By Jo Nova

It’s a 6pm bonfire on the Australian grid

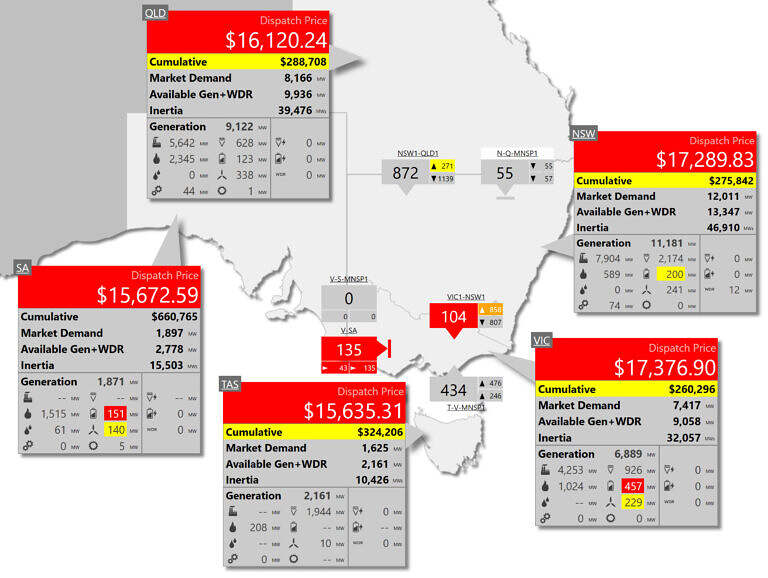

Over at WattClarity on Monday when every state had prices over $3,000 per MWh simultaneously, Dan Lee noted that this was extremely rare. Since 2008, there have only been 32 intervals when prices were above $1,000 in all five states at once and nine of the 32 occurred on Monday.

Then Tuesday was so much worse:

Naturally the Sydney Morning Herald is blaming “aging coal plants”

Because we can’t get rid of coal fast enough, right? Somehow it’s a “harbinger of the price hikes” we’re facing “if aging fossil fuel generators are forced to stay open longer”. So geniuses, if prices hit $17,000 a megawatt-hour when some coal power is down for a day, what happens when we get rid of coal entirely? Is that when Tinkerbell saves the day by turning Sydney Harbor into a giant battery, or when $17,000 prices become the “new norm”?

Somehow the unplanned outages of reliable coal plants create sky high prices, whereas the unplanned outages of wind and solar power create Utopia.

Not so coincidentally, the price spikes on July 31 2024 occurred when wind and solar generators were out:

The price spikes were also boosted by the cold weather we aren’t supposed to be getting in our warmer world.

The synoptic chart for July 31 shows that old familiar pattern. One high pressure cell can ruin wind turbine production everywhere:

Caitlin Fitzsimmons of the Sydney Morning Herald blames the slow-down in new wind farm approvals for the dire situation. But another 1,000 wind turbines won’t save the day when there is no wind. More useless wind power is still useless, it just costs more.

Blame the capitalists!

Poor Giles Parkinson at Reneweconomy blames the price spikes on evil profiteering but worries the public will think it’s renewable generators fault. He can see that these prices are bad news for the image of the “transition”:

Generators fill their pockets again, pushing grid prices to new highs and leaving renewables to cop the blame

What we see here is naked greed, around an essential service…

Geoff Eldridge, from GPE NEMLog, says the average wholesale price across all NEM regions hit a jaw-dropping $16,419/MWh in the early evening on Tuesday. That smashes the previous record of $12,491 /MWh reached on July 14, 2022, at the height of the international fossil fuel crisis sparked by the invasion of Ukraine.

With a perfectly straight face he complains about competition being reduced as reliable generators are forced out of the market:

Renewables are supposed to challenge this and lower the price on wholesale markets by introducing competition. But as the number of fully dispatchable generators declines, competition at critical times has actually been reduced – at least for the time – and like seagulls around a box of chips, the market players dive in.

This, of course, is exactly what the “renewable transition” was subsidized to do — to force out the cheaper competition. So the more we transition the more expensive it will get:

And the problem is that in a hotly partisan energy debate, and a lop-sided and populist media disinterested in actual facts, it will be renewables that get the blame.

But he seems to realize it isn’t a free market, and in that he is correct. The regulators allowed giant conglomerate groups to own competing generation units, which means they can play these off one another. When they drive out coal power they win big in the rest of their portfolio.

Battery storage is supposed to throw a bit more competition into the market. But the problem is that many of these assets are now owned or contracted to the very same energy giants that control the rest of the generation. If anything, it’s made it easier for them to control prices and profits.

Predatory capitalism worked well for AGL. They were given Liddell coal plant for nothing in 2014, but wouldn’t sell it for $250 million in 2018. It was worth more dead than alive. Banker analysts explained that they wouldn’t sell AGL either, because if someone else kept Liddell running it would keep wholesale electricity prices down (which is bad for all the other generators). Liddell coal power was shut down in April last year. If it was still running, we might not have had these price spikes. Where was Giles Parkinson when Liddell was being given away, run into the ground, and then driven out of the market? He was cheering the rigged market on. Now it is coming back to bite him.

The last few days were some of the lowest wind power for the month. There was high demand, but it was not a record:

Paul McArdle at WattClarity drills through a few bidding details and says it appears there were more cheap bids than usual and the cold weather demand was a primary driver. But we will have to wait for the longer analysis that always occurs after these market disruptions.

Daily prices are on fire this week — the average wholesale prices for the last three days were about $250/MWh in NSW and Queensland, in the order of $300 in Victoria and Tasmania, and a shocking $675 for South Australia (which has lots of wind and solar power and no “old coal plants” at all). That’s effectively 72 hours of wildly high prices. And even though the retail electricity providers will be hedged, the spot prices still feed through to the retail electricity bills sooner or later.