Recent Posts

-

Forget “renewable energy” — new AI data centers are building their own gas plants in Texas

-

Saturday

-

Buy a battery, join a virtual power plant, and let AGL eat 80% of your battery for dinner

-

Friday

-

Labor Net Zero obsession: Australians don’t know they’re spending $12,000 million dollars a year to fix the weather

-

Thursday

-

Wednesday

-

MPs from Left and Right in France vote to ditch “low emission zones” and bans on old cars

-

Tuesday

-

Monday

-

Sunday

-

Billions of dollars spent on wind, solar and batteries and Australian electricity emissions went up last year

-

Saturday

-

Friday

-

Free Speech wins: Trump declares, no US Visas for any foreign official who censors Americans

-

Thursday

-

New world Energy order: Taiwan closes the last nuclear power plant, then days later, plans a referendum to reopen it

-

Wednesday

-

Bang! Price bomb sinks Transmission lines: Plan B says let’s pretend cars, home solar and batteries will save “Transition”

-

Tuesday

-

Monday

-

Sunday

-

Saturday

-

If only we’d built those offshore wind turbines, eaten more cricket-burgers, we could have stopped the floods, right?

-

Friday

-

If UK had never tried renewables, each person would be £3,000 richer

-

Thursday

-

New AI data centers will use the same electricity as 2 million homes

-

Wednesday

-

No one knows what caused the Blackout but Spain is using more gas and nukes and less solar…

-

Tuesday

-

Monday

-

Sunday

-

Half of Australia doesn’t want to pay a single cent on Net Zero targets

-

Saturday

-

Secret comms devices, radios, hidden in solar inverters from China. Would you like a Blackout with that?

-

Friday

-

LSE junk study says if men didn’t eat so much red meat we’d have nicer weather

-

Thursday

-

Now they tell us? Labor says new aggressive Net Zero policy they hid from voters “is popular”

-

Wednesday

-

British politics in turmoil after Reform’s wins — Greens Deputy even attacks Net Zero from the left

-

Tuesday

-

Monday

-

Sunday

-

Children of 2020 face unprecedented exposure to Extreme Climate Nonsense…

-

Saturday

-

60% are skeptics: Only 13% of UK voters say Net Zero is more important than cost of living

-

Friday

-

Climate change is causing South Africa to rise and sink at the same time

-

Thursday

-

Why is the renewables industry allowed to sponsor political advertising in schools and call it “education”?

|

By Jo Nova

New AI Data Centers need so much energy, so fast, they’re are going off-grid

Such is the blistering race to get ahead in the global AI battle, that the industry is not waiting for the bureaucrats to build new power plants anymore, they are doing it themselves. And the leading edge of data engineers are not choosing the clean green wind or solar power of the future — they’re building gas plants. The sun and wind are free, but the battery back up, high voltage lines, long approvals, and unreliable supply

Dylan Baddour, Arcelia Martin, Ars Technica

The plant would be big enough to power a major city, with 1,200 megawatts of planned generation capacity fueled by West Texas shale gas. It will only supply the new data center, and possibly other large data centers recently proposed, down the road.

The project is one of many others like it proposed in Texas, where a frantic race to boot up energy-hungry data centers has led many developers to plan their own gas-fired power plants rather than wait for connection to the state’s public grid.

It was Energy Transfer’s first-ever contract to supply gas for a data center, but it is unlikely to be its last. In a press release, the company said it was “in discussions with a number of data center developers and expects this to be the first of many agreements.”

Behold the modern gold-rush — look at the number of applications to build power (of all sorts) and connect it to the grid in Texas:

There were more than 2,000 active generation interconnection requests as of April 30, totalling 411,600 MW of capacity, according to grid operator ERCOT. A bill awaiting signature on Gov. Greg Abbott’s desk, S.B. 6, looks to filter out unserious large-load projects bloating the queue by imposing a $100,000 fee for interconnection studies.

Larry Fink, head of BlackRock, claims people don’t care about renewables now, they just want power:

The reliance on gas power for data centers is a departure from previous thought, said Larry Fink, founder of global investment firm BlackRock, speaking to a crowd of industry executives at an oil and gas conference in Houston in March.

About four years ago, if someone said they were building a data center, they said it must be powered by renewables, he recounted. Two years ago, it was a preference.

“Today?” Fink said. “They care about power.”

To get some idea on the seismic transition that is really underway, ponder that one of the new start ups wants 5,000MW of energy for a new data center covering 2,600 acres, and it is going in to a small town in Texas of less than a thousand people. That’s a massive 5GW for a town of 940 people.

There are still a few projects with renewable ambition. One project team that requires just 120MW said it will use just wind power and one large plant says they hope to run a 5GW data center on “private wind, solar and hydrogen” but they will start with gas at first.

We, here in Australia, are not even in the race.

0 out of 10 based on 0 rating

10 out of 10 based on 1 rating

By Jo Nova

Who wants to buy a battery to help save the Energy Minister?

