air, and it’s been there all the time.

The funny thing is that for years everyone was measuring the air at the bottom of the tree trunk and finding methane emissions, but when Vincent Gauci et al measured 1 – 2 metres further up the tree, not only did the methane emissions shrink to nothing, the gas started to disappear from the air around the trunk. Apparently bacteria under the bark were dining on the methane.

The team looked at trees in Brazil, Panama, United Kingdom and Sweden and estimate that all the worlds trees might already be absorbing as much as 50 million tons of methane, about as much as” is coming out of all the worlds landfill sites”, or roughly equivalent to half the worlds cows.

Scientists got this wrong, every way they could

Researchers used to think trees did nothing much with methane, but around 2006 some scientists were surprised to discover that trees emitted methane, especially in swampy areas. In 2017 a paper showed wetland trees gave out a lot of methane, “like a chimney”:

““In the seasonally flooded part of the Amazon, the trees become a massive chimney for pumping out methane,” says one researcher.“

The bad news back then, was that most of the world’s estimated 3 trillion trees emitted methane at least some of the time. If it had have been Porches instead, we’d have heard all about it.

Since methane is supposedly responsible for a quarter of global warming, you’d think the science industrial complex would have been all over this so they could save the world. Apparently forest scientists even used to entertain students by setting fire to the gases hissing from the trunks in the Amazon, so it’s not like “nobody knew”. Everyone knew, but apparently no one really wanted to announce bad news about their forest friends and give the deniers ammunition to cut down a tree, so people didn’t want to look.

Among the first was Vincent Gauci, then at the UK’s Open University and now at Birmingham University. “When I was first working on this, it was poo-pooed,” he says. When Pangala, then also at The Open University, made her first measurements of trees emitting methane in the swamps of Borneo, she had the same experience. Despite finding that the trees increased standard estimates of emissions from the swamps sevenfold, “it took 18 months to get it published,” she says. “We were rejected by several journals. They just weren’t interested.” — e360Yale

So prejudice and politicized funding stopped humans from figuring what trees were really doing for ages.

The same Vincent Gauci went back and did the study higher up the trees only to find the exact opposite of what they expected and had read in peer reviewed papers:

By Laura Allen, ScienceNewsExplores

Trees, too, were known to release methane, especially those growing in wet soils. These trees take up the gas from soil and emit it through their trunks.

Vincent Gauci studies methane emission from trees. He’s an environmental scientist at the University of Birmingham in England. Gauci knew trees in wet places, such as the tropics, give off methane from their trunks. Next, he wanted to study its release from trees in drier soils. He expected these upland trees would give off methane, though less than those at wetter sites. But that’s not what he found.

“We were surprised to see the exact opposite,” says Gauci. The trees were actually taking in methane. Think of how many trees there are on the planet, he notes. That could add up to a lot of methane being removed from the air.

Very little is known about these microbes, says Gauci. In fact, little is known about gas exchange in tree bark and branch surfaces. And those surfaces add up to a huge area. “If we were to unwrap all the trees and roll them flat, they would basically cover the entire Earth’s land surface,” he says.

This discovery may have doubled the amount of methane that the land absorbs (that we know about).

This research is important and eye-opening, says Kazuhiko Terazawa, a forest ecologist. He studies trees and methane at the Hokkaido Research Organization in Japan. The study’s estimates for how much methane trees might take up surprised him. If correct, he says, this means the land absorbs nearly twice as much methane as people had thought it did.

Not surprisingly, the methane was taken up a lot faster in the tropics than in colder places like England and Sweden. What took just a few minutes in Panama took 20 minutes in Europe. Naturally, bacteria work faster in the warmth. It follows then, though no one said as much, that in a warmer world, methane will be removed from the atmosphere even faster.

Using data from the four sites, the team estimated how much methane all the world’s forests may be absorbing. It might be as much as 50 million tons, they calculated. “It’s a sizable chunk,” says Gauci. That’s about as much methane as wafts from all the world’s landfills.

In preindustrial times some 50 million bison may have roamed North America emitting methane for thousands of years without reaching a “tippint point”, turning Earth into Venus or causing the sixth mass extinction.

From the press release: Trees act like a chimney…

…l POST NOTE: There is bound to be a benefit to the trees.

