Guest post by Eric Worrall

How can we predict the climate, when we can’t even predict financial markets?

Financial markets are a high stakes battle between teams of skilled traders, armed with powerful computers. [In a perfect market] The factors that affect market prices are well known, and for mathematicians, surprisingly simple to describe. Yet with all this underlying simplicity, traders don’t attempt to predict the future, because they know from bitter experience that predicting the future is futile. Instead, they use their models to gain a deeper understanding of the present.

Say you are trading financial options. Options are a right to buy or sell an underlying commodity (gold, shares in a company, tons of beef, whatever) at a future point in time, for an agreed price. The exact rules vary in different places, but essentially – your option gives you the right to buy an ounce of gold in one month, say, for $1000.

If so, and the price of gold is $1,200 per ounce, then your option is worth $200, right?

Wrong. In one month, the price of gold might be $800, in which case your option is worthless – there is no point using the option to buy gold at $1,000, when you could simply buy it on the spot market for $800. Or in one month, the price of gold might be $1,400, in which case your option will be worth $400, double the $200 it would be worth if you exercised the option (activated the trade) at the current price of $1,200.

How do you price something based on a future price which you can’t foresee?

The answer is you try to estimate the likelihood of the price shifting significantly from its current value. You add an estimate of gold price volatility to your calculation, based on the current range of prices, how much the price of gold is jumping around in a day’s trade, versus the length of time left on the option (1 month).

Of course, there’s more to it that that. Instead of buying and holding the option, you could have put the money into a high interest bank account. So the interest you could have earned if you put the money into a savings account is part of the cost of owning the option – that has to be factored into the value of the option. And if you want to be really precise, you have to consider counterparty risk (the risk that the issuer of the option will go bust, and won’t honor the deal), market liquidity(whether there are enough buyers and sellers to ensure a “real” market, or whether the scarcity of market participants will allow big players to fix prices to maximise their profits at the expense of other participants), sovereign risk (the risk the government will step in and ruin your trade with hostile new laws), and the cost of making a trade (tax, market fees, your time, etc).

But I just said traders don’t use their models to predict the future, and isn’t what I described sounding an awful lot like predicting the future?

The point is, the model can’t tell you what the price of gold will be – it can only tell you what the price of gold might be, to give a range of outcomes with their probabilities as you see it.

So traders use their models to explore possibilities. To protect themselves from the $800 risk, they cover themselves by buying a complementary option – for example, they might buy the right to sell a large quantity of silver at $20 / ounce – the opposite kind of option to their right to buy gold option. The price of silver more or less tracks the price of gold, so buying a right to sell silver means that if the price of gold drops, rendering their gold option worthless, the price of silver will also most likely drop. If the trader gets the right deal when buying the silver option, the trader can still make a profit if the gold price (and the silver price) falls, by buying silver at a low price, and selling it at the locked in silver option price of $20. If the trader has done their job, in the event of a price drop, they will make enough profit from their silver trade to more than offset their loss on the now worthless gold option.

The skill of the trader is exploring the landscape of possibilities, to use the models to help discover paired complementary deals which can lock in a guaranteed profit, regardless of what happens to market prices.

Of course, real trading strategies are generally a lot more complicated than this simplistic example. With all the competing teams of highly skilled traders crawling over the possibility landscape all hours of the day or night, the opportunity for a profit from a deal that simple should disappear before it properly had a chance to manifest.

My point is, the models are not used to predict the future, they are used to explore the landscape of future possibilities, to discover ways to lock in guaranteed profits, and to provide alerts if the portfolio of options and other instruments has an unexpected weakness – to identify scenarios in which traders’ portfolios become exposed to a serious risk of loss, so they can patch the holes in their positions before they become a problem.

Nobody is daft enough in the financial world to believe they can predict the future. The models are only used to answer “what if” questions, to help close loopholes in their complex web of trades which might lead to dangerous losses.

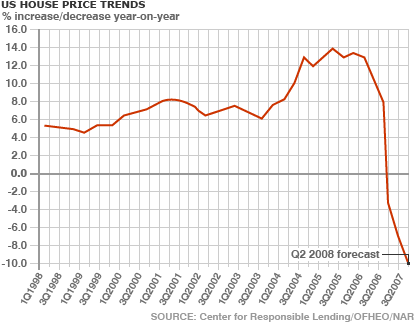

In addition, traders are acutely aware of the limitations of their models. For example, from the limited viewpoint of mainstream financial models, the subprime mortgage crisis occurred because the boundary conditions of the financial models were breached. One of the underlying assumptions of most financial models is that you can always buy and sell your financial instruments (options, stock, gold, etc), but in times of extreme crisis, the market sometimes freezes up – nobody wants to touch your worthless paper with a barge pole. In these conditions, the model description of reality breaks down, and the door is opened to uncontrolled losses.

The big difference between climate science and financial markets, is that the best PhDs work in financial markets, potentially earning millions of dollars per year in bonuses, helping big banks lock in profits and avoid risk. The financial modellers know the limitations of modelling – most of them know you can’t predict the future with a mathematical model, so they don’t even try. The limits of models is a lesson they have all learned through bitter experience, while watching the occasional delusional colleague take a fall. Even in financial markets, skilled scientists sometimes become seduced by the illusion of model predictive skill, before being wiped out when the markets unexpectedly turn against them.

By contrast, climate modellers claim their models have predictive skill – because there is no reality check to correct this delusion. When the model failure is obvious, such as the growing divergence between model predictions and observed temperatures, there is no penalty for failure. Climate modellers have the freedom to claim their nonsense is still valid, even in the face of overwhelming evidence that it is not. There are no groups of angry shareholders in climate academia, challenging the mistakes of modellers, demanding that failed or delusional modellers be fired from their jobs.