Spread the word, the new desperate plan to rescue the Transition Fantasy is to trick Australians into buying home batteries (and EVs) because the wind and solar factories can’t afford to pay for their own backup. But read about the experience of poor Mr Anderson. He accepted a $1,000 discount off the price of his battery, and in return agreed to allow AGL to draw off emergency power from his battery to “stabilize the grid in times of drama”. But he didn’t realize that the Australian electricity market did drama all the time. It’s like The Hunger Games at 6pm and he’d just volunteered as tribute.

It seemed like a good idea to sign up to be part of a virtual power plant (VPP). It was fine for the first year, he says, but then AGL started draining his battery at dinnertime, leaving him buying electricity when it was the highest price. Worse, they also changed his payment plan — and he got suckered with the “Demand Tariff” surprise — the diabolical plan which takes someone’s single greatest half hour consumption and then charges them that high rate for the whole month.

AGL disputes his claims (but the more they say, the worse it looks). They declare they don’t flatten home batteries “below 20%” and insist they sent him a letter about the tariff changes. Don’t we all feel so much better, eh?

The reputational damage of this kind of behaviour needs to be known far and wide

Let’s do our part to share his story.

May 9th 2025 [ABC]

Mr Anderson says that in the first year after joining the scheme and getting the battery, he barely noticed a thing. “It was all very gentle and easy going,” he says.

“The idea of it was to help stabilise the grid in times of drama. “So it all seemed very reasonable. “And for the first year, I don’t even think they touched the battery.”

That all changed after a year or so when Mr Anderson says he started noticing some dramatic shifts. They changed the way they use the battery,” he says.”It went from these little bites every now and again to just full on sucking the thing down to its 5 per cent reserve level, just dragging everything out of it. “And you could map when they were doing that to when the price on the (national electricity market) had skyrocketed.”

They drained the battery and flicked the pricing plan:

Mr Anderson asserts AGL also started “draining” his battery at times, forcing him to buy power from the grid at peak prices.

To compound his frustrations, he says the changes amounted to a double whammy — by forcing him to buy power from the grid at peak times, he claims he was driving up his costs under a demand tariff.

Oh Great: AGL will only drain 80% from your battery?

AGL, which is Australia’s biggest energy retailer with more than 4 million customers, defended its actions in relation to Mr Anderson and its management of the VPP. A spokeswoman rejected claims AGL ever entirely depleted the batteries of participating households, saying it was the company’s policy to always leave at least 20 per cent of a charge remaining.

What good, exactly, is a battery left at 20% charge? For practical purposes the last 20% is untouchable. Beyond that, the homeowner risks permanent damage to the battery. At that point it’s not backup power for your home, it’s a placebo with a lithium core.

So when they say “we’ll never drain your battery below 20%”, what they really mean is: “We’ll take everything that’s usable — and leave just enough so the warranty doesn’t catch fire.”

AGL kept digging — pointing out that the tariff change was completely separate from the VPP deal

It’s true that AGL surprised all kinds of customers with the “Demand Tariff” bomb, not just battery owners, but they can’t pretend they cared about their customers in either situation. AGL was separately awful in two different ways.

The Demand Tariffs, by the way, were so noxiously unfair and unjust that after the backlash last year, AGL is no longer using them.

Mr Anderson has said his experience was so bad he’s left the VPP scheme.

9.9 out of 10 based on 75 ratings

10 out of 10 based on 7 ratings

By Jo Nova

For your sake, the Australian government took at least $440 of yours this year and spent it on electrical hobgoblins that claim to make nicer weather in a hundred years. That’s $1,800 for each family of four, in order to reduce world temperatures by nothing in our lifetimes.

How many families would willingly give up that kind of money on the witchdoctor weather quest?

The IPA has done what the Labor Government is too dishonest to do, and the Opposition was too scared to do. Adam Creighton added up the bonzana the government has spent on climate change since 2022 — and it’s exploded like a tanker of polyurethane-policy-filler. It sticks to everything, can’t be removed and if we burn it down, it fills the room with cyanide.

Back in 2021 the nation was throwing $1.7 billion dollars a year on certified weather voodoo. But after Labor won in 2022 that figure ballooned until now the federal budget spending on “climate change” and ‘Net Zero’ has expanded to $9 billion. But this is barely the start of the true cost Australians have paid — The transition bonfire added about $150 to most electricity bills in Australia this year. For some Australians electricity has risen by as much as 50% since the Labor government was elected. Then there’s another $3b in electricity rebates each year to hide the true cost of the electricity horror show. Someone has to pay those rebates, and since it’s borrowed money, that’ll be the kids. Then there are the businesses that folded, the jobs that were lost, the factories that moved away, and the higher cost of frozen everything in supermarkets.

How did we go broke — gradually then suddenly.

By Matthew Cranston, The Australian

“The array of ‘programs’ and ‘funds’ related to climate change and net zero, which are typically piled on top of one another, year after year, has become ridiculous and almost impossible to track. It raises serious questions about how effectively and efficiently public funds are being spent,” Mr Creighton said. “Despite all this soaring spending on net zero, Australia’s emissions have fallen only 2.8 per cent on the government’s own figures compared to 2005, once you exclude creative accounting with trees.”

What do we call it when the government commands the economy — communism?

