Hands Up: It’s Net Zero now or a 1.5% interest rate hike?

So Australia is adopting Net Zero because the Global Financiers, who only want to save the world, would have refused to lend us money without jacking up our interest rates by 1.5%. The banker punishment would have meant a “17% investor exodus”. Fancy a stock market collapse?

This remarkable admission comes in the modeling released today by the Morrison government. No one is even trying to hide it.

At least we can stop pretending this has anything to do with science or the voters. Just cut out the IPCC and go straight for the BlackRock Temperature Tax, eh?

Note the “penalties” are imposed by global financiers:

Modelling shows real cost of no net-zero carbon emissions

Greg Brown and Geoff Chambers, The Australian

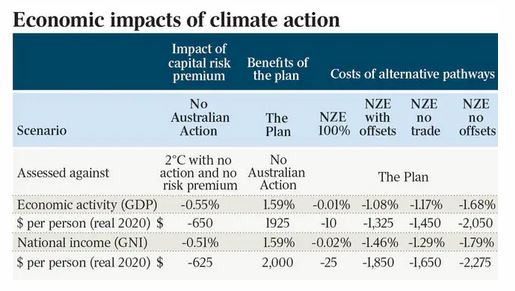

Businesses and households would have faced interest rate hikes of up to 1.5 per cent under expected penalties imposed by global financiers if the government had failed to adopt net zero emissions by 2050, modelling for the Glasgow climate package shows.

The penalty regime would have sparked a 17 per cent investment collapse by the middle of the next decade, cutting 0.9 per cent from gross domestic product and making each Australian more than $650 poorer.

Households would have paid an extra $25bn a year to service home loans, and business and credit card debts.

If only Australia had its own sovereign currency? If only there were competitive money lending institutions out there, somewhere in the whole wide world who were happy to loan us money purely for profit? But no such luck.

Who knew bankers would turn down profits to protect the turtles?

…

Years ago, I said the corruption starts with the currency, and here it is unmasked. Australians voted for no carbon trading scheme, no carbon tax, and no more climate spending. But long before that we voted for Easy Money and that payday is here.

In theory the modeling was supposed to show how we will be $2,000 richer if we try to change the climate rather than if we leave that to the sun and just make things the customers want instead.

So much for capitalism, competition, and voting for policies.

Offsets is code for “global emissions trading”.

The government revealed it received advice from Treasury that there would be a “capital risk premium” of between 100 and 150 basis points if Australia did not adopt a net-zero by 2050 target. This would increase borrowing costs on current levels by between $25bn and $38bn, according to economist Saul Eslake.

“It is almost certain that Australia would face some form of global response if it did not take on a credible 2050 emissions target,” says the government’s analysis of the modelling.

“This could take a variety of forms: increased capital costs for Australian governments, firms and households reflecting increased perceived financial risks; trade action against Australian exports intended to offset any competitive advantage derived from perceived weaker abatement policies; or lower demand for specific Australian products reflecting potential consumer concerns about a perceived lack of action on climate.”

Apparently all bankers really want to help the planet

A giant Spanish Bank once spent €100 b on Earth’s weather, cos they are nice people. Bank of America spent $50 billion to save the world. Citigroup commited $100 billion, Goldman Sachs pledged $750 billion. Banks are just falling all over themselves to help. Deutsche Bank built 70 foot high clock towers of doom, and produced their own climate science reports. Blackrock wanted Australia to shut coal plants faster.

They just worry about the poor and the polar bears, right?

And maybe because Climate change is potentially a $7 Trillion dollar money making venture (for bankers).

Who voted for the Bankers?

The real rulers are the ones who decide the rules and the penalties.

- The Ground Zero of Global Corruption – it starts with The Currency

- UN Green Climate Fund: good for bankers, bureaucrats, but not so much the poor

- Flashback to 2013: UN $315 billion CDM carbon market was comatose after Warsaw. It may last years

- Billionaires club fund Green Blob “Climate Works”