Financial traders have certain responsibilities with the funds they manage, climate worriers have no such restrictions, therefore they can model/predict/do whatever they like.

171

And if their predictions turn out to be garbage as from the UK Met office, then the government rushes to buy them a bigger and more expensive supercomputer.

GIGOMF – garbage in. garbage out, money flows

190

But Graeme No.3

The UK Met Office with it’s new super-duper computer can now make very poor predictions so much faster.

So that’s an improvement – isn’t it?

231

The BoM is following suit: http://www.computerworld.com.au/article/545032/budget_2014_-_govt_funds_new_bureau_meteorology_supercomputer/.

31

That’s the beauty of the computer. It can do things very fast. However, it can’t tell you whether what you’ve ordered it to do is useful or not. It’s equally at home producing good stuff or garbage. It could not care less, one way or the other. And it doesn’t lose any sleep over the result.

Now if someone could invent a computer with a conscience… But maybe first we need to invent a climate modeler with a conscience. 😉

61

A fine piece Eric Worrall.

You’ve set out the stall why modeling is a very useful tool, and should not be the gold standard of prediction that some would have us believe. Well explained.

Markets, like some aspect of the climate are deterministic but they are also chaotic, thus not (easily) predictable.

Note that some aspect of our climate are just random (the effect of a volcanic eruption in a particular area, or meteor impacts, etc.) These are completely unpredictable and can only be accounted for after the fact.

172

There is a great difference between climate and trading. In climate everything is coupled but the world has had millions of years to find a stable position, so everything has a balance. It the weather is too hot, evaporation causes clouds and rain to cool the land. Call it the monsoons. We in Australia are experiencing it now and India is dependent on it.

In financial markets, there is the real possibility of positive feedback leading to runaway positions and market meltdown, tipping points. This was part of the CO2 scare, but it is not true. Unless there is a big event like a volcano, meteor or change in solar intensity, you can expect long standing systems to have found the stable position where the forces are in balance and the feedback is negative. A perturbation settles.

Automatic computerized trading systems are in real trouble on the stock exchange with runaway trading run in milliseconds by watching algorithms protecting vested interests or trying to optimize returns. What used to take weeks now happens in seconds and can bring down the entire exchange. This has happened a few times in the last decade.

So the core point is that simple man made single variable trading systems are unpredictable and my point is that they are also inherently unstable, which is worse. Weather systems are much more stable even if some of the oscillations take decades, like our land of droughts and flooding rains. Unfortunately every climate scare monger points to the annual ‘average’ as being a guaranteed position and any deviation is a disaster. Even ‘averages’ can change as part of the balance between thousands of forces without it being the result of a single input, CO2.

171

I don’t entirely agree with that.

It is possible to set up a computer trading system which goes mad and introduces runaway feedback but such events cannot be infinite. They just wreak their havoc and then run out of power when the market collapses. They cannot then spring back into life for a while because all the money has been used up and people are feeling more cautious for a while.

Totally analogous to a wild fire or a hurricane.

The time scale is different but the effects are scalable.

30

42.

81

In fairness the climate models weren’t developed to forecast future climates, more to experiment with relationships in it given we only had one world.

Also this piece does trend to suggest the future’s markets are simply the playground of traders trying to beat each other. These markets have an important foot in the real world. They are used by users of the commodities (including $) being traded who want to remove the risk of its volatility from their business. It for example allows an exporter to manage some of the currency risk from future revenue. This probably constrains the future’s market more than any traders’ models.

50

Absolutely – trading produces some important real world benefits, it increases liquidity, and reduces spreads (the difference between buy and sell price), active trading makes it more difficult for big players to fix prices and scr*w everyone else.

91

I wonder how much direct human involvement still occurs in trading. A bit dangerous in the brave new world of HFT. The greatest tragedy is how many great minds are wasted trying to screw each other in virtual trading. Think what they might have achieved had they been employed to do something useful.

50

HFT isn’t everything – its mostly good for arbitrage, jumping on and profiting from slivers of inconsistency in market prices. So in a sense it also contributes, it helps keep everything liquid, and keeps the market consistent.

And trading is useful. Ultimately trading and markets are what direct efficient resource allocation. If there is an opportunity to make a profit, that is usually because there is an unfulfilled need, a lack of something – so having ever watchful markets pounce on such needs and throw money at fulfilling the need to correct the imbalance which created the profit opportunity is I would argue a genuine public good.

51

Hi Eric

HFT represents a very uneven playing field.

Our Super funds or individuals buying or selling all pay a transaction fee.

Such is not the case with HFTraders who can buy and sell FOR UNEARNED PROFIT on fractions of a cent price variation with no commission payable.

It is a matter of serious concern that this “Market” is actually two markets, one being hidden from the general public for very good reason; it is fleecing them?

KK

20

HFT is IMO not unearned profit – it takes a tremendous amount of time and money to build a HFT rig, and the risks to the owner of the HFT rig are horrendous. Because everything happens so quickly, a small bug in the code can cause hundreds of million of dollars losses in the fraction of a second it takes to hit the “off” switch.

And arguably HFT helps the market, by bringing its operation closer to the ideal of a perfect market, and by helping to narrow the gap between buy and sell prices – which reduces the costs of trading for everyone else.

Yes HFT players pay less per trade than most other people – but its normal to receive a volume discount when you are a big client.