The construction of electricity generation and distribution, which is dominated by renewable energy projects such as wind and solar, has now reached a record share of total engineering construction.

Westpac economist Pat Bustamante said that since 2020, work done on renewables had grown by 250 per cent from around $2bn a quarter to around $7bn, “with a significant portion of this growth driven by the public sector”.

It’s a scandal that the Labor Government doesn’t come clean with a single figure cost for climate spending

Australian voters had no idea how much of their money is being squandered turning our power stations into fake weather control machines.

It’s another scandal that the ABC never demands to know the answer. Isn’t that exactly what we pay them for — to ask the hard questions? What did we get for $500 each —as it happens, more emissions.

It would take a PhD to estimate what the real cost is, but 100% of our academics are too busy trying to scare more funds out of the public to add up something we actually need to know. As a bucket estimate, $9 billion in public spending plus $3b in electricity rebates equals $12 billion annually. That’s $440 for every man, woman and child, and by the time we add in extra electricity costs the figure would easily be $500 to $600 each. It’s a level of spending that only 2% of Australians say they are happy to pay.

At no point did they ask you if you would rather keep the money yourself. That’s because they know Australians don’t want the Carbon Sky Whale.

Who do the politicians, the ABC and the Academics serve? The Chinese Communist Party?

10 out of 10 based on 96 ratings

What a nice surprise, a lovely card in the post box from the Netherlands today.

Thank you!

8.9 out of 10 based on 13 ratings

! The site is currently under DDOS (Distributed Denial-of-Service) attack again. Traffic is crazy.

Literally hundreds of thousands of requests coming in from the US, Vietnam and Brazil.

Thanks for your patience.

Apologies, it’s difficult to write posts when the server is overloaded.

(I will be reviving the largely dormant X account soon. @JoanneNova)

UPDATE: Massive suspicious traffic relentless. We’ve taken some action. Hopefully not blocking real traffic.

Please respond on X or email support.jonova AT proton.me.

10 out of 10 based on 52 ratings

By Jo Nova

Good news — there is one less hyper-complex, pointless, car-hate program in the world

It all flipped so quickly: Only six months ago President Macron was hurling France into a climate changing roadmap of the Octopus kind. The people of France were going to have to buy EVs, work from home, swap the filet mignon for tofu, and take fewer flights overseas. Even large screen televisions were going to have to shrink, to save electrons. And some bureaucrats were enthusiastically even dreaming that they would reach into homes and set the thermostats to max out at 19C (66F) in winter and to only cool to 25C (78F) in summer.

To beat French car owners around the head, the National government legislated car zoning incentives to make life hard for anyone who wanted to drive an old car. The low emission zones started in 2019 and had already spread like a municipal leprosy to every town larger than 150,000 people.

In these ZFEs (zones à faibles émissions), cars were ranked and given a sticker. Crit’Air 0 were the cleanest and Crit’Air 5 were the most “polluting” vehicles. Different rules applied to each sticker class in each town with a soul sapping complexity. In Paris for example, Crit’Air 3 cars (basically diesel cars older than 2011, and petrol cars before 2006) were banned on weekdays. Fines varied from €68 to €750. It was a case of — if you like your car, you can keep it — (locked in the garage, right?)

But cars older than 1997 were seen as such baby killers they were not allowed to have a Crit’Air Sticker at all, so their drivers would be fined if they were caught on any weekday between 8am and 8pm. Obviously, the bans hurt the poor and the rural workers — who drove older cars. They also hurt the tradies, and small businesses that used a van.

The low emission zones were so unpopular, as the BBC even admits, they “turned into something of a lightning rod for Macron’s supporters”. (The wonder is that it took five years?)

Last week the French National Assembly voted 98 to 51 to scrap the zones entirely. The government had tried to dilute the rules, and save the restrictions to Paris and Lyon, but MP’s were having none of it. Evidently, many politicians were afraid of word getting back to voters that they didn’t vote down the low emissions zones. (Go, democracy).

Interestingly, these car zones were so awful that even some members on the far left of French politics, joined the centre right to get rid of them.

Finally, there are hints of life on the far left:

“Green policies should not be imposed on the backs of the working classes” — Clémence Guetté.

Guetté is described in the Wall Street Journal as being “to the left of Bernie Sanders”. The Greens and Socialists though, still voted for the car sticker program to change the weather. They probably like having stickers on their cars to tell everyone how smugly clever they are.

BBC

A handful of MPs from Macron’s party joined opposition parties from the right and far right in voting 98-51 to scrap the zones, which have gradually been extended across French cities since 2019.

But it was a personal victory for writer Alexandre Jardin who set up a movement called Les #Gueux (Beggars), arguing that “ecology has turned into a sport for the rich”.

The low-emission zones began with 15 of France’s most polluted cities in 2019 and by the start of this year had been extended to every urban area with a population of more than 150,000, with a ban on cars registered before 1997.

Marine Le Pen condemned the ZFEs as “no-rights zones” during her presidential campaign for National Rally in 2022, and her Communist counterpart warned of a “social bomb”.

