Environmental wokeness has become a liability for investors

The backlash against ESG has hit bonds, stocks, corporates

In a recent survey, half of large investors in North America now admit to worrying that ESG exposes them to legal risk. When companies want to create a Green-Woke project they issue ESG bonds to get loans to build it, but sometime between last year and this year those Bonds have halved. Suddenly companies are not dressing up in the Big Green cloak. That’s $6 billion in ESG investments that didn’t happen.

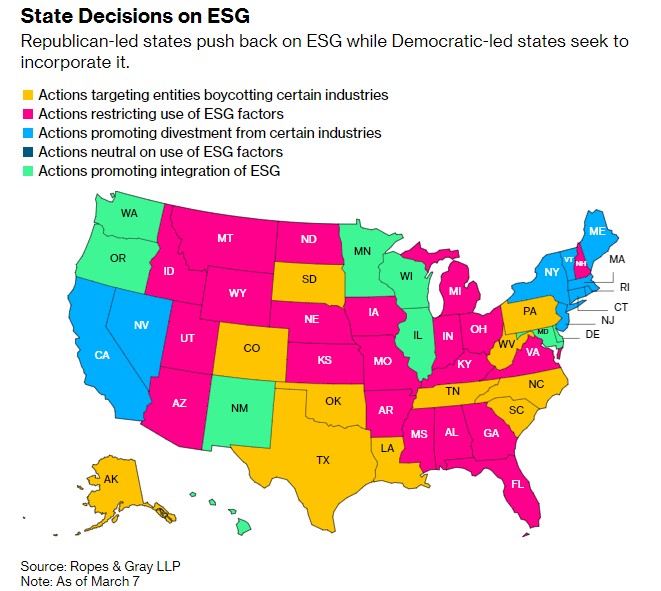

The change in direction has been driven by Florida and Texas and the 19 or more states that have joined them. Even though the $2b in funds Ron De Santis pulled from BlackRock et al last year was a drop in the ocean for a $10 trillion dollar fund, it was the tip of a spear at the heart of the beast. The financial houses and asset managers were using other people’s money to force through political changes those same people didn’t want to vote for. If the crowd followed De Santis the whole game was up.

De Santis has just tightened the screws further today:

DeSantis Steps Up Attack on ESG as Florida Bars Public Investments

By Marvin G Perez, Bloomberg

The new legislation prohibits Florida municipalities from selling bonds tied to ESG projects, as well as imposing restrictions on seeking ESG ratings. In 2022, Florida issuers sold $13 billion of long-term bonds, making it the fourth-largest issuer in the US, behind California, New York and Texas.

The law also bars Florida’s public money from being deposited in financial institutions that are deemed to pursue “social, political, or ideological interests” in their investment decisions. Florida had almost $37 billion in state deposits…

It’s a phase change in the US with an exodus from ESG Bonds:

US ESG Bond Market Chokes on Republican Backlash, Investor Angst

By David Caleb Mutua, Bloomberg

Companies sold about $6 billion of bonds last quarter to pay for projects that help the environment, achieve a social goal, or improve their governance, a type of debt known as ESG. That’s down more than 50% from the same time last year, according to data compiled by Bloomberg, which focused on companies outside the financial industry.

Many investors are reconsidering their approach to ESG. Almost half of North America’s biggest investors worry that the politics around ESG securities in the US exposes them to legal risks, according to a global survey of firms overseeing $27 trillion published last month.

Texas is boycotting funds that boycott fossil fuels:

Meanwhile in the US, Texas Comptroller of Public Accounts Glenn Hegar in August 2022 first listed 10 firms and more than 340 individual funds that “boycott energy companies,” a designation that compels state-run entities like pension managers to sell their holdings.

“This represents a material shift in the conversation around ESG,” Texas Comptroller Hegar said in an emailed statement. “The shine is wearing off as Americans discover that ESG investments are not only failing to deliver the financial returns that their proponents promised, but also simultaneously distorting the free market incentives that actually might move the needle on some of the policy objectives that ESG investments supposedly support.”

So now they scramble to look non-Woke

In March Texas added HSBC to the blacklist. HSBC protested saying that it doesn’t “consider itself to be boycotting the financing of energy companies,” but last year they sacked Stuart Kirk for saying that investors don’t have to worry about “climate risk” years from now. HSBC’s political agenda is obvious.

Instead of discussing how they might not know snow, now companies are talking about the risks of “anti-ESG” efforts.

Bad news for Eco-Worrier-finances has piled on in the last six months. Environmental investors lost 22% last year — in the same year that Energy investors made 54% gains. In December Vanguard dropped out of GFANZ, the glorious Glasgow banker accord. In January, Larry Fink, the CEO of BlackRock complained the attacks on ESG were getting ugly and personal. Shucks. Where was he when bankers called us “climate deniers”?

Bad news for Eco-Worrier-finances has piled on in the last six months. Environmental investors lost 22% last year — in the same year that Energy investors made 54% gains. In December Vanguard dropped out of GFANZ, the glorious Glasgow banker accord. In January, Larry Fink, the CEO of BlackRock complained the attacks on ESG were getting ugly and personal. Shucks. Where was he when bankers called us “climate deniers”?

Companies are laying low on ESG as backlash intensifies

Emily Peck, Axios

Companies don’t want to talk about their environmental, social and governance goals anymore, experts in ESG and communications tell Axios.

State of play: Anti-ESG forces are in full swing this proxy season — the time of year when public companies host their annual meetings, and shareholders vote on a slate of investor proposals.

-

-

- A dozen financial companies, including BlackRock, Blackstone and KKR, now list anti-ESG efforts as a risk in their annual reports, the Financial Times recently reported.

-

-

-

- Investors have filed 68 anti-ESG proposals this year to date — compared to 45 in all of 2022, per data from the Sustainable Investments Institute, a nonprofit.

- BlackRock CEO Larry Fink didn’t mention the term ESG anywhere in his most recent investor letter, a departure from those of the past several years, as Axios’ Andrew Freedman reported.

-

Wall Street titans confront ESG backlash as new financial risk

Patrick Temple-West and Brooke Masters, Financial Times

Wall Street’s largest asset managers, private equity firms and brokers have warned that a backlash against sustainable investing is now a material risk, in filings that show how acrimony over ESG principles has become a perceived threat to profits.

A dozen big US financial companies including BlackRock, Blackstone, KKR and T Rowe Price added language to annual reports filed in the past month cautioning that pressures such as “divergent views” or “competing demands” on environmental, social and governance (ESG) investing could hurt financial performance.

The collapse in bonds is not happening yet in Europe where ESG Bond sales are up this year. It’s very much starting and spreading from the US states. Share the stories, copy the mechanisms. Use the words “fiduciary duty”, “due diligence”, and if you are in the US “anti-trust”.

h/t Bill in AZ, NetZeroWatch UK