I’m not arguing naughty things don’t happen – there was a major scandal recently, accusations that major banks were conspiring to manipulate the LIBOR rate, a benchmark interest rate against which many other market prices are calculated. But this wasn’t because of HFT.

http://en.wikipedia.org/wiki/Libor_scandal

41

Eric we have just come through the GFC which was devastating for most savers.

That meltdown occurred for a reason; greed and some banks being allowed to stretch the trading rules past the ridiculous.

Some made heaps; most suffered because of Government failure to monitor and regulate the market.

A market with a leak in the bottom is not a market.

KK

http://joannenova.com.au/2015/01/volatility-from-vega-why-math-models-cant-predict-the-future/#comment-1668315

20

I laugh at EMH. The markets are far from efficient. LIBOR, insider trading, the GFC fiasco with subprime repackaged as rolled gold securities, and front running to name a few.

I won’t argue that markets aren’t useful… but unregulated markets can be an absolute disaster. The biggest problem is that Wall Street owns the US politicians. No regulation will ever pass without Wall Street making sure it doesn’t hinder their pursuit for ever greater profits.

One can dress it up as “efficiency” but it has got precious little to do with it. There is no reason whatsoever for a market to be “efficient” at the nanosecond time scale. The only reason to trade quicker and with less lag than your competitors is to take advantage of the discrepancy to line your own pockets. Most trades don’t involve humnans directly any more… that, right there, tells you all you need to know.

20

… I won’t argue that markets aren’t useful… but unregulated markets can be an absolute disaster. …

Markets need rules, but not necessarily regulation. A lot of the time regulators think more about saving their own skins or helping their political masters. For example, consider the bank bailouts. The banking sector didn’t need bailing out, there were plenty of banks which weren’t wrecked which would happily have stepped in and filled any gaps left by failed businesses. But the vast amount of taxpayer money used to refloat bankrupt banks also inadvertantly saved the investment portfolios of politicians who had lost heavily when the banks crashed.

I’m sure though that politicians were thinking of the public good, when they diverted 100s of billions of taxpayers money into refinancing bankrupt businesses.

40

There’s regulation and then there’s regulation. Too many in the US are ideologically opposed to any form of regulation. As if free markets solve every problem automatically.

Another massive issue is that the central bankers of the world have taken it upon themselves to ‘save’ economies. An example of too much market interference. You’d think there’d be a happy medium in there somewhere.

20

Over regulated markets are a problem too. So what’s the solution, Bulldust?

The heart of any market is the ability of those who trade to judge how much risk they want to take and decide accordingly. It’s a part of the basic freedom we all want to enjoy — to decide for ourselves. So where do you draw the line? The risk should be as easy as possible to figure out for everyone. How do we do that?

The current market reform, Dodd-Frank, is just wasting money on red tape. Risk is a part of life, period.

10

And please don’t misunderstand me. I don’t favor a completely unregulated market. But I don’t have any love for regulations based on pure unadulterated jealousy that say I made an unjustifiable windfall profit if I manage to buy today and sell tomorrow at a gain above some certain percent. Such is the level of the current regulatory regime on Wall Street’s back.

It’s simply nonsense.

10

The alternatives to open market trading is a closed market. We know much about the pitfalls of this type of system as the USSR had this type of regime. N. Korea still has. This is where the elites dictate.

A more closed system is exactly what the UN through ‘Carbon Trading’ is aiming for, as CO2 levels as dictated by the UN (through their fiction of ‘x°C maximum global temperature rise’) would constrain all nations in their use of carbon based fuels and the generation of CO2. This is where the UN elites wish to be and dictate to all.

We may not have a perfectly fair and equitable system now but the UN’s ideas would surely knock us all back to the dark-ages.

61

There’s plenty of systems between the extremes. I don’t know of any economy actually operating pure laissez-faire. IMHO Oz seems to have a good balance. People complain we have nanny states, but we are well short of EU levels of central control.

10

But we still get screwed.

30

As an example, some faux science says a 50% change in a 0.04% component over 100 years will crash an unstable e world physical by changing temperature 3%? Really? Is that so bad?

Consider the oil price where one player, Saudi, decided to instantly halve the price oil. Against obvious logic, they have decided they can live with half the income? Clearly they do not expect to crash world economies but ultimately to make more money.

Watch how the world reacts to cover the oil situation. Every country will be affected, some badly in the short term but what is a problem for some will be a real boon for most people. Will the world economies crash? We hope not, that systems will react and many might actually benefit. Saudi is calculating the same thing and would be certain that they will be better off.

The only people who will really hate this are the Greens. Windmills and solar power are suddenly twice the price.

101

Actually, I think OPEC is probably countering substitution, the world was beginning to kick its oil addiction, and was switching to coal. A period of low oil price will build volume, which can be exploited later by raising the price again. IMO this is all about building volume. This is a very good thing for many economies, and those shale producers who can hold out will do very well from about 2017 I think. Putin is right about this the low price is temporary, just until economies improve enough to build volume.

20

Looking at oil, nobody predicted the slump, too many variables.

http://www.wsj.com/articles/why-the-drop-in-oil-prices-caught-so-many-by-surprise-1414526075

In many respects this chaos in the market is reflected in our atmospheric system.

50

Chaos on the markets are usually cause by human greed and its overreach. Chaos in the atmospheric system is the normal method of regulation.

20

For one third of the power delivery.

Tony.