The head of the right-wing Republicans in the Assembly, Laurent Wauquiez, talked of “freeing the French from stifling, punitive ecology”, and on the far left, Clémence Guetté said green policies should not be imposed “on the backs of the working classes”.

Green Senator Anne Souyris told BFMTV that “killing [the ZFEs] also means killing hundreds of thousands of people” …

The legislation still has to go through the upper house, though it is expected to. And it doesn’t stop tyrant-municipalities from imposing their own small tourist-deterrent zones. But spread the word in case any of our politicians think this idea is not radioactively awful. They need to know it’s been tried and failed so we don’t have to repeat the experiment.

See also France, Yes Even France, Rethinks Low-Emissions Zones, Wall Street Journal

Car and signs picture created with AI.

9.9 out of 10 based on 97 ratings

8 out of 10 based on 9 ratings

8.7 out of 10 based on 15 ratings

8.1 out of 10 based on 29 ratings

By Jo Nova

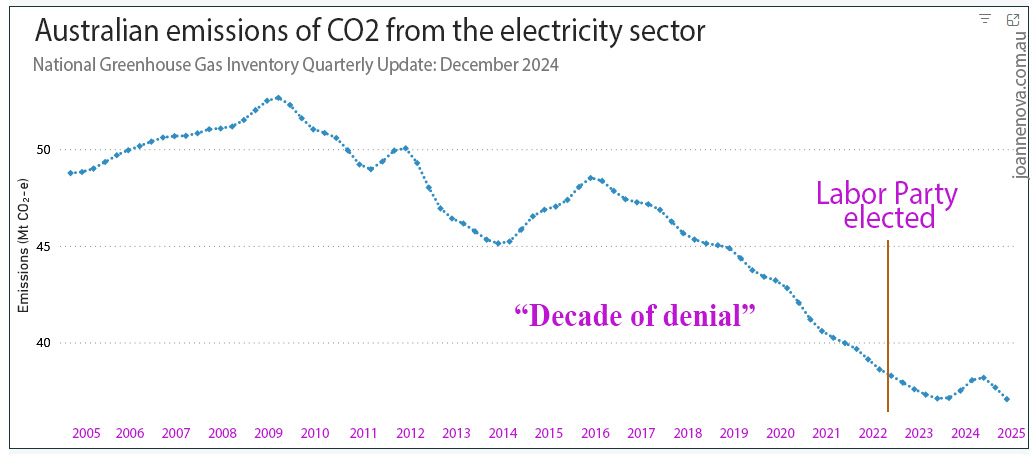

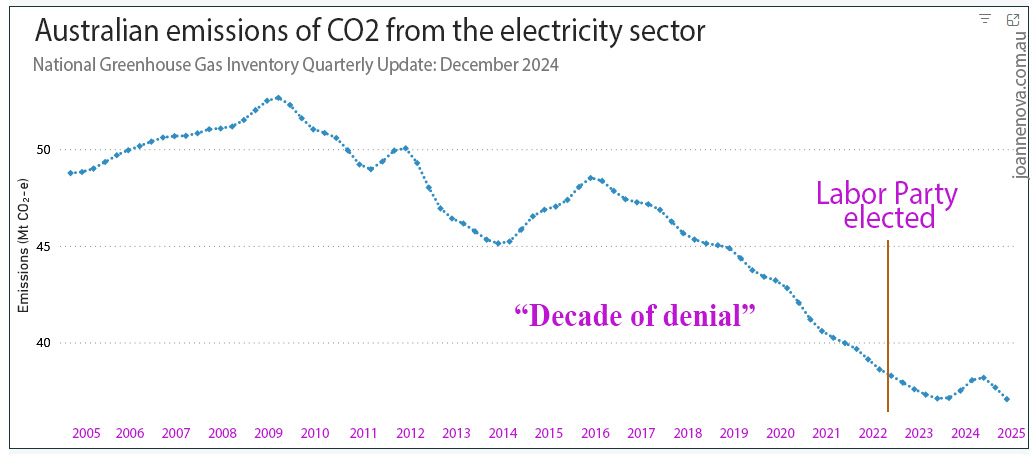

Welcome to Futility Island

Anthony Albanese was elected in May 2022 and set God-like new emissions targets in to legislation. Ponder the scale of the national achievements of the last three years. All that money, all the wind factories, the solar panels, the batteries, the holes bored in the Snowy Mountains, and this is all we have to show for it?

This is the graph from the latest Quarterly figures shown on the DCCEEW website (with added notation from me):

Poignantly, Mr Bowen, the Minister for Weather Changing and Energy said — “We’re turning around a decade of denial and delay, by setting serious climate targets in law and delivering the policy certainty to industry to bring down emissions”. Indeed. (Do tell us when you start Chris?)

The bump last year was because the clouds didn’t rain on the Tassie Hydro Scheme as much as we needed. And the wind didn’t blow anywhere much in Australia in Quarter 2 last year. Who can forget the calm days of April-May-June last year when the wind turbines on the continent stood still? At one point, $20 billion dollars worth of wind power could only make as much power as two diesel generators.