For all we know, the microbes that feed on methane probably help the trees in some way. Perhaps they defend the bark from fungus, or produce some nutrient trees need, or perhaps they help in moisture control. Who knows? In which case, the trees acting like chimney-pumps for methane are just feeding the good guys in the bark higher up the tree.

If I had to bet, I’d put money on the healthy tree biome stopping fungal rot of some sort, or perhaps producing some phytochemical trees need, like a pesticide that makes chewing bark less fun for beetles.

UPDATE: And lets not forget it was only this year that we realized 90% of the latest surge in methane comes from microbes around the world, not from us.

REFERENCES

Bark-dwelling methanotrophic bacteria decrease methane emissions from trees, Nature Communications, DOI: 10.1038/s41467-021-22333-7

Gauci, V., Pangala, S.R., Shenkin, A. et al. Global atmospheric methane uptake by upland tree woody surfaces. Nature (2024). https://doi.org/10.1038/s41586-024-07592-w

9.8 out of 10 based on 65 ratings

By Jo Nova

The science is settled, except when they need more money

Australia’s leading climate modeler wants a big new Climate Agency, and to make the case he admits the current models really can’t predict if rivers will rise or fall, if Antarctica will get bigger or smaller, if sea levels will rise much, or if El Ninos or La Nina will be more common or if the floods of Lismore will occur more often.

To give us some idea of how bad the current models are, he’s recommending we shift from models with 100 kilometer blocks to high resolution models with 1 km cells. These new models will be at least 10,000 times bigger than current ones, and if they increase the vertical slices, they could easily be one hundred thousand or even a million times bigger.

And if they get this super model, they’ll need 10,000 to one million times the energy. But now that we’ve wrecked the grid, good luck running those monster data centers off sunlight and breezes.

Full credit to Tony Thomas for digging through pages of turgid text and webinars to uncover the truth.

Andy Pitman, November 2024 Oh Boy it’s an eye-popping list.

In the past, Pitman has admitted climate change doesn’t necessarily cause more droughts. He’s also said he wouldn’t bet his superannuation (pension fund) on the climate models. This time Pitman admits the models are low resolution, have a lot of “critical gaps”, don’t resolve the oceans or clouds well, and that using the best CMIP6 models (the same ones the expert UN has beaten us over the head with) may risk “fundamentally wrong projections of future climate and its variability.”

Shouldn’t every Australian know this? I mean we’re spending half a trillion dollars to solve “climate change” but the models might be fundamentally wrong? Doesn’t that matter. The seas might not swamp us, the rivers might keep flowing. Antarctica might not melt?

Where was Andy Pitman when Australia was wrecking its grid, destroying jobs and our lifestyles? Where were any of our climate academics when leaders of our political parties were telling us that every drought, fire and storm was caused by climate change and would only get worse?

The Ivory Tower elitists sat silently by when the government forces bricklayers, farmers and children to solve a climate problem that might be just a modeling error?

And now they want more money — and I would say we desperately need models that work, but what’s the point, if we can’t trust the modelers to be absolutely, scrupulously honest with us?

By Tony Thomas, Quadrant

Pitman even concedes that current climate models can’t predict whether natural disasters will become more or less common in the warming era. Remember his words when you next hear the ABC or Climate Council claiming that such-and-such storms and floods are “climate-fuelled”.

Using current CMIP models, or indeed the regional models that rely on them, therefore risks fundamentally wrong projections of future climate and its variability. — P17 of “The Decadal Plan“

Now they tell us? Modelers don’t know if we’ll get more wind droughts or cloudy days?

Right after we built 12,000 megawatts of weather dependent generators, we find out that the modelers have no idea whether we will get more long spells of cloudy windless days which cripple our grid. This new vulnerability is buried under the label “High impact weather events”. As if windless nights belong in the same category as storms and floods.

It’s hidden in one of the Five Key Questions of National Significance:

5. Where will changes in high impact weather events support and/or undermine net zero ambition and where can associated risks be managed effectively?

Like the rest of the document the language is obtuse, convoluted, and speaks with a forked tongue. They don’t want to come out and just say Australia badly needs models a million times bigger so we can predict the climate.

Tony Thomas sums it up:

He [Pitman et al] also admits that he and fellow climate alarmists have no idea:

-

-

-

-

- when and where so-called “tipping points” might arise (wow, so honest!)