181

For one third of the unreliable power delivery

41

Yes Ian good pickup, Tony you just must stop equating solar/wind power to coal … its not the same thing coal power is reliable, solar and wind is only reliable at 1/5th of actual capacity if and only if it has at least 24 hours storage associated. To compare them you have to use the minimum 24 hour averaged output of both sources. Using annual averages is wrong, bdcause there is no such thing as annual storage.

21

It hardly seems to matter. Even the local regional shopping mall now has solar panels on top of its parking structure. They must have some financial advantage from it but I sure would like to know who is making up the difference between their slightly lower electricity cost and the real cost of the installation. My bet is that the taxpayers make up that difference.

They make good shade if you can park under them though.

21

volatile reporting!

16 Jan: Bloomberg: Stefan Nicola: Even Rich Nations Face Climate ‘Danger Zone,’ Report Says

The researchers led by Stockholm University identified four ecosystems where boundaries have been crossed, throwing the stability of the environment into disarray. The findings were published in the journal Science and will be presented at the World Economic Forum in Davos next week…

Regardless of what target is chosen, researchers gathered by the UN say that human activity is destabilizing the climate and will melt glaciers, raise seal levels and trigger more violent storms in the decades to come…

http://www.bloomberg.com/news/2015-01-15/even-rich-nations-face-climate-danger-zone-report-says.html

16 Jan: Bloomberg: Brian K. Sullivan: Forget That Warm Weather Talk: U.S. Is About to Get Cold

The computer forecast models have taken a turn for the cold.

The prospects of a January thaw are dropping right off the map. Even the chances that the U.S. East Coast will hold on to some above-normal temperatures into the last week of the month are fading like cheap paint in the bright sun.

Instead of displaying the gold and orange of milder weather, the maps have turned blue across the Midwest, which may be the same color your lips will be when the temperature drops. For the East, the outlook is for seasonal readings, and given that it’s January, you can color those cold, too.

“The big story this week is that our expected January thaw next week has been obliterated, and that the models keep getting colder and colder in general, starting next week through the end of January,” said Todd Crawford, a meteorologist with WSI in Andover, Massachusetts…

Chills running from Chicago to Dallas will do more for natural gas demand than in New England because the Midwest uses more gas…

http://www.bloomberg.com/news/2015-01-15/forget-that-warm-weather-talk-u-s-is-about-to-get-cold.html

50

‘the models keep getting colder and colder in general’

Short term predictions a couple of weeks out is weather forecasting, predicting long range is more complex. I’m becoming obsessed with Great Climate Shifts.

http://c3headlines.typepad.com/.a/6a010536b58035970c01b8d0c0be04970c-pi

40

I’m with you on that.

It seems to me that if climate is different from long range weather (particularly at the global level) then we should have an agreed taxonomy for the different climates (as far as I know climate science doesn’t), know which ones we’ve experienced recently (say last 2000 years) and when they occurred, and be debating what the next one we are going to have (being clear about what constitutes a “change in climate”).

10

We keep on hearing about the debt clock @ $18 T US however the derivative traders have knocked up a first trading @ $1 Quadrillion US in promises & thin air!

http://kingworldnews.com/former-white-house-official-warns-terrifying-cyprus-style-global-endgame/

There is probably not one real hard commodity which trades at physical supply/demand price dicsovery.

50

There is much debt that the coming financial Armageddon will overshadow the climate rage and instead of fighting melons we will be focused on economy fighting hordes of people trying to burn your house

10

If the climate equivalent of traded goods is global mean temperature, then we all knew very early in the year that 2014 was going to be the warmest evvah because….

There’s a couple of ‘big players’ trading global mean temperatures who’ve gamed the system for their own ‘profit’. We all know they will continue to ‘fix prices’ higher, even if only by hundreths of a degree.

Anyone betting that global mean temperatures will drop anytime soon is a fool who deserves to lose the shirt off his back.

100

Whats a big player these days?

The ERM, the Exchange Rate Mechanism, was an attempt by European government banks to hold currency rates static using their tremendous trading presence, their ability to exhaust efforts to shift prices by deploying billions of dollars of taxpayer money to defend the exchange rate they wanted.

But in the end they failed – when the strain of the artificial rates got too much, when they diverged too much from what they would have been without all the government intervention, this created a major profit opportunity.

George Soros organised a consortium which controlled over 100 billion pounds, so much money it overwhelmed the British Government’s efforts to constrain currency rates to their fantasy target level.

http://en.wikipedia.org/wiki/European_Exchange_Rate_Mechanism

60

The ERM was an attempt to secure a closed market within the EU.

Like all closed markets it leaked value and wealth – Soros was bright enough to sieze the opportunity and run with it. It is to to eternal shame of the EU elites that they thought that they could do this in a modern world.

The UN ‘Carbon Trading’ scheme is just another version. This time the UN is trying to close the fossil fuel market so that the UN elites can dictate terms and conditions on fuel use and tariffs.

30

This is another complete death argument for climate modelling for me, always has been. I first heard it in Michael Chrichton’s lecture (linked below).

https://www.youtube.com/watch?v=MDCCvOv3qZY

Its a powerful argument that we cannot create models to accurately predict activity in a system we created. A system which is boringly simplistic when compared to the climate of this planet. Belief that we can accurately model the climate, from a fraction of a fraction of the historical data of that system is delusional, narcissistic and very probably outright fraud.

120

I’ve just listened to it…2hours well spent. Thank you Safetyguy66.

00

Apologies for this repeat posting but it is still relevant.

By definition the

“Those who have training or practical, real world expertise in modelling know straight up that the so called “Climate Models” are not Models.

Every time I hear the word Model I cringe, because it reminds me of the true purpose of present day models which is to muddy the waters and overpower sensible analysis.