For some reason none of our expert Climate Models saw any of that coming far enough in advance for us to plan ahead. So we just had to burn a bit more gas and coal. You’d think at this point, the failure of extra wind and solar would be so obvious, the Greens would be begging the Labor Party to build some nuclear plants. But they don’t care about CO2 either.

Beyond that, ponder that even despite weather anomalies, the Labor Government and all the extra “renewables” have not seemingly achieved much in the last three years (or not much in the way of emissions). With all the money spent, wasn’t the line supposed to dip below the trend, not plateau?

The thing is, more than a million people have immigrated to Australia since 2022, and they like emitting carbon dioxide too, and need houses and cars, but no one talks about that. Does the Labor Government care about our national emissions, or is it all just a performance art to justify trips to Davos and Brazil, and enrich their friends and donors?

By Greg Brown and Perry Williams, The Australian

Anthony Albanese’s 2030 target to reduce emissions is on life support after new data showed Australia’s carbon footprint rose slightly last year driven by a 2.2 per cent increase in the electricity sector.

Figures released by the Climate Change Department show carbon dioxide emissions rose by 0.05 per cent in 2024 to 446.4 million tonnes, equivalent to 27 per cent lower than in 2005.

Despite Labor going all in on renewables as part of its climate change agenda, emissions in the electricity sector increased in 2024 with coal and gas needing to step up due to a lack of water limiting hydro generation in Tasmania.

Australia has currently reduced its emissions by 27% in total since 2005 (mostly due to land use changes, not electricity, but that’s another story). Supposedly, if something supernatural happens, like aliens visit, or a meteor hits Sydney, we’re going to get to a 43% reduction by 2030.

Otherwise to have even the faintest ethereal chance we’d need to increase “renewable-unreliables” from the current 40% up to 82% and 2030 is only five years away? Everyone knows it’s impossible, and yet the crazy bus keeps going?

Even the believers like Bruce Mountain are saying he did not think there was a chance… yet Mr Bowen is still emphatic that “we’re on track”. (Like we live in a different decade of denial now?)

We’re so “on track”, that 75% of the projects the Minister is expecting are not taking off:

Only a quarter of the large-scale renewable energy generation required to hit Labor’s 2030 target in the first three months of 2025 progressed to a firm capital commitment, new data showed this week, sparking a warning that the pace of investment must quickly accelerate to hit the end of decade goal.

At this point in our breakneck transition, wind-factories and solar panels should be going in all over the country. But we just heard that the price of high voltage transmission towers was going to cost up to 55% more than expected, and the AEMO was throwing their previous plans to the wind. Now, we’re all supposed to subsidize each other to buy home batteries, EVs, and solar panels. What do we call that — a pyramid scheme?

9.9 out of 10 based on 96 ratings

7.7 out of 10 based on 15 ratings

8.9 out of 10 based on 17 ratings

By Jo Nova

Nothing like mucking up the holiday plans of the overbearing bureaucrat…

To combat the rise of the Blob’s new insidious censorship laws Donald Trump will deny visas to any foreign officials who are now or ever were involved in censorship of American citizens.

Suddenly EU lawmakers, and Brazilian Judges will find they can’t get a visa to the USA, and the ban may apply to their family members too.

This should slow down the spread of new cancerous “content moderation” laws around the world, and the attacks on the US Tech Giants. It would also apply to the Australian Prime Minister, Anthony Albanese if he brings back the Misinformation and Disinformation laws he tried to rush through last November.

Thus, it may be that Donald Trump may yet prevent some of the worst laws ever dreamed up in Australia (hallalujah). Not that anyone in the government will ever admit that.

Press Statement, Marco Rubio, Secretary of State

Today, I am announcing a new visa restriction policy that will apply to foreign nationals who are responsible for censorship of protected expression in the United States. It is unacceptable for foreign officials to issue or threaten arrest warrants on U.S. citizens or U.S. residents for social media posts on American platforms while physically present on U.S. soil. It is similarly unacceptable for foreign officials to demand that American tech platforms adopt global content moderation policies or engage in censorship activity that reaches beyond their authority and into the United States. We will not tolerate encroachments upon American sovereignty, especially when such encroachments undermine the exercise of our fundamental right to free speech.

One of the worst offenders, the EU, brought in the “Digital Services Act,” (DSA) which threatens monster fines of 6% of global turnover if companies did not “moderate content” to the EU’s vague, ambiguous satisfaction. This would have meant all the large platforms would have had to second guess what was acceptable speech, and censor it automatically. These censorship-by-proxy laws meant the EU could technically claim they weren’t censoring anyone directly, but in reality, they were farming out the censorship to platforms like X, Meta, Google, Apple and Amazon. And because of the risk of obscene fines, the lawyers for all these companies would have been sweating on their automated word hunts, and the censorship would have been worse than if the EU did it openly.

The EU wanted to be the Global Regulator of the Internet. Most of the large platforms would not want to run two different mirror platforms in order to comply with the EU rules, so they would adopt the new moderation rules around the world.

By Simon Lewis and Daphne Psaledakis, Reuters

WASHINGTON, May 28 (Reuters) – The U.S. will impose visa bans on foreign nationals it deems to be censoring Americans, Secretary of State Marco Rubio said on Wednesday, and he suggested the new policy could target officials regulating U.S. tech companies.