- whether climate change will increase or decrease the Murray Darling water flows

- whether an increase in CO2 will cause more or less rain for a given location

- how climate change will impact cities and urban landscapes (Andy, stop upsetting the Melbourne and Sydney city councils’ climate crusaders)

- how wind droughts and heavy clouding might undermine renewables and net-zero targeting (via week-long blackouts).

In a repudiation of the “settled science” notion the climate crowd has pushed for 25 years, Pitman now acknowledges that despite decades of study, the catastrophists still have no idea if Australia will see more El Nino, rather than La Nina, climate events, or even whether more vegetation will reduce or increase greenhouse emissions (so much for tree plantings offsetting emissions). “These are not easily solvable but offer profoundly different futures for Australia,” he admits (p13). Odd that we are to invest trillions in net zero when we have no idea what’s what.

We need models thousands of times better!

Pitman lays out many shortcomings of current “expert” climate models because he’d really like a much finer resolution models of just 1km2.

Ocean processes operate across many scales, and eddies in the Southern Ocean transfer considerable heat and nutrients14. These eddies are also crucial to the uptake, transport and storage of carbon15. Operating at scales of order 10 km, they are too fine to be resolved in ocean models used for climate projections. This means the role that oceans play in influencing climate are poorly resolved. – p17 Ocean processes operate across many scales, and eddies in the Southern Ocean transfer considerable heat and nutrients14. These eddies are also crucial to the uptake, transport and storage of carbon15. Operating at scales of order 10 km, they are too fine to be resolved in ocean models used for climate projections. This means the role that oceans play in influencing climate are poorly resolved. – p17

As a result of their poor resolution, current climate models do not faithfully represent critical weather systems, and it is the amplification of extremes by weather system processes that cause the extreme events and consequential disasters we observe. For example, the Lismore (NSW) floods in 2022 were associated with multiple weather processes, initiated over the Southern Ocean and interacting with synoptic-scale processes and moist tropical air that led to a sequence of extreme weather events and catastrophic flooding. Global climate models cannot resolve these processes, and therefore cannot tell us if such events will become more common in the future. As the weather that produces extreme events is connected globally, downscaling using high-resolution regional climate models cannot overcome the limitations introduced in the global models, as downscaling relies on the global models for information at its boundaries.-p17

These transcripts come from Andy Pitmans speech in the launch webinar

The speech and documents make tough reading. You get the feeling they just didn’t want to tell us straight how bad the models are. I wanted to capture his exact words, for the record.

All those environmental sinks might becomes sources (so much for carbon farming, eh?) Shame about that business you set up…

7:30 [Andy Pitman] Some of these questions, you might think we have answers to….

For example, many people would recognize both terrestrial and marine as providing a critical ecosystem service, it takes up human emissions of CO2, and provides enormous support for Australians Net Zero ambitions … but there’s a little problem with this, we don’t actually know to what degree our terrestrial and marine systems will continue to support our Net Zero ambitions and positive environmental outcomes. They may turn into sources of CO2 and methane, in ways that really undermine our Net Zero ambitions.

We will definitely get more water or less water, more river, or less river, more plants, or less...

9:00 In addition Australia is demonstrably at risk of abrupt changes in weather and climate. Many of you would be familiar with tipping points… It matters a great deal if we could say things about when and where these things might be realized. At the moment we really can’t.

9:30 Water is obviously fundamental to the most arid inhabited continent on Earth. But we don’t actually know whether Climate Change will increase or decrease flows of water through systems like the Murray Darling. We don’t yet know whether changes in rainfall will be helped or hindered by the way ecosystems response under higher elevated CO2 concentration. Whether the higher water use efficiency of vegetation will help the flow of water through the Murray Darling or the vegetation will suppress the flow of water in the Murray Darling….

No we don’t know what will happen to the cities:

Urban Areas, it’ It might surprise a lot of you to know that the climate modeling systems we use internationally do not represent our urban landscapes.

Page 13: Plants, rain, El nino, who knows?

Some major challenges have been explored for decades — whether we will see a more El Nino or La Nina state in the future, or whether vegetation will help or hinder net zero ambition.

These are not easily solvable…

Page 17 We can’t predict extreme events, and they may not be getting worse, we don’t know:

The Lismore (NSW) Floods in 2022 were associated with multiple weather process, initiated over the Southern Ocean and interacting with synoptic scale processes and moist tropical air that led to a sequence of extreme weather events and catastrophic flooding. Global climate models cannot resolve these processes and therefore cannot tell us if such events will become more common in the future.