Powerful computers are not necessary to have good model, at least to start with.

If the basics are correct and meaningful they are probably also simple.

By definition, a model has certain requirements that must be met:

First a model has one or more input factors which are variable (eg atmospheric CO2 level)

and when this variable changes the model must register changes in another factor (eg

atmospheric temperature) which shows conclusively that the two factors, input and output,

are linked.

The most important requirement of any Model however is that it must duplicate reality.

By definition a model successfully duplicates reality in some range of operation and allows extension, and

prediction, outside the measured limits used to verify the model.

A model which does not duplicate reality of the link between causal factor and effect is by definition NOT A MODEL.

Global Climate models have NEVER duplicated reality in any way and by definition cannot be claimed to be

models.”

KK

80

“First a model has one or more input factors which are variable (eg atmospheric CO2 level) and when this variable changes the model must register changes in another factor (eg atmospheric temperature) which shows conclusively that the two factors, input and output, are linked.”

Isn’t this the whole problem though? Surely in order to test/demonstrate the notion that CO2 concentrations increase atmospheric temperatures, your model must be designed to simulate that.

Therefore if you have designed your model correctly, it will always show an increase in temperature for an increase of inputs, regardless of whether that simulates reality or not. The basic math behind the model is locked into the reaction of increasing temperature for an increase of CO2 it simply cant work any other way and if it did, you would need to change your model to make it work, or its not simulating your hypothesis.

So this leads to the inevitable question of “what is the point of that”? If you suspect the CO2/Temperature relationship, what is the point of simply creating a model which has no other possible outcome than to simulate that relationship. You may as well write a song about it, or choreograph a modern dance piece. No matter what happens your “model” will provide you with the answer you were always looking for.

This has in my mind always rendered the entire “modelling as proof” notion nothing more than a self fulfilling prophecy regardless of whether it accurately simulates the real climate or nor. The fact that the models don’t even come close to simulating the detail of climate activity since the modelling started, basically demonstrates the utter pointlessness of the exercise and the stupidity and futility of then taking action on the basis of the results.

I think all I just did was re-iterate your point, but I certainly agree strongly with your assessment.

http://www.climate-skeptic.com/2014/07/2361.html <– Computer models as evidence.

50

Hi Safety

In fact you have reiterated my point;

‘If you suspect the CO2/Temperature relationship, what is the point of simply creating a model which has no other possible outcome than to simulate that relationship. ”

The point is that a model can only exist if the relationship can be demonstrated experimentally.

From a theoretical point of view there can be no measurable link between CO2 levels and Temperature of the atm because other factors swamp that tiny effect.

A model cannot be constructed to link the two factors.

An exploratory computer simulation, as all Climate Models are, is NOT a model because it does not function.

All models must be based on a known and measurable relationship between factors.

KK

40

KK,

Back in the late 1960s the size and complexity of military software projects began to increase dramatically. By the 1070s it was even worse. And as any good project manager would, the Defense Department wanted to know before launching a project, exactly what it would cost and how long it would take. Many players jumped in with models for the cost and time to deliver a software project. As far as I ever found, none of them did the job.

Estimating cost and time for software is nothing like most engineering projects. The variables are many, from how well the project is specified in the first place to how big and complex it is and how hard it is to test. And most important of all, how much does it push the state of the art? All of these are highly subjective.

The similarity to climate modeling should be obvious.

I haven’t been in that military world for a long time but I suspect, just from smaller civilian projects I worked on, that the problem has never been adequately solved.

I wish modelers all the luck they can get. They need it.

30

Global financial crushes are only predicted by crackpots that no one listens to. The experts predict only what the herd predicts. 2008 was no different. Now they they predict total economic collapse, fall of oil prices (came true), fall of the dollar and gold price >2000$. As usual no one believes them.

The lack imagination also applies to science too. I see that using my personal experience of how the petroleum industry behaves, like a pack of sheep. Despite having the best tools for exploration they rarely venture outside the box. Big companies like governments retain the worst personel who would fail in smaller companies. These companies like the government are anti-individual and hence anti-innovative thinking. This is best illustrated by the revolution in the unconventional exploration (shale gas & oil) when they get into the discovered areas late buying at the premiums from smaller operators and often not understanding the risks.

They create an internal culture believing that their own company is the best. I live off this arrogance as this creates unbelievable opportunities for guys like me.

Climate rage is the same, exasperated by the trail of money which also contributes to the moral decay and abondoment of scientific principle. Combine this with 4th grade scientists and you have the witches cauldron.

80

The world has been warming since the end of the little ice age but how much of that is natural & how much man made. That is a difficult question and on top of that the climate has been changing for over 10,000 years.

Raw temperature records have been subject to adjustments (homogenisation) with past records almost invariably lower than when recorded. If this continues then each year will of course be hotter than the last and is indeed man made. Raw temperatures, since they first began being recorded, should be displayed along with the adjustments with clear explanations of why the adjustments are being made. Satellite data should also be included as their data is not showing the warming predicted by models.

Most of the alarm is coming from projections coming from computer models. Most who work with models know that they are a useful tool but few would “bet the farm” on the basis that they are infallible. The effects of clouds, the sun and positive/negative feedbacks are not well understood yet and until they are the debate should be opened up as there a very many well qualified & awarded scientists who disagree with the global warming theory and they should be listened to and given a voice. To date very few get a run in the print media.

If models were so infallible then we would be seeing economists uniformly, correctly predicting economic lows & highs as well as major events such as the GFC, however very few ever do.