U.S. tech companies and the Trump administration have challenged U.S. allies in Europe, alleging censorship of social media platforms. Restricting officials from visiting the U.S. appeared to be an escalation by Washington.

The dispute comes as the EU seeks a trade deal with Washington to avoid President Donald Trump’s threatened 50% tariffs on European imports. Rubio’s announcement came just before he met with German Foreign Minister Johann Wadephul in Washington.

The Australian government dreams of bringing in its own worse-version of the EU laws

The Combatting Misinformation Laws here, would have been more draconian, more sweeping and apply to even smaller platforms, including fines for solo bloggers. The Australian rules were aimed at stopping people professing things that “undermined trust in institutions” or caused “harm to public health” so (don’t criticize vaccines, don’t be nasty to the ABC, BoM or CSIRO and don’t say bad things about the Government!)

At the time, even the US based CATO Institute warned the Australian rules would hit free speech around the world, including Americans. So obviously Mr Albanese could find himself on the visa ban list if he did. (Lucky for him, he failed, eh?)

The Transnational Streisand Effect

Imagine if the Australian government rewrites the Misinformation laws so that US companies only have to censor Australians. The Labor Party might accidentally set up a transnational feedback loop of defiance, where censorship at home creates more speech abroad. It would surely spring forth a radioactive Streisand Effect as those same censored Australians sent messages to friends and ex-pats in the US who could thus wreck havoc and mischief and speak up for them. It could spawn a whole new industry in the US of proxy content providers, paid to say things about Australia that Australians were not allowed to say. It could be all-American sport pointing out the stupid things that were banned in Australia. Wouldn’t that be fun?

An E.U. bureaucrat on free speech was woken,

Thinking U.S. tech giants too outspoken,

At J.F.K. airport was shocked,

When free entry was blocked,

With no visa, back to Brussels, was broken.

–Ruairi

Mt Rushmore image Image by Pete Linforth from Pixabay.

Airplanes image by dakotaviking from Pixabay

9.8 out of 10 based on 100 ratings

10 out of 10 based on 11 ratings

By Jo Nova

The energy situation is flipping on a dime around the world

Political entities are waking up to the need for reliable mass power. Consider the whiplash in Taiwan. They closed the last of six nuclear reactors on May 17th, marking the end of a nuclear era that started in 1970. But, hey ho, two weeks later, they’ve decided to hold a referendum on whether to restart the same plant. The vote is set for August 23.

By Tsvetana Paraskov, OilPrice

Taiwan will hold in August a referendum on whether the just-shuttered last nuclear reactor should be restarted once safety checks are completed, in a major reversal of the country’s policy amid energy security concerns.

Since 2018, Taiwan has shut down four other nuclear reactors and cancelled construction of two others following a referendum in 2021.

Earlier this month, Taiwan’s Parliament amended the country’s nuclear power act to allow plant operators to apply for a 20-year license renewal beyond the existing 40-year limit. This legislative amendment effectively opens the door to restarting nuclear power plants in the country.

The reasons given for reopening the plant are both the escalation in energy needs for Taiwan’s silicon chip industry (is that code for “AI”?), and heightened fears of a military blockade from China. Because the plant needs to be comprehensively checked for safety, apparently it may be three years before it is operational again.

A country torn between Net Zero goals, and aggression from China

Apparently the Taiwanese government was full bore on the sacred green goals in 2016 (and wouldn’t that suit Beijing?) but lately things have got too hot and people are starting to add up the security risks of being on an island where 97% of the energy is imported.

In the new uncertain world, suddenly coal is better than gas (it’s easier to store) and old nuclear plants are an asset.

Jane Rickards, The Strategist, ASPI

Lai’s government is understandably concerned about energy security, as at least 97 percent of the island’s energy is imported. But it also wants to reduce carbon emissions, having established a goal of net-zero by 2050. The Taiwanese government views LNG as a cleaner type of energy and is phasing out the widespread use of coal. Natural gas powered 32 percent of Taiwan’s electricity in 2016. The figure rose to 42 percent last year, and Lai is pushing for it to reach 50 percent by 2030. The drive for LNG grew following Donald Trump’s election as US President. Taiwan plans buy more US LNG over the next decade to help reduce its trade surplus with the United States.

However, LNG is difficult to store long term, which would create problems in the event of a quarantine or blockade. Taiwan is densely populated and has limited space for the fuel’s expensive storage infrastructure. Lu Tsaiying, an energy expert with Taiwan’s Research Institute for Democracy Society and Emerging Technology, notes that Taiwan holds enough LNG for 12 days’ ordinary consumption. In contrast, the coal stock is enough for 42 days and the crude oil stock for 146 days.

Lu predicts that coal, which currently powers 39 percent of Taiwan’s electricity, and renewables, powering 12 percent, would be the main sources of energy during a blockade, quarantine or even a war.

In the world we thought we lived in, trading partners didn’t do naked industrial sabotage

In an extraordinary move Chinese Communist Party appears to be actively cutting and damaging submarine cables around Taiwan — with accidents involving Chinese controlled ships that change names frequently and are registered in foreign countries.