Further there is evidence the high-resolution coupled models simulate fundamentally different historical trends in tropical and Southern Ocean sea surface temperatures, reproducing recent observed changews which courses models cannot. They also exhibit greater low-frequency variability in midlatitude regions. Compare with Coupled Model Intercomparison Project (CMIP)-class models. Using current CMIP models, or indeed the regional models that rely on them, therefore risks fundamentally wrong projections of future climate and its variability.

Page 22: The current models are low resolution and can’t do sea ice, clouds, storms, ice sheets, plants, cities and farms.

Projections on timescales of decades to centuries at low spatial detail using Earth System models. The low spatial detail is balanced by large numbers of simulations. The lower computational cost means the more components can be included (e.g. Chemistry, fire, nutrients,) but some processes which may be extremely important are difficult to resolve (eh, sea ice, topographic forcing of clouds and storms, cloud processes, some ice sheet dynamics, vegetation demography, urban landscapes, agricultural areas).

Page 25 contains Antarctic surprises like how 70 billion tonnes of snowfall accumulated across East Antarctica contributing to a net gain of mass in Antarctica — which was a reversal in the mass loss trend over the preceding 20 years..

A future with more ARs [atmospheric rivers] leading to a larger accumulation of snow on the Antarctic continent would be experienced very differently in Australia to a future with fewer ARS. Specifically projections o

The modelers didn’t see that coming either.

REFERENCES

A Decadal Plan for Australian Earth System Science 2024–2033, released November 25th, 2024

— This one is for Julian. —

Turtle Model by SAIF 4 from Pixabay

10 out of 10 based on 95 ratings

10 out of 10 based on 12 ratings

By Jo Nova

And so it begins, scientists start peeling off the climate change labels from the ideology

The Trump clean-out has not even started and the bow wave is washing off some of the faded advertising.

Just as ESG and DEI are quietly disappearing into the bushes, soon, “climate change” will vanish too.

One day most scientists will say “we always knew it was overdone”. But right now, brave scientists are sticking to their beliefs … playing the victim card and adopting new advertising to keep their funding.

Oliver Milman, The Guardian

The prospect of an even more ideologically driven Trump administration slashing budgets and mass-firing federal staff has given America’s scientific community a sort of collective anxiety attack. “We all feel like we have a target on our backs,” said one National Oceanic and Atmospheric Administration scientist, who added that agency staff are already seeking to “pivot” by replacing mentions of the climate crisis with more acceptable terms such as “air quality”.

“My god, it’s so depressing,” said another federal scientist about the incoming administration. A doctoral candidate, when asked about entering the workforce under Trump, simply puffed her cheeks and groaned. “If someone offered me a departmental position now, I’d jump,” said one Nasa researcher.

It’s not like modern science is a lap-dog serving whoever feeds them the biggest biscuits…

Science is in such a crisis, even the Guardian staff realize something is wrong:

But scientists in the US face a broader crisis beyond the next president, amid a swirl of misinformation and declining trust in the profession among the American public. Overall trust in scientists has fallen by 10% since the pandemic, Pew polling has shown,…

And the AGU President, who helped turn science into a religion, accidentally explains some of it:

“When we get that kind of polling data, it is concerning,” acknowledged Lisa Graumlich, a paleoclimatologist and the current AGU president.

“The conspiracy theories are out there, the misinformation is there,” said Graumlich. “Social media engines and the algorithms can take a person that isn’t necessarily prone to a conspiracy mindset and have them end up in this rabbit hole of misinformation.”

Where was Graumlich when NASA and NOAA were spreading misinformation that science is done by groupthink and consensus? Or when they pretended evidence came from computer simulations of Earth, and not the real thing?

And yet, already, in The Guardian desert of journalism — one tiny sensible shoot appears:

Some researchers think scientists should adapt to this hyper-partisan environment by sticking to unadorned facts, rather than anything that could be seen as campaigning. “We have been come to be seen as just another partisan lobbying group,” said Ken Caldeira, a climate scientist.

That’s a good start.

H/t to Willie Soon.

Alarmists must be feeling the shock,

As ‘settled science’ now hits a roadblock,

Fearing their climate pipe dreams,

Will come apart at the seams,

With Donald Trump in charge, taking stock.