50

“The world has been warming since the end of the little ice age but how much of that is natural & how much man made. ”

The question is just plain wrong!

We live within a natural system where nature through many hidden and seen feedback machanisms will attempt to assert stability on conditions. Humans and their megre impact on the globe is minor compared to the major forces that nature can and will use. This coupled to the fact that climate is many thousand if not millions of variables, all jossling along impacting on each other as positive and negative feedbacks. IMO human influence is lost in the natural noise of this chaotic system.

E. g.

A side panel on page 149 in ‘Recent Changes of Arctic Multiyear Sea Ice Coverage and the Likely Causes’ by Igor v. Polyakov, John E. Walsh, and Ronald Kwok AMS2012 (http://journals.ametsoc.org/doi/abs/10.1175/BAMS-D-11-00070.1 a free PDF download.)

says –

This comment was refering to –

Significant efflux of carbon dioxide from streams and rivers in the United States

David Butman & Peter A. Raymond

NATURE GEOSCIENCE | LETTER

http://www.nature.com/ngeo/journal/v4/n12/full/ngeo1294.html

10

a follow-up to some comments yesterday:

Throsby gives listeners a Summer repeat of Bob Brown, a day after her repeated hour with Rob Oakeshott, in which he trashes the Govt over the carbon tax, ETS, etc:

18 Jan: ABC Margaret Throsby Interview: Dr Bob Brown

First broadcast August 2014

http://www.abc.net.au/radionational/programs/throsby/dr-bob-brown/5978662

the Talking Plants prog – a half-hour of Talking Climate – drier, wetter, more extreme:

18 Jan: ABC RN: Talking Plants: Gardening in a changing climate

In Australia, summer temperatures are on the rise and spring rain is decreasing. Some plants will no longer survive in our gardens. What can we do?

http://www.abc.net.au/radionational/programs/talkingplants/podcasts/tps5/5936830

40

They could have asked me, we have plants that can survive any unfortunate climate change. Wet or dry, hot or cold. They are what’s called ‘native plants’.

40

Jan 2014:

16 Jan 2014: ABC: Australian heatwaves more frequent, hotter and longer: Climate Council report

Heatwaves in Australia are becoming more frequent, hotter and are lasting longer because of climate change, a report released today by the Climate Council says…

And it predicts that future heatwaves will last up to three days longer on average, they will happen more often, and the highest temperatures will rise further.

“It is clear that climate change is making heatwaves more frequent and severe,” report co-author Professor Will Steffen said in a statement…

Extreme weather ‘can be attributed to climate change’

Professor Steffen says the extreme weather patterns can be attributed to climate change, with the continued burning of fossil fuels trapping more heat in the lower atmosphere…

http://www.abc.net.au/news/2014-01-16/australian-heatwaves-getting-hotter-and-longer/5202272

Jan 2015:

17 Jan: Sky News: AAP: Australia facing worse weather in the future

And Professor Will Steffen of the Climate Council says incidences of heatwaves, bushfires and other extreme weather in Australia are increasing.

‘Climate change is a major factor in the increase in extreme heat that Australians have experienced over the last few decades,’ Prof Steffen said on Saturday.

‘Hot days are happening more often while heatwaves are becoming hotter, longer and more frequent. This is worsening bushfire danger weather.

‘The long-term warming trend has been driven by the increase of greenhouse gases in the atmosphere, caused primarily by the burning of fossil fuels.’…

Third, record hot days and heatwaves are expected to increase further in the future. And finally, limiting future increase in heatwave activity requires urgent and deep cuts to greenhouse-gas emissions…

http://www.skynews.com.au/news/national/2015/01/17/australia-facing-worse-weather-in-the-future.html

2016???

30

I still don’t know whether that means we will get more or less cyclones. They forecast fewer than average (4) this year yet we have warmer seas offshore. None yet, and it’s mid January. There seems little truth in that Climate Council facts-less statement.

40

See if this helps..

http://www.csiro.au/Outcomes/Climate/Understanding/State-of-the-Climate-2012/Future-Changes.aspx

The CSIRO writes a detailed piece on what to expect in terms of natural disasters. It could be summarised as “two bob each way”.

20

When will the ship of fools sail south again for a barbecue picnic on the ice?

50

Refresh my memory, please. For a while before Queensland became Lake Queensland in 2010/11, Tim Flannery had been going around singing “it ain’t gonna rain no mo’, no mo'”. Did Will Steffen or the Climate Council support him?

30

The forecasting models appeal,

To those who believe they are real,

But for climate; not viable,

And about as reliable,

As what entrails of chickens reveal.

130

So if computer generated mathematical models have failed to predict future market trends and computer generated climate models (sorry KK) continuously fail to predict any climate variations then idea of a Carbon Trading Market must be one of the biggest crapola ideas of all time, a 2 headed love child borne of 2 failed parents way too closely related.

100

So how did the financial modelers and economists go with the GFC? Total fail. This was because it was caused by a multi trillion dollar fraud with fake mortgages sold by Merchant Banks.

It is the same with the absurd proposition of man made Global Warming, currently running at $1Bn a day. The same Merchant Banks are behind it but this time with the political support of the communist Greens still determined to bring down the West. China is exempt, of course.

You have to wonder if the world was cooling in 1988, whether the IPCC would announce Man Made Global Cooling, caused by H2O from combustion and the formation of clouds. You would need to buy carbon credits and the hot house effect would have been ignored.