In a grey war, there is always plausible deniability, but Taiwan have arrested at least one captain and charged him accordingly.

by Gahon Chia-Hung Chiang, staff of Legislator Kuan-Ting Chen, Taiwan

China’s illegal, coercive, aggressive, and deceptive (ICAD) activities pose a mounting threat to global democracies, with subsea cable sabotage emerging as a particularly alarming tactic. These fiber-optic cables, which carry over 99 percent of global internet traffic, form the backbone of modern communication networks—underpinning economic transactions, defense coordination, and digital infrastructure.

In early 2025, the Xingshun 39 (興順39), a Tanzania-flagged vessel controlled by a Chinese entity, deliberately severed subsea cables near Keelung, disrupting Taiwan’s external communications….

Just weeks later, in late February 2025 another incident occurred when the Hongtai 58 (宏泰58)—a Togolese-registered cargo vessel suspected of having a Chinese crew—severed Taiwan’s third subsea cable linking Taiwan and Penghu.

These were not isolated incidents, but rather part of a troubling persistent pattern. According to Chunghwa Telecom, in 2023 cables connecting Taiwan and the Matsu Islands—Taiwan’s off-shore islands near China—were severed 12 times, resulting in repair costs of NTD $96.4 million (USD $2.9 million). [1] While China has consistently denied involvement, the pattern of repeated cable disruptions, which align with its strategy of leveraging civilian assets for military purposes, suggests a concerted effort to degrade Taiwan’s ability to maintain stable digital infrastructure.

The brazen hostility would be enough to make even a crazy nation think about national security instead of fixing the weather 100 years from now. Given that a Chinese ship recently circumnavigated Australia following our submarine cable network, maybe we should be too?

9.6 out of 10 based on 69 ratings

8.1 out of 10 based on 16 ratings

By Jo Nova

The Transmission line cost bomb just went off and it changes everything

This is big. So big the AEMO just announced transmission line costs are up as much as 55%, and they are going to re-visit projects they previously said needed to proceed (which is the nice way of saying they will have to axe some or many of them). What no one is spelling out, is that if the transmission lines can’t be built, they also can’t build the vast solar and wind “farms” that the Labor government was depending on. Suddenly a lot of renewable projects are orphans.

Australia is supposed to build 10,000 kilometers of high voltage transmission lines by 2050. But last week, the AEMO admitted in their Draft 2025 Electricity Network Options Report that these interconnectors would cost between 25 to 55% more than expected, which makes them essentially unaffordable.

Plan B is where they pretend cars, home solar and batteries can save the “Transition”

The old plan of massive wind and solar factories spread across the continent is quietly mutating into a DIY version where the government hopes homeowners will rescue the Net Zero transition by buying the batteries the government and the wind and solar factories can’t afford. What did I say a year ago: “They want you in an EV so they can use your battery to rescue the unreliable grid they built“.

The code word for this is CER or Consumer Energy Resources.

The big question is whether the government can trick enough people into handing over the cash to buy an EV, or a home battery that even with a $4,000 subsidy will barely break even in a best case scenario. What happens when the punters realize the battery they bought to reduce their own costs is being drained by our electricity management at peak hour to keep the grid from crashing?

What happens when the poor realize they are paying more for electricity so rich people can have solar panels and batteries and (slightly) cheaper electricity? Hell to pay.

Now they talk about “social licence”?

The AEMO and renewables fans are also admit the farmers didn’t like them, so the routes had to be redrawn on longer, more difficult paths, and the payments for the pain and inconvenience turned out to be much larger than the inner city latte set expected. Thus and verily, the timelines have also blown out.

The farmer’s pain is referred to as a “social licence” consideration. The farmers, though, don’t mince words:

Western Victorian Farmer Would the AEMO care so much about social license if they could have forced the lines through? What they are really afraid of is burning off the whole damn country when families everywhere realize they had to pay for $20 thousand million dollars of high voltage lines so renewables factories could make a profit from the subsidies the families also had to pay for too. Professional leaches at 440,000 volts.

There is karma here. Renewables need high voltage lines, but high voltage line installers need cheap reliable energy. Once upon a time, when we had lots of cheap coal power, we might have been able to afford to make the transmission towers that industrial renewables need. But now that the same people who want renewables have banned gas exploration, and destroyed cheap electricity, they can’t possibly afford to build more transmission lines.

Suddenly the AEMO realizes that transmission line costs will hurt consumers. Now they tell us?

They should have seen this coming years ago:

By Perry Williams, The Australian

A massive surge in costs to build $20bn worth of electricity transmission would trigger a hit in household power bills, the Australian Energy Market Operator says, amid skill shortages and a battle to win over communities and farmers to the green energy switch.

The cost of overhead transmission line projects has ballooned by up to 55 per cent, with substations rising as much as 35 per cent compared with equivalent estimates provided for AEMO’s 2024 electricity plan.

This is big. So big the AEMO is going to reconsider projects it previously said needed to proceed.