–Ruairi

Image by Helen Boulton from Pixabay

9.9 out of 10 based on 121 ratings

9.3 out of 10 based on 15 ratings

9.3 out of 10 based on 12 ratings

By Jo Nova

People forget that while electricity flows down those long interconnectors, sometimes high prices flow back the other way.

The Dunkelflute (wind drought) and a cold weather spell means electricity is at nosebleed prices. In southern Norway usually people pay €0.18 per KWh but the electricity price rose to over €1.12 per kilowatt hour for the highest cost hour last week. In southern Sweden the electricity used for a 10 minute shower cost €2.65 compared to €0.01 in central Sweden.

Montel Analytics forecast German wind output to drop to 2.8 gigawatts, compared to a normal capacity of 19 gigawatts at this time of year. The shift in weather has forced Germany to burn more fossil fuels, fire up coal power stations, and import energy from France…

In Germany consumer prices hit €936 per megawatt hour at one point last week because wind energy had failed. This was the highest level in 18 years. Things were so bad, companies stopped production in Germany.

Due to record-high electricity prices in Germany, several companies, including some that have been in operation for over a century, have been forced to halt production. Currently, electricity prices have reached €936 per megawatt-hour, Azernews reports.

The Saxon Feralpi electric steelmaking plant in Riesa has completely ceased operations. Company executives, in a statement to Bild newspaper, expressed that the situation is dire and stressed the urgent need for power plants that can start operating in the near future to mitigate the crisis.

The steep rise in electricity prices is also expected to affect individual consumers, including one million families. The supplier company Tibber has warned of price hikes of up to 400% in a statement on social media platform X.

“It’s an absolutely sh*t situation,” said Norway’s energy minister

Norway is swimming in hydropower but still gets 10% of their electricity from wind power on the continent. Both ruling parties in Norway are promising to cut the interconnector deal with Denmark and the continent.

“It’s an absolutely sh*t situation,” said Norway’s energy minister Terje Aasland cited by FT, reacting to electricity prices in the country that are six times that of the EU average these days.

The two ruling parties in Norway are pledging to campaign to cut the two power interconnectors that link the country with Denmark, when they come up for renewal in 2026, reports the FT. The smaller coalition party, the Center Party is eyeing revisiting similar energy links with the UK and Europe.

With current high Norwegian prices, critics argue Norway should only send electricity from its abundant hydropower abroad after it has ensured low prices at home, as was the case for decades previously.

The Swedish Minister is blaming the Germans for closing their nuclear plants

Euractive Dec 13th, 2024

… Swedish Prime Minister Ulf Kristersson (Moderates, EPP) angered the opposition with his words: “There will be hard times ahead”. “I realise that nobody is happy when I say that ‘if we hadn’t shut down half of nuclear power, we wouldn’t have these problems’. But it’s true and it needs to be said.”, Kristersson said, referring to the previous Social Democrat-Greens coalition closing several nuclear reactors between 2019 and 2020 as part of a policy shift towards greater reliance on renewable energy sources.

Sweden’s Energy Minister Ebba Busch went further and blamed the Germans too (to be fair, both Sweden and German closed nuclear power plants in 2019, but Germany closed all their nuclear plants in April 2022).

“I’m furious with the Germans,” Busch told Swedish broadcaster SVT.

“They have made a decision for their country, which they have the right to make. But it has had very serious consequences,” she added.

When wind production in neighbouring Germany is low, Swedish electricity is exported to fill the gap, reducing the supply available to Swedish consumers and driving up prices.

Last year Sweden decided to build 10 new nuclear reactors. They still have three operating plants with six reactors.

At least one study calculated if Germany had just kept using nuclear power, it would have saved $600b and cut emissions by 73%. Those losses will only grow.

Photo: Mrb-Wind, lower Saxony, Germany.

Photo High voltage lines: Image by minka2507 from Pixabay

9.9 out of 10 based on 118 ratings

8.7 out of 10 based on 20 ratings

|

JoNova A science presenter, writer, speaker & former TV host; author of The Skeptic's Handbook (over 200,000 copies distributed & available in 15 languages).

Jo appreciates your support to help her keep doing what she does. This blog is funded by donations. Thanks!

Follow Jo's Tweets

Follow Jo's Tweets To report "lost" comments or defamatory and offensive remarks, email the moderators at: support.jonova AT proton.me

Statistics

The nerds have the numbers on precious metals investments on the ASX

|

Recent Comments