30

I suppose with green investments you get a double risk; firstly the investment itself, and then the risk due to the green science on which it is based which is pretty dubious in itself. How many green schemes have come to grief; wave energy, hot rocks, ponzi forestry…

50

Eric, nice post. As with all analogies, there are strengths and weaknesses.

But your main point (as I saw it) is imdisputable. Trading models have immediate consequences for traders. Climate models don’t. That is as perverse as can be from an incentives perspective. Thanks for pointing it out.

80

Rud,

“Trading models have immediate consequences for traders. Climate models don’t.”

That’s what you got out of Eric Worrall’s piece?

What about the point that models can not predict the future, and despite that knowledge climate scientists and alarmists are still presenting models as fact.

Or the point that because models only represent vague possibilities or best guesses stock market analysts and traders with a lot less variables than climate modellers are more careful because of consequences, responsibility and liability of losses caused society by poor advice.

Or the point that climate scientists and alarmists take no responsibility nor assume any liability for losses caused to society from poor advice based given by them based on the results of climate models.

Geez, Rud, billions of dollars literally washed down the storm water drain because Tim Flannery advised the country that “… even the rain that falls will not fill dams or rivers.”

And that’s only the losses from one bit of advice, telling people to invest in green scemes on the basis of vague model outcomes and then having investors pour good money into a hypothetical geothermal company is another.

The money could have built schools and hospitals, the list of genuine infrastructure upgrades is endless, roads, rail, telecommunications, medical research.

If any other colourful entrepreneur failed as miserably they’d have been gaoled or on the run.

30

14 Jan: Bloomberg: Melting Glaciers Imperil Kathmandu, Perched High Above Rising Seas

By Natalie Obiko Pearson

The capital of the poorest Asian country after Afghanistan already is feeling the effect: Rising temperatures are crimping power and food supplies as rural migrants stream to a city of 1 million that’s among the world’s most crowded…

The mountainous Himalayan nation may have crossed a tipping point of irreversible damage. Its glaciers have lost about a third of their ice reserves since 1977…

“Glacial melt is the most obvious and potentially game-changing impact of climate change,” said Johannes Zutt, the World Bank’s country director for Nepal and Bangladesh. “If it reduces over time because there’s less ice to melt, that can have an incredibly destabilizing impact in a region where, during the dry period, it can get very dry.” …

“Rains don’t come like they used to,” he says, gesturing with gnarled hands and blackened nails toward the sky. Three years ago, they never came and he lost everything he’d invested that year. His three children are studying so they can get city jobs either in Kathmandu or abroad, he said. “I don’t want this life for my children,” he said. “It’s too uncertain.”

http://www.bloomberg.com/news/2015-01-13/melting-glaciers-imperil-kathmandu-perched-high-above-rising-seas.html?hootPostID=2cc9f39af8796b2aaa4e534de92f4966

all recent articles from Himalayan Times, where they might enjoy some global warming:

Freezing cold threatens life of poor in Tarai

Life has become really hard as cold wave has struck the region for last three weeks…

We are unable to work because of the freezing cold,” he added, “Our homes are empty and there is no blanket or a piece of cloth to cover our body.”

Fire made to keep herself warm kills elderly

RAUTAHAT: A 75-year-old woman was burnt to death after her clothes caught fire while trying to keep herself warm, at Gaur-4 of Rautahat yesterday evening…

Shivering man dies on 3-wheeler as mercury plummets

Govinda Sah (35) from Darbhanga of Bihar state of India was going to his home from Kathmandu.

Sah was travelling on a three-wheeler while he started shivering due to cold before breathing his last, according to the vehicle driver Bibek Mishra…

Mercury significantly plummeted in the region since Saturday, throwing normal life out of gear.

Public schools in the district were shut since Sunday for four days due to increasing cold.

Elderly dies of hypothermia in Rautahat

With this death, the number people who died of cold-related problems in Rautahat district this winter rose to eight…

As mercury plunged in the district following sporadic rainfall for two days, the Gaur-based District Hospital has witnessed an increase in the flow of patients suffering from respiratory problems, including asthma, cough, fever and pneumonia, according to Dr. Ranjit Yadav.

Most of them are the elderly and children, he said.

Cold wave claims woman in Bardiya

Normal life has been hit hard due to bone-brushing cold in the district for the past few weeks.

Market places have been closed and the poor visibility has affected the movement of vehicles in the district.

Cold affects normal life in western Tarai

Normal life in western Tarai including Rupandehi district has been affected due to excessive cold following thick fog for the past few days.

Mostly, children and elderly people have been directly hit hard due to cold.

Similarly, cold has also affected labourers, farmers and drivers.

People are found burning firewood at different places in the district to avoid cold…

Doctors said that mostly children are found suffering from pneumonia and elderly people from asthma. Number of students has been decreased due to the cold and some of government schools have given winter vacation to students.

20

And Pat just to add to your list –

Turkey headed for coldest winter in 20 years

JANUARY 17, 2015

Snow in Saudi Arabia – Videos

JANUARY 16, 2015

Heavy snowfall expected in Japan

JANUARY 16, 2015

Record snowfall in western Norway – 2 to 3 meters (6 to 10 feet)

JANUARY 16, 2015

Tropical snowfall causes congestion in Sa Pa (Vietnam)

JANUARY 12, 2015

This sums up the snow in Saudi Arabia

JANUARY 12, 2015

Iraq – Sulaymaniyah province in a white dress of snow

JANUARY 10, 2015

Record snow in Florida

JANUARY 10, 2015

Greek islands buried under 6½ ft (2 m) of snow – Video

JANUARY 9, 2015

Just some of the reports on http://iceagenow.info

Must be global warming…

30

i realise jo has begun an unthreaded thread, but this is a response to bloomberg’s himalayan scare story:

2013: Himalayan Times: Dust linked to Himalayan glaciers melting

DAVOS: The International Association of Cryospheric Sciences (IACS) proposes to set up a working group to study the impact of dust and black carbon from forest fires on the accelerated melting of snow and glaciers on the Himalayas.

The decision was taken at a recent meeting in Davos, Switzerland…

While analysing the satellite data, Singh noticed during the winter season a vast pool of atmospheric pollution over the Indo-Gangetic plains reaching to the Himalayan foothills.

“The dust which is very common in the western parts of India almost every year (during April-June) reaches to the western parts of the Himalayas,” Singh told IANS.

He said the dust also enhanced water vapour and carbon monoxide in the atmosphere resulting in the warming up of the troposphere, especially in the western parts of the Himalayan region accelerating the melting of glaciers.

He added that pollution in the Indo-Gangetic plains from industrial activities, biomass burning and sometimes forest fires further contributed to the warming of troposphere and the Himalayan snow/glaciers…

In the eastern parts of the Himalayan region, black carbon from the forest fires in countries on the eastern India “deposits on the snow/glaciers of the Himalayan and Tibetan region”, Singh said.

According to Singh, it is difficult to say which one affects the glaciers most — black carbon or the dust.

“In theory, black carbon is a lot more effective but generally the dust concentration is much higher than black carbon and therefore dust can have larger impact,” he said.

http://www.thehimalayantimes.com/fullNews.php?headline=Dust+linked+to+Himalayan+glaciers+melting&NewsID=386642

Karakoram continues to defy the CAGW alarmists:

Oct 2014: Himalayan Times: What prevents Karakoram glaciers from retreating?

“It has been a source of controversy these glaciers have not been changing while other glaciers have,” said Sarah Kapnick, a postdoctoral researcher at the Princeton University.

Glaciers have exhibited mass stability or even expansion in the Karakoram region contrasting with the glacial mass loss across the nearby Himalayas and Tibetan Plateau, a pattern that has been termed the Karakoram anomaly.

For the study, the researchers collected data on recent precipitation and temperatures from the Pakistan Meteorological Department and other sources, including satellite data.

They compared a set of high-resolution climate model simulations from 1861 to 2100 to focus on the distinct seasonal cycles and resulting climate change signatures in three regions of the Himalayas: the Karakoram; the central Himalayas; and the south-east Himalayas which included part of the Tibetan Plateau. They found a new model that simulates climate down to an area of 19 square miles was able to match the observed temperature and precipitation cycles seen in the Karakoram.

Karakoram region gets most of its extra moisture in the winter, when westerly winds bring snow to the mountains. The central and south-east Himalayan regions get most of their moisture from monsoons in the summer. Because summer is warmer, most of this precipitation falls as rain.

Previous models overestimated temperature of the Karakoram, and underestimated the amount of snow in the region, the researchers found. “The total amount of rain is increasing during summer months. But since the temperatures are rising above freezing, they’re not translating to increased snowfall; they’re translating to decreased snowfall in those two regions,” said Kapnick. “In Karakoram, snowfall is decreasing in summer but increasing in winter,” Kapnick pointed out…

http://thehimalayantimes.com/fullNews.php?headline=What+prevents+Karakoram+glaciers+from+retreating%3F&NewsID=430705

20

Computer models also played a major role in blowing up the financial system just a few years ago. The computers were telling the bankers what they wanted to hear so they were happy, until it was too late. (Like taking a wrong turn onto an exit ramp because the voice from the computer says to.)

And note that they had a bunch of the smartest SOBs on the planet doing their software code.

10

Couldn’t agree with this post more Eric. Having worked in the financial services industry the one thing I can also confirm is that anyone who is consistently wrong in their predictions and speculations has a pretty short career!

40

So: traders are arbitrageurs, not soothsayers. Climate scientists try to be soothsayers. I suppose climate scientists would be more credible if they were a little more humble and honest about the uncertainties of their models.

10

As a trader myself i must say there are only probabilities in the market. hence we can make predictions about the market with a certain degree of certainty/probability. there are rather accurate methods out there to determine bottoms and tops to a rather accurate degree. one is using Fibonacci extensions and Elliot Wave patterns. Others are finding chart patterns, determine trendlines, support and resistance levels, and divergences in technical indicators. Hence, we as traders have to determine the highest probability route the market will seek to take and act upon it using many unbiased objective factual methods. if it were entirely impossible to predict the market then nobody would be trading. there’s a good degree of certainty actually. the market has to ashere to natural rules, since it’s driven by human beings.

For one, historical stock prices are NOT adjusted or corrected. If that would happen, then making predictions about future stock prices would become entirely and totally impossible and the stock market would collapse. For example, we can’t have the stock price low of AAPL in April 2013 being changed from ~$50 to $40 and change the recent high in November 2014 of around $120 to $140. That would screw up Fib-retrace levels of (23.6, 38.2, 50, 61.8% etc) and thus totally change low risk/high reward entry points, and totally FUBAR the charts and market. Apparently this adjusting is A-OK with temperature data…. hmmmmm…. because if you change the past you can’t predict the future. The stock market has been around for much longer and climate scientists can learn a thing or 2 about the no-no’s of data adjusting and data-analysis!

In addition, being biased, subjective, unfactual and emotional within trading will cause one to loose money. One would wish the same would happen with many climate scientists who are biased, subjective, unfactual, and emotional. I think most are very bad traders….

10