“AEMO recognises that increases in costs for electricity transmission network development would impact bills for electricity consumers,” the operator said. “The 2026 ISP will revisit transmission network projects previously identified as needing to proceed … seeking to ensure that overall costs for consumers are optimised.”

Hence the “Plan B” is to get the consumer to foot the bill:

One area where AEMO may be able to cut back on costs is by leaning more heavily on household sources such as rooftop solar, electric vehicle to grid supplies and batteries which received a recent subsidy boost. Taxpayers will contribute $4000 for an average household battery installation under a $2.3bn election commitment by the Prime Minister, with Labor promising the policy will push electricity prices down for “everyone”.

As Graham Lloyd points out, the power utilities are all warning that shifting the burden to householders is not going to work:

By Graham Lloyd, The Australian

In April, Transgrid said assumptions that Virtual Power Plants will experience the same level of availability and flexibility to respond to market conditions as an equivalently sized utility-scale battery energy storage system are not reasonable.

Households were unlikely to accept that their assets may be accessed frequently and run very hard because household solar and batteries are primarily investments intended to provide utility and value to consumers rather than the market, Transgrid said.

In March, Queensland power utilities Ergon Energy and Energex gave a similar warning.

“We are cautious of the approach to model customer behaviour based on economically rational models, as we consider most CER investments do not conform to these modelling outcomes,” the utilities said.

“For example, based on our anecdotal experience, AEMO’s assumptions regarding the level of battery energy storage systems uptake supported by Virtual Power Plants may be overstated.”

We know this is the new desperate rescue plan for the doomed transition because even the industry lobby site, Reneweconomy, is working so hard to sell it as “handing power to the people”

Giles Parkinson puts on a brave face, pretending that this is “sailing with the wind” and has been “brewing for a while” (as if it’s not a surprise) but this is a big backflip by the AEMO and it’s not remotely good for all those wind and solar projects.

Even he admits this is a fundamental rethink.

Giles Parkinson, Reneweconomy

One thing that seems certain, however, is that the manner of getting there, and closer to 100 per cent renewables over the following decade, is about to get a fundamental rethink, and it could end up delivering the most significant change to the country’s renewable energy blueprint yet.

The document flags a new focus on using existing local networks for more wind, solar and storage, and on leveraging consumer energy resources – the rooftop solar, household batteries and EVs that will be bought and installed by consumers themselves.

That’s a funny way to phrase it Giles? Killing the business…

It’s a significant move. In the absence of a carbon price, rooftop solar has been the most effective tool in killing the business case for Australia’s aging fleet of dirty fossil fuel generators. But it has created issues of its own, and will remain a wild card for the grid if it can’t be tamed by an army of small batteries.

And who pays for that army of small batteries Giles?

Wait, now you tell us that the best way to reduce costs is with “consumer energy resources”, and it’s supposed to be cheaper for everyone. Why didn’t you say so before…

And the growth of consumer energy resources is possibly the best way to ensure that prices do, as promised, actually fall in the transition from coal to green energy – both for those who own and install them, and those who don’t.

He blames the big bad capitalists — but never acknowledges that it was the stupid socialists who rewrote the market:

The evidence so far is that it hasn’t, mostly because the new assets – wind, solar and especially storage – are largely controlled by the same companies that own and control the coal and gas assets.

Indeed, the socialists make it possible for predatory capitalism to monopolize the market and then they act surprised when it does?

Even Giles Parkinson say it’s an appalling mess:

However the plan is framed, social licence remains absolutely critical. Despite the best efforts of some really good renewable energy developers, it’s been poorly handled.

The worst of it has come in the management of the transmission routes, but a combination of entitled development companies, bloody-minded opposition and some appalling planning regimes have created an appalling mess – highlighted by the latest backflip by the new Queensland state LNP government.

Blame the management indeed. Anything but admit it was always a stupid idea. The renewables fantasy was never going to work. It was a horrible plan to cover the country-side in expensive, intrusive, live infrastructure that ruined views, raised the risk of fires, and got in the way of farming and firefighting. And it was all done in the futile hope of changing the weather.

But rejoice, in part, at least, the protests by farmers and communities are working

The industry is so rattled, they even asked Reneweconomy not to publicize their projects lest the people notice what they want to do:

Little wonder some developers are wary of scrutiny. One even asked Renew Economy last week to stop reporting on projects put in front of the federal government’s EPBC process because of the risks of unwanted scrutiny.

Clearly, we need to watch the EPBC list. Can anyone help identify where these are officially listed? If they don’t want us to see, then I’d like to know…

Image by Nerijus jakimavičius from Pixabay

9.8 out of 10 based on 113 ratings

8.1 out of 10 based on 12 ratings

|

JoNova A science presenter, writer, speaker & former TV host; author of The Skeptic's Handbook (over 200,000 copies distributed & available in 15 languages).

Jo appreciates your support to help her keep doing what she does. This blog is funded by donations. Thanks!

Follow Jo's Tweets

Follow Jo's Tweets To report "lost" comments or defamatory and offensive remarks, email the moderators at: support.jonova AT proton.me

Statistics

The nerds have the numbers on precious metals investments on the ASX

|

Recent Comments