Strange things are happening in the calm before the storm…

This week the financial world balances on the edge, and all the old rules have broken. Joe Biden is signing off on an oil drilling program on US soil which he said he’d never do — and it’s one of the largest ever — like building “66 new coal plants”. At the same time the Bank of England is apparently cutting the sacred climate change spending, and has leaked this news to the world.

As someone said on Twitter, “last week was a different country”.

After all these years, climate change has fallen out of the Weekly Hit Parade of Panic.

Bank of England Headquarters, London, photo by Елена Пехчевска

Bank of England Will Cut Spending for its Work on Climate Change

By Ellen Milligan and Philip Aldrick, Bloomberg

Climate programs will slip lower on the central bank’s agenda so officials can focus more on the core operations such as financial stability…

As Dr Benny Peiser of NetZeroWatch says “the risk of costly climate and Net Zero policies have become a bigger threat to the UK’s economy and financial stability than climate change.”

It’s not all good news though. One of the Bank’s new core operations is “a digital currency” — which is the ultimate social credit score and even more invasive than a carbon tax. Either climate change is being crushed under the weight of financial reality, or else it’s become irrelevant as newer, more potent scares appear. Sorry to be a cynic. The only thing that has materially changed about reality in the last week are bad loans rattling the stockmarkets.

A major turning point?

The Bank of England has been pumping climate fear for years, and like the chief Octopus — it has been organizing other central bankers:

The move marks a sharp break from the emphasis Mark Carney put on climate during his term as BOE governor from 2013 to 2020.

Rishi Sunak, during his term as chancellor of the exchequer in 2021, updated the BOE’s monetary policy remit to “reflect the government’s economic strategy for growth that is environmentally sustainable and consistent with the transition to a net zero economy.”

BOE officials led by Carney have been among the most vocal in speaking about the climate-related risks facing the global economy in the coming decades. They helped build the Network for Greening the Financial System, a group of almost all the world’s top central banks coordinating best practice on oversight.

The Bloomberg reporters also mention that Michael Bloomberg, the owner, “backed Mark Carneys work on the Task Force on Climate-related Financial Disclosures”. It’s all so cosy isn’t it? Presumably Bloomberg himself could easily confirm this story or bury it if he wanted too. Something has changed…

Giant, huge, US carbon monster drilling oil project: all OK now?

Black is White, Up is down. And after Biden did everything to avoid approving oil drilling on US soil, even being nice to Venezuela, he’s just done exactly that:

Joe Biden signs off oil drilling equivalent to 66 coal plants in ‘climate catastrophe’

by David Millward, TheTelegraph

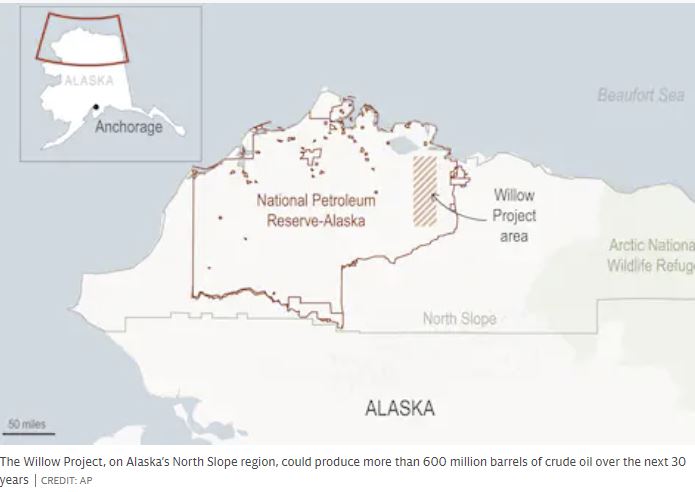

His administration gave the green light to the Willow Project on Alaska’s North Slope, effectively reversing a policy pledge he made during the 2020 presidential election.

Having entered office vowing “no more drilling on federal lands, period”, Mr Biden’s hand has been forced by soaring energy prices, which have fuelled inflation.

The Willow Project, which has been led by oil behemoth ConocoPhillips, could produce more than 600 million barrels of crude oil over the next 30 years.

Does carbon dioxide matter, or doesn’t it?

Obviously, this week is a convenient week for announcing major backflips and hoping people won’